Wayne, Michigan, is a vibrant city located in Wayne County, Michigan, United States. Situated just west of Detroit, Wayne is a thriving community with a rich history and diverse population. Home to about 17,000 residents, Wayne offers a small-town charm while providing easy access to big-city amenities. Now, turning our attention to Section 262 of the Delaware General Corporation Law, this section focuses on the appraisal rights available to stockholders of Delaware corporations in certain circumstances. The Delaware General Corporation Law is a comprehensive set of statutes governing the formation, organization, governance, and dissolution of corporations in Delaware, which is known for its business-friendly legal framework. Section 262 of the Delaware General Corporation Law specifically addresses the rights of stockholders who dissent from certain corporate actions. These actions may include mergers, consolidations, or conversions involving Delaware corporations. If a stockholder believes that the terms of a proposed action are not fair, they have the option to exercise appraisal rights under Section 262. Appraisal rights allow dissenting stockholders to have their shares independently appraised to determine their fair value. This process involves a monetary assessment of the shares, which may be higher or lower than the market price. The dissenting stockholders have the right to receive this fair value in cash for their shares, rather than participating in the action proposed by the corporation. While Section 262 of the Delaware General Corporation Law outlines the general framework for appraisal rights, there may be different types of actions or scenarios that warrant its application. These include: 1. Mergers: When two companies combine, either through a merger or consolidation, dissenting stockholders may choose to exercise their appraisal rights if they believe the proposed terms are not fair. 2. Consolidations: Similarly to mergers, dissenting stockholders in a proposed consolidation have the right to seek fair value for their shares through the appraisal process if they disagree with the terms. 3. Conversions: In the case of a conversion, which involves changing a corporation's form (e.g., converting from a corporation to a limited liability company), Section 262 allows dissenting stockholders to exercise appraisal rights if they believe the conversion is not in their best interests. By providing appraisal rights, Section 262 of the Delaware General Corporation Law aims to protect minority stockholders and ensure they receive fair compensation for their shares in situations where corporate actions may impact their investment negatively. These rights provide a mechanism to resolve disputes and safeguard the interests of stockholders in Delaware corporations.

Wayne Michigan Section 262 of the Delaware General Corporation Law

Description

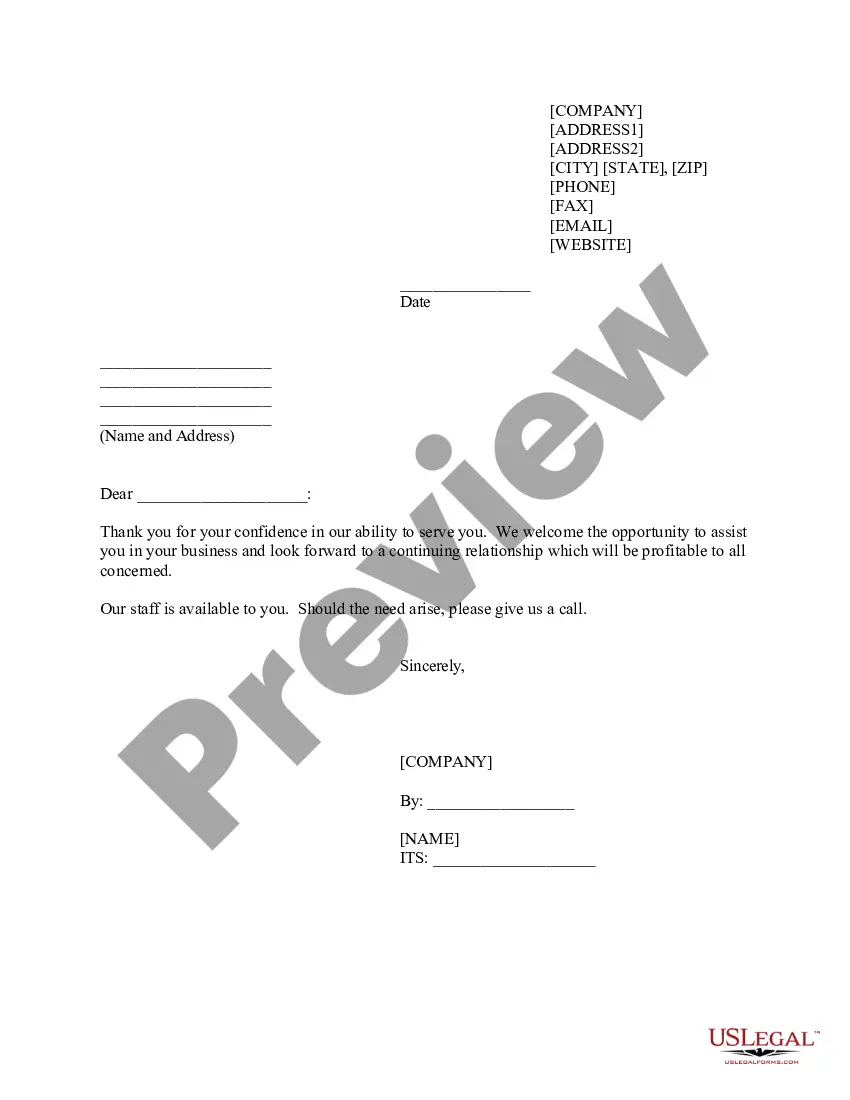

How to fill out Wayne Michigan Section 262 Of The Delaware General Corporation Law?

If you need to find a reliable legal form provider to get the Wayne Section 262 of the Delaware General Corporation Law, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it easy to get and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse Wayne Section 262 of the Delaware General Corporation Law, either by a keyword or by the state/county the document is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Wayne Section 262 of the Delaware General Corporation Law template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less pricey and more affordable. Set up your first business, arrange your advance care planning, draft a real estate agreement, or execute the Wayne Section 262 of the Delaware General Corporation Law - all from the convenience of your home.

Join US Legal Forms now!

Form popularity

FAQ

In short, the market out exception (at least in Delaware) provides that a shareholder does not have appraisal rights if they are receiving stock and not cash for their shares in the target company.

By providing for appraisal rights, a jurisdiction like Delaware provides investors with a powerful tool to protect the value of their investment against unfair, opportunistic or simply ill-timed bids by allowing the investor to require a court to determine the fair value of the securities notwithstanding the

When certain corporate transactions, such as a merger and consolidation, deprive the shareholders of their ownership interests in a corporation against their will, the shareholders can use the appraisal statutes to obtain the fair value of the shares that have been taken.

As explained by the Supreme Court, the appraisal right is exercised by any stockholder who has voted against the proposed corporate action by making a written demand on the corporation within 30 days after the date on which the vote was taken for the payment of the fair value of his shares.

When a dissenting shareholder disagrees with a firm's actions, they can exercise appraisal rights; appraising their shares, and being paid the fair market value for them. Dissenters' rights provide an easy way out of a company for a shareholder.

No Appraisal Rights When Shareholders Can Receive Acquirer Stock.

An appraisal right is a legal right of a company's shareholders to demand a judicial proceeding or independent valuation of the company's shares with the goal of determining a fair value of the stock price.

out merger is a strategic merger transaction that is accomplished for the purpose of eliminating unwanted minority shareholders. out merger can be used by one or more majority shareholders to eliminate one or more minority shareholders.

MBCA section 13.02(a) lists five mandatory appraisal triggers, each of which specifically defines events that require the corporation to offer its shareholders appraisal rights: (1) mergers, (2) share exchanges, (3) dispositions of assets, (4) amendments to the articles, and (5) conversion or domestication.