Title: Chicago Illinois Adoption of Nonemployee Directors Deferred Compensation Plan: Explained with Sample Plan Introduction: The Chicago Illinois Adoption of Nonemployee Directors Deferred Compensation Plan is an arrangement offered to nonemployee directors serving various organizations within the city of Chicago, Illinois. This plan allows nonemployee directors to defer a portion of their compensation, gaining advantages such as tax-deferred growth, flexibility in investment choices, and potential company matching contributions. This detailed description will provide insights into the features, benefits, and types of Chicago Illinois Adoption of Nonemployee Directors Deferred Compensation Plan. I. Features of the Chicago Illinois Adoption of Nonemployee Directors Deferred Compensation Plan: 1. Compensation Deferral Options: — Choice of deferring a fixed percentage or specific amount of compensation. — Flexibility to defer base retainers, meeting fees, stock awards, or all forms of compensation. — Opportunity to defer cash fees or request that fees be paid in equity or other forms based on the plan's provisions. 2. Tax-Deferred Growth: — Contributions made to the deferred compensation plan grow on a tax-deferred basis until distribution. — Directors have the potential to accumulate greater wealth by deferring compensation and reaping the benefits of compounding returns. 3. Variety of Investment Choices: — Typically, directors can choose from a range of investment options offered by the plan. — Options may include traditional investment options such as mutual funds, stocks, bonds, or more specialized ones like real estate investment trusts (Rests) or index funds. 4. Company Matching Contributions (if applicable): — Some plans may offer a company matching contribution to incentivize nonemployee directors to participate. — The matching contribution may be a fixed percentage of the director's deferred compensation or based on a predetermined formula. II. Benefits of the Chicago Illinois Adoption of Nonemployee Directors Deferred Compensation Plan: 1. Attractive Long-Term Wealth Accumulation: — By deferring compensation, directors have the opportunity to accumulate significant retirement savings over time. — Tax-deferred growth can enhance the overall growth potential of the deferred funds. 2. Improved Retirement Income Planning: — Directors can align their retirement income with their anticipated needs by deferring compensation. — By strategically planning distributions, directors may potentially manage their tax obligations more efficiently during retirement. 3. Greater Flexibility and Control: — Directors can exercise greater control over their investment choices. — The plan affords flexibility in selecting investments based on the director's risk tolerance, financial goals, and market conditions. Types of Chicago Illinois Adoption of Nonemployee Directors Deferred Compensation Plan: 1. Fixed Percentage Deferral Plans: — Directors choose to defer a specific percentage of their compensation, typically ranging from 10% to 50%. 2. Specific Amount Deferral Plans: — Directors elect to defer a fixed amount from their total compensation, allowing for greater control over the deferred sum. 3. Combination Plans: — Directors have the option to use both the fixed percentage and specific amount deferral methods, providing maximum flexibility. Conclusion: The Chicago Illinois Adoption of Nonemployee Directors Deferred Compensation Plan offers nonemployee directors serving Chicago-based organizations an advantageous option to defer a portion of their compensation. With tax-deferred growth potential, variety of investment choices, and the possibility of company matching contributions, this plan provides a comprehensive solution for directors' long-term wealth accumulation and retirement income planning needs. By understanding the features, benefits, and types of this plan, nonemployee directors can make informed decisions regarding their financial future. [Note: While the content is fictitious, it provides a general outline that can be expanded upon or adapted as per requirements.]

Chicago Illinois Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan

Description

How to fill out Chicago Illinois Adoption Of Nonemployee Directors Deferred Compensation Plan With Copy Of Plan?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Chicago Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Chicago Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Chicago Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan:

- Analyze the page content to make sure you found the appropriate sample.

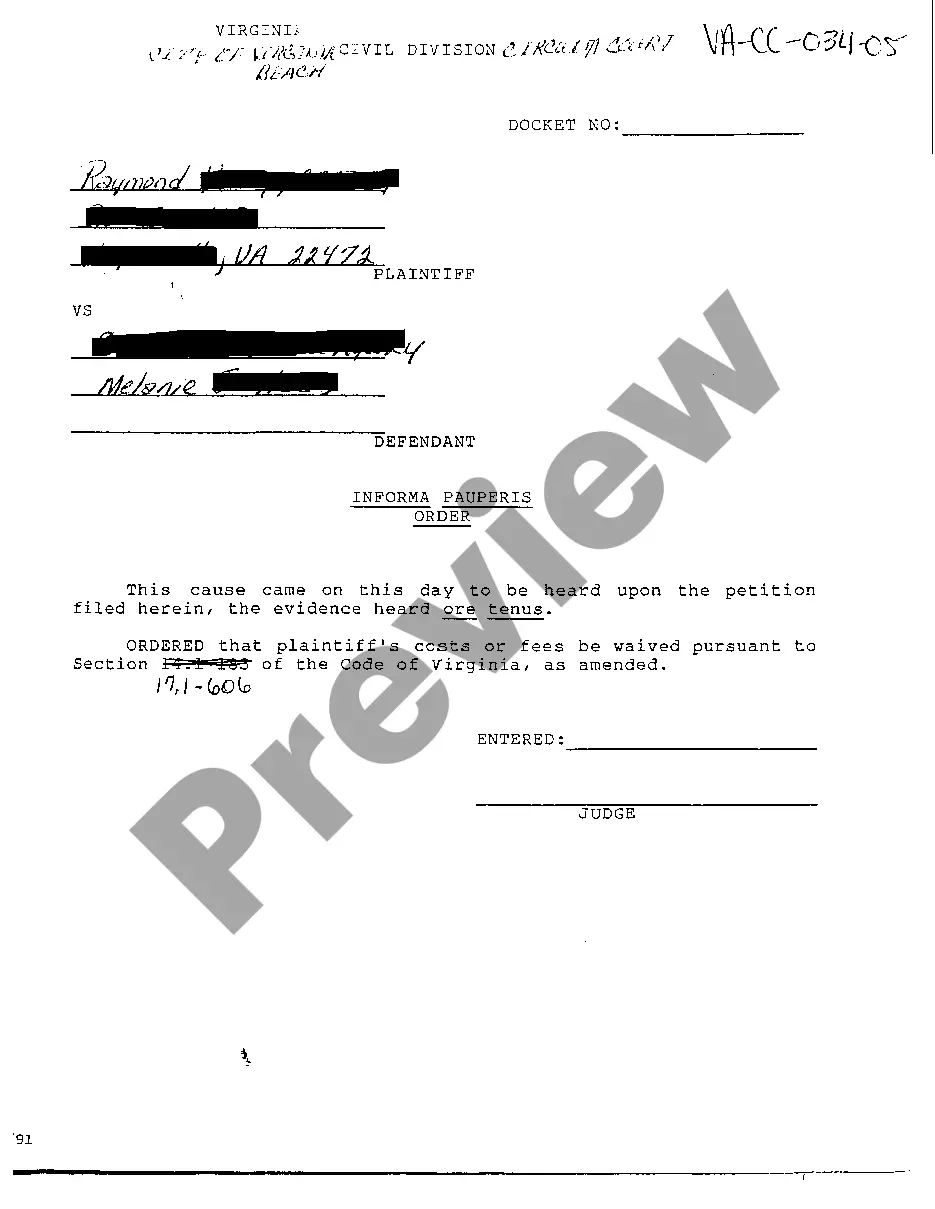

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!