The Mecklenburg North Carolina Proposal aims to authorize and issue subordinated convertible debentures to address specific financial requirements. Convertible debentures are a type of long-term debt instrument that gives the bondholder the option to convert the debt into equity at a later date. By issuing subordinated convertible debentures, the proposal is designed to provide the issuer with greater flexibility and potentially reduce the cost of borrowing. This proposal involves several key aspects and relevant keywords, including: 1. Authorization: The proposal seeks to obtain the necessary legal authority to issue subordinated convertible debentures. This authorization ensures compliance with applicable regulations and offers the flexibility to utilize this financing mechanism when required. 2. Issuance: Once authorized, the proposal enables the actual issuance of subordinated convertible debentures. This involves offering these instruments to potential investors and determining the terms, conditions, and maturity of the debentures. 3. Subordinated Debt: The debentures proposed are classified as subordinated, indicating their lower priority in the event of issuer bankruptcy or liquidation. This distinction is crucial for investors, as it affects the risk and potential return associated with these instruments. 4. Convertibility: The debentures possess the unique feature of convertibility, which offers the bondholder the right to convert them into equity at a future date. This option provides potential benefits for both the issuer and the investor, such as the ability to benefit from future company growth. 5. Financial Requirements: The proposal outlines specific financial needs that could be addressed through the issuance of subordinated convertible debentures. These requirements might include funding expansion plans, refinancing existing debt, or investing in new projects that align with the issuer's strategic goals. Different types of Mecklenburg North Carolina Proposal to authorize and issue subordinated convertible debentures can be classified based on factors such as: 1. Maturity: Various debentures might have different maturity periods, ranging from short-term to long-term. Shorter-term debentures may cater to immediate funding needs, while longer-term debentures could align with the issuer's long-term financial strategy. 2. Coupon Rate: The coupon rate refers to the interest paid on the debentures. Multiple types of debentures with different interest rates can be issued to attract a diverse group of investors based on their risk tolerance and return expectations. 3. Conversion Terms: The proposal might include different conversion terms, such as conversion price, conversion ratio, and conversion period. These terms determine the conditions under which the bondholder can convert the debenture into equity, offering investors various options based on their investment strategies. In summary, the Mecklenburg North Carolina Proposal aims to obtain authorization for issuing subordinated convertible debentures, which provide flexibility, cost-effective financing, and potential benefits for both the issuer and investors. By involving keywords like authorization, issuance, subordinated debt, convertibility, and financial requirements, the proposal covers critical aspects necessary to both understand and consider while evaluating subordinated convertible debentures.

Mecklenburg North Carolina Proposal to authorize and issue subordinated convertible debentures

Description

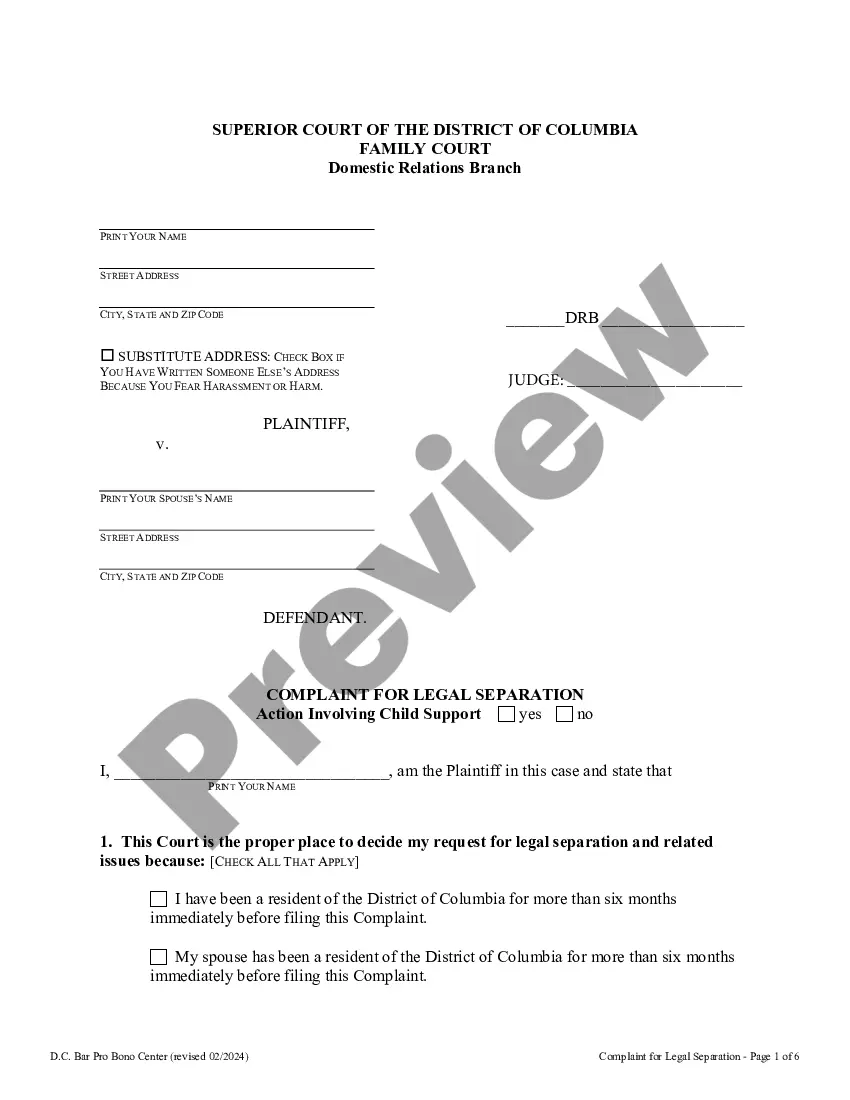

How to fill out Mecklenburg North Carolina Proposal To Authorize And Issue Subordinated Convertible Debentures?

Draftwing forms, like Mecklenburg Proposal to authorize and issue subordinated convertible debentures, to manage your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents intended for different cases and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Mecklenburg Proposal to authorize and issue subordinated convertible debentures template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Mecklenburg Proposal to authorize and issue subordinated convertible debentures:

- Make sure that your form is specific to your state/county since the regulations for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Mecklenburg Proposal to authorize and issue subordinated convertible debentures isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our service and get the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!