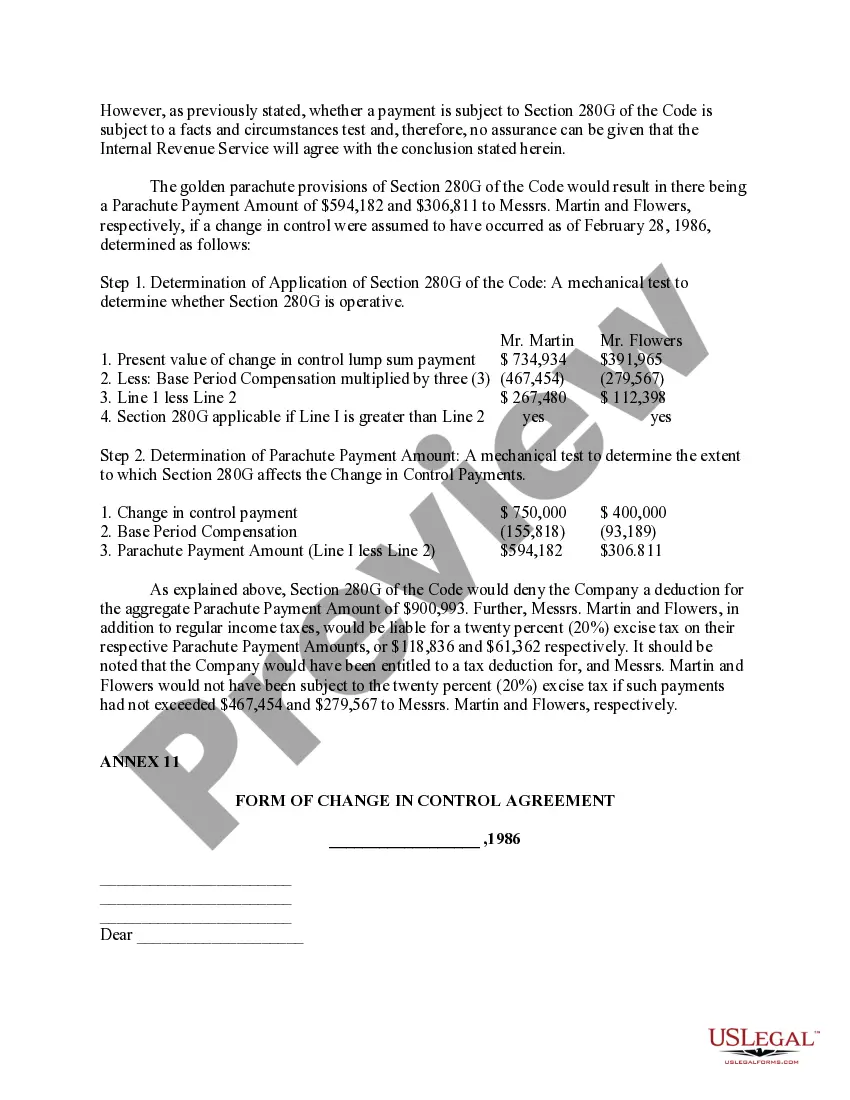

Phoenix, Arizona Ratification of Change in Control Agreements: Explained in Detail In the dynamic world of business, change in control agreements play a crucial role in protecting the interests of companies and their executives during times of mergers, acquisitions, or any substantial change in company ownership. In Phoenix, Arizona, companies utilize a specific procedure known as "Ratification of Change in Control Agreement" to ensure a smooth transition and maintain stability. The process of ratification involves obtaining official approval for the change in control agreement from relevant stakeholders, such as board members, shareholders, and senior executives. This formalizes the agreement's terms and conditions, providing legal certainty and protection to all parties involved. Alongside the ratification, a copy of the form of change in control agreement is appended to offer complete transparency and clarity. In the context of Phoenix, Arizona, there are several types of ratification of change in control agreements, each catering to unique scenarios. The most common ones include: 1. Merger or Acquisition Change in Control Agreement: This type of agreement focuses on safeguarding the interests of executives and employees in the event of a merger or acquisition. It establishes provisions such as severance packages, bonuses, and other financial benefits, ensuring employees' transition and trust during the change in control process. The Board of Directors, shareholders, and the newly formed company must undertake the ratification of this agreement. 2. Change in Control Agreement for Private Equity Investment: In cases involving private equity investments, this agreement outlines the terms under which a private equity firm invests in a company. It specifies clauses regarding management changes, control, and decision-making authority during and after the investment process. Ratification by shareholders, board members, and executives is essential to validate this agreement. 3. Management Team Change in Control Agreement: This agreement specifically addresses situations where there is a change in the management team due to various reasons like retirement, resignation, or termination. It establishes the terms surrounding severance packages, non-compete clauses, and other relevant provisions to protect the interests of the departing executive and ensure business continuity. Ratification by the company's board of directors or shareholders is necessary for the agreement to take effect. 4. Employee Change in Control Agreement: This agreement is designed to protect the interests of key employees of a company during a change in control scenario. It outlines specific benefits, such as severance packages, stock options, and retention bonuses, that will be awarded to employees in case of a change in control event. Ratification generally requires the approval of the Board of Directors. In conclusion, Phoenix, Arizona ratification of change in control agreements provides the necessary framework for ensuring a smooth transition during times of substantial change in company ownership. These agreements foster trust, provide financial security, and outline the rights and obligations of all parties involved. By ratifying these agreements and maintaining transparency with a copy of the form of change in control agreement, companies can navigate change with confidence, safeguard their interests, and maintain stability in their operations.

Phoenix Arizona Ratification of change in control agreements with copy of form of change in control agreement

Description

How to fill out Phoenix Arizona Ratification Of Change In Control Agreements With Copy Of Form Of Change In Control Agreement?

Drafting documents for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Phoenix Ratification of change in control agreements with copy of form of change in control agreement without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Phoenix Ratification of change in control agreements with copy of form of change in control agreement on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Phoenix Ratification of change in control agreements with copy of form of change in control agreement:

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

Change of Control Payments means any payment (including any benefit or transfer of property) in the nature of compensation, to or for the benefit of the Executive under any arrangement which is partially or entirely contingent on a Change of Control, or is deemed to be contingent on a change of control or ownership of

For example, a change of control may be triggered by a sale of more than 50% of a party's stock, a sale of substantially all the assets of a party or a change in most of the board members of a party. For a standard change of control clause, see Standard Clause, Loan Agreement: Change of Control Event of Default.

A change of control is a change in a company's ownership or management that results in the decision-making capacity of that entity being exercised by a different group of shareholders and/or directors.

The securities account control agreement enables the secured party to obtain control over the security entitlement, and therefore the securities account, and so enables its security interest in the securities account to be perfected (UCC § 9-106).

Parties normally seek to include provisions in an agreement that allow for either termination or an adjustment of their rights, such as payment, upon a change of structure or ownership of the other party. This is known as a ?change of control? clause.

A control agreement is a type of collateral agreement that is entered by a debtor to secure obligations under a loan agreement. In a control agreement, the debtor, secured party, and the account maintainer (usually a bank) agree to allow the secured party to have security interest in the debtors account.

A control agreement is a type of collateral agreement that is entered by a debtor to secure obligations under a loan agreement. In a control agreement, the debtor, secured party, and the account maintainer (usually a bank) agree to allow the secured party to have security interest in the debtors account.

A deposit account control agreement (DACA), also called a control agreement, is a tri-party agreement among a deposit customer (the debtor), a deposit customer's lender (the secured party) and a bank.

1. Transfer of Percentage of Company Stock. A change of control typically includes the transfer of a certain percentage of the target company's issued and outstanding shares from the target company to the acquirer.

Interesting Questions

More info

Q: I'm changing my mind in the period after the Annual Meeting! What can I do? Q: Will the shareholders in my company have to vote to approve the change in control? The change in control may require shareholders to vote “FOR.” A change in control may not trigger a shareholder vote. It will likely be the case that a majority of the voting power of the shareholders in the controlling shareholder's position (the controlling portion that represents the entire voting power of all outstanding shares) is required to accept the change. If after the Annual Meeting (i.e. for any reason before the Change in Control Agreement is entered into), the shares of a majority of the shares of a controlling shareholder's class are owned (or controlled) by the controlling shareholder or their representatives, and the board of directors of the controlling shareholder has a quorum as defined in the Change in Control Agreement, a shareholder vote is required.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.