The Maricopa Arizona Agreement and Plan of Merger is an important legal document that outlines the details and terms of the merger between Corning Inc, Apple Acquisition Corp, and Nichols Institute. This merger combines the resources, expertise, and market presence of these three entities to create a stronger and more competitive organization. Keywords: Maricopa Arizona, Agreement and Plan of Merger, Corning Inc, Apple Acquisition Corp, Nichols Institute, merger, legal document, terms, resources, expertise, market presence, competitive organization. 1. Maricopa Arizona Agreement and Plan of Merger between Corning Inc, Apple Acquisition Corp, and Nichols Institute: This particular agreement refers to the comprehensive merger plan and terms between Corning Inc, Apple Acquisition Corp, and Nichols Institute. It signifies the consolidation of the three entities into a single corporate structure, governed by the terms laid out in the agreement. 2. Maricopa Arizona Agreement and Plan of Merger for Strategic Expansion: This type of agreement focuses on the strategic expansion of Corning Inc, Apple Acquisition Corp, and Nichols Institute through the merger. It highlights the intention to leverage each organization's strengths, resources, and market advantage to achieve a broader presence and increased profitability. 3. Maricopa Arizona Agreement and Plan of Merger for Research and Development Collaboration: This agreement is characterized by a strong emphasis on research and development collaboration between Corning Inc, Apple Acquisition Corp, and Nichols Institute. The merger aims to pool their collective expertise, technology, and innovation capabilities to drive advancements and breakthroughs in their respective industries. 4. Maricopa Arizona Agreement and Plan of Merger for Enhancing Manufacturing Capabilities: This agreement focuses on enhancing manufacturing capabilities through the merger. Corning Inc, Apple Acquisition Corp, and Nichols Institute aim to combine their manufacturing facilities, infrastructure, and production expertise to achieve economies of scale, optimize efficiency, and improve the quality and delivery of their products. 5. Maricopa Arizona Agreement and Plan of Merger for Global Market Expansion: This type of agreement highlights the intention of Corning Inc, Apple Acquisition Corp, and Nichols Institute to expand their presence in the global market through the merger. It outlines strategies to leverage their combined market reach, distribution channels, and customer base to penetrate new markets, increase market share, and drive international growth. In summary, the Maricopa Arizona Agreement and Plan of Merger between Corning Inc, Apple Acquisition Corp, and Nichols Institute is a significant legal document that outlines various types of mergers based on the specific goals and objectives of the merging entities. From strategic expansion to research collaboration, manufacturing enhancement, and global market expansion, these agreements demonstrate the comprehensive nature of the merger and its potential impact on the organizations involved.

Maricopa Arizona Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute

Description

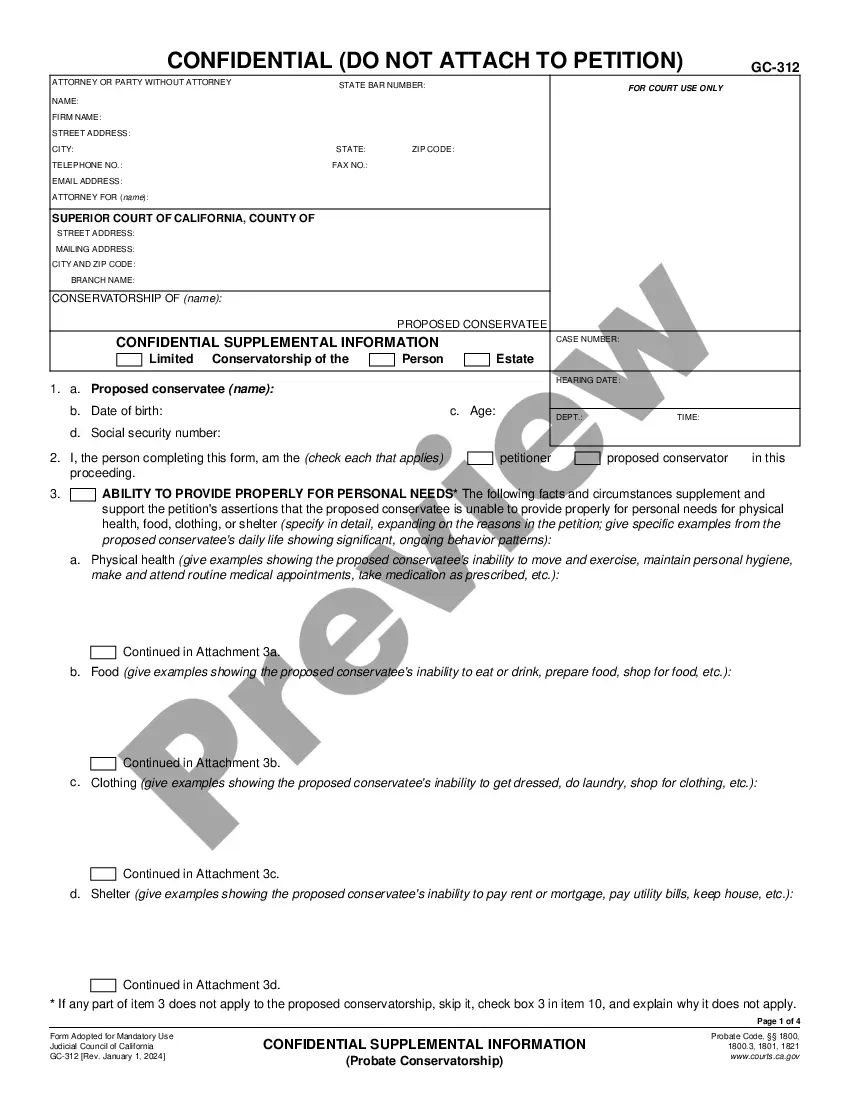

How to fill out Maricopa Arizona Agreement And Plan Of Merger By Corning Inc, Apple Acquisition Corp, And Nichols Institute?

Whether you intend to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Maricopa Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the Maricopa Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!