The Allegheny Pennsylvania Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute is a significant legal document that outlines the terms and conditions for the merger of these three entities. The merger involves Corning Inc, a renowned glass and ceramics manufacturing company, Apple Acquisition Corp, a subsidiary of technology giant Apple Inc, and Nichols Institute, a leading provider of medical testing services. This particular agreement and plan of merger pertains specifically to the merger arrangements between Corning Inc, Apple Acquisition Corp, and Nichols Institute in Allegheny County, Pennsylvania. The document lays out the steps and provisions for combining the resources, assets, and operations of these companies to create a unified and strategic enterprise. Some key components covered in the Allegheny Pennsylvania Agreement and Plan of Merger include: 1. Parties Involved: The agreement clearly identifies the merging parties—Corning Inc, Apple Acquisition Corp, and Nichols Institute—along with their legal statuses and jurisdictions. 2. Merger Structure: It outlines the structure of the merger, which could be a triangular merger or a direct merger. The document includes details regarding how the companies will be integrated, including the allocation of shares and assets. 3. Purchase Price and Consideration: The agreement defines the purchase price and the method of consideration for the merger. It specifies whether the payment will be in cash, stocks, securities, or a combination of these. 4. Representations and Warranties: This section details the declarations made by each party involved in the merger, ensuring that all disclosed information is accurate and complete. It includes financial statements, tax records, and other relevant information. 5. Conditions Precedent: The agreement specifies the various conditions that need to be fulfilled before the merger can proceed. These may include regulatory approvals, shareholder consent, and compliance with applicable laws and regulations. 6. Termination and Amendment: This section outlines the rights of all parties involved to terminate the agreement under specific circumstances. It also addresses the process through which the agreement can be amended or modified. Additional types of Allegheny Pennsylvania Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute may include variations in the geographical location or the specific entities involved. For instance, there could be an agreement and plan of merger between these companies in a different state or jurisdiction, specifying its own unique terms and conditions. In conclusion, the Allegheny Pennsylvania Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute is a legally binding document that solidifies the merger between these companies in Allegheny County, Pennsylvania. It covers various aspects of the merger, including parties involved, purchase price, representations, conditions precedent, and termination.

Allegheny Pennsylvania Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute

Description

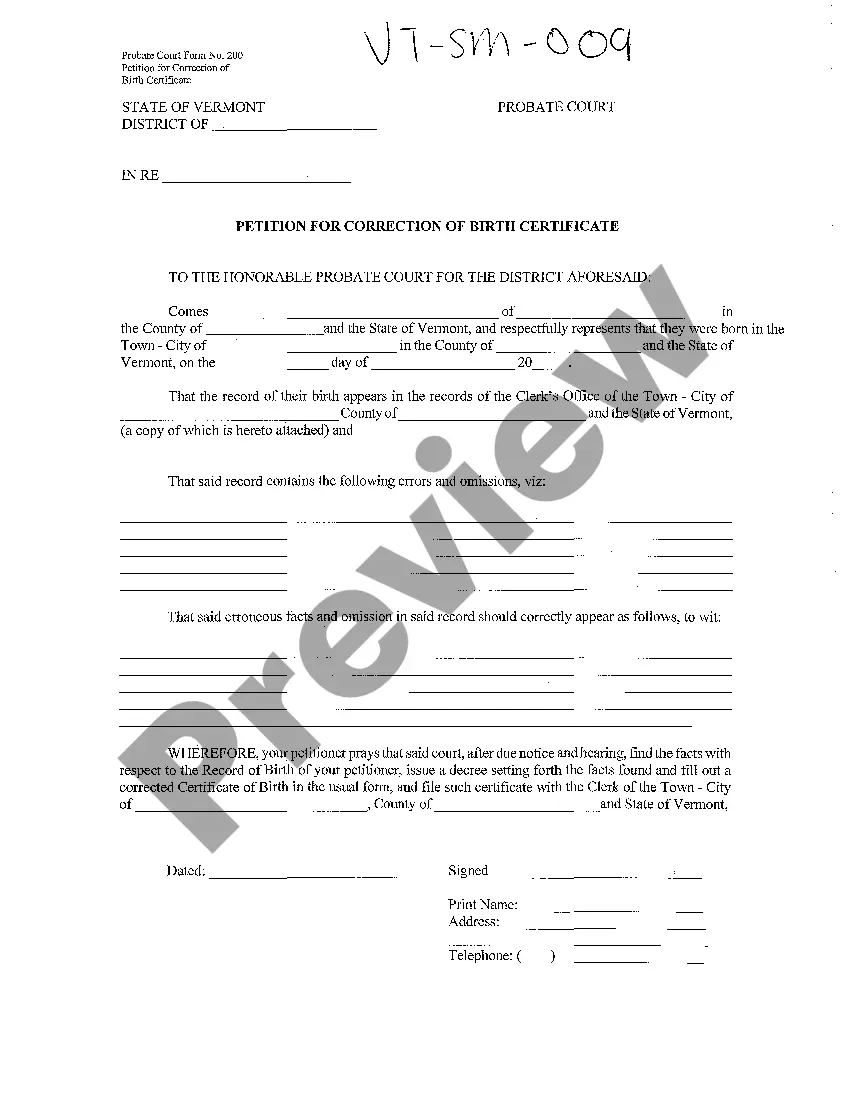

How to fill out Allegheny Pennsylvania Agreement And Plan Of Merger By Corning Inc, Apple Acquisition Corp, And Nichols Institute?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Allegheny Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Allegheny Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Allegheny Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute:

- Make sure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Allegheny Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!