Title: Los Angeles California Proposal to Authorize and Issue Subordinated Convertible Debentures Introduction: Los Angeles, California, the entertainment capital of the world, is proposing a remarkable financial initiative — the authorization and issuance of subordinated convertible debentures. This detailed description will explore the concept, benefits, and potential applications within the context of Los Angeles, California. Keywords: Los Angeles, California, proposal, authorize, issue, subordinated convertible debentures 1. Understanding Subordinated Convertible Debentures: Subordinated Convertible Debentures are a type of investment instrument that combines elements of a debt instrument (debentures) and equity security (convertible shares). They offer bondholders the potential to convert their debt holdings into equity shares, providing an opportunity to participate in the future growth of the issuer. 2. The Proposal's Objectives: The Los Angeles, California Proposal aims to utilize subordinated convertible debentures as a means to raise capital while simultaneously fostering economic expansion, development, and public welfare within the city. 3. Benefits of Subordinated Convertible Debentures: — Flexible Financing Solution: By issuing subordinated convertible debentures, Los Angeles can secure long-term fixed-rate financing while preserving capital and avoiding immediate equity dilution. — Attraction of Investors: Offering potentially higher returns than traditional bonds, these debentures may draw interest from a diverse pool of investors seeking both fixed income and potential equity growth. — Mitigation of Risk: If economic conditions deteriorate, these debentures provide a cushioned position as subordinated debt, increasing investor confidence. — Alignment with Sustainable Development Goals: The proposal indicates a strong emphasis on projects that support sustainability, infrastructure development, poverty reduction, and social initiatives. 4. Potential Applications within Los Angeles, California: — Infrastructure Development: The issuance of subordinated convertible debentures can attract capital for key infrastructure projects such as transportation systems, renewable energy, water management, and affordable housing, contributing to urban sustainability and economic growth. — Entertainment Sector Expansion: Los Angeles' vibrant entertainment industry, including film, television, and digital media, could benefit from the infusion of funds raised through the debentures for production facilities, technology advancements, and talent development. — Start-up Incubation: Supporting entrepreneurial endeavors, these debentures could be directed towards nurturing Los Angeles' vibrant start-up ecosystem, encouraging innovation and job creation. Types of Subordinated Convertible Debentures (if applicable): While the Los Angeles, California Proposal does not explicitly specify different types of subordinated convertible debentures, variations may manifest in terms of maturity periods, conversion ratios, interest rates, and project-specific offerings. Each debenture type may cater to different investor preferences and project requirements. Conclusion: The Los Angeles California Proposal to authorize and issue subordinated convertible debentures holds immense potential for raising capital, encouraging economic growth, and realizing sustainable initiatives within the city. By combining the stability of fixed-rate debt with the potential upside of equity, this innovative financial strategy paves the way for a prosperous future for Los Angeles, California, and its residents. Keywords: Los Angeles, California, proposal, authorize, issue, subordinated convertible debentures.

Los Angeles California Proposal to authorize and issue subordinated convertible debentures

Description

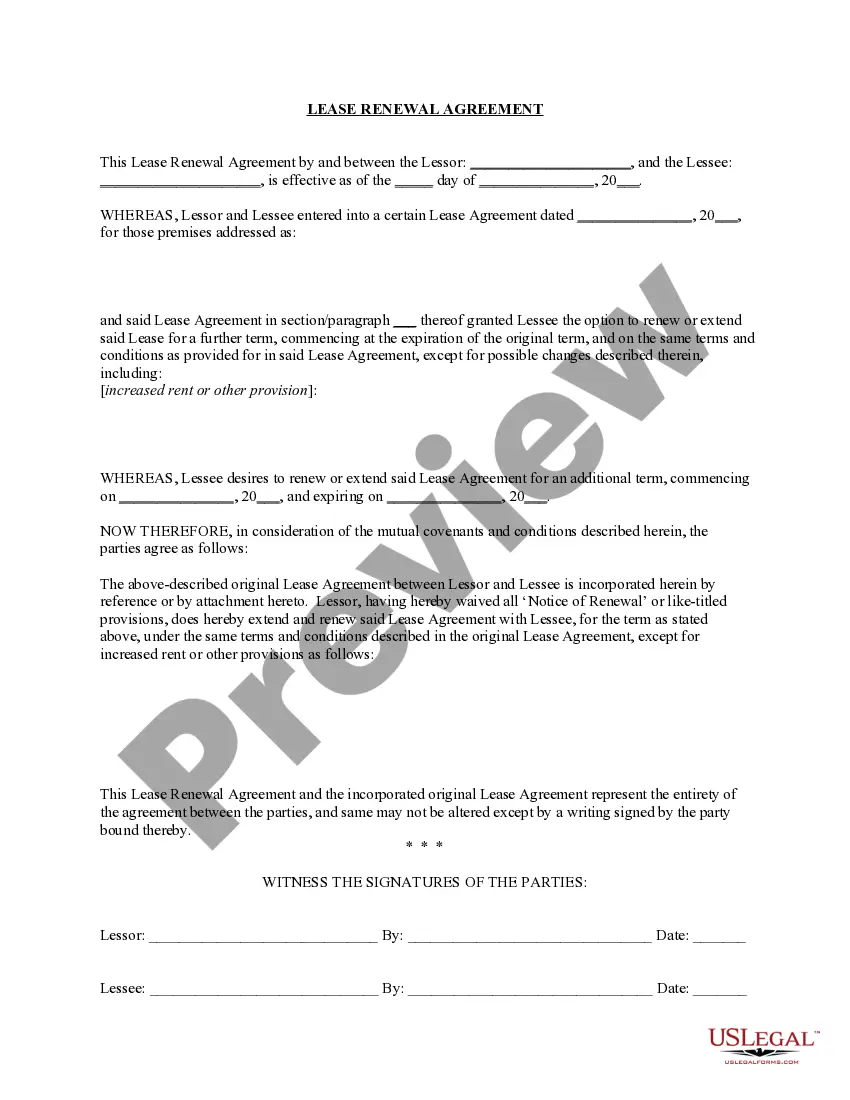

How to fill out Los Angeles California Proposal To Authorize And Issue Subordinated Convertible Debentures?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Los Angeles Proposal to authorize and issue subordinated convertible debentures without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Los Angeles Proposal to authorize and issue subordinated convertible debentures by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Los Angeles Proposal to authorize and issue subordinated convertible debentures:

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!