Middlesex Massachusetts Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with a copy of the plan is a legally binding document that outlines the procedures and requirements for providing vacation benefits to employees who hold company stock. In Middlesex, Massachusetts, companies have the option to implement different types of authorization plans for granting accrued vacation benefits to employees who own company stock. These plans may include: 1. Stock Compensation Vacation Plan: This type of plan allows employees to accrue vacation benefits based on their stock holdings in the company. The more stock an employee owns, the more vacation benefits they can accumulate over time. 2. Stock Performance Vacation Plan: Under this plan, employees' vacation benefits are directly tied to the performance of company stock. If the stock performs well, employees can earn higher vacation benefits. Conversely, if the stock falters, their accrued vacation benefits may be affected. 3. Stock Option Vacation Plan: In this plan, employees are granted stock options as part of their overall compensation package. These stock options can be exercised to acquire company stock, and the vacation benefits increase in parallel with the number of stock options exercised. Regardless of the specific type of plan chosen by a company, adopting a Middlesex Massachusetts Authorization for payment of accrued vacation benefits to employees with company stock serves several purposes. First and foremost, it ensures that employees with company stock are entitled to vacation benefits on par with their colleagues who do not possess stock holdings. It also incentivizes employees to invest in company stock and align their interests with the corporate success. The Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock requires specific components. It typically includes: 1. Identification of the employer and employees: The document should specify the name of the employer and list the employees who are eligible for vacation benefits under the plan. 2. Stock ownership requirements: The plan should outline the minimum stock ownership threshold that an employee must meet to qualify for vacation benefits. 3. Vacation accrual calculation: The plan should articulate how vacation benefits are calculated based on the employee's stock ownership or stock performance. 4. Vesting and distribution schedule: The document should clarify the vesting period and how the vacation benefits will be distributed to qualified employees. 5. Amendments and termination: The Authorization should mention the procedures for making changes to the plan and the conditions under which it may be terminated. In conclusion, Middlesex Massachusetts Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock ensures fairness, rewards employee investment in the company, and provides a clear framework for granting vacation benefits.

Middlesex Massachusetts Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

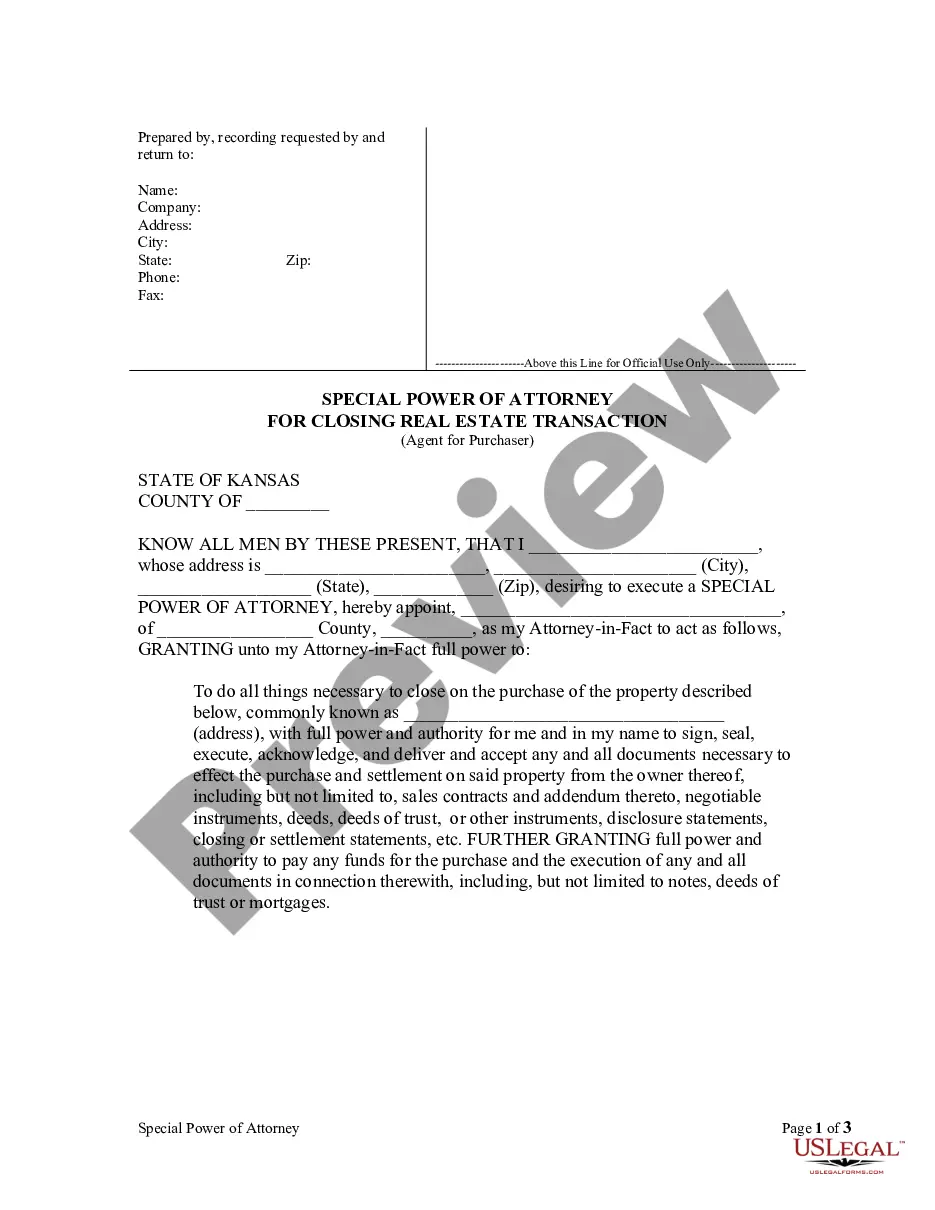

How to fill out Middlesex Massachusetts Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

Creating forms, like Middlesex Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, to manage your legal matters is a difficult and time-consumming task. Many cases require an attorney’s participation, which also makes this task expensive. However, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for different scenarios and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Middlesex Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before downloading Middlesex Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan:

- Ensure that your form is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the Middlesex Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our website and download the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!