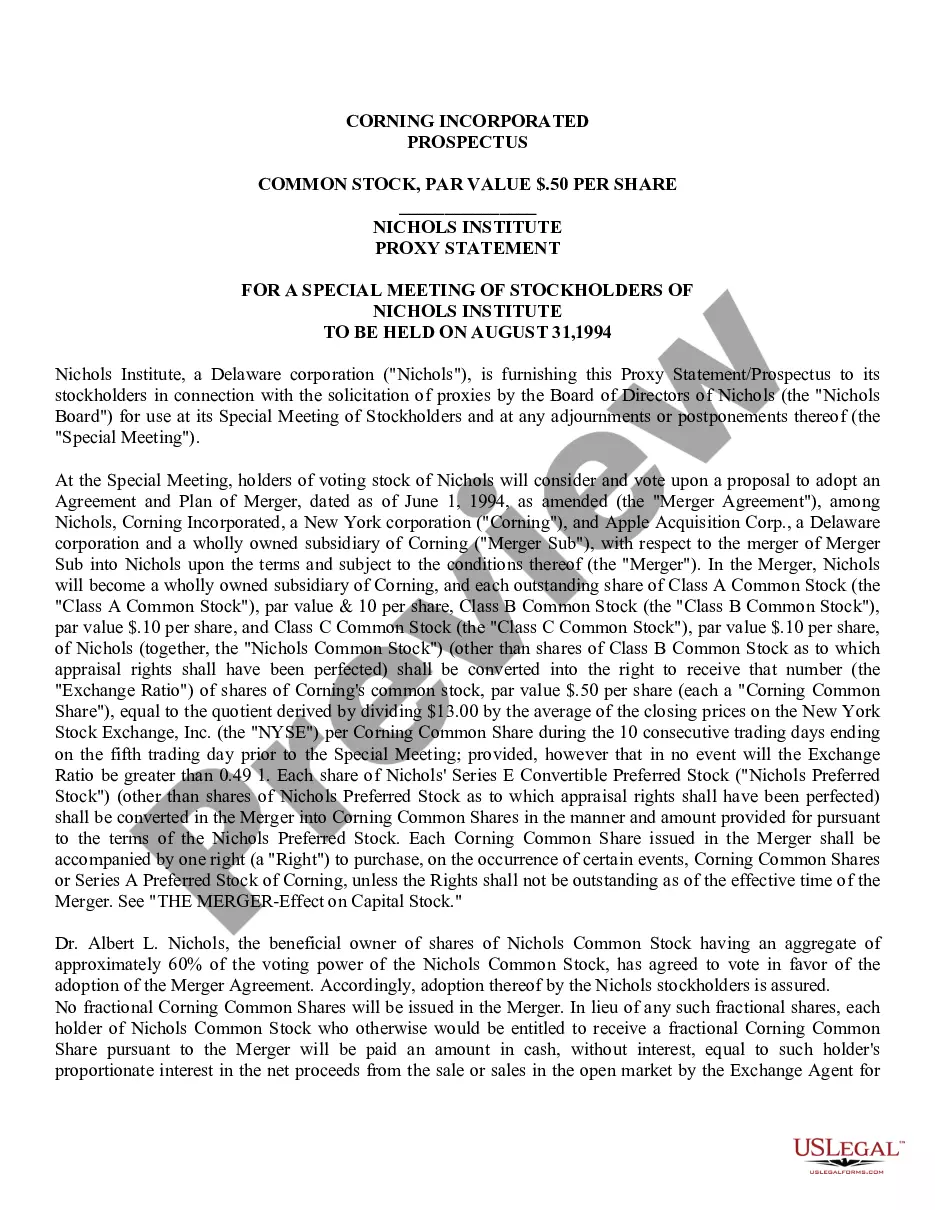

Orange California Adoption of Nonemployee Directors Deferred Compensation Plan is a carefully designed program aimed at attracting and retaining top-tier talent as nonemployee directors. This comprehensive plan offers a range of benefits, incentives, and deferred compensation options to eligible directors serving on the board of companies based in Orange, California. The Orange California Adoption of Nonemployee Directors Deferred Compensation Plan is structured to provide financial security and reward directors for their valuable contributions. By offering a deferred compensation component, the plan allows directors to defer a portion of their annual cash retainer and/or meeting fees, ensuring a significant tax advantage. The deferred funds grow tax-free until distribution, which can be scheduled to coincide with retirement or termination of services. One type of the Orange California Adoption of Nonemployee Directors Deferred Compensation Plan is the Defined Contribution Plan. Under this structure, directors can choose to allocate a percentage of their compensation to a variety of investment options such as mutual funds, stocks, or bonds. This approach empowers directors with flexibility and customization to create a diversified portfolio tailored to their individual financial goals. Another type of plan offered in Orange California is the Defined Benefit Plan, where directors receive a fixed amount of compensation based on pre-established criteria. Directors can elect to receive this benefit as a lump sum or as periodic payments over a specific period. This plan provides certainty and stability, ensuring directors can plan for their financial future without worrying about market fluctuations. The Orange California Adoption of Nonemployee Directors Deferred Compensation Plan includes various features enhancing its attractiveness. These features may include a vesting schedule that ensures the directors remain committed to the company over a specific period, forfeiting benefits should they terminate services prematurely. Furthermore, the plan may incorporate a clawback provision allowing the company to recoup funds in certain situations, such as fraud or misconduct by the director. To ensure transparency and clarity, a copy of the Orange California Adoption of Nonemployee Directors Deferred Compensation Plan is provided to all eligible directors. This document outlines the plan's details, including eligibility requirements, contribution limits, investment options, distribution provisions, and any additional terms and conditions. Directors are encouraged to review the plan thoroughly and seek professional advice before making any decisions regarding their deferred compensation. Overall, the Orange California Adoption of Nonemployee Directors Deferred Compensation Plan is a valuable tool for companies looking to attract and retain top-notch directors. By offering flexibility, tax advantages, and various plan options, this program provides the necessary incentives to ensure the company's long-term success while promoting the financial security and well-being of its directors.

Orange California Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan

Description

How to fill out Orange California Adoption Of Nonemployee Directors Deferred Compensation Plan With Copy Of Plan?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Orange Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Orange Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Orange Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!