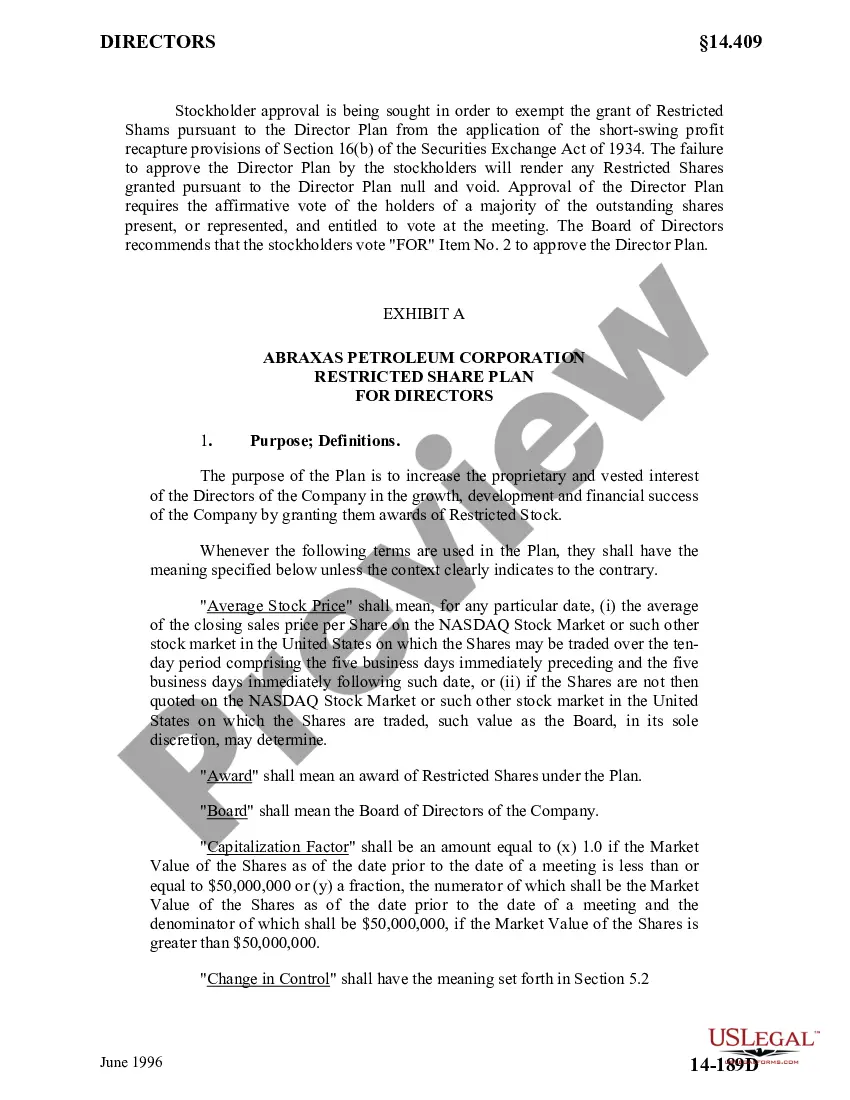

The Alameda California Approval of Restricted Share Plan for Directors is an important document providing a comprehensive outline of the procedures and regulations related to the allocation and issuance of restricted shares to directors of companies based in Alameda, California. This plan emphasizes the significance of ensuring fair and suitable compensation for directors and aligning their interests with the success of the organization. The primary objective of the Alameda California Approval of Restricted Share Plan for Directors is to outline the criteria, conditions, and limitations for granting restricted shares to directors. These shares are subject to certain restrictions and are typically awarded to motivate, retain, and reward directors for their contributions to the company's growth and performance. Key aspects covered in this plan include: 1. Eligibility criteria: The plan specifies the requirements for directors to be eligible for participation in the restricted share program. These could include factors such as years of service, role, and commitment to the organization. 2. Share allocation and vesting: The plan outlines the number of restricted shares that may be allocated to directors and the specific vesting schedule to determine when the shares will be fully owned by the directors. This schedule is often linked to the director's tenure and performance over a specified period. 3. Restriction periods and conditions: The plan details the restriction periods during which the shares cannot be sold, transferred, or otherwise disposed of. It also outlines any conditions, such as continued service or achievement of performance targets, that must be met for the shares to fully vest. 4. Settlement of shares: The plan describes how the shares will be settled upon vesting. This could include cash payments, stock transfers, or a combination of both. The plan may also define the valuation method to determine the fair market value of the shares at the time of settlement. 5. Tax and regulatory considerations: The plan takes into account any applicable tax requirements or regulations related to the grant of restricted shares to directors. It ensures compliance with relevant laws and includes provisions to handle tax withholding obligations. Different variations or types of the Alameda California Approval of Restricted Share Plan for Directors may exist, depending on the specific needs or preferences of the company. Such variations may include plans tailored for different industries or company sizes, plans that incorporate performance-based metrics, or plans that provide flexibility in the allocation of shares. In conclusion, the Alameda California Approval of Restricted Share Plan for Directors is a vital tool for companies in Alameda, California, to establish a fair and effective method of compensating their directors through the issuance of restricted shares. By aligning the interests of directors with the success of the organization, this plan fosters motivation, retention, and accountability, ultimately contributing to the long-term growth and prosperity of companies in Alameda, California.

Alameda California Approval of Restricted Share Plan for Directors with Copy of Plan

Description

How to fill out Alameda California Approval Of Restricted Share Plan For Directors With Copy Of Plan?

Creating forms, like Alameda Approval of Restricted Share Plan for Directors with Copy of Plan, to manage your legal matters is a tough and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents created for a variety of cases and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Alameda Approval of Restricted Share Plan for Directors with Copy of Plan template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Alameda Approval of Restricted Share Plan for Directors with Copy of Plan:

- Ensure that your document is compliant with your state/county since the regulations for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Alameda Approval of Restricted Share Plan for Directors with Copy of Plan isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and download the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Restricted stock is an actual share of stock that the recipient receives, but the rights to sell or transfer the shares are restricted until the vesting period passes. Like RSUs, a certain vesting period or service level must be met in order to obtain full value from the stock.

Restricted shares are unregistered, non-transferable shares issued to a company's employees. They give employees incentive to help companies attain success. They are most common in established companies that want to motivate people with an equity stake. Their sale is usually restricted by a vesting schedule.

Restricted shares provide an employee with a stake in their company, but they have no tangible value before they vest. Vesting gives employees rights to employer-provided assets over time, giving the employees an incentive to perform well and remain with a company.

Which of the following choices is a characteristic of restricted stock? The employee is not required to pay for the stock but rather is given the shares on the grant date.

A restricted share scheme grants an employee restricted shares in their employer company. The shares are issued with restrictions requiring the shares to be retained on trust for the participant for a fixed period before they can be sold. The employee has beneficial ownership during this period.

Restricted and unrestricted stocks are important components of corporate executive compensation packages. Restricted stocks have particular conditions that must be fulfilled before they can be transferred or sold, whereas unrestricted stocks have no such conditions. There are two types of restricted stocks.

Which of the following is correct regarding the nature of restricted stock? The shares can only be sold back to the issuing company and not outside investors.

Restricted stock units (RSUs) are a way your employer can grant you company shares. RSUs are nearly always worth something, even if the stock price drops dramatically. RSUs must vest before you can receive the underlying shares. Job termination usually stops vesting.

The advantages of restricted stock bonus/purchase plans are (1) the employee can make the §83(b) election; (2) the employee is generally entitled to capital gain treatment on sale of vested stock; and (3) the Company gets a wage deduction without paying cash wages.