The Salt Lake Utah Ratification of Sale of Stock is a legal document that solidifies the authorization and approval of the sale of stocks within the region of Salt Lake City, Utah. This comprehensive agreement ensures that all parties involved in the stock transaction are aware of their rights, responsibilities, and obligations. The ratification process is crucial as it provides a legal framework for validating and legitimizing the sale of stocks. It includes the approval of the sale by the relevant authorities, such as company directors, shareholders, and any required regulatory bodies. To ensure accuracy and compliance, the Salt Lake Utah Ratification of Sale of Stock outlines the specific terms and conditions associated with the sale. It encompasses details such as the number and type of stocks being sold, the selling price, any associated fees or commissions, and the timelines for completing the transaction. For a more comprehensive view, there are different types of Salt Lake Utah Ratification of Sale of Stock that cater to specific scenarios and legal requirements. Some of these variants may include: 1. Corporate Ratification of Sale of Stock: This specific type focuses on the sale of stocks within corporate entities. It is especially important when dealing with publicly traded companies or closely-held corporations. 2. Individual Ratification of Sale of Stock: This variant caters to sales of stocks by individual stockholders who wish to transfer their ownership to another party. It addresses the various legal aspects related to such transactions. 3. Shareholders' Ratification of Sale of Stock: This type involves the collective approval of the sale by the shareholders of a particular company. It ensures that the majority of shareholders support the sale and prevents any potential disputes. By utilizing the Salt Lake Utah Ratification of Sale of Stock, all parties involved can engage in the stock sale process with confidence, knowing that the transaction has been evaluated, approved, and is legally binding. The document serves as a safeguard, protecting the interests of both buyers and sellers while maintaining the integrity of the stock market and regulatory compliance.

Salt Lake Utah Ratification of Sale of Stock

Description

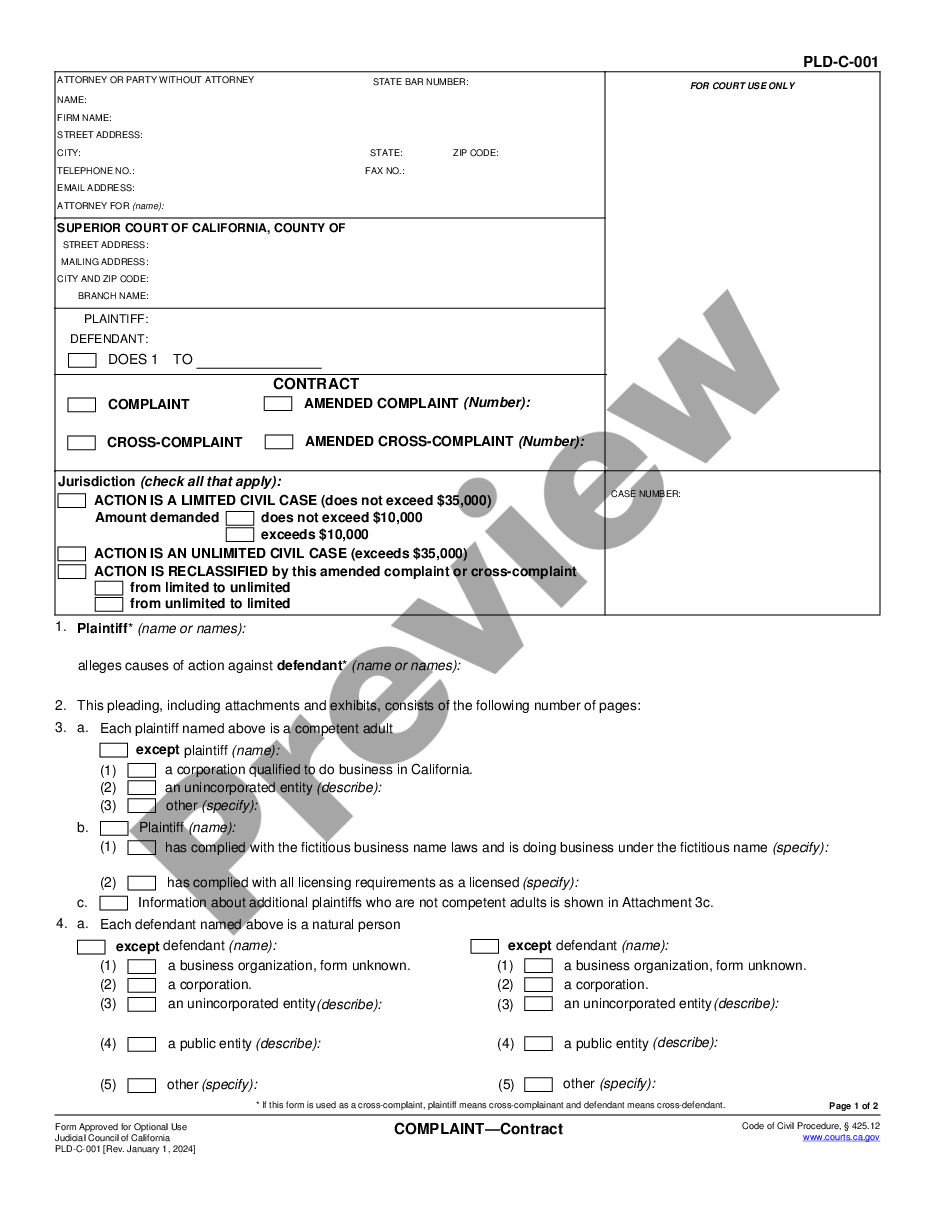

How to fill out Salt Lake Utah Ratification Of Sale Of Stock?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Salt Lake Ratification of Sale of Stock, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the latest version of the Salt Lake Ratification of Sale of Stock, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Ratification of Sale of Stock:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Salt Lake Ratification of Sale of Stock and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

Interesting Questions

More info

See also Article 2: Rights, No Copyright. SALT LAKE CITY (AP) — A federal appeals court says Utah cannot prohibit online retailers from displaying billboards that advertise their products. The 2nd U.S. Circuit Court of Appeals said Tuesday that the signs “contravene” Utah's ability to protect the state's trademarks from being infringed. The billboards are displayed on public buses, and the court said they're more likely than others posted on private property to be viewed by passersby. Copyright 2007 The Associated Press. All rights reserved.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.