Bronx, New York, is a vibrant borough located in the northern part of New York City. It is known for its rich cultural diversity, historical landmarks, and bustling urban vibe. With a population of approximately 1.5 million, Bronx offers a unique blend of residential neighborhoods, commercial centers, and iconic attractions. One of the proposed amendments to a Partnership Agreement in Bronx, New York, is the provision for the issuance of preferred partnership interests. This amendment aims to introduce a new class of partnership interests that hold certain advantages and preferences compared to regular partnership interests. By allowing the issuance of preferred partnership interests, the partnership can provide additional benefits and incentives to specific partners or investors. Preferred partnership interests usually come in two types: cumulative and non-cumulative. Cumulative preferred partnership interests entitle the holders to receive unpaid distributions from previous years before common partnership interest holders can receive any distribution. On the other hand, non-cumulative preferred partnership interests do not accumulate any unpaid distributions and are only entitled to receive distributions if the partnership declares them for the current period. The proposed amendment seeks to add provisions related to the issuance, rights, and preferences of preferred partnership interests. It may outline details such as the dividend rate, liquidation preference, voting rights, redemption rights, conversion rights, transferability restrictions, and any other preferred rights that the partnership wishes to bestow upon these preferred interest holders. This amendment to the Partnership Agreement will provide flexibility and customization for the partnership, allowing it to attract potential partners or investors who may have specific preferences or investment requirements. It can also help align the interests of different stakeholders and incentivize continued investment and participation in the partnership. In conclusion, the proposed amendment to the Partnership Agreement in Bronx, New York, aims to introduce the issuance of preferred partnership interests to provide enhanced benefits and preferences to certain partners or investors. These preferred partnership interests can come in variations such as cumulative or non-cumulative, and the amendment will outline the specific rights and provisions associated with these interests. By implementing this amendment, the partnership can adapt to the needs of its stakeholders and potentially attract new investment opportunities.

Bronx New York Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests

Description

How to fill out Bronx New York Sample Proposed Amendment To Partnership Agreement To Provide For Issuance Of Preferred Partnership Interests?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Bronx Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Bronx Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Bronx Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests:

- Make sure you have opened the right page with your local form.

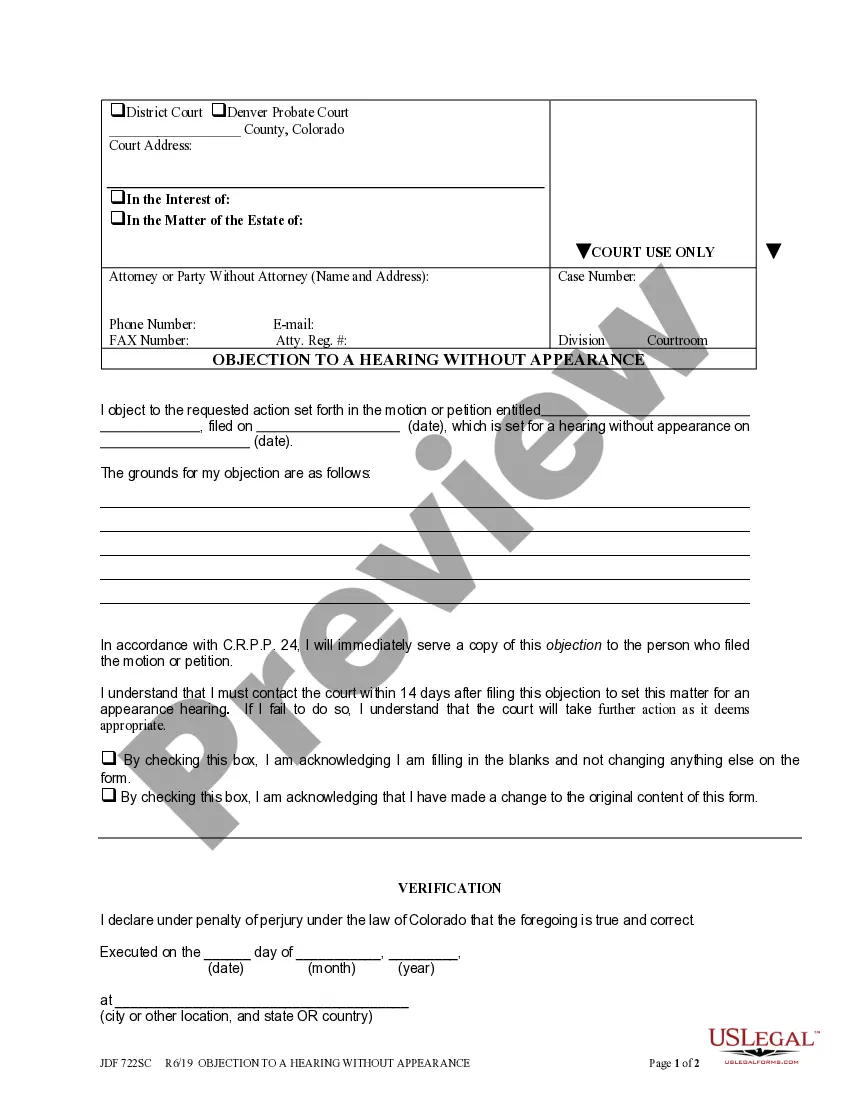

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Bronx Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!