The San Antonio Texas Agreement and Plan of Merger, executed by Corning Inc, Apple Acquisition Corp, and Nichols Institute, is a legally binding contract that outlines the terms and conditions of a merger between these respective entities. This merger is intended to bring together the unique assets, expertise, and resources of each company to maximize operational efficiencies, expand market reach, and drive future growth. Key Keywords: San Antonio Texas, Agreement and Plan of Merger, Corning Inc, Apple Acquisition Corp, Nichols Institute, merger, terms and conditions, assets, expertise, resources, operational efficiencies, market reach, growth. In the realm of San Antonio Texas, there are several types of Agreement and Plan of Mergers that have been executed by Corning Inc, Apple Acquisition Corp, and Nichols Institute: 1. Strategic Merger: Such a merger would be aimed at capitalizing on complementary strengths, technologies, or markets of the involved parties. By combining their resources and expertise, this type of merger enhances their competitive position within the San Antonio Texas region and beyond. 2. Vertical Merger: In this type of merger, Corning Inc, Apple Acquisition Corp, and Nichols Institute, which may operate in different stages of the same industry's supply chain, merge with each other to form a comprehensive, integrated company. Vertical mergers can create synergies, streamline operations, and potentially reduce costs within the San Antonio Texas market. 3. Conglomerate Merger: This merger type brings together companies from unrelated industries or sectors within San Antonio Texas. Corning Inc, Apple Acquisition Corp, and Nichols Institute could merge to diversify their portfolio or access new markets within the region, leveraging their combined resources and expertise. 4. Horizontal Merger: A horizontal merger occurs when two or more competitors operating in the same industry merge to increase their market share and consolidate their positions within the San Antonio Texas market. Corning Inc, Apple Acquisition Corp, and Nichols Institute might undertake a horizontal merger to eliminate duplicate operations, gain economies of scale, and enhance their competitive advantage. It is important to note that the specific details, scope, and structure of each Agreement and Plan of Merger can vary depending on the strategic goals and circumstances of the involved parties.

San Antonio Texas Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute

Description

How to fill out San Antonio Texas Agreement And Plan Of Merger By Corning Inc, Apple Acquisition Corp, And Nichols Institute?

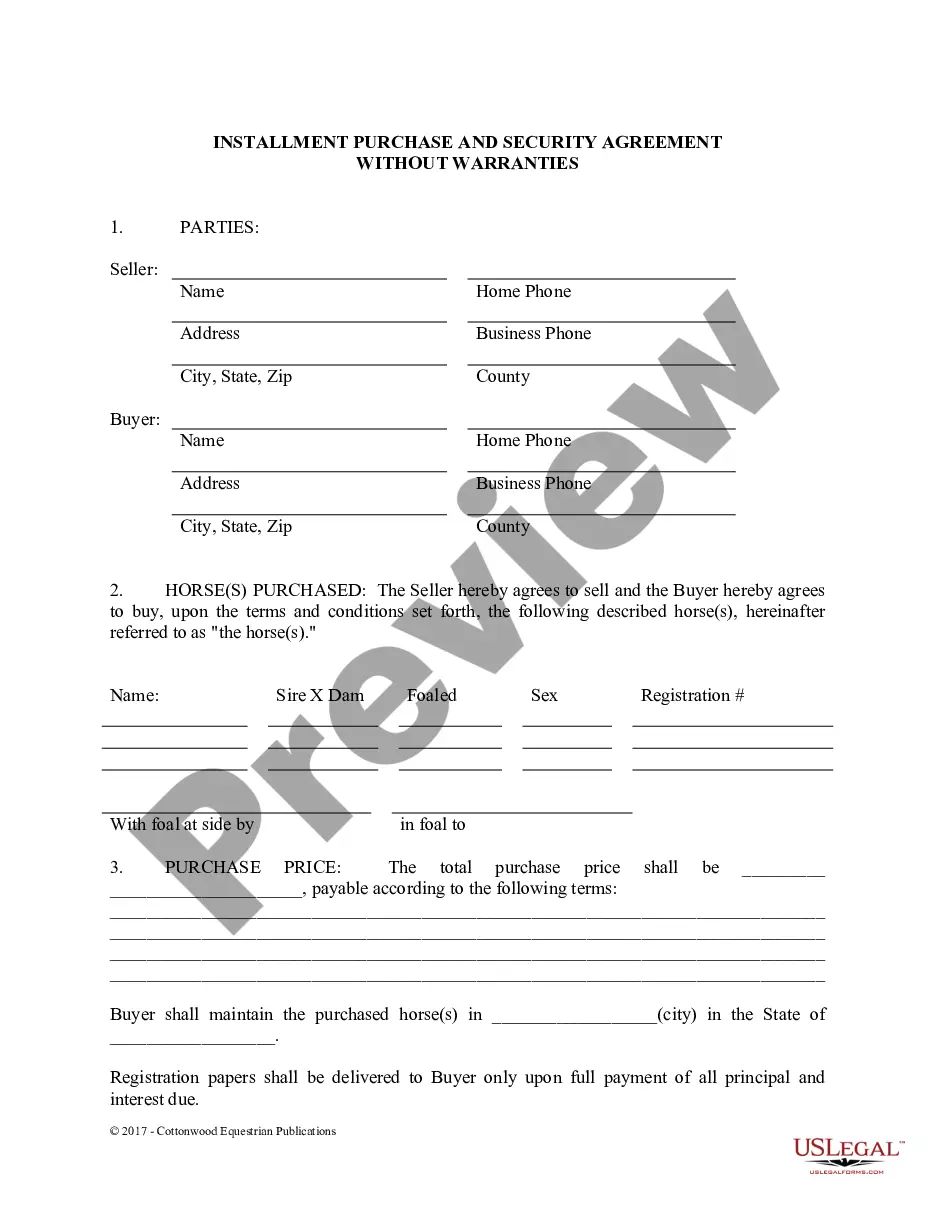

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including San Antonio Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed materials and guides on the website to make any activities related to document completion straightforward.

Here's how you can find and download San Antonio Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the related document templates or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and purchase San Antonio Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed San Antonio Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney entirely. If you have to deal with an extremely difficult situation, we recommend getting a lawyer to check your form before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-compliant documents effortlessly!