Franklin Ohio Authorization to Adopt a Plan for Payment of Accrued Vacation Benefits to Employees with Company Stock Description: The Franklin Ohio Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock is a policy established by the city of Franklin, Ohio. This policy aims to provide a structured and transparent approach to compensating employees with company stock for their accrued vacation benefits. Under this plan, employees who have accrued unused vacation time can opt to receive payment in the form of company stock. This serves as an attractive option for employees who wish to invest in the success of the company while also enjoying the benefits of their earned vacation time. The plan requires the implementation of a comprehensive system to track employee vacation accruals accurately. Any employee who accumulates a significant amount of vacation time can choose to participate in the program. By opting into the plan, employees can leverage their vacation benefits to acquire company stock, thereby aligning their interests with the company's performance. Keywords: Franklin Ohio, Authorization, adopt a plan, payment, accrued vacation benefits, employees, company stock, copy of plan. Types of Franklin Ohio Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock: 1. Basic Compensation Plan: The basic compensation plan outlines the standard guidelines for the payment of accrued vacation benefits to employees with company stock. It includes eligibility criteria, vesting schedules, and detailed information on how the stock will be allocated to participating employees. 2. Stock Performance Incentive Plan: This type of authorization plan is designed to provide additional benefits to employees based on the company's stock performance. Under this plan, employees receive a higher value of company stock for their accrued vacation benefits if specified performance metrics are met. It incentivizes employees by tying their vacation benefits directly to the company's financial success. 3. Deferred Stock Compensation Plan: The deferred stock compensation plan allows employees to elect to defer a portion of their accrued vacation benefits and have them converted into company stock. This plan offers employees the flexibility to customize their compensation structure and potentially benefit from the stock's value appreciation over time. 4. Restricted Stock Unit (RSU) Plan: This plan grants eligible employees a certain number of RSS as part of their accrued vacation benefits. RSS represents an ownership interest in the company but are restricted until specific conditions, such as vested employment tenure, are met. Through this plan, employees have the opportunity to gradually unlock their vacation benefits in the form of company stock. In summary, the Franklin Ohio Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock is a comprehensive policy that offers various types of plans for compensating employees with company stock based on their accrued vacation benefits. These plans provide employees with flexibility, alignment with the company's performance, and potential investment growth.

Franklin Ohio Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

How to fill out Franklin Ohio Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Franklin Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the latest version of the Franklin Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Franklin Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan:

- Glance through the page and verify there is a sample for your area.

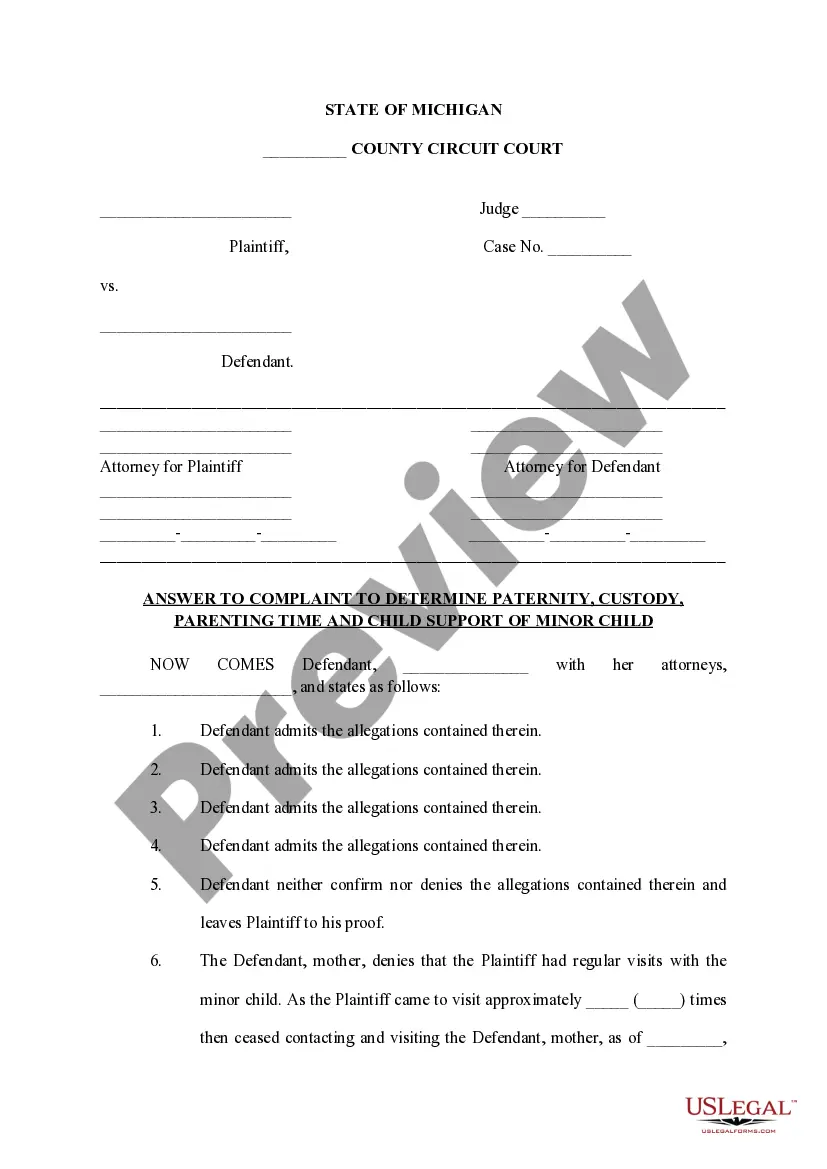

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Franklin Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!