Wayne Michigan Proposed Additional Compensation Plan with copy of plan

Description

How to fill out Wayne Michigan Proposed Additional Compensation Plan With Copy Of Plan?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business purpose utilized in your region, including the Wayne Proposed Additional Compensation Plan with copy of plan.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Wayne Proposed Additional Compensation Plan with copy of plan will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Wayne Proposed Additional Compensation Plan with copy of plan:

- Ensure you have opened the correct page with your localised form.

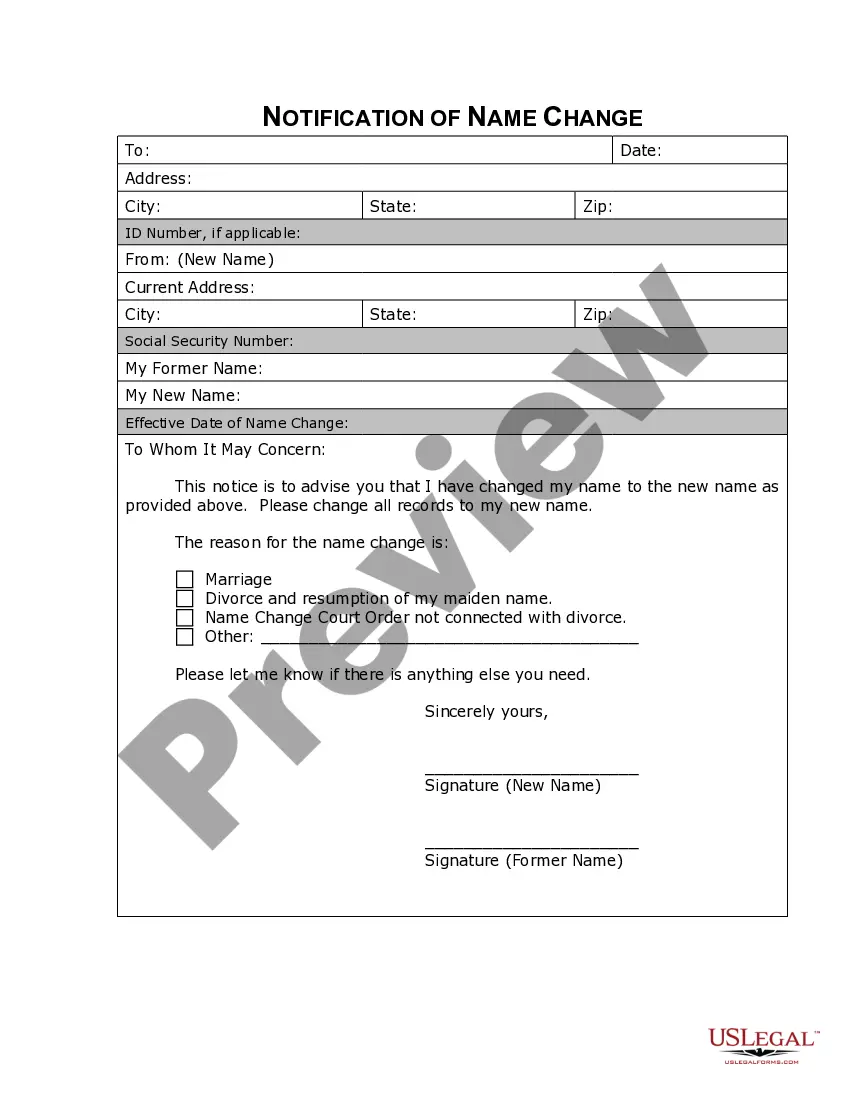

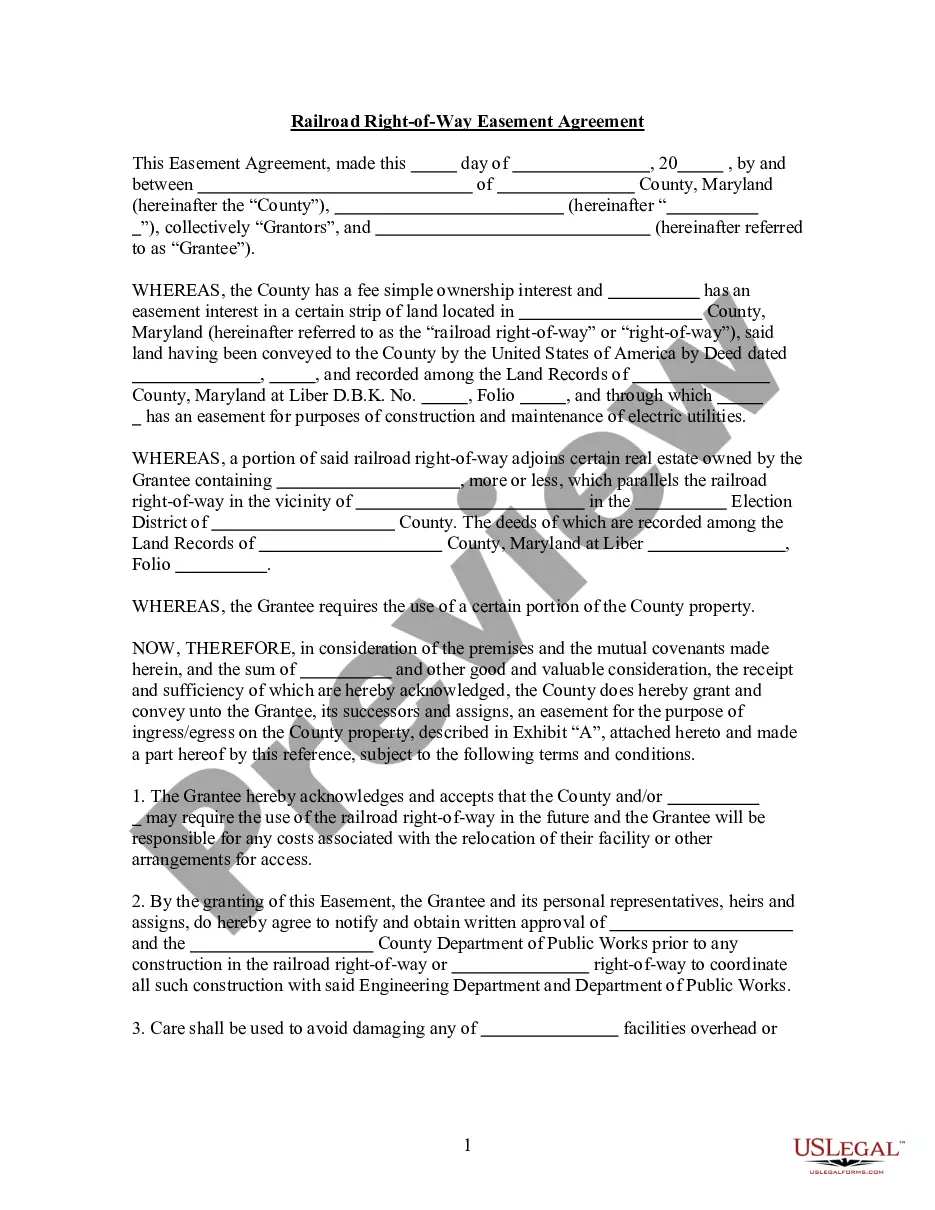

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Wayne Proposed Additional Compensation Plan with copy of plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

You may qualify for a property tax credit if all of the following apply: You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes and/or service fees were levied.

Property Protected by Michigan's Homestead Exemption The homestead exemption applies to your principal residence only. It could include your house, condominium, co-op unit, mobile home, motor home, boat or other watercraft, or manufactured home. The homestead exemption also applies to appurtenances to the property.

In short, Michigan is a relatively tax-friendly destination for retirees. It does not tax Social Security and it provides a sizable deduction for seniors on other types of retirement income. Sales taxes are somewhat below average, while property taxes are above average.

Contact your county Department of Health and Human Services (DHHS) office to apply for State Emergency Relief (SER) funds if you are at risk of losing your home due to back property taxes, maximum $2,000 lifetime for Home Ownership Services. Call 211 for local referrals.

Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200.

Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200.

Pursuant to MCL 211.51, senior citizens, disabled people, veterans, surviving spouses of veterans and farmers may be able to postpone paying property taxes. Eligible taxpayers can apply for a summer tax deferment with the City Treasurer.

Understand Your Tax Bill. Ask for Your Property Tax Card. Don't Build. Limit Curb Appeal. Research Thy Neighbors. Walk the Home With the Assessor. Allow the Assessor Access. Look for Exemptions.

How do I become tax exempt in Michigan? You will have to provide proof that your organization is Michigan non-profit. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors, making a claim for exemption from sales or use tax.