Title: Tarrant Texas Authorization to Adopt a Plan for Payment of Accrued Vacation Benefits to Employees with Company Stock Introduction: The Tarrant Texas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock is a crucial policy that provides employees with the opportunity to convert their accumulated vacation days into company stock. This detailed description aims to explain the benefits of this plan and its potential variations. Key Benefits of the Plan: 1. Tax Advantages: By converting unused vacation days into company stock, employees can potentially benefit from tax advantages. The plan may include provisions that allow for tax-deferred or tax-favorable treatment of the stock received in exchange for vacation time. 2. Employee Motivation and Retention: Implementation of this plan showcases the company's commitment to employee ownership and enhances employee motivation and loyalty. Providing shares of stock instead of traditional cash payment for accrued vacation benefits can strengthen the bond between the employee and the company. 3. Potential for Stock Appreciation: When employees receive company stock, they become shareholders, participating in the company's growth and success. If the company performs well in the market, employees can potentially experience stock appreciation, resulting in increased wealth and financial security. 4. Long-Term Investment Strategy: For employees seeking a long-term investment opportunity, receiving company stock instead of cash may align with their investment goals. This plan encourages employees to be actively involved in the financial success of the company and potentially benefit from long-term capital appreciation. Variations of Tarrant Texas Authorization to Adopt a Plan for Payment of Accrued Vacation Benefits with Company Stock: 1. Company Stock Purchase Option: In this variant, employees have the option to purchase company stock using their accrued vacation days at a discounted price or at market value depending on the plan's terms. 2. Stock Vesting Period: Some plans may include provisions that require employees to meet certain conditions before becoming fully vested in the company stock received in exchange for accrued vacation days. These conditions may include minimum employment duration or achievement of performance targets. 3. Stock Dividend Payment: The plan might offer the employees an additional benefit by providing dividend payments on company stock received in lieu of vacation benefits. This can further enhance the overall financial reward for employees participating in the plan. 4. Stock Repurchase Option: Alternatively, the plan may include an option for the employee to sell their company stock back to the company at a predetermined price or based on market value, affording them liquidity while maintaining flexibility. Conclusion: The Tarrant Texas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock is a progressive approach that combines employees' vacation benefits with ownership in the company. This plan can act as a strong motivator, promoting employee retention, aligning interests, and potentially enhancing financial security through stock appreciation. By offering variations such as stock purchase options, vesting periods, dividend payments, and stock repurchase options, companies can tailor the plan to meet the unique needs and preferences of their employees, creating a win-win scenario for both the employee and the organization.

Tarrant Texas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

How to fill out Tarrant Texas Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Tarrant Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Tarrant Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan from the My Forms tab.

For new users, it's necessary to make several more steps to get the Tarrant Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan:

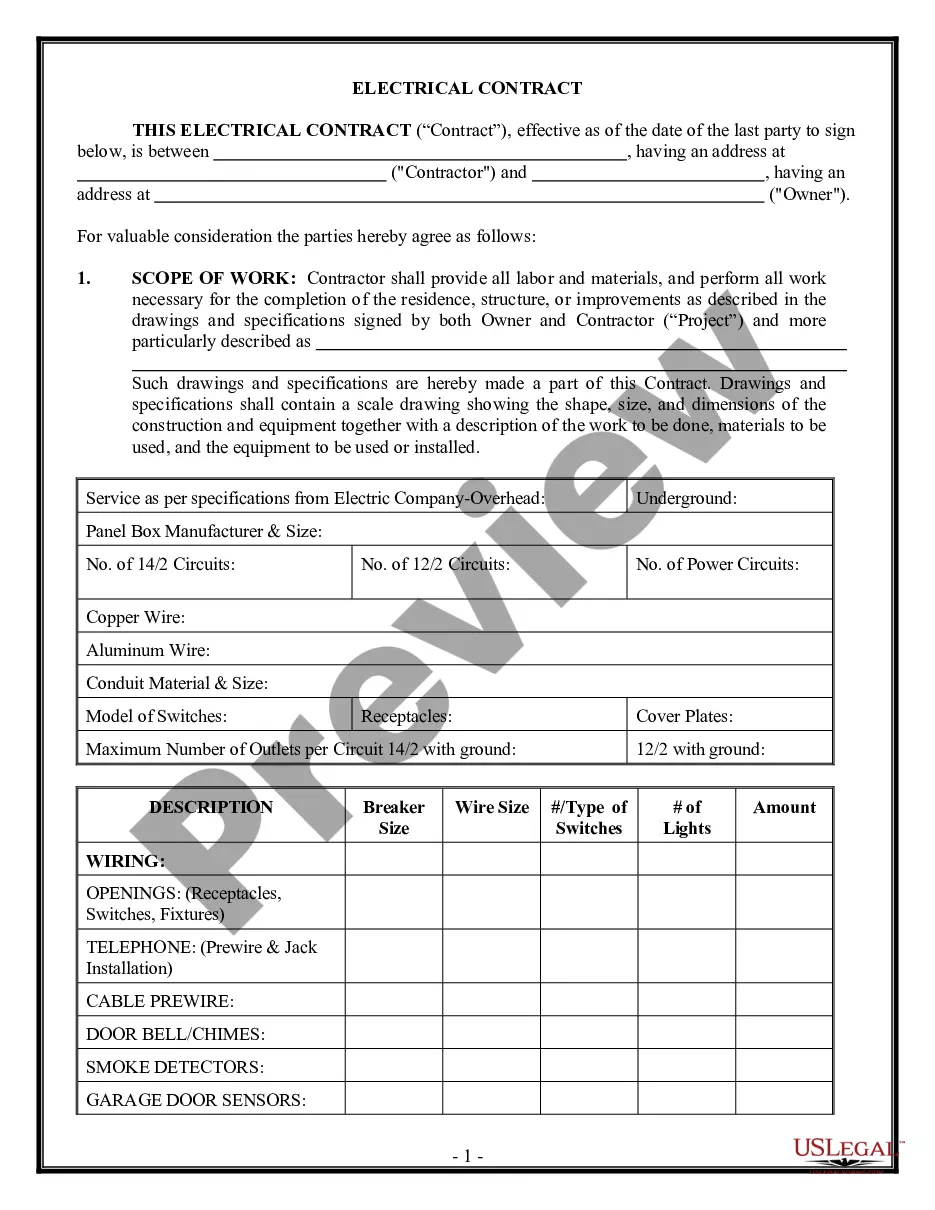

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!