San Antonio Texas Stock Redemption Agreements with Exhibits of Fair Lanes, Inc. A Stock Redemption Agreement is a legal agreement between a corporation and its shareholder(s) that allows the corporation to repurchase the shareholder's stock. In the case of San Antonio, Texas, Stock Redemption Agreements involving Fair Lanes, Inc., there are several types worth mentioning. 1. Traditional Stock Redemption Agreement: This type of agreement allows Fair Lanes, Inc. to repurchase the stock of its shareholders at a predetermined price or formula. The agreement outlines the terms, conditions, and rights of both parties involved, ensuring a smooth process and protecting the interests of both Fair Lanes, Inc. and its shareholders. 2. Voluntary Stock Redemption Agreement: This agreement allows shareholders of Fair Lanes, Inc. to voluntarily offer their shares for repurchase. It might occur when shareholders wish to exit their investment or when the corporation decides to retire certain classes of stock. The agreement details the procedures for voluntary stock redemptions, providing a framework for communication and financial considerations. 3. Forced Stock Redemption Agreement: This type of agreement is initiated by Fair Lanes, Inc. or its board of directors when they are legally obligated to repurchase the shares of a shareholder. Common instances that trigger forced stock redemptions include shareholder non-compliance with organizational rules, bankruptcy, or violations of shareholder agreements. The agreement outlines the conditions and steps required for Fair Lanes, Inc. to redeem the stock against the shareholder's will. 4. Buy-Sell Agreement: A buy-sell agreement is often incorporated into a Stock Redemption Agreement to establish predetermined triggers or events that allow stock to be redeemed. It helps manage change within Fair Lanes, Inc. and outlines how shares will be repurchased and at what price in situations such as death, disability, retirement, or disagreement between shareholders. Exhibits of Fair Lanes, Inc. might include relevant documentation supporting the Stock Redemption Agreements mentioned above. These exhibits may consist of financial statements, valuation reports, certificates of stock ownership, board resolutions, or any other documents relevant to the specific agreement. These exhibits serve as evidence to validate the terms, conditions, and transactions involved in the Stock Redemption Agreements. In conclusion, San Antonio, Texas, Stock Redemption Agreements with exhibits of Fair Lanes, Inc. encompass various types of agreements, each serving a specific purpose. Whether it's a traditional, voluntary, forced, or buy-sell agreement, these legal instruments outline the terms and conditions under which Fair Lanes, Inc. repurchases its shareholders' stock, ensuring compliance, protecting interests, and facilitating a smooth process for all parties involved.

San Antonio Texas Stock Redemption Agreements with exhibits of Fair Lanes, Inc.

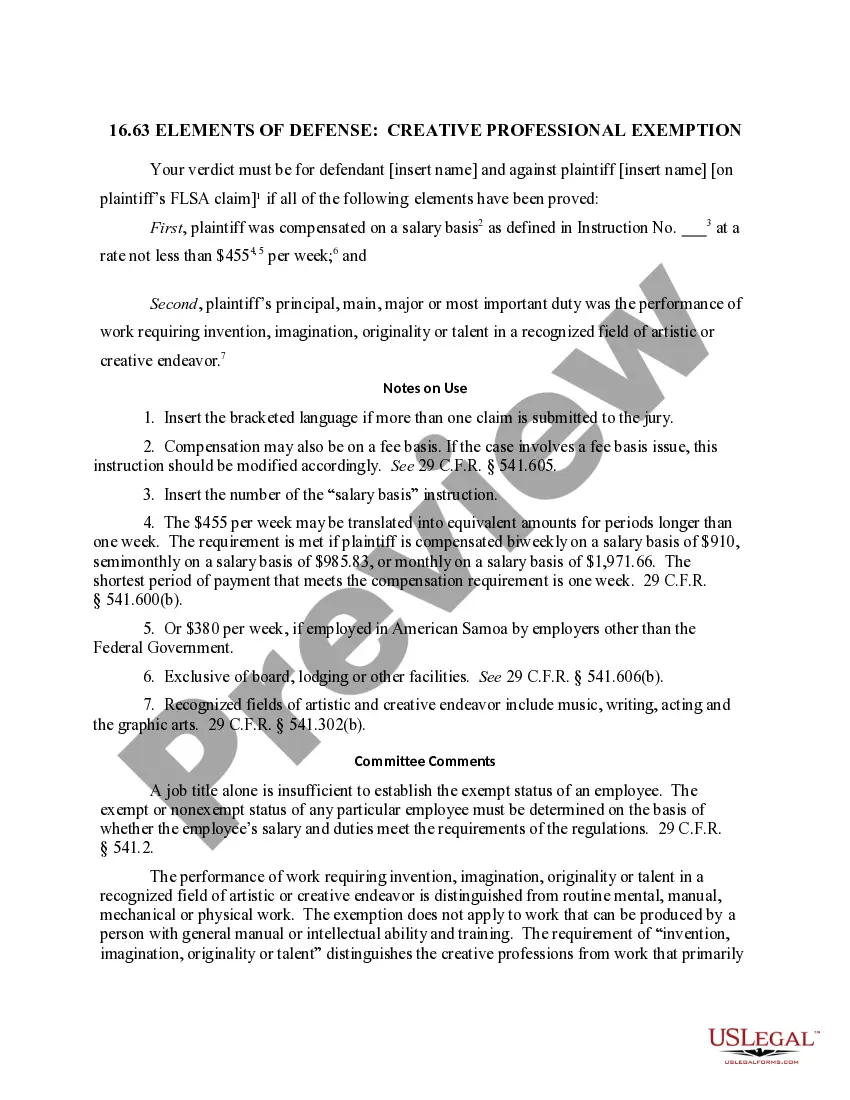

Description

How to fill out San Antonio Texas Stock Redemption Agreements With Exhibits Of Fair Lanes, Inc.?

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, finding a San Antonio Stock Redemption Agreements with exhibits of Fair Lanes, Inc. meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Aside from the San Antonio Stock Redemption Agreements with exhibits of Fair Lanes, Inc., here you can find any specific document to run your business or personal deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your San Antonio Stock Redemption Agreements with exhibits of Fair Lanes, Inc.:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Antonio Stock Redemption Agreements with exhibits of Fair Lanes, Inc..

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!