Title: Exploring Nassau New York's Proposal to Approve Directors' Compensation Plan: Understanding the Copy of Plan Introduction: Nassau County, located in New York, has recently put forth a Proposal to Approve Directors' Compensation Plan. This comprehensive initiative aims to redefine how directors are compensated by offering a well-structured and equitable system. In this article, we delve into the details of this proposal, looking closely at the copy of the plan and exploring its different types, if applicable. Keywords: Nassau New York, Proposal, Approve, Directors' Compensation Plan, Copy of Plan 1. Understanding the Nassau New York Proposal's Intent: The Nassau New York Proposal to Approve Directors' Compensation Plan is a strategic endeavor designed to revamp the compensation structure for directors. By doing so, it aims to align the interests of directors with the long-term goals of the county, ensuring their commitment and dedication to the betterment of Nassau County. Keywords: Intent, Compensation Structure, Directors, Commitment, Betterment, Nassau County 2. Key Components of the Directors' Compensation Plan: The copy of the plan reveals several crucial components that would shape the proposed compensation system. These may include: a. Increased Base Salary: The plan may outline an increment in directors' base salary to reflect their responsibilities, contribution, and market competitiveness. b. Performance-Based Incentives: The proposal might introduce performance-based incentives to motivate directors and reward exceptional work. Such incentives could be tied to key performance indicators and achievement of specific goals. c. Stock Options or Equity: The plan may incorporate stock options or equity grants, enabling directors to share in the county's success and align their interests with the County's long-term growth. d. Additional Benefits and Perks: The plan might outline additional benefits and perks to attract top talent, including health insurance, retirement plans, and other provisions. Keywords: Components, Base Salary, Performance-Based Incentives, Stock Options, Equity, Benefits, Perks 3. Different Types of Nassau New York's Directors' Compensation Plans: While there might not be specific types of the Directors' Compensation Plan, variations could exist to accommodate the specific needs and nuances of different director roles within Nassau County's administration. These might include: a. Compensation Plan for Executive Directors: Tailored to directors overseeing executive functions within different departments, this plan may focus on high-level decision-making roles and might incorporate profit-sharing arrangements. b. Compensation Plan for Non-Executive Directors: This plan could be designed for directors involved in policy-making, advisory, and oversight roles, potentially emphasizing compensation elements like stock options or performance-based bonuses. Keywords: Types, Compensation Plan, Executive Directors, Non-Executive Directors, Profit-Sharing, Stock Options, Performance-Based Bonuses Conclusion: Nassau County's Proposal to Approve Directors' Compensation Plan entails a comprehensive strategy aimed at redefining how directors are compensated. By incorporating various compensation components, like increased base salary, performance-based incentives, stock options, and additional benefits, Nassau County seeks to attract and retain top talent for improved governance. While different types of plans may exist for executive and non-executive directors, the overarching goal remains aligning directors' interests with long-term growth. Keywords: Nassau County, Strategy, Compensation Components, Attract, Retain, Governance, Alignment, Long-Term Growth.

Nassau New York Proposal to Approve Directors' Compensation Plan with copy of plan

Description

How to fill out Nassau New York Proposal To Approve Directors' Compensation Plan With Copy Of Plan?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Nassau Proposal to Approve Directors' Compensation Plan with copy of plan, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Proposal to Approve Directors' Compensation Plan with copy of plan from the My Forms tab.

For new users, it's necessary to make several more steps to get the Nassau Proposal to Approve Directors' Compensation Plan with copy of plan:

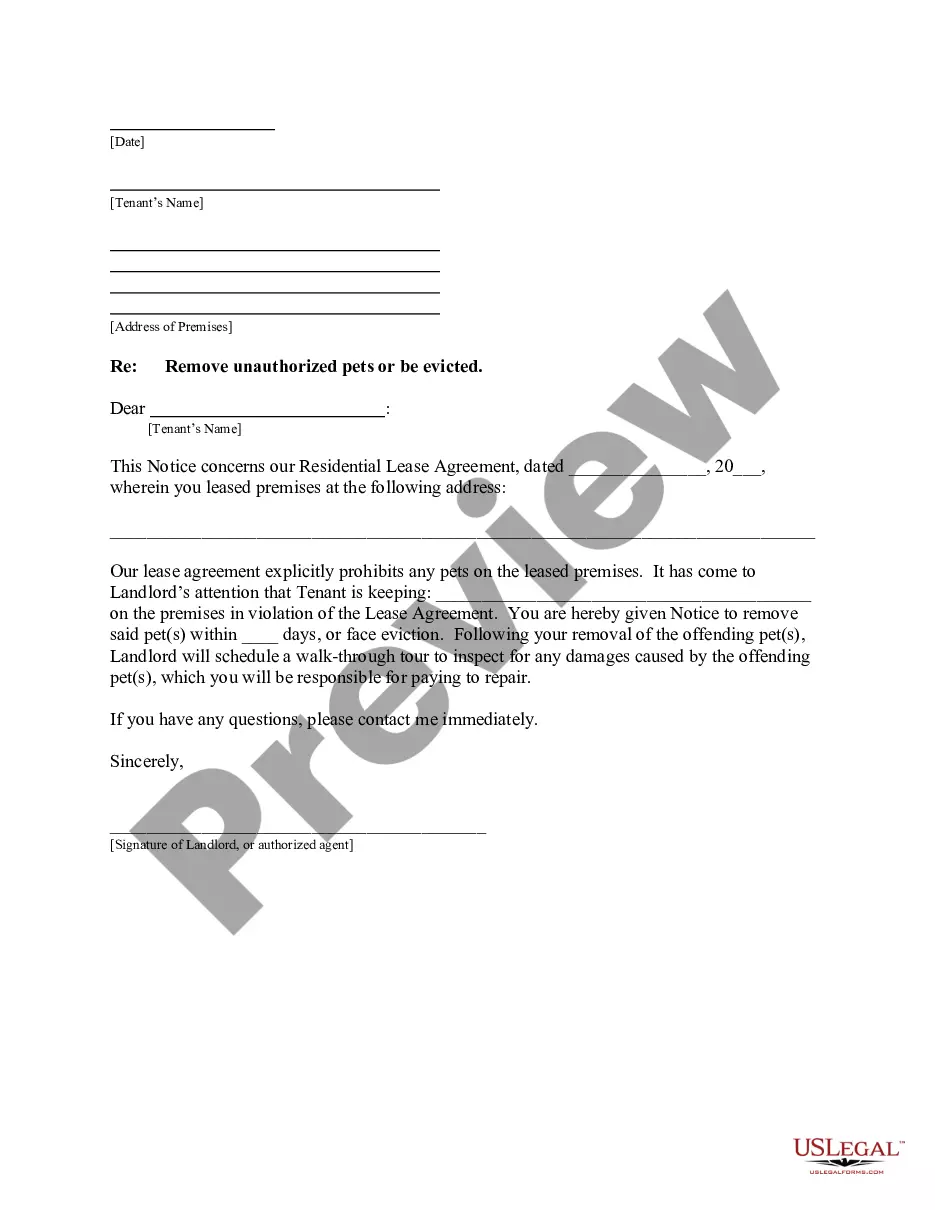

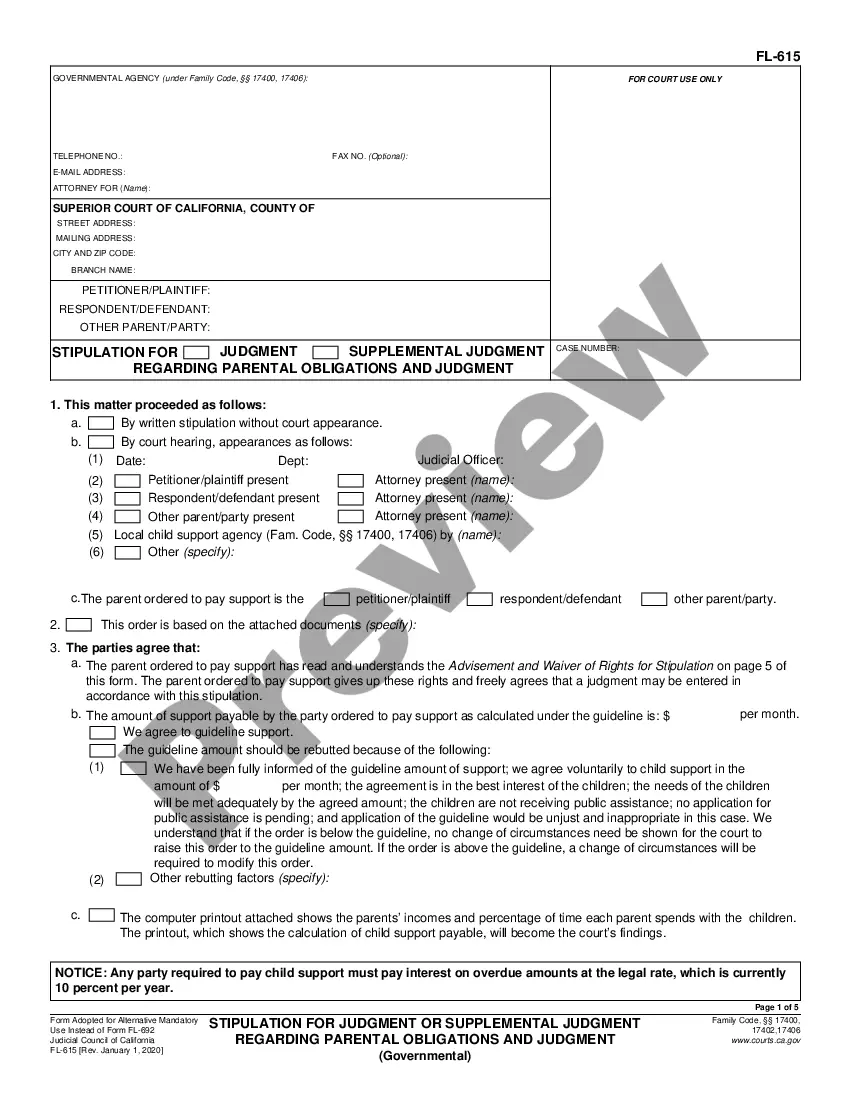

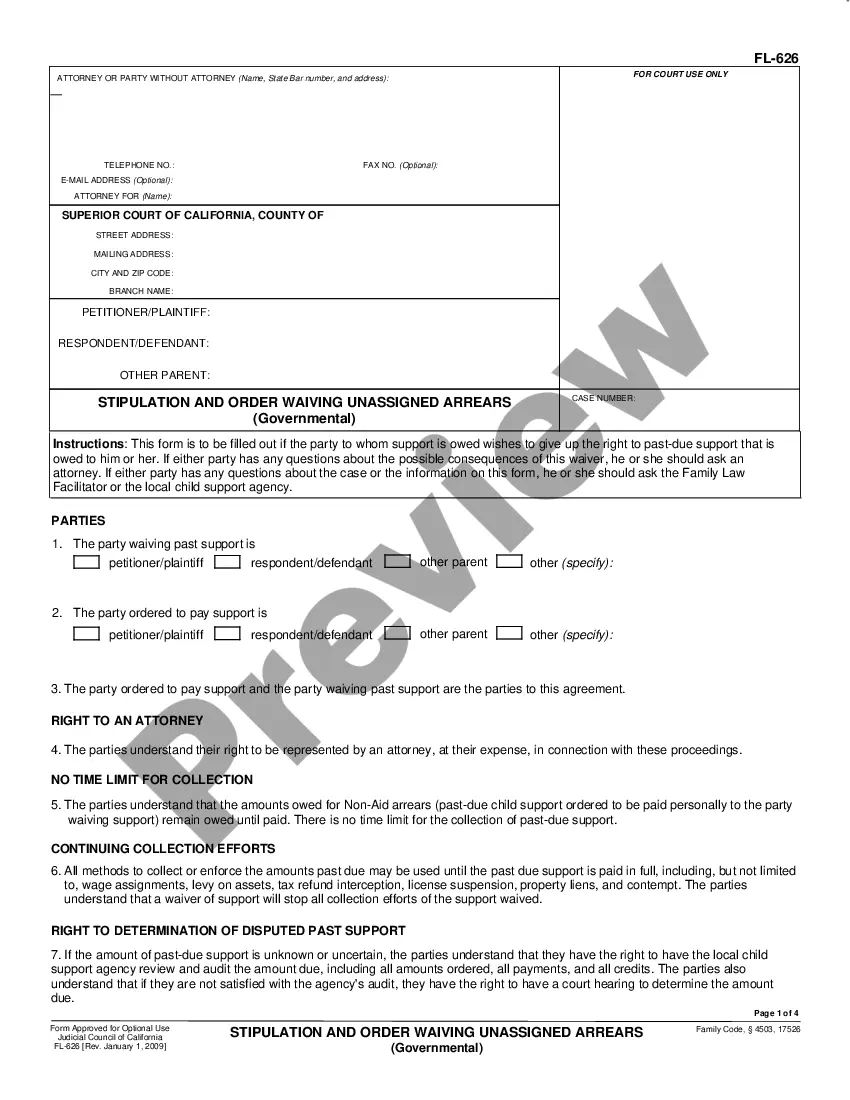

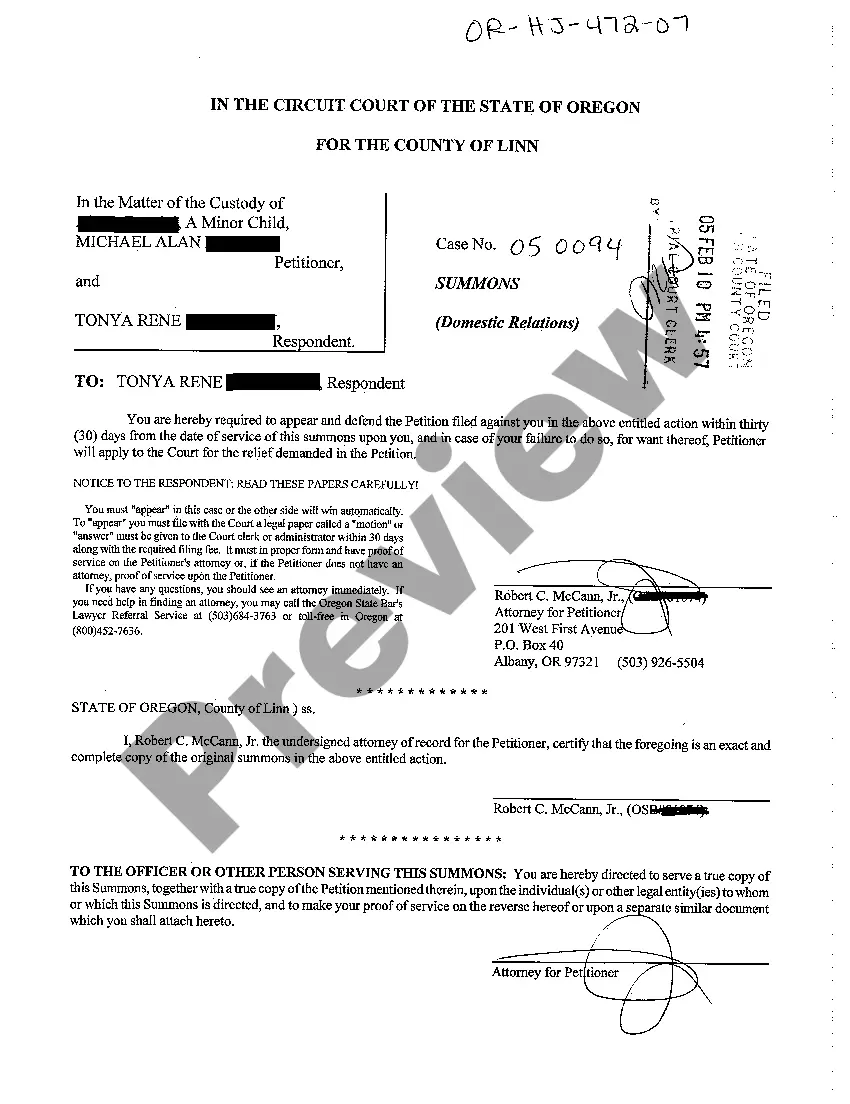

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!