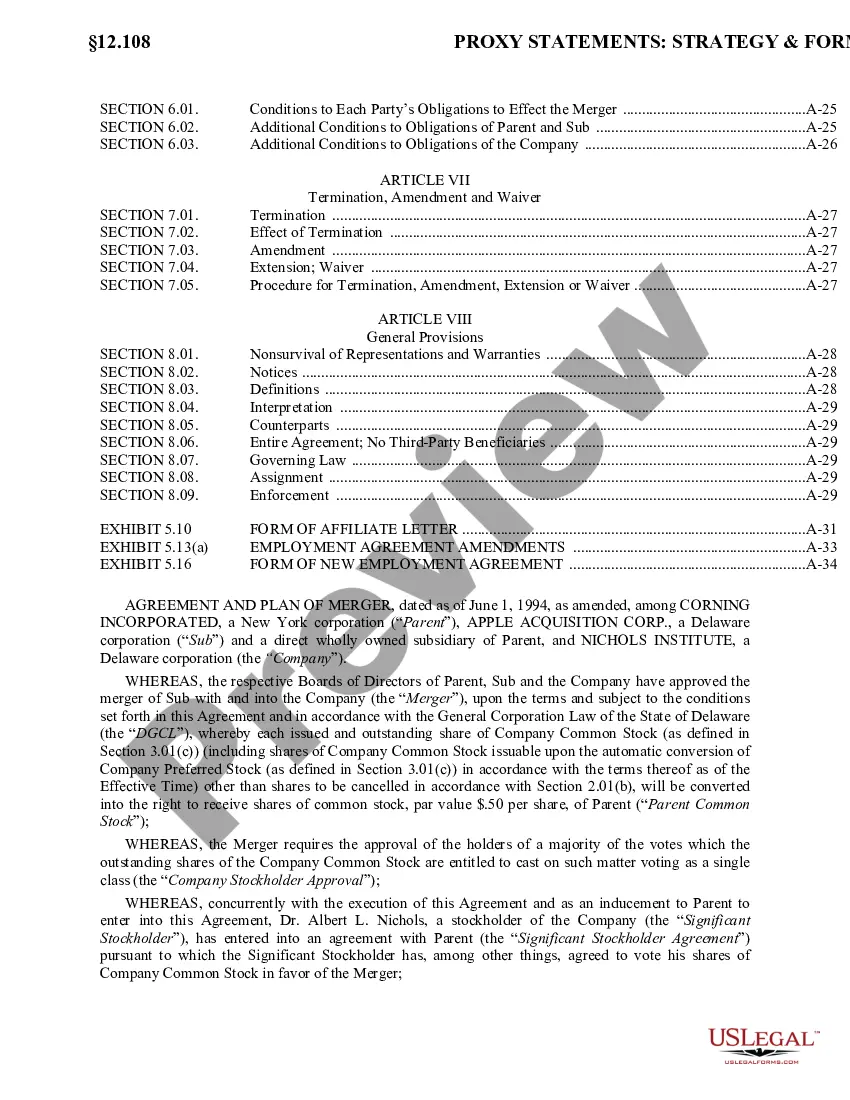

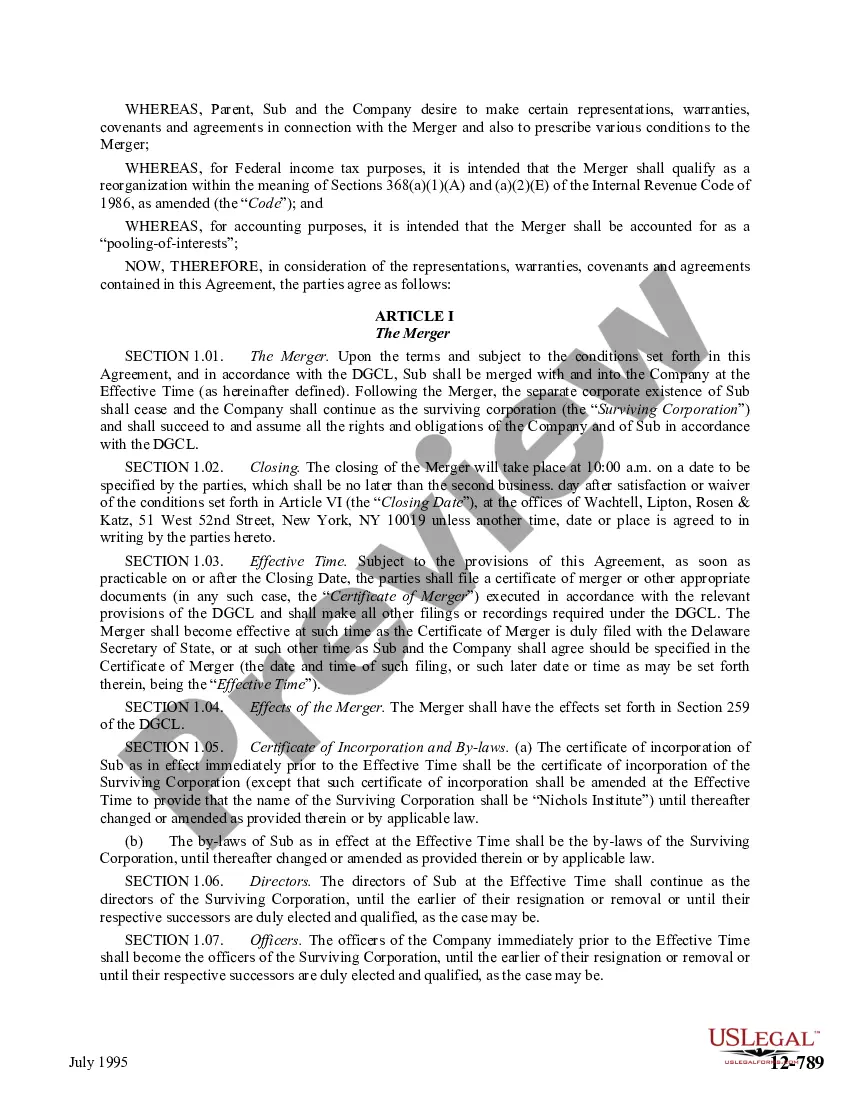

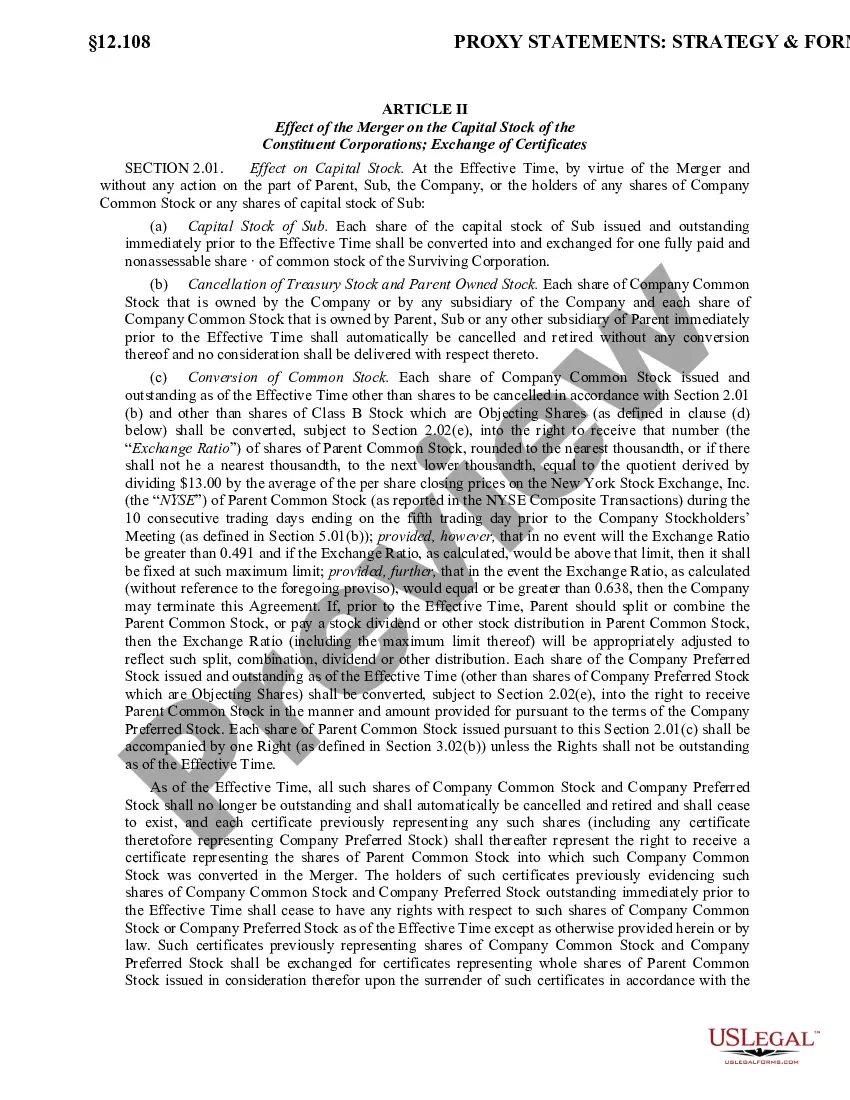

Title: Exploring the Phoenix Arizona Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute Introduction: The Phoenix Arizona Agreement and Plan of Merger is a significant legal document that outlines the terms and conditions of the merger between Corning Inc, Apple Acquisition Corp, and Nichols Institute. This detailed description aims to shed light on the various types of mergers associated with this agreement, providing valuable insights into the process and the implications it holds for the involved entities. 1. Vertical Merger: One type of merger covered in the Phoenix Arizona Agreement and Plan of Merger is the vertical merger. This occurs when companies operating at different stages within the same supply chain come together to streamline their operations, improve efficiencies, and enhance profitability. In the context of this agreement, it could imply that Corning Inc, a global technology company, and Apple Acquisition Corp, a partner organization, are merging their capabilities with Nichols Institute, a renowned healthcare diagnostic company based in Phoenix, Arizona. 2. Horizontal Merger: Another possible type of merger is the horizontal merger. In this scenario, companies operating in the same industry or market come together to combine their resources, core competencies, and market share. Corning Inc, Apple Acquisition Corp, and Nichols Institute may be joining forces through this agreement to leverage their collective expertise and expand their market presence in the healthcare and technology sectors. 3. Conglomerate Merger: While not explicitly mentioned, a conglomerate merger could also be a potential consideration within the Phoenix Arizona Agreement and Plan of Merger. This merger occurs when companies from unrelated industries combine their operations, diversifying their offerings and creating synergies. All three entities involved in this agreement have unique specializations, which could create avenues for diversification, innovation, and complimentary growth opportunities. 4. Strategic Intent: The Phoenix Arizona Agreement and Plan of Merger emphasizes the strategic intent behind the merger. Corning Inc, Apple Acquisition Corp, and Nichols Institute come together with the common goal of capitalizing on their shared vision, competency, and resources to achieve economies of scale, enhance research and development capabilities, expand their customer base, and drive sustainable growth. Conclusion: The Phoenix Arizona Agreement and Plan of Merger represents a groundbreaking collaboration between Corning Inc, Apple Acquisition Corp, and Nichols Institute. By examining the various types of mergers encompassed in this agreement, such as vertical, horizontal, and potentially conglomerate mergers, it becomes apparent that this amalgamation is driven by the vision of creating a powerful synergy, aiming to revolutionize healthcare diagnostic technologies while leveraging each entity's unique strengths.

Phoenix Arizona Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute

Description

How to fill out Phoenix Arizona Agreement And Plan Of Merger By Corning Inc, Apple Acquisition Corp, And Nichols Institute?

Drafting documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Phoenix Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute without expert assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Phoenix Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Phoenix Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute:

- Examine the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

A company merger is when two companies combine to form a new company. Companies merge to expand their market share, diversify products, reduce risk and competition, and increase profits.

A certificate of merger, also known as an articles of merger, is a document that provides evidence of the merger between two or more entities into one entity.

Articles of merger are legal documents outlining the roles and responsibilities of two or more parties as they merge into a single entity. Articles of merger may also be called a certificate of merger. This agreement outlines the intent of multiple parties to merge and outline the merger's operational aspects.

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

7. A statement that the Agreement of Merger will be provided to any stockholder of any constituent corporation or any partner of any constituent limited partnerships. Execution Block - The document must be signed by an Authorized Officer of the surviving Delaware corporation.

The stocks of both companies in a merger are surrendered, and new equity shares are issued for the combined entity. An acquisition is when one company takes over another company, and the acquiring company becomes the owner of the target company.

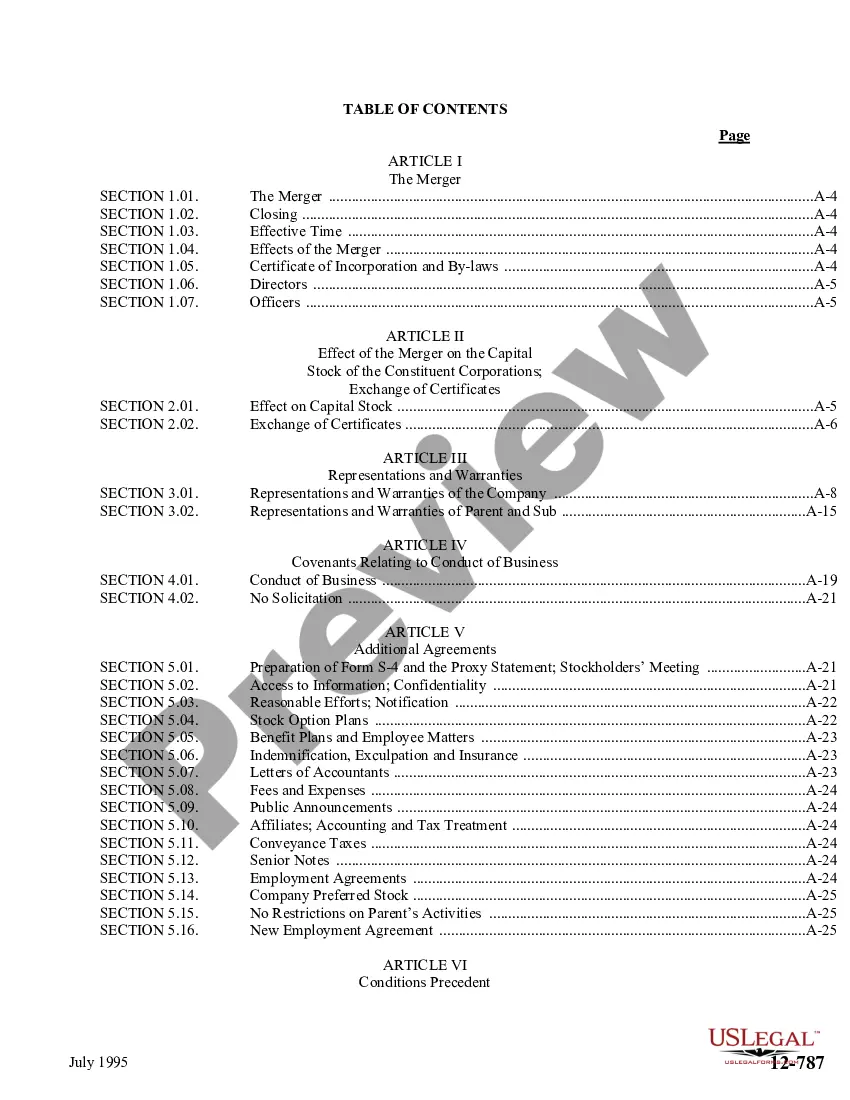

The key terms include: The Buyer and Seller, Price (per share, or lump sum for private companies), and Type of Transaction.Treatment of Outstanding Shares, Options, and RSUs and Other Dilutive Securities.Representations and Warranties.Covenants.Solicitation (?No Shop? vs.Financing.Termination Fee (or ?Break-Up Fee?)

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.