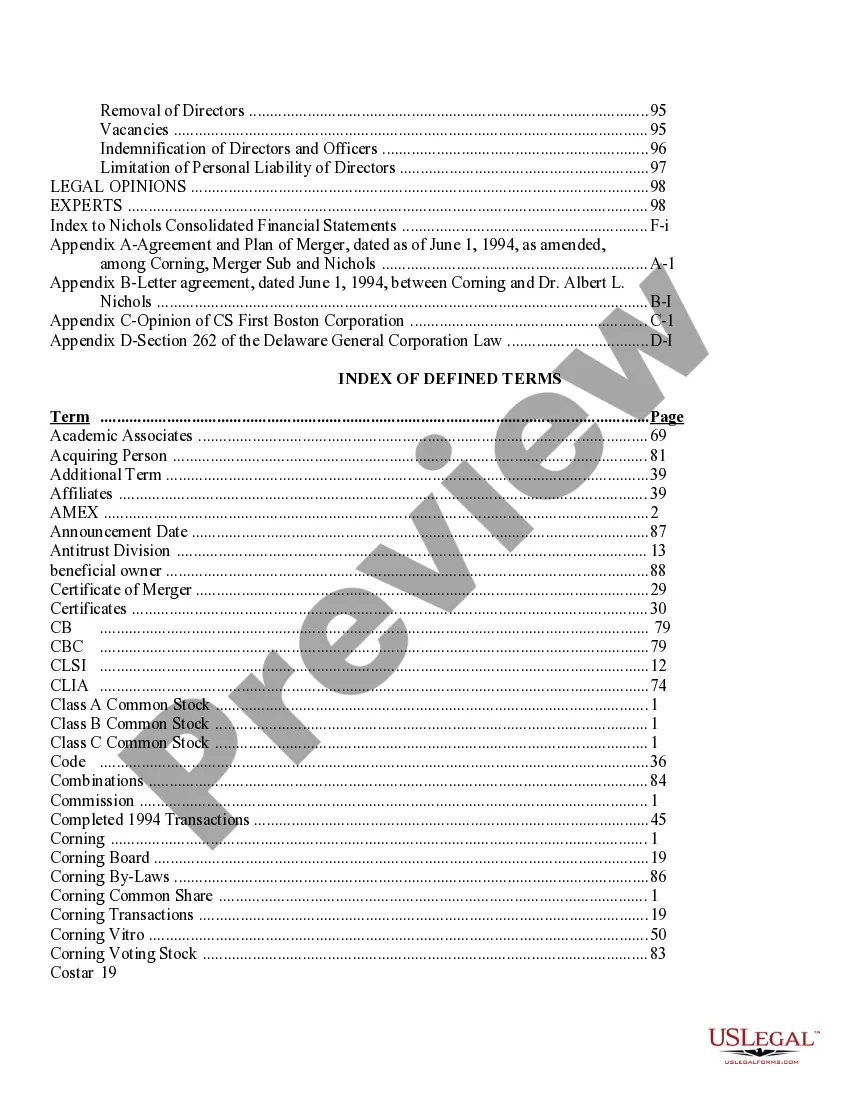

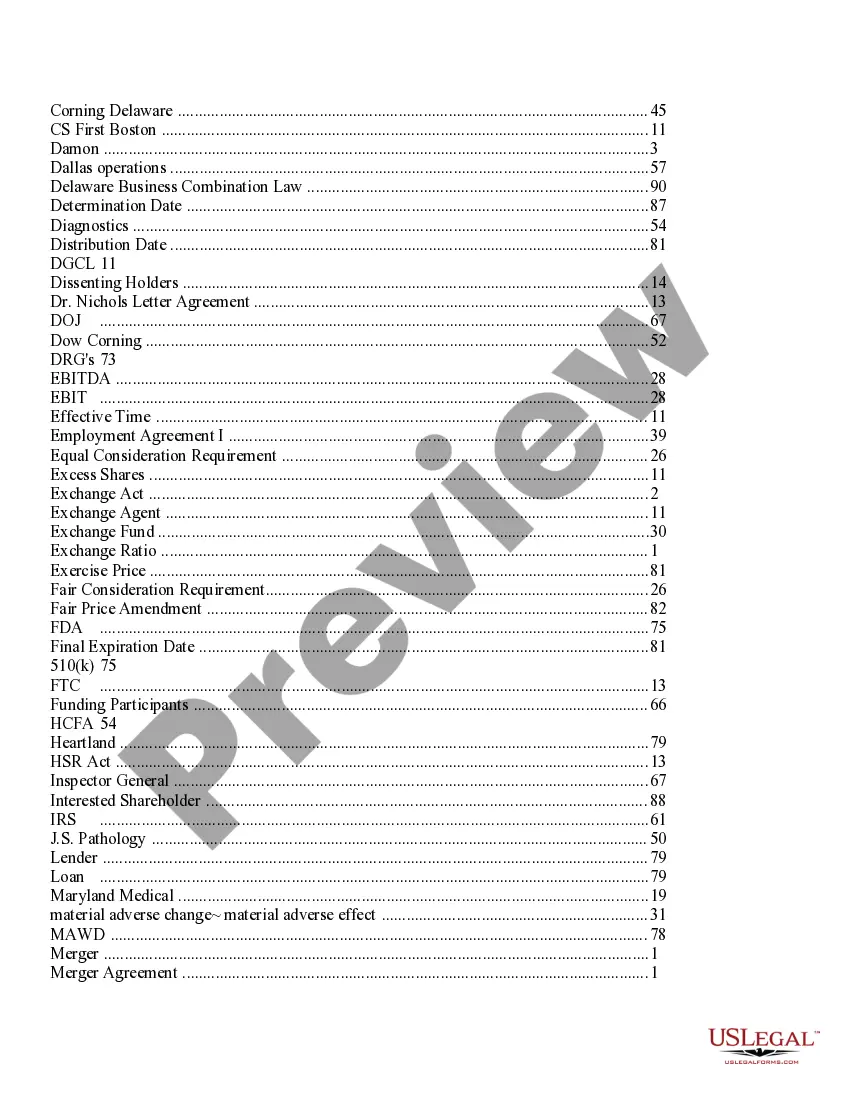

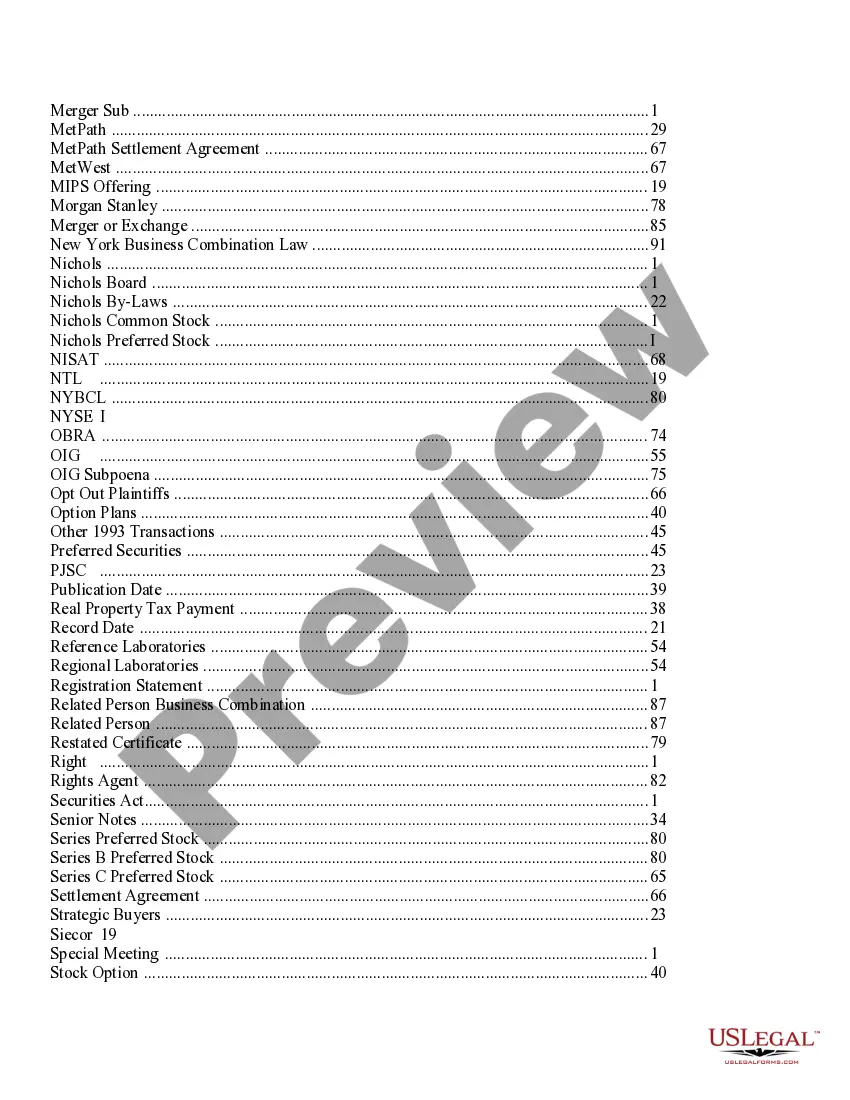

Los Angeles California Proxy Statement — Prospectus of Corning Incorporated is an important legal document that provides essential information to shareholders and potential investors of the company. It serves as a comprehensive guide detailing the company's financial status, corporate governance, executive compensation, and other necessary disclosures. The Los Angeles California Proxy Statement — Prospectus of Corning Incorporated without appendices typically comprises several sections, each containing specific information: 1. Cover Page and Table of Contents: This section provides an overview of the document, including the date, company name, and a list of contents for easy navigation. 2. Notice of Annual Shareholders Meeting: Here, shareholders are informed about the date, time, and location of the annual shareholders meeting. It also includes details on how to vote, attend, and participate in the meeting. 3. Proxy Statement: The proxy statement focuses on the items that will be discussed and voted upon during the annual meeting. It includes in-depth information on each proposal, such as the election of directors, adoption of executive compensation plans, and amendment of bylaws. 4. Information about Directors and Executive Officers: This section provides biographical details of the company's directors and executive officers, highlighting their qualifications, experience, and involvement in other organizations. 5. Corporate Governance: The corporate governance section outlines the company's corporate structure, board committees, and policies related to ethics, conduct, and compliance. It emphasizes Corning Incorporated's commitment to transparency, accountability, and responsible decision-making. 6. Executive Compensation: In this section, detailed compensation information is provided for the company's top executives, including salaries, bonuses, equity awards, and other benefits. It also explains the rationale behind the compensation structure and the board's role in determining executive pay. 7. Security Ownership: This part discloses the ownership of Corning Incorporated's voting securities by directors, executive officers, and significant shareholders. It helps stakeholders understand the distribution of ownership and potential conflicts of interest. 8. Shareholder Proposals: Here, information on any proposals made by shareholders, which will be addressed during the annual meeting, is included, along with explanations and the board's response or recommendation. 9. Other Information: This section incorporates additional important details, such as voting procedures, proxy solicitation, deadlines for submitting proxies, and contact information for inquiries. These sections constitute the main components of a Los Angeles California Proxy Statement — Prospectus of Corning Incorporated without appendices. It is important to review this document thoroughly to make informed decisions and gain a comprehensive understanding of the company's operations, financials, and governance practices.

Los Angeles California Proxy Statement - Prospectus of Corning Incorporated without appendices

Description

How to fill out Los Angeles California Proxy Statement - Prospectus Of Corning Incorporated Without Appendices?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Los Angeles Proxy Statement - Prospectus of Corning Incorporated without appendices, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the current version of the Los Angeles Proxy Statement - Prospectus of Corning Incorporated without appendices, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Los Angeles Proxy Statement - Prospectus of Corning Incorporated without appendices:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Los Angeles Proxy Statement - Prospectus of Corning Incorporated without appendices and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!