The Philadelphia Pennsylvania Severance Compensation Program is a comprehensive initiative designed to support employees who have been terminated from their employment in the city of Philadelphia, Pennsylvania. This program aims to provide financial assistance and security to those individuals who have faced involuntary job loss, helping them navigate the challenging transition period between jobs. The Philadelphia Pennsylvania Severance Compensation Program offers various types of compensation packages tailored to meet the needs and circumstances of terminated employees. These packages are intended to ease the burden of sudden unemployment and assist individuals in maintaining their financial stability during this critical time. 1. Base Severance Package: This is the standard compensation package offered to eligible employees, providing a lump sum payment determined by factors such as length of service, salary, and position within the company. 2. Enhanced Severance Package: Some individuals may qualify for an enhanced severance package, which offers additional monetary benefits beyond the base package. This might include higher payment amounts, extended healthcare coverage, or outplacement assistance to aid in finding new employment opportunities. 3. Early Retirement Severance Package: Employees who are close to retirement age may be eligible for an early retirement severance package. This type of compensation is tailored specifically for those employees who are opting to retire early due to job termination, and it includes benefits such as pension enhancements or extended healthcare coverage until they become eligible for Medicare. 4. Industry-Specific Severance Package: Certain industries may have their own specific severance packages with additional benefits or considerations unique to their line of work. These packages are designed to address the distinctive challenges and circumstances faced by employees in those industries. The Philadelphia Pennsylvania Severance Compensation Program aims to provide a safety net for terminated employees by offering financial assistance, emotional support, and access to resources that can facilitate their transition into new employment. This program recognizes the importance of supporting individuals during this often difficult and uncertain phase, ensuring a smooth and confident pathway towards future career opportunities.

Philadelphia Pennsylvania Severance Compensation Program

Description

How to fill out Philadelphia Pennsylvania Severance Compensation Program?

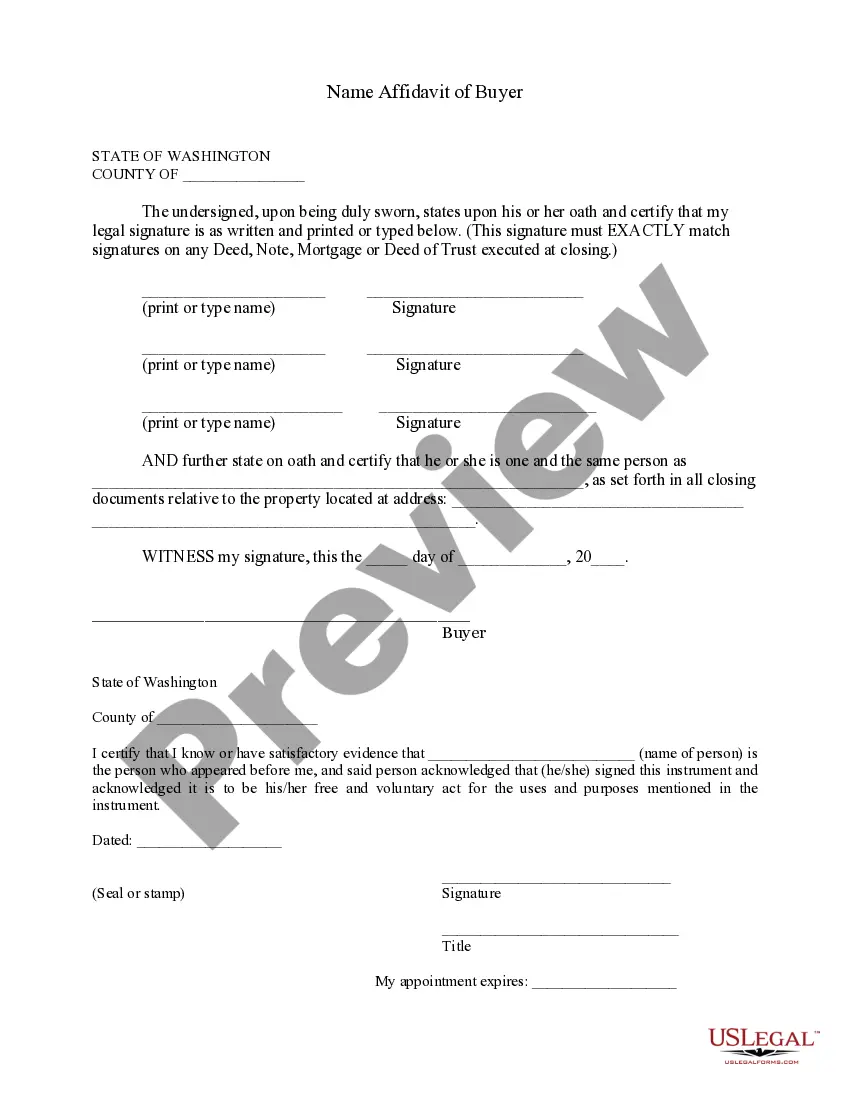

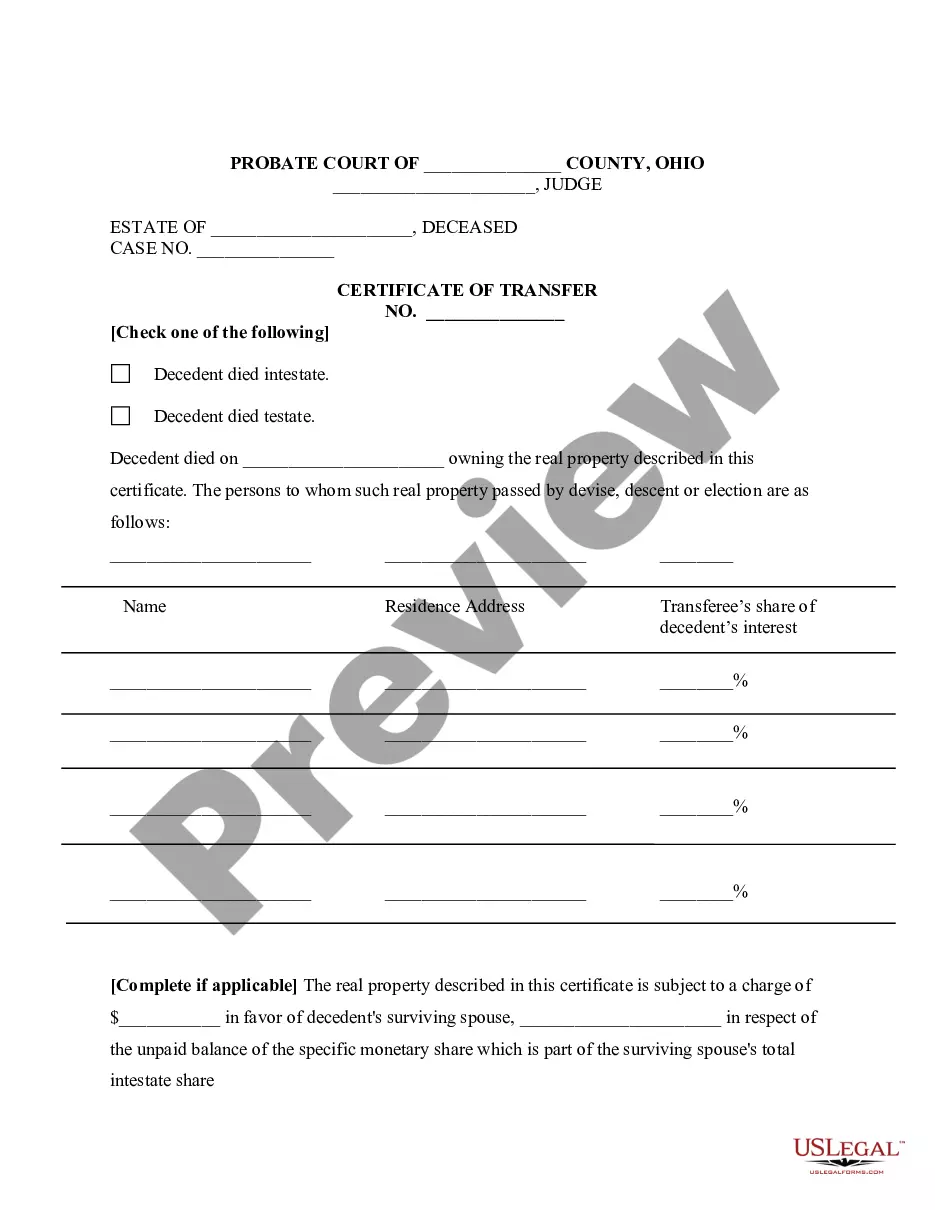

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Philadelphia Severance Compensation Program, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Philadelphia Severance Compensation Program from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Philadelphia Severance Compensation Program:

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

In Pennsylvania, severance pay might reduce your benefits. If your severance package exceeds 40% of the average annual wage of Pennsylvania, the amount of your severance pay will be deducted from your weekly unemployment benefits.

There is a formula for calculating severance pay. One week's pay is calculated by considering your total wages (excluding any overtime hours worked) over a period of eight weeks and divided by eight to get an average.

Typical severance packages offer one to two weeks of paid salary for every year worked. You usually have 21 days to accept a severance agreement, and once it's signed, you have seven days to change your mind.

For salaried employees: If your salary is $100,000 per year, that is $4,000 for two weeks (given the cap is 25 weeks). If you have been at the company for 10 years, your severance pay would be $40,000 ($4,000 X 10 years). Remember severance pay is not always given; it is dependent on the scenario with your employer.

How does severance, separation or salary continuation pay affect my UC benefits? 200bSeverance pay received by a claimant that exceeds 40 percent of Pennsylvania's average annual wage is deducted from the claimant's UC if the claimant's application for benefits (AB) date is on or after Jan.

While there is no Pennsylvania law that requires an employer to offer severance pay, the law does enforce payment when an agreement has been made, according to the Pennsylvania Department of Labor and Industry.

While there is no Pennsylvania law that requires an employer to offer severance pay, the law does enforce payment when an agreement has been made, according to the Pennsylvania Department of Labor and Industry.

In Pennsylvania, severance pay might reduce your benefits. If your severance package exceeds 40% of the average annual wage of Pennsylvania, the amount of your severance pay will be deducted from your weekly unemployment benefits.

The deductible portion of your severance pay is allocated to the weeks immediately following your separation from employment, based on your full-time weekly wage. EXAMPLE: You received severance pay of $25,000. For Benefit Years that begin in 2022, 40% of Pennsylvania's average annual wage is $23,659.26.