Houston Texas Designation of Rights, Privileges, and Preferences of Preferred Stock is a legal document that outlines the specific rights, privileges, and preferences granted to holders of preferred stock in a company based in Houston, Texas. Preferred stock is a type of stock that typically provides certain benefits and advantages to shareholders. The Houston Texas Designation of Rights, Privileges, and Preferences of Preferred Stock can include various provisions tailored to meet the specific needs and objectives of the company and its shareholders. The primary purpose of this document is to define the unique rights, preferences, and privileges associated with preferred stock that differentiate it from common stock. Some common types of Houston Texas Designation of Rights, Privileges, and Preferences of Preferred Stock include: 1. Cumulative Preferred Stock: This type of preferred stock entitles shareholders to receive unpaid or omitted dividends in the future, which are accrued and paid at a later date. 2. Convertible Preferred Stock: Convertible preferred stock allows shareholders the option to convert their preferred shares into a predetermined number of common shares, providing them with the opportunity to benefit from any potential increase in the company's stock value. 3. Participating Preferred Stock: With participating preferred stock, shareholders are entitled to receive additional dividends, usually on top of the fixed dividend rate, based on a predetermined formula. This type of preferred stock allows shareholders to participate in the company's profits beyond their fixed dividend rate. 4. Non-Cumulative Preferred Stock: In contrast to cumulative preferred stock, non-cumulative preferred stock does not accumulate or carry forward unpaid dividends if they are omitted or not paid in a specific period. Shareholders in this case are only entitled to receive dividends for the current period. The contents of the Houston Texas Designation of Rights, Privileges, and Preferences of Preferred Stock typically include detailed information such as: — Dividend preferences: Outlining the specific dividend rate and preference of preferred stockholders to common stockholders when it comes to receiving dividends. — Liquidation rights: Determining the order in which preferred shareholders would receive their investments back if the company was to be liquidated or sold. — Voting rights: Establishing the extent to which preferred shareholders can participate in company decisions through voting on certain matters. — Conversion rights: Outlining the terms and conditions for converting preferred shares into common shares, if applicable. — Redemption provisions: Specifying the circumstances and conditions under which the company can redeem or buy back preferred stock from shareholders. — Preemptive rights: Granting preferred shareholders the option to maintain their ownership percentage by purchasing additional shares before they are offered to others in subsequent stock issuance. — Protective provisions: Determining any specific safeguards or conditions to protect preferred stockholders' rights, such as restrictions on major corporate changes or management decisions. It is crucial for both the company and preferred stockholders to clearly define the rights, privileges, and preferences associated with preferred stock in a Houston Texas Designation of Rights, Privileges, and Preferences of Preferred Stock, ensuring transparency, clarity, and adherence to applicable laws and regulations.

Houston Texas Designation of Rights, Privileges and Preferences of Preferred Stock

Description

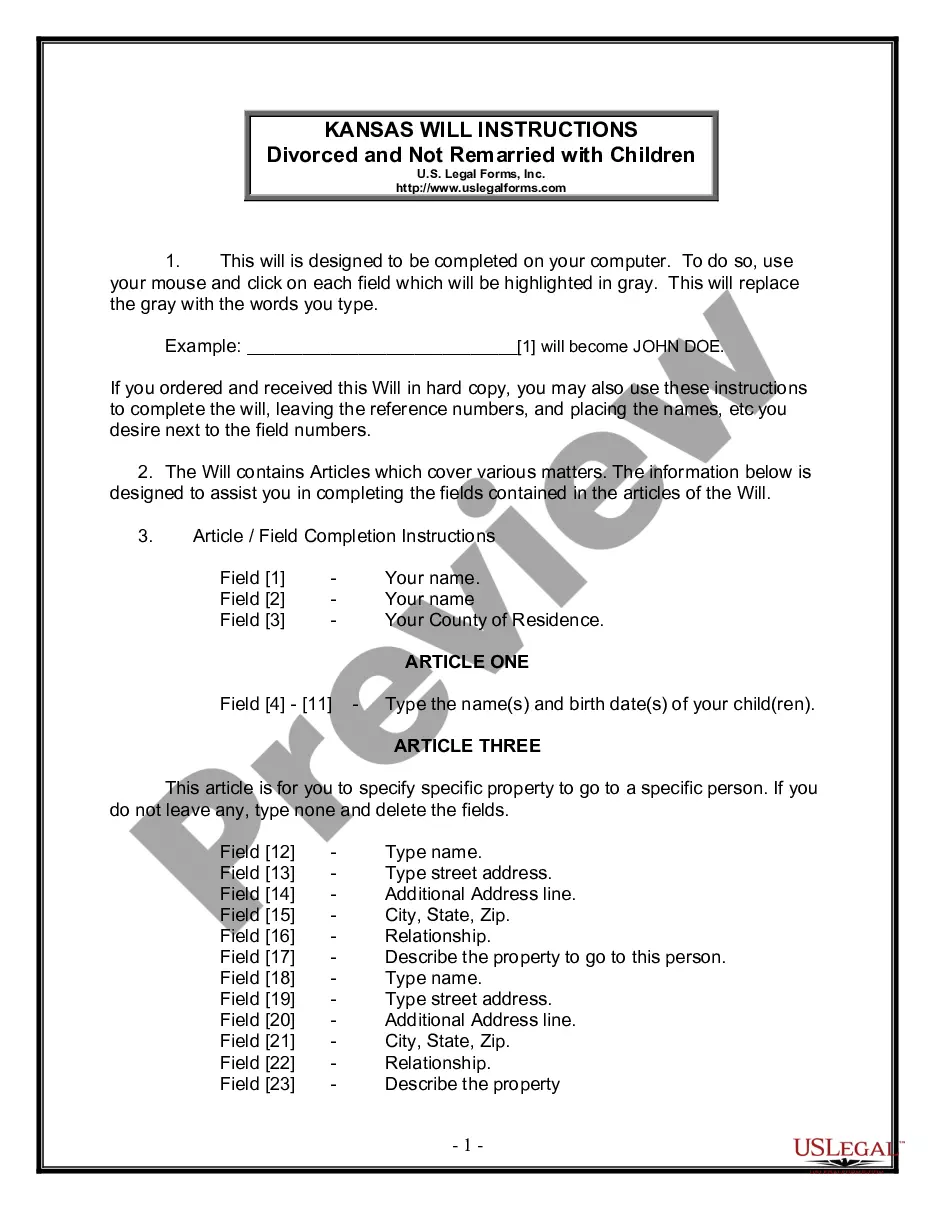

How to fill out Houston Texas Designation Of Rights, Privileges And Preferences Of Preferred Stock?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Houston Designation of Rights, Privileges and Preferences of Preferred Stock, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed materials and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how to purchase and download Houston Designation of Rights, Privileges and Preferences of Preferred Stock.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Check the related forms or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and buy Houston Designation of Rights, Privileges and Preferences of Preferred Stock.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Houston Designation of Rights, Privileges and Preferences of Preferred Stock, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional completely. If you have to cope with an extremely complicated case, we advise using the services of an attorney to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and get your state-compliant documents with ease!

Form popularity

FAQ

A designation is a description, name, or title that is given to someone or something. Designation is the fact of giving that description, name, or title. formal

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Something that designates; a distinctive name or title; appellation. nomination, appointment, or election to an office, position, etc.: His designation as treasurer has been confirmed.

As a general matter, holders of preferred stock have the same appraisal rights under Section 262 of the DGCL as the holders of common stock.

Private Preferred Stock A private company is one that hasn't yet offered its common shares to the public. Venture capitalists and private equity investors can inject money into a nonpublic company by purchasing private preferred stock. The company can use the cash to help grow and operate.

Unlike common stockholders, preferred stockholders have limited rights which usually does not include voting.

Preferred Designation means the Certificate of Designation with respect to the Series D Preferred Stock, the Series E Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock and the Series I Preferred Stock adopted by the Board of Directors of the Company and duly filed

If your child receives a designation at school it recognizes they have a chronic health condition, special physical or mental health needs, or learning challenges. That means your child has access to extra funding and an Individual Education Plan (IEP) to help support them at school.

Preferred stockholders generally do not have voting rights, as common stockholders do, but they have a greater claim to the company's assets.

Preferred stocks are equity investments, just as common stocks are. However, preferred stocks yield a set dividend that must be paid in preference to any dividend paid to owners of common stock. Like bonds, preferred stocks may be purchased for their regular income payments, not their market price fluctuations.