Hillsborough County, Florida, is a vibrant and rapidly growing region located on the western coast of the state. Known for its stunning beaches, vibrant culture, and thriving economy, Hillsborough County offers a high-quality lifestyle for residents and attracts numerous visitors every year. In Hillsborough County, the approval of a Stock Retainer Plan for Nonemployee Directors is an important aspect of corporate governance among various companies and organizations. This plan is designed to compensate nonemployee directors with stock options or shares in recognition of their valuable contributions to the company. The Stock Retainer Plan offers nonemployee directors the opportunity to acquire company stocks as a form of retention or incentive. This compensation method aligns the interests of the directors with those of the shareholders, highlighting a commitment to the long-term success and growth of the organization. By offering stock options or shares, companies provide nonemployee directors with an added incentive to actively participate in board activities, make strategic decisions, and contribute to the overall success of the company. This fosters a sense of ownership and encourages directors to share their expertise and insights to help drive the organization forward. There are variations of the Stock Retainer Plan that companies may choose to implement in Hillsborough County, Florida. These variations might include different vesting schedules, exercise prices, and eligibility requirements. Some companies may opt for an annual grant of stock options tied to meeting specific performance metrics, while others may offer periodic grants based on the director's tenure. The approval of a Stock Retainer Plan for Nonemployee Directors is a significant decision that requires thorough consideration and review by the board of directors and corporate governance committees. The plan, along with its terms and conditions, must comply with relevant laws, regulations, and corporate policies to ensure fairness and transparency. It is crucial for companies in Hillsborough County to provide a copy of the Stock Retainer Plan to nonemployee directors to ensure they fully understand the terms and benefits associated with their compensation. This document outlines the specifics of the plan, including vesting schedules, exercise periods, taxation implications, and any other relevant details. In summary, Hillsborough County, Florida, embraces the practice of approving Stock Retainer Plans for Nonemployee Directors to attract and retain top talent in corporate governance. The implementation of such plans with clear terms and conditions ensures that directors feel valued and motivated to actively contribute to the growth and success of the organization.

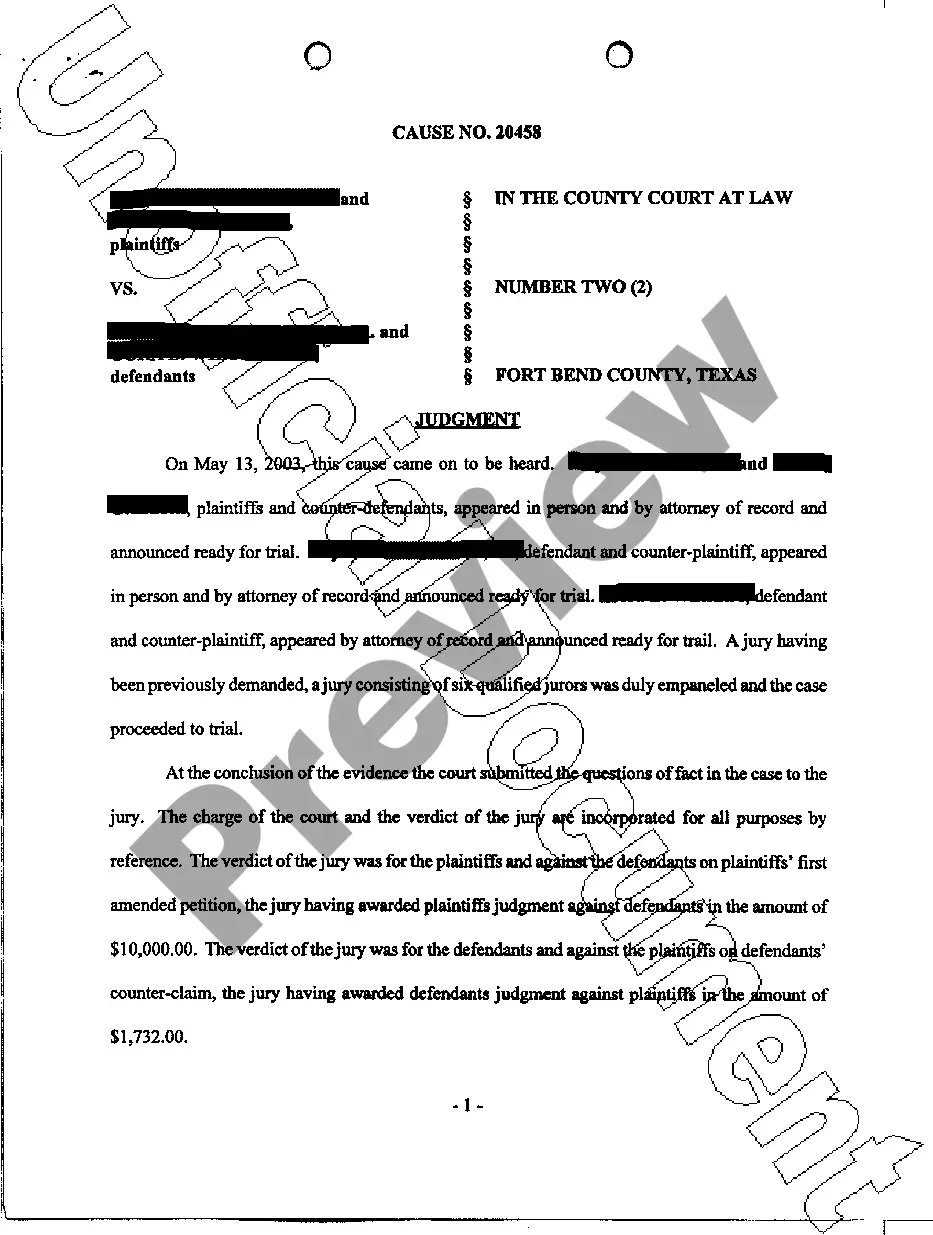

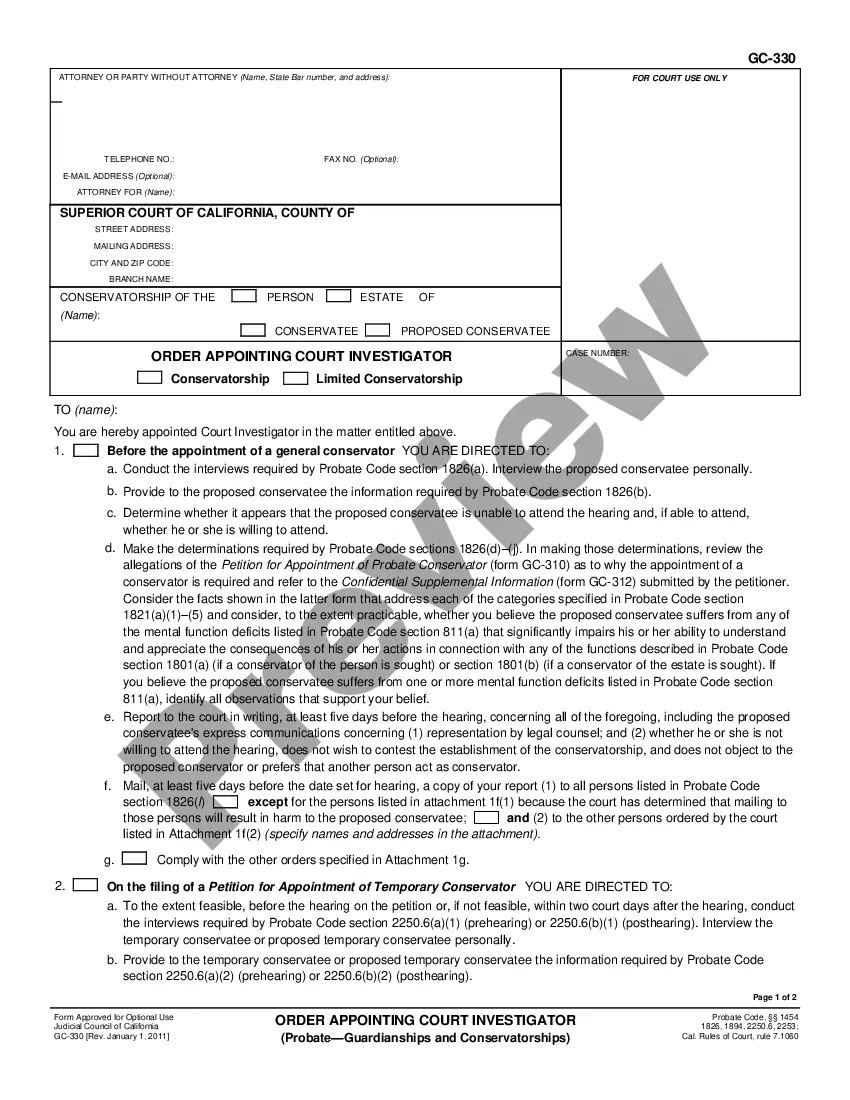

Hillsborough Florida Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan

Description

How to fill out Hillsborough Florida Approval Of Stock Retainer Plan For Nonemployee Directors With Copy Of Plan?

Draftwing forms, like Hillsborough Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan, to take care of your legal affairs is a challenging and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for various scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Hillsborough Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before downloading Hillsborough Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan:

- Make sure that your form is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Hillsborough Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our service and download the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!