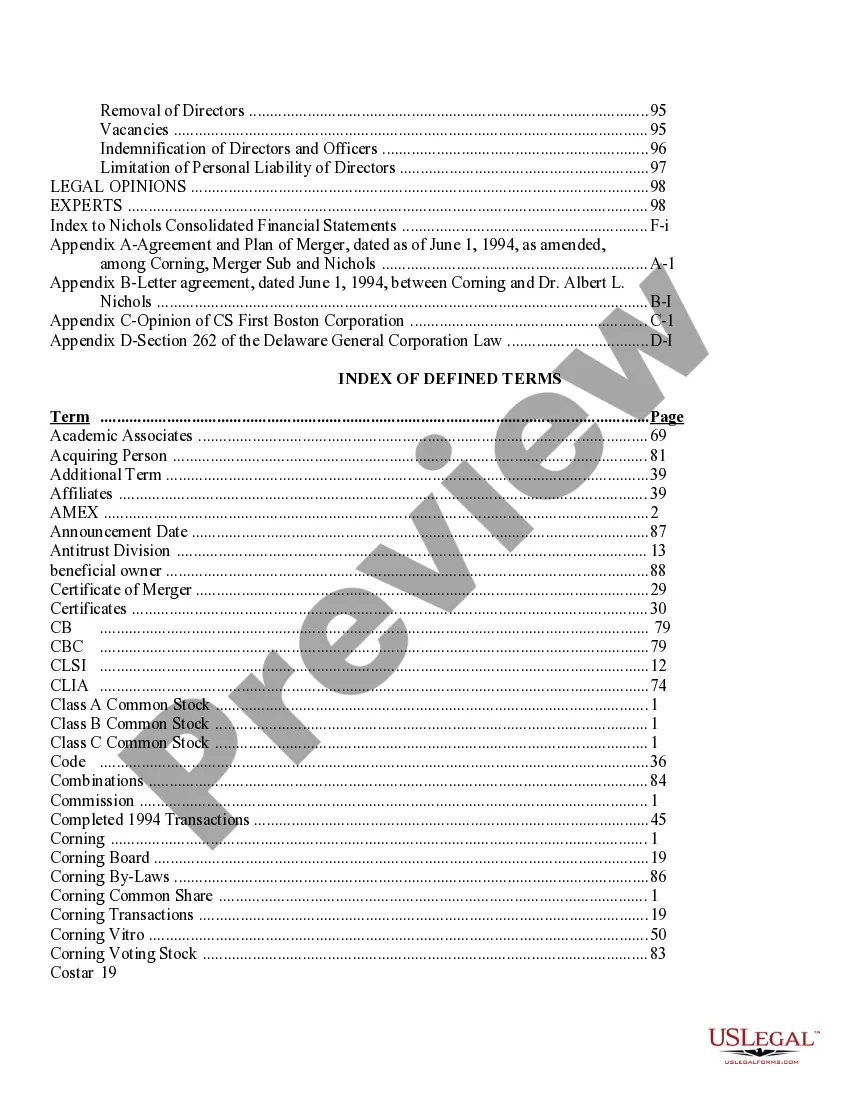

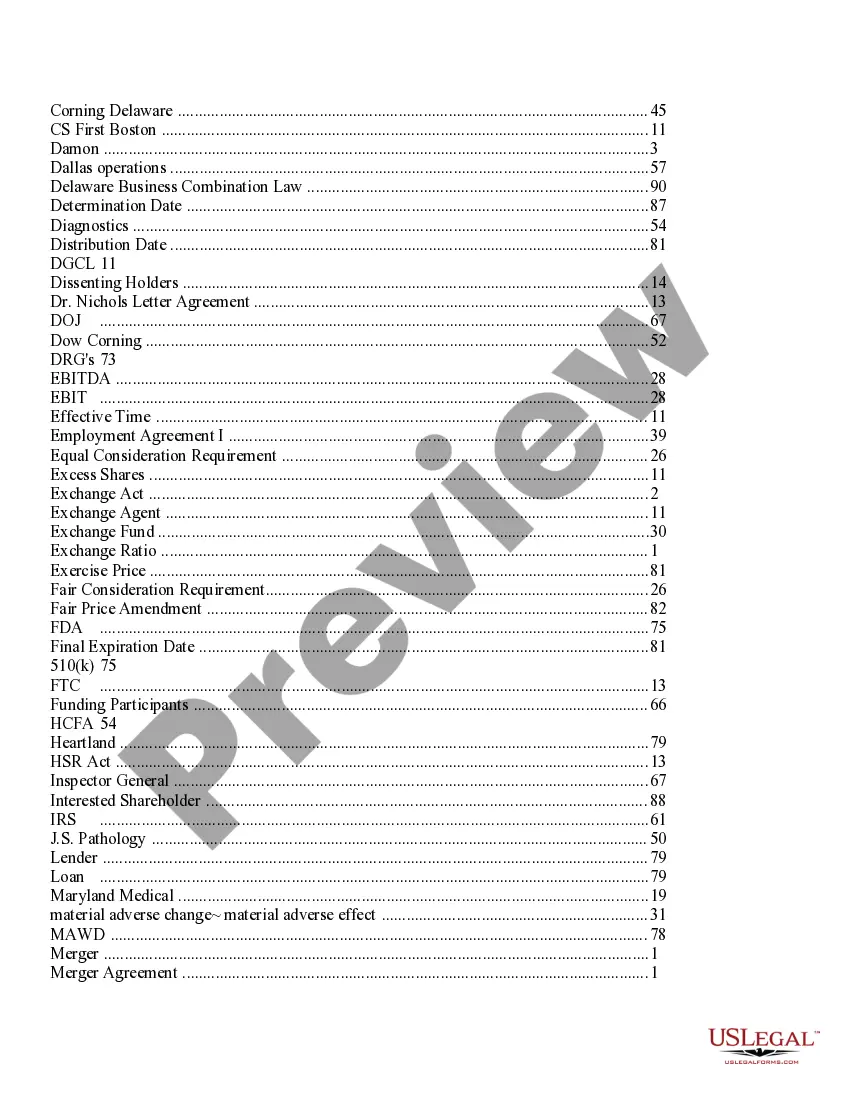

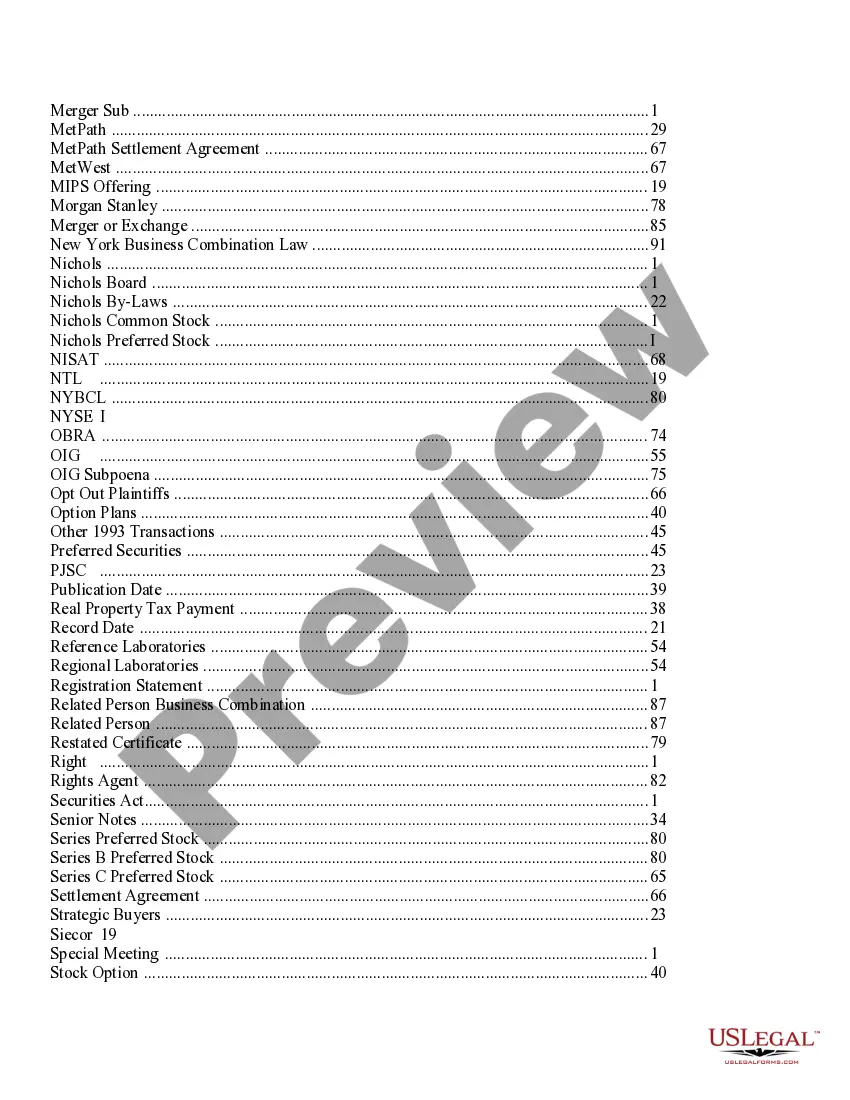

San Antonio Texas Proxy Statement — Prospectus of Corning Incorporated without appendices is a document that provides valuable information relating to the corporate governance and financial status of Corning Incorporated, a leading American technology company with a focus on specialty glass, ceramics, and optical physics. The San Antonio Texas Proxy Statement serves as a formal record of the annual or quarterly meeting held by Corning Incorporated in San Antonio, Texas. It offers shareholders and potential investors an in-depth insight into the company's operations, including its strategic direction, executive compensation, board composition, and corporate governance practices. This proxy statement encompasses several crucial sections, each contributing to a comprehensive understanding of Corning Incorporated's affairs. It commences with a letter to shareholders from the company's management, providing an overview of its performance and achievements in the previous fiscal year. The document also includes information regarding the meeting agenda, highlighting key topics to be discussed, such as the election of directors, executive pay and benefits, auditing matters, and any proposed changes to the company's articles of incorporation or bylaws. Furthermore, the proxy statement discusses the biographies and qualifications of the current directors standing for re-election, shedding light on their expertise and experience relevant to Corning Incorporated's business operations. It presents the governance structure, outlining the committee assignments and their respective responsibilities within the company. The proxy statement also offers details on executive compensation, including salary, bonuses, stock grants, and other benefits awarded to the company's top executives. This section aims to justify the compensation decisions made by the board of directors and provides shareholders with transparency regarding the alignment of executive performance with company goals. Additionally, the document provides insights into the company's financial condition, reporting key figures such as revenue, net income, earnings per share, and changes in shareholder equity. This helps shareholders and potential investors gauge the overall financial health and profitability of Corning Incorporated. It is important to note that there might be several versions of the San Antonio Texas Proxy Statement — Prospectus of Corning Incorporated without appendices, tailored to specific meetings or events. For instance, an annual proxy statement would differ from a special proxy statement for extraordinary corporate events, such as mergers, acquisitions, or stockholder proposals. In summary, the San Antonio Texas Proxy Statement — Prospectus of Corning Incorporated without appendices is a significant document that provides shareholders and potential investors with critical information about the company's management, governance, executive compensation, and financial performance.

San Antonio Texas Proxy Statement - Prospectus of Corning Incorporated without appendices

Description

How to fill out San Antonio Texas Proxy Statement - Prospectus Of Corning Incorporated Without Appendices?

Draftwing documents, like San Antonio Proxy Statement - Prospectus of Corning Incorporated without appendices, to manage your legal affairs is a tough and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for different scenarios and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the San Antonio Proxy Statement - Prospectus of Corning Incorporated without appendices template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting San Antonio Proxy Statement - Prospectus of Corning Incorporated without appendices:

- Make sure that your document is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or going through a brief description. If the San Antonio Proxy Statement - Prospectus of Corning Incorporated without appendices isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our service and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!