The Dallas Texas Form of Indemnity Agreement by Financial Corporation of Santa Barbara is an important legal instrument used to protect individuals or entities from financial losses or damages. This agreement outlines the terms and conditions under which Santa Barbara Financial Corporation will indemnify the party named in the agreement. Key relevant keywords for this topic include: Dallas Texas, Form of Indemnity Agreement, Financial Corporation, Santa Barbara, legal instrument, protect, individuals, entities, financial losses, damages, terms, conditions, indemnify. This specific form of indemnity agreement offered by Santa Barbara Financial Corporation serves as a binding contract between the corporation and the party seeking indemnification. It is designed to provide security and assurance that the party will be reimbursed for any financial losses or damages incurred due to certain specified events or circumstances. The Dallas Texas Form of Indemnity Agreement typically covers a wide range of situations, such as legal claims, liabilities, lawsuits, damages, penalties, fines, or costs that the party may face. By signing this agreement, the party is essentially transferring the risk to Santa Barbara Financial Corporation, which agrees to bear the financial burden arising from these events. There may be different types or variations of the Dallas Texas Form of Indemnity Agreement offered by Santa Barbara Financial Corporation, depending on the specific needs and requirements of the party seeking indemnification. Some possible variations may include: 1. General Indemnification Agreement: This is a standard form of indemnity agreement that provides broad protection to the party against various potential risks and liabilities. 2. Indemnification Agreement for Directors and Officers: This type of agreement specifically focuses on protecting directors and officers of an organization from legal actions or liabilities arising from their roles and responsibilities. 3. Indemnity Agreement for Contractors or Vendors: This agreement is tailored for contractors or vendors working with Santa Barbara Financial Corporation and aims to indemnify them from any losses or damages incurred while performing their contractual obligations. 4. Indemnification Agreement for Business Transactions: This type of agreement is specific to indemnifying parties involved in mergers, acquisitions, sales, or other business transactions, ensuring they are protected from any potential financial risks or liabilities associated with the transaction. Overall, the Dallas Texas Form of Indemnity Agreement by Financial Corporation of Santa Barbara provides crucial protection and peace of mind to parties involved, mitigating potential financial losses and creating a legally binding commitment between the corporation and the indemnified party.

Dallas Texas Form of Indemnity Agreement by Financial Corporation of Santa Barbara

Description

How to fill out Dallas Texas Form Of Indemnity Agreement By Financial Corporation Of Santa Barbara?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Dallas Form of Indemnity Agreement by Financial Corporation of Santa Barbara, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Dallas Form of Indemnity Agreement by Financial Corporation of Santa Barbara from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Dallas Form of Indemnity Agreement by Financial Corporation of Santa Barbara:

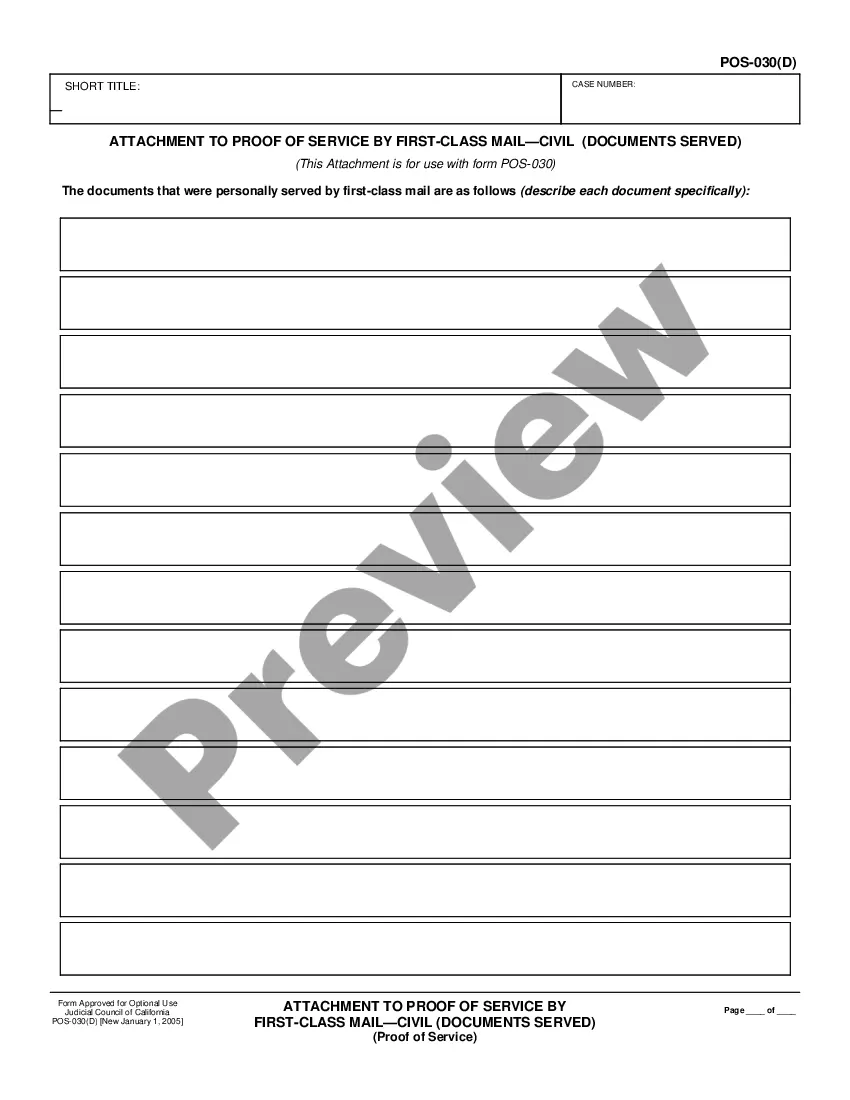

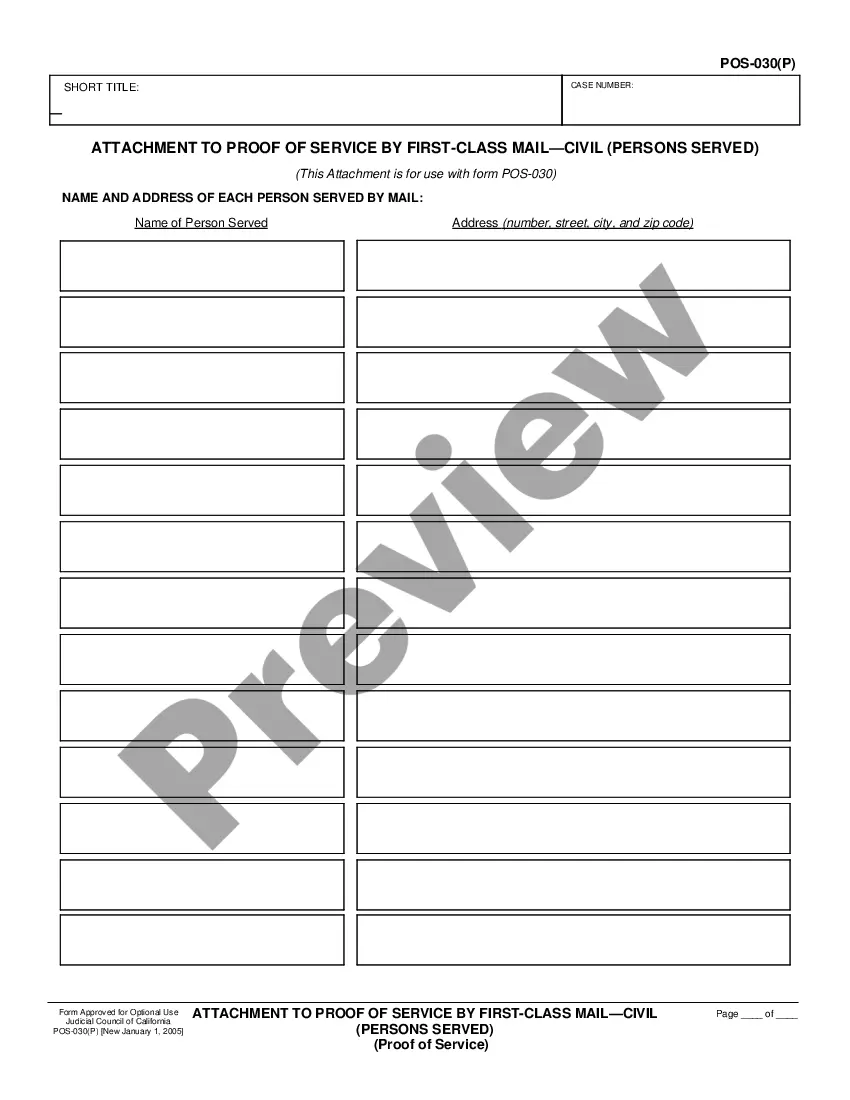

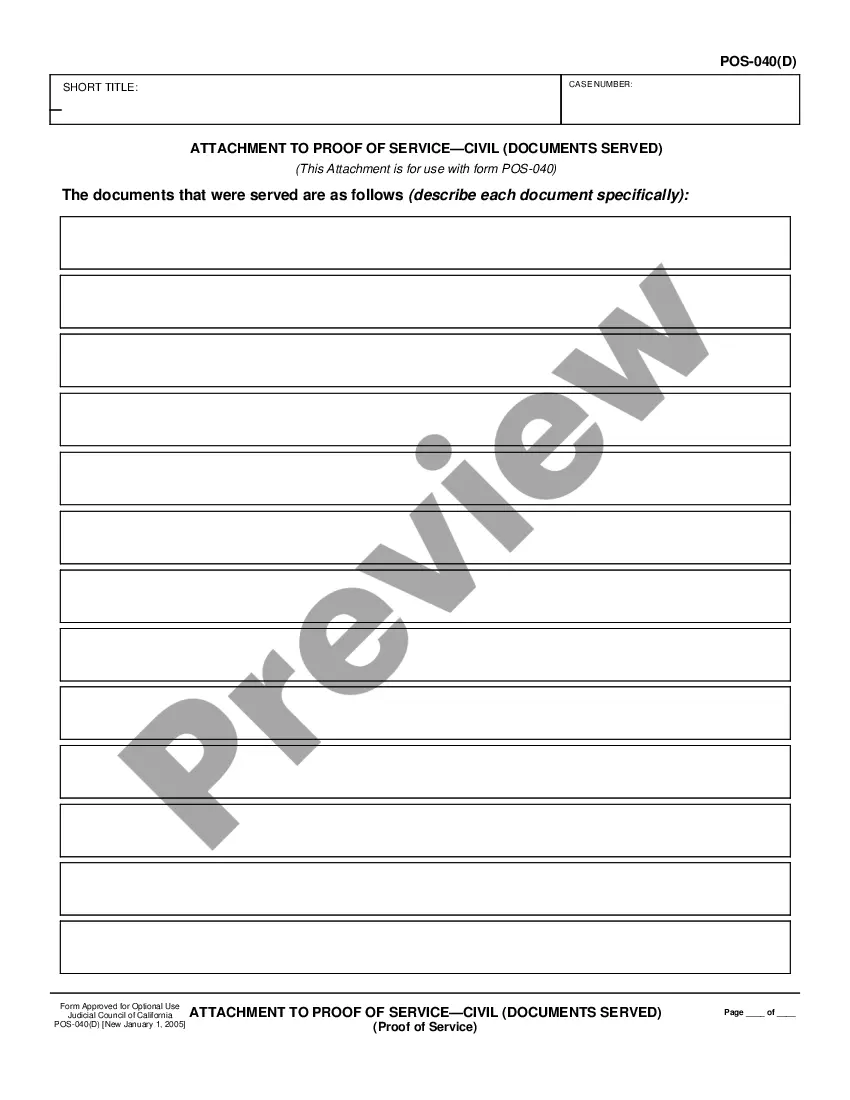

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!