Houston, Texas Approval of Restricted Share Plan for Directors: A Comprehensive Overview Keywords: Houston Texas, Approval, Restricted Share Plan, Directors, Copy of Plan Introduction: The city of Houston, Texas, known for its thriving business environment, has witnessed the approval of a Restricted Share Plan (RSP) specifically tailored for directors. This detailed description aims to shed light on the nature and significance of the Houston Texas Approval of Restricted Share Plan for Directors, outlining its key features, benefits, and possible variations. A. Definition and Purpose: The Houston Texas Approval of Restricted Share Plan for Directors is an initiative formulated by the local government to incentivize and retain corporate directors serving in Houston-based companies. This plan provides an opportunity for directors to receive a certain number of restricted shares as a form of compensation over a predetermined period. B. Features and Benefits: 1. Performance-Based: The Houston Texas Approval of Restricted Share Plan for Directors typically links the allocation of restricted shares to the achievement of pre-established performance goals and objectives. This ensures that directors are motivated to enhance the company's performance, aligning their interests with shareholders. 2. Vesting Periods: One key aspect of this plan is the presence of vesting periods, during which directors must remain active within their roles to gain full ownership of the granted restricted shares. Such periods promote long-term commitment, as the directors are encouraged to contribute to the company's growth and development over time. 3. Voting Rights and Dividends: Directors participating in the Houston Texas Approval of Restricted Share Plan may often possess full voting rights for their restricted shares, providing them with a say in crucial decision-making processes. Additionally, they may be eligible to receive dividends during the vesting period, further enhancing their participation in the company's financial rewards. 4. Long-Term Retention: By offering restricted shares, the plan encourages directors to maintain long-term commitments with Houston-based companies, fostering stability and sustained growth within the local business ecosystem. This allows businesses to attract and retain talented individuals who possess a vested interest in the company's success. C. Types of Restricted Share Plans for Directors: 1. Stock Option Plans: Under this variant, directors are allowed to purchase company shares at a predetermined price within a specific period, providing potential financial gains if the stock value appreciates. 2. Restricted Stock Units (RSS): RSS are non-transferable units that represent future company shares. Directors receive specified RSS that vest over a certain timeframe, granting them actual shares upon completion. 3. Performance Share Units (Plus): Plus tie the allocation of shares to the accomplishment of specific performance objectives, such as revenue growth, profitability, or market share. Directors are granted shares in proportion to the achievement of pre-defined goals, ensuring alignment with overall business success. Conclusion: The Houston Texas Approval of Restricted Share Plan for Directors signifies the local government's dedication to fostering a strong business environment, promoting the retention of talented directors within Houston-based corporations. The plan's key features, such as performance-based rewards, vesting periods, and voting rights, aim to align director interests with long-term company goals. Different types of restricted share plans, including stock option plans, RSS, and Plus, provide flexibility to cater to diverse company needs. By embracing these plans, Houston-based companies can attract experienced directors committed to driving sustainable growth and overall corporate success.

Houston Texas Approval of Restricted Share Plan for Directors with Copy of Plan

Description

How to fill out Houston Texas Approval Of Restricted Share Plan For Directors With Copy Of Plan?

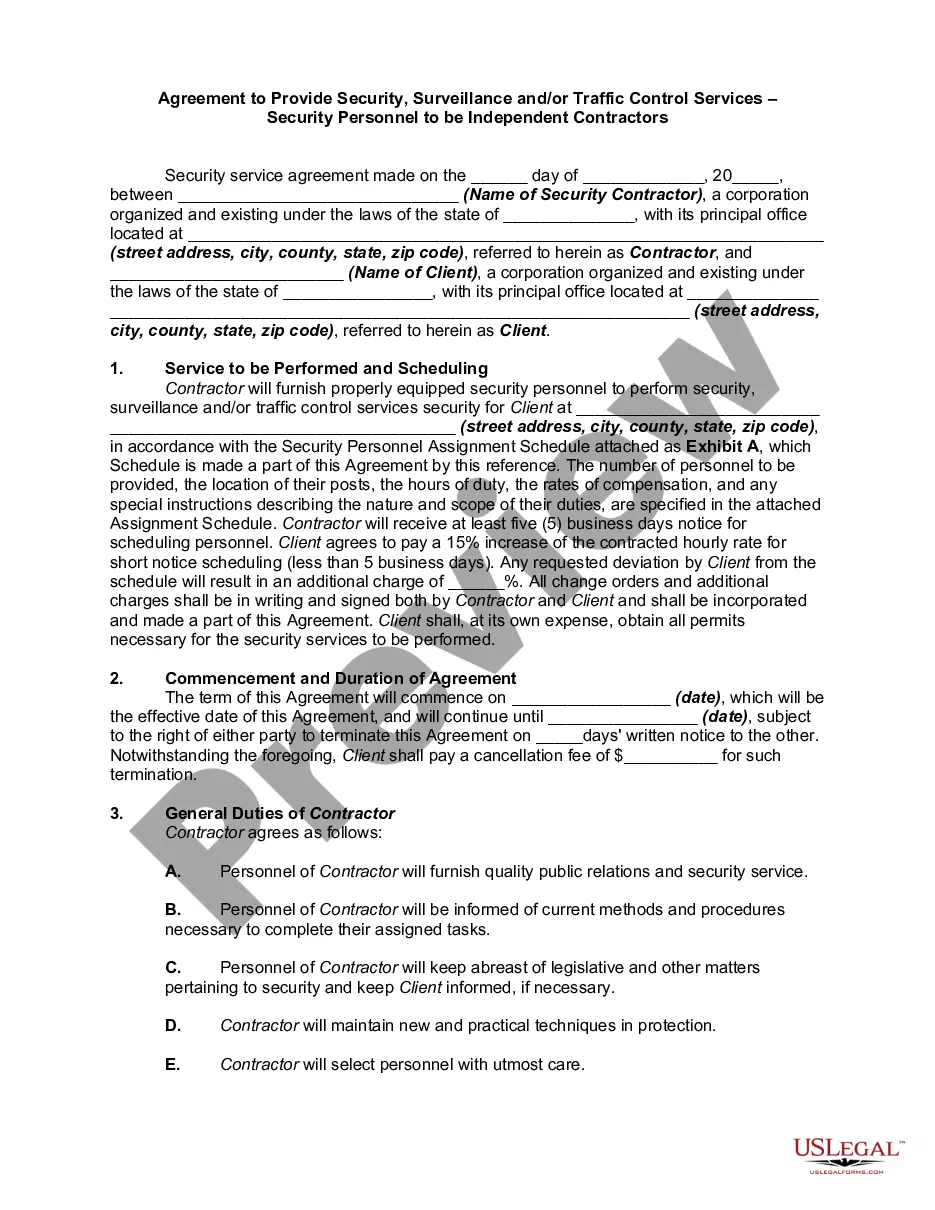

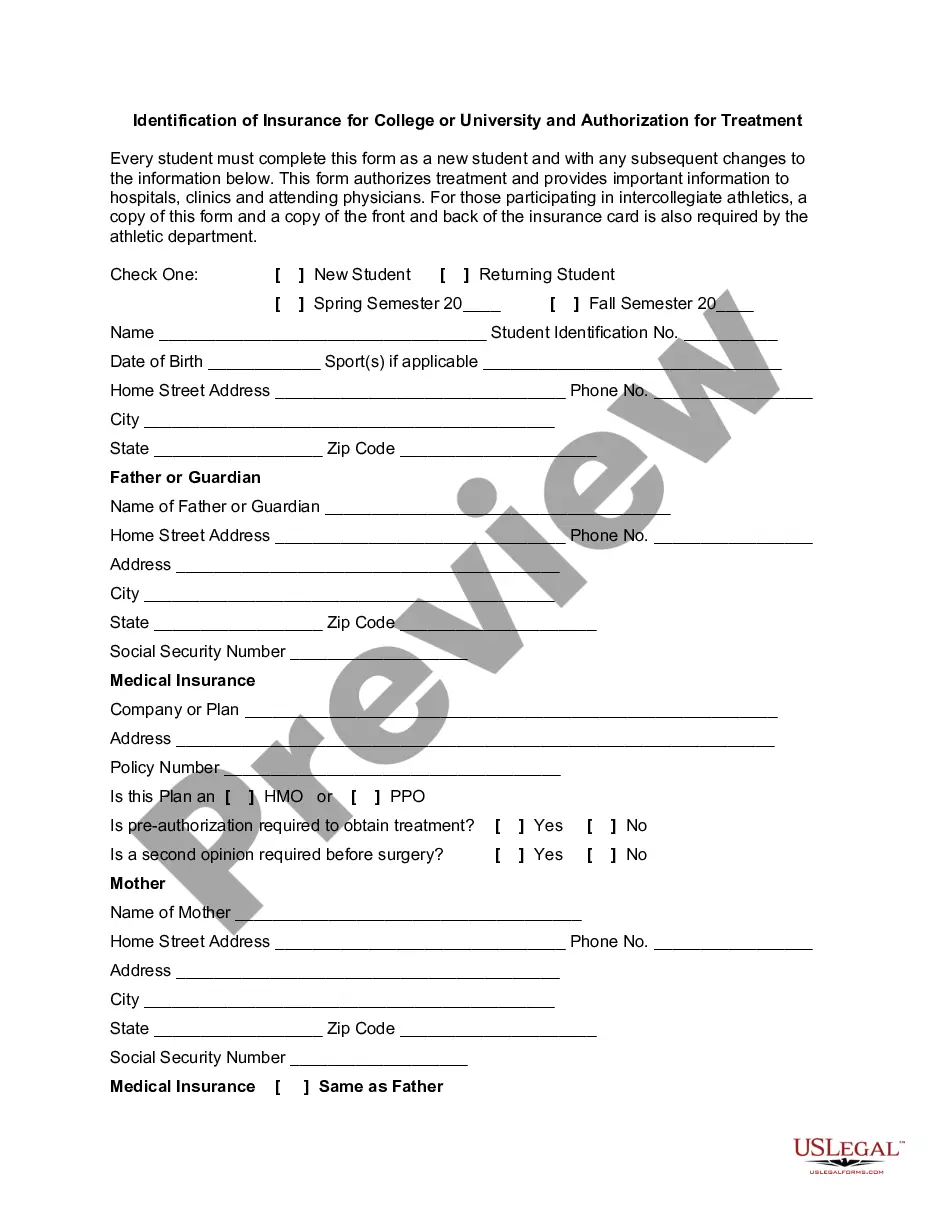

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Houston Approval of Restricted Share Plan for Directors with Copy of Plan, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the current version of the Houston Approval of Restricted Share Plan for Directors with Copy of Plan, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Houston Approval of Restricted Share Plan for Directors with Copy of Plan:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Houston Approval of Restricted Share Plan for Directors with Copy of Plan and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!