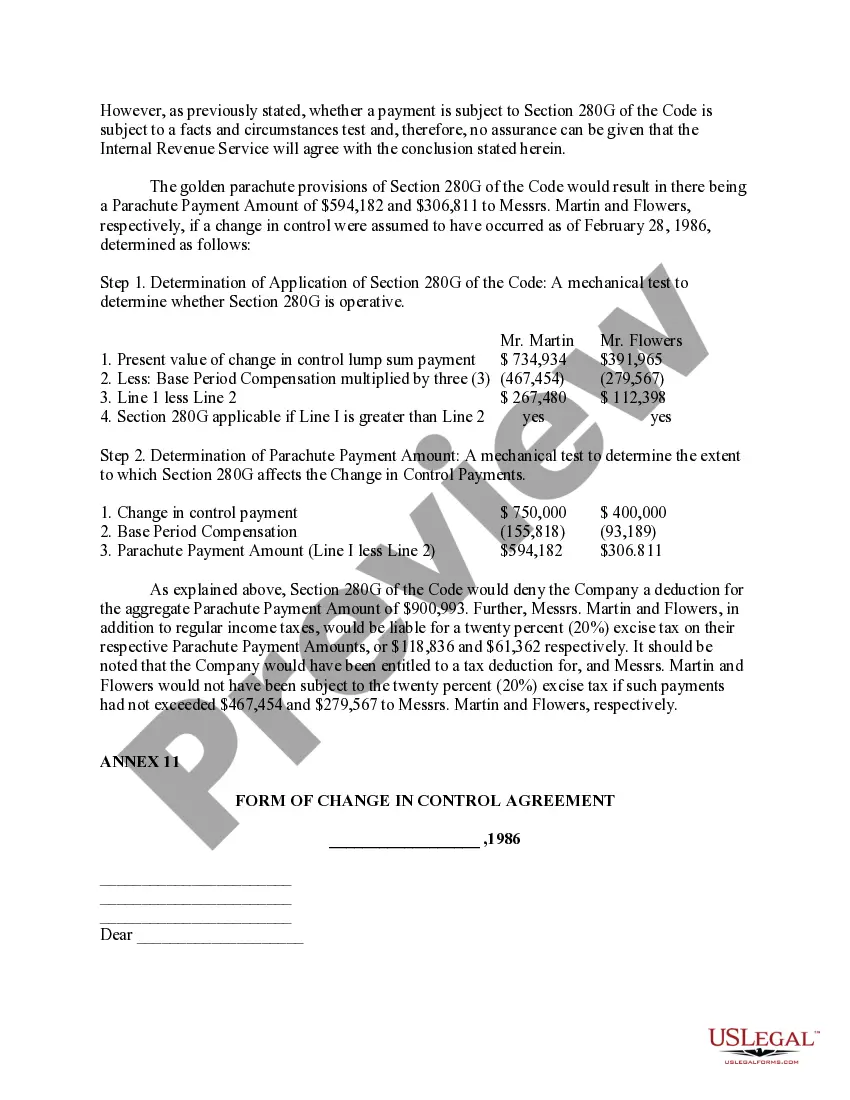

Middlesex Massachusetts Ratification of Change in Control Agreements: Explained In Middlesex Massachusetts, ratification of change in control agreements is an essential legal process that ensures the smooth transition of authority and responsibilities in various organizational settings. These agreements are put in place to safeguard the interests of both the company and its top executives during a change in ownership, acquisition, or merger. This detailed description will shed light on the significance of such agreements and provide an overview of the different types available, including relevant keywords for better understanding. What is a Change in Control Agreement? A change in control agreement, also known as a golden parachute or executive retention agreement, refers to a legal contract between a company's board of directors or shareholders and its key executives, typically the CEO, CFO, or other high-ranking officers. This agreement outlines the terms and conditions that will come into effect if a change in control of the company occurs. It aims to protect the executives' rights, compensation packages, benefits, and job security during the transitional period when a new owner or entity takes charge. Importance of Ratification: Ratification of change in control agreements is imperative to ensure that the terms agreed upon by both the company and its executives are legally binding. It confirms that the document's content and terms are acknowledged, understood, and agreed upon by all parties involved. Ratification provides a solid foundation for enforcing the agreement, thus minimizing potential disputes or conflicts that may arise during the process of change in control. Types of Change in Control Agreements in Middlesex Massachusetts: 1. Single-Trigger Agreement: A single-trigger agreement becomes effective when a certain defined event takes place, such as a merger, acquisition, or change in control. Once this event occurs, the executive becomes entitled to receive predefined benefits, such as severance pay, accelerated stock options, continued healthcare coverage, or pension plans. 2. Double-Trigger Agreement: In contrast to a single-trigger agreement, a double-trigger agreement requires two specific events to occur before the executive becomes eligible for the benefits. Usually, these events involve a change in control and a subsequent termination of employment or a significant reduction in responsibilities and compensation. This type of agreement provides additional protection for executives against possible unfavorable employment conditions after the change in ownership. 3. Modified Single-Trigger Agreement: A modified single-trigger agreement is a variation of the original single-trigger agreement. It contains additional clauses that limit the benefits an executive can receive upon a change in control event. For instance, the executive might receive partial rather than full severance pay if they voluntarily resign within a specified timeframe after the change in control. Copy of Form of Change in Control Agreement: To view and understand the exact terms and conditions of a change in control agreement, it is crucial to refer to a copy of the form of such an agreement. This document outlines the specific provisions related to payout amounts, vesting schedules, non-compete agreements, confidentiality clauses, and other key elements. Consulting the copy of the form while ratifying the agreement provides a comprehensive understanding of the rights and obligations of the company and its executives. In conclusion, Middlesex Massachusetts ratification of change in control agreements with a copy of the form of such an agreement is crucial for ensuring a smooth transition of power during periods of ownership change. By understanding the types of agreements available and the essential keywords associated with these formal arrangements, executives and shareholders can confidently navigate the complexities that accompany corporate restructurings, while safeguarding their respective interests.

Middlesex Massachusetts Ratification of change in control agreements with copy of form of change in control agreement

Description

How to fill out Middlesex Massachusetts Ratification Of Change In Control Agreements With Copy Of Form Of Change In Control Agreement?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Middlesex Ratification of change in control agreements with copy of form of change in control agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Middlesex Ratification of change in control agreements with copy of form of change in control agreement from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Middlesex Ratification of change in control agreements with copy of form of change in control agreement:

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!