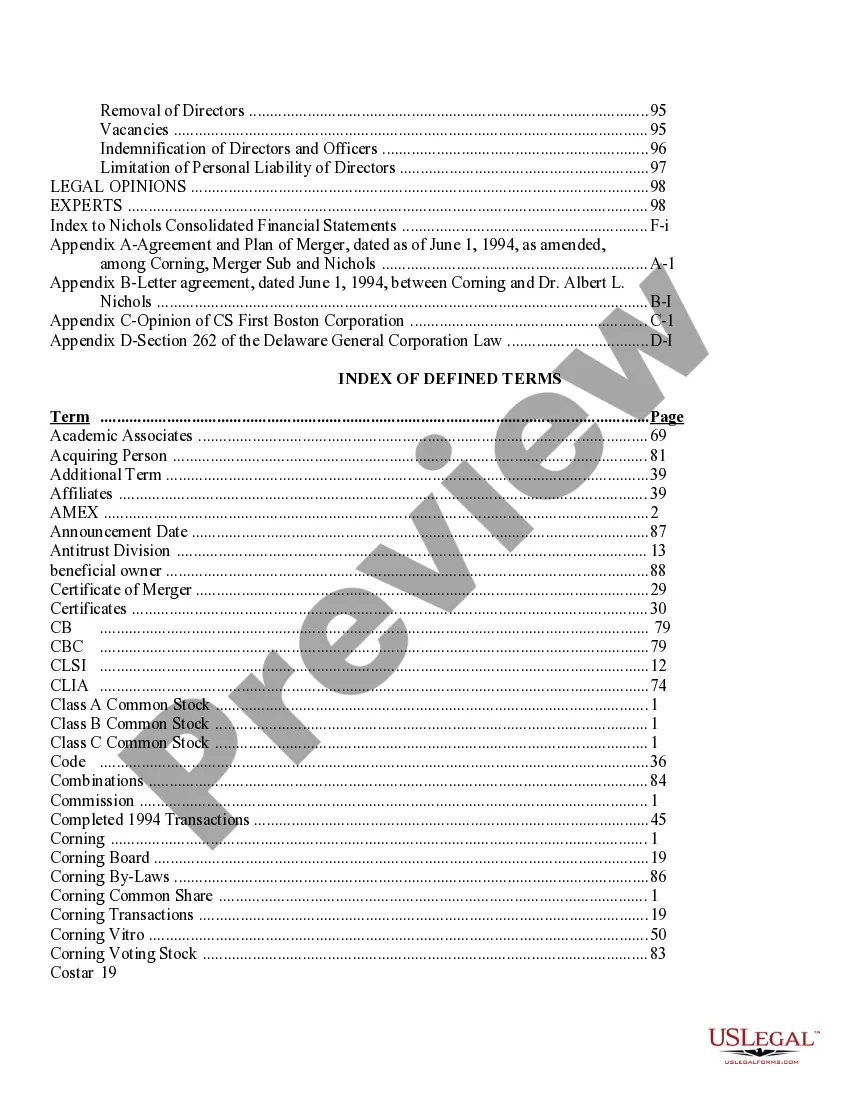

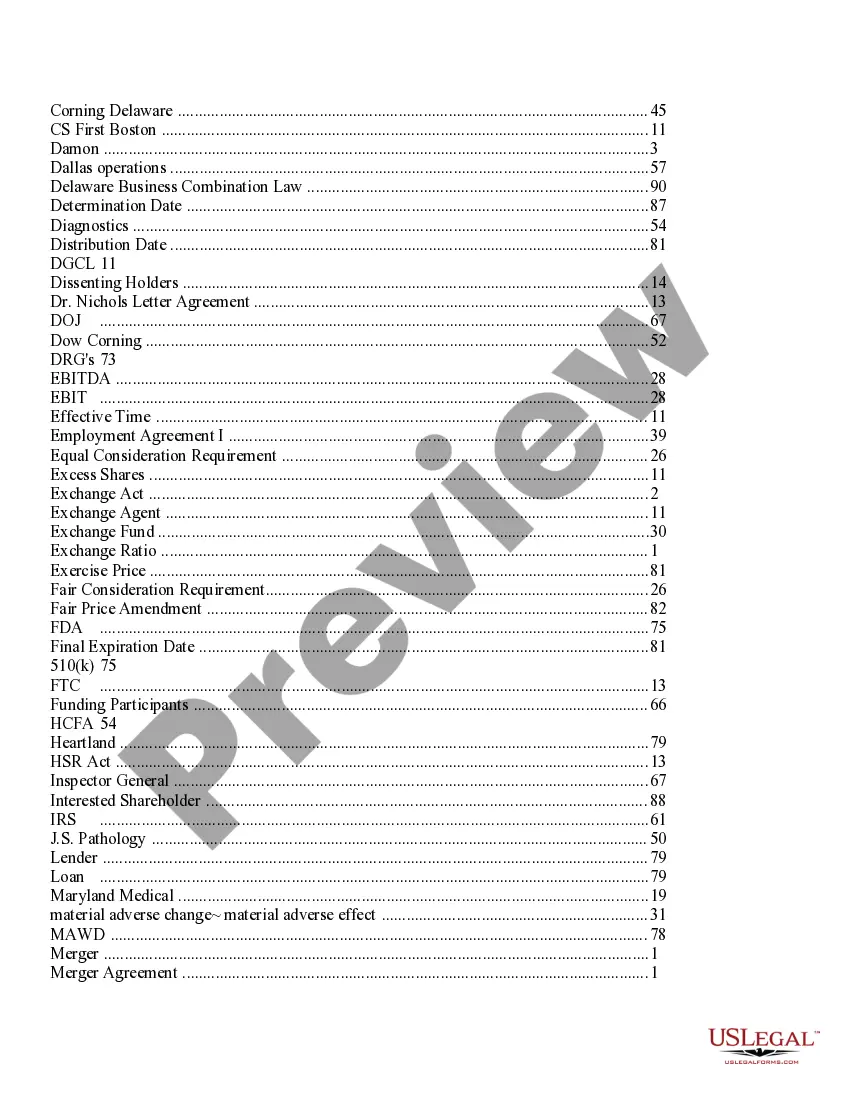

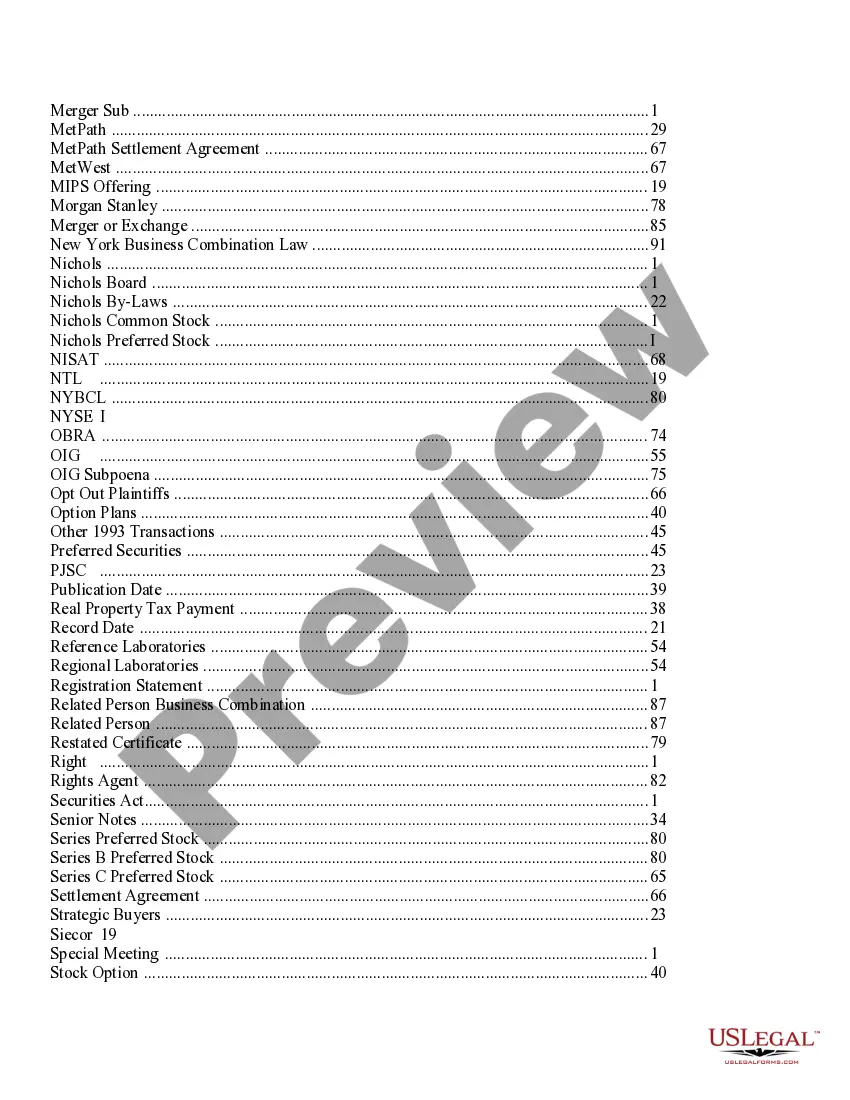

The Philadelphia Pennsylvania Proxy Statement — Prospectus of Corning Incorporated is a comprehensive document that provides detailed information about the corporate governance practices and financial standing of the company. It serves as a disclosure document for shareholders and potential investors, offering essential insights into Corning Incorporated's operations, strategies, and outlook. This Proxy Statement — Prospectus highlights Corning Incorporated's Philadelphia presence and outlines various key aspects of the company. It covers topics such as executive compensation, board structure and composition, management team, and shareholder voting rights. By examining these details, stakeholders can make informed decisions regarding their investments and gain a thorough understanding of Corning Incorporated's performance and prospects. The Philadelphia Pennsylvania Proxy Statement — Prospectus of Corning Incorporated does not feature appendices, ensuring a streamlined reading experience for shareholders and potential investors. Different types of Proxy Statements — Prospectuses may exist, depending on the specific purpose and regulatory requirements for various jurisdictions. However, in this case, the absence of appendices emphasizes a concise presentation of essential information pertinent to investors associated with Philadelphia, Pennsylvania. Key keywords associated with this document include: 1. Philadelphia, Pennsylvania: Highlighting Corning Incorporated's operations and presence in the city, including any subsidiary branches or significant activities taking place there. 2. Proxy Statement: Referring to the document that empowers shareholders to authorize someone else to vote on their behalf during corporate meetings and serves as an avenue for crucial disclosures. 3. Prospectus: A disclosure document providing pertinent information about a company's business, financials, risks, and investment opportunities, aiming to attract potential investors. 4. Corning Incorporated: The specific company for which this Proxy Statement — Prospectus is prepared, outlining its relevant aspects and strategic direction. 5. Corporate Governance: Encompassing the policies, structure, and practices that guide and regulate a company's operations, ensuring transparency, accountability, and shareholder value. 6. Executive Compensation: Detailing the remuneration package, bonuses, stock options, and other benefits provided to top executives, offering insight into alignment with performance and shareholder interests. 7. Board Structure and Composition: Highlighting the size, composition, diversity, and experience of the board of directors overseeing Corning Incorporated's management and decision-making processes. 8. Management Team: Introducing key executives and their roles within the company, emphasizing their experience and highlighting their contributions to Corning Incorporated's overall performance. 9. Shareholder Voting Rights: Explaining the mechanisms by which shareholders can exercise their voting rights and participate in decision-making processes, allowing them to influence corporate actions and policies. 10. Financial Standing: Illustrating the financial health and performance metrics of Corning Incorporated, including revenue, profit, assets, liabilities, and any pertinent financial ratios. Overall, the Philadelphia Pennsylvania Proxy Statement — Prospectus of Corning Incorporated without appendices serves as a crucial tool for investors and shareholders to gain insights into the company's Philadelphia operations, corporate governance practices, and financial standing without extraneous supplementary materials.

Philadelphia Pennsylvania Proxy Statement - Prospectus of Corning Incorporated without appendices

Description

How to fill out Philadelphia Pennsylvania Proxy Statement - Prospectus Of Corning Incorporated Without Appendices?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Philadelphia Proxy Statement - Prospectus of Corning Incorporated without appendices, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any activities related to paperwork execution simple.

Here's how to locate and download Philadelphia Proxy Statement - Prospectus of Corning Incorporated without appendices.

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some records.

- Examine the related forms or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Philadelphia Proxy Statement - Prospectus of Corning Incorporated without appendices.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Philadelphia Proxy Statement - Prospectus of Corning Incorporated without appendices, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you need to deal with an exceptionally challenging situation, we recommend using the services of an attorney to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!