Middlesex Massachusetts Reduction in Authorized Number of Directors refers to a legal process in which the number of directors in Middlesex Massachusetts is decreased. This reduction can occur due to various reasons such as organizational restructuring, cost-cutting measures, or changes in corporate governance policies. In Middlesex County, Massachusetts, which is one of the 14 counties in the state, reduction in the authorized number of directors can have significant implications for businesses, nonprofits, and government entities alike. It is essential to understand the process, requirements, and potential consequences associated with this reduction. The Massachusetts General Laws provide guidelines for such reductions. According to Chapter 156B: Section 26, corporations in Middlesex County may reduce the number of directors through a formal amendment to their articles of organization — the foundational document governing a corporation's internal affairs. The reduction process typically involves several steps. Initially, the board of directors and/or shareholders of the organization must propose the amendment to the articles of organization. This proposal should specify the desired number of directors and provide a rationale for the reduction. The proposal would then need to be approved by a majority vote of the shareholders or directors, depending on the corporation's bylaws and governing structure. Once the proposal is approved internally, the organization must file the amended articles of organization with the Secretary of the Commonwealth of Massachusetts. This filing ensures that the authorized number of directors is officially reduced in the eyes of the law. It's important to note that different types of organizations in Middlesex Massachusetts, such as for-profit corporations, nonprofit organizations, and government entities, may experience a reduction in authorized number of directors differently. For instance: 1. For-profit corporations: In Middlesex County, for-profit corporations, including both publicly-traded companies and privately-held businesses, can undergo a reduction in authorized number of directors to align their leadership structure with strategic goals, economic conditions, or legal requirements imposed by regulators. 2. Nonprofit organizations: Nonprofits operating in Middlesex County may seek a reduction in authorized number of directors to streamline decision-making processes, enhance efficiency, or respond to changes in funding or programmatic priorities. This reduction can be crucial for governance adjustments within nonprofit boards. 3. Government entities: Municipalities, agencies, or departments within Middlesex County's local government arena could consider reducing the authorized number of directors or board members to optimize decision-making, improve accountability, and streamline administrative processes. This reduction can yield a more functional and agile governing body. In conclusion, the Reduction in Authorized Number of Directors is a legal process that allows organizations in Middlesex Massachusetts to decrease their director count. By following the guidelines provided by Massachusetts General Laws, organizations can undertake this reduction to adapt to various internal and external factors that call for a revised leadership structure. Whether it is for-profit corporations, nonprofit organizations, or government entities, a reduction in authorized number of directors can lead to enhanced efficiency, improved decision-making processes, and better alignment with strategic goals.

Middlesex Massachusetts Reduction in Authorized Number of Directors

Description

How to fill out Middlesex Massachusetts Reduction In Authorized Number Of Directors?

Preparing documents for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Middlesex Reduction in Authorized Number of Directors without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Middlesex Reduction in Authorized Number of Directors on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Middlesex Reduction in Authorized Number of Directors:

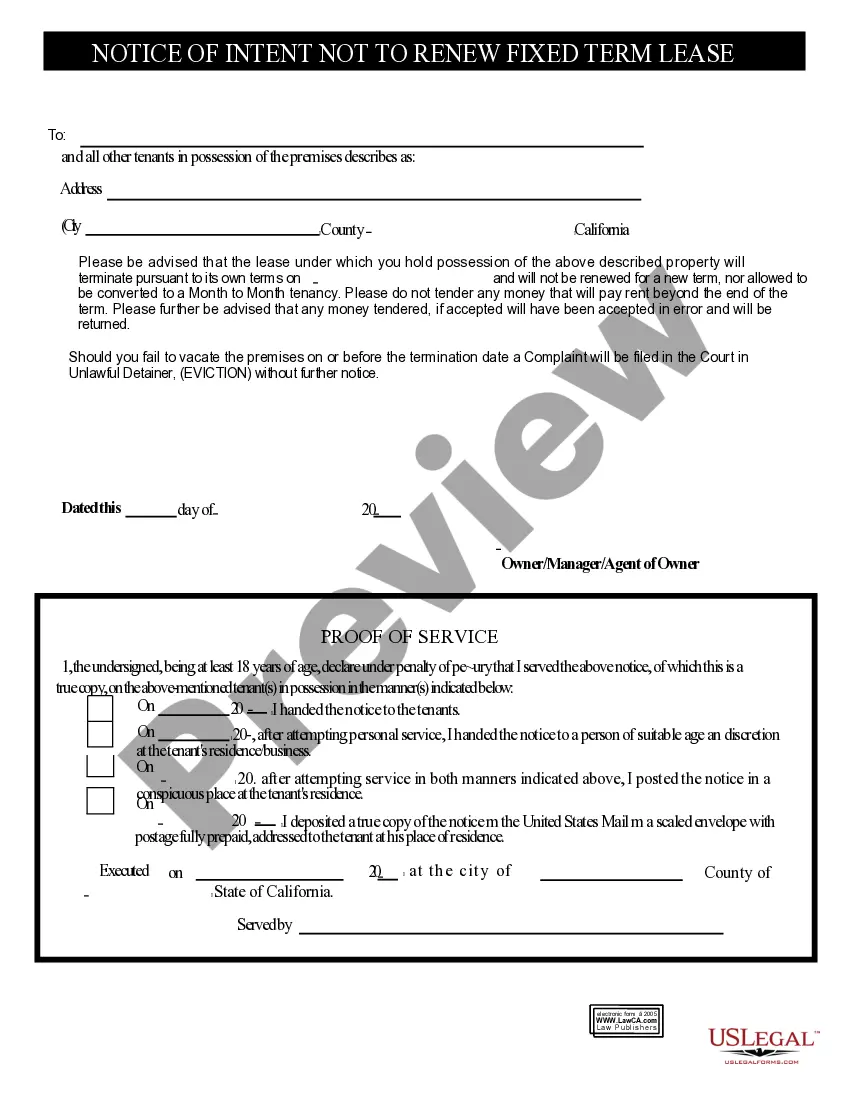

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split). A stock split is exactly what it sounds like: a division of shares.

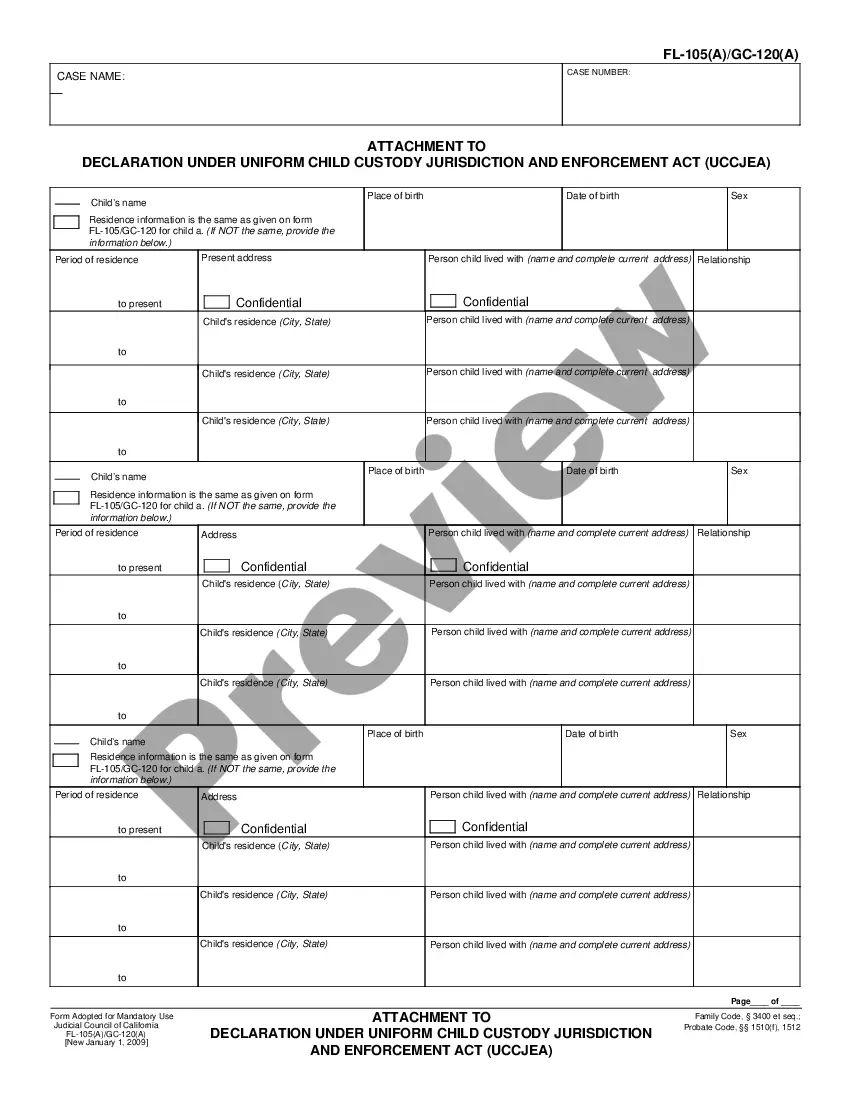

As can be gleaned from the foregoing, there are three (3) basic requirements for amending the Articles of Incorporation, namely: Majority vote of the board of directors. Written assent of the stockholders representing at least 2/3 of the outstanding capital stock. Approval by the Securities and Exchange Commission.

Navigate to Securities > Shares. Click Manage share classes and select Manage authorized. Click on the + to the right of the latest entry, which will duplicate that row. Replace the newest row's filing date and authorized count of each share class with the updated information from the latest incorporation document.

The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

To make amendments to your Delaware Stock Corporation, you submit the completed State of Delaware Certificate of Amendment of Certificate of Incorporation form to the Department of State by mail, fax or in person, along with the filing fee and the Filing Cover Memo. Non-stock corporations use a separate amendment form.

Board Obligations Regarding Valid Amendment Section 242 of the DGCL requires in most scenarios that the board of a stock corporation must approve a proposed charter amendment and submit it to stockholders for approval.

There are two scenarios for filing a Delaware Certificate of Amendment of Certificate of Incorporation. The Amendment may be filed either before the corporation has issued any stock or after stock has been issued and payment for stock has been received.

A company may refrain from issuing all of its authorized shares to maintain a controlling interest in the company and therefore prevent a hostile takeover. The number of authorized shares can be changed by shareholder vote.

Due to the nature of cumulative voting, the number of directors the company has can make a tremendous difference in who can elect a majority of the Board. To protect minority rights, the California law requires a certain number of directors to be on the Board.

If you want to amend your California articles of incorporation, you must file a Certificate of Amendment of Articles of Incorporation form with the California Secretary of State (SOS) by mail or in person. Checks should be payable to the Secretary of State.