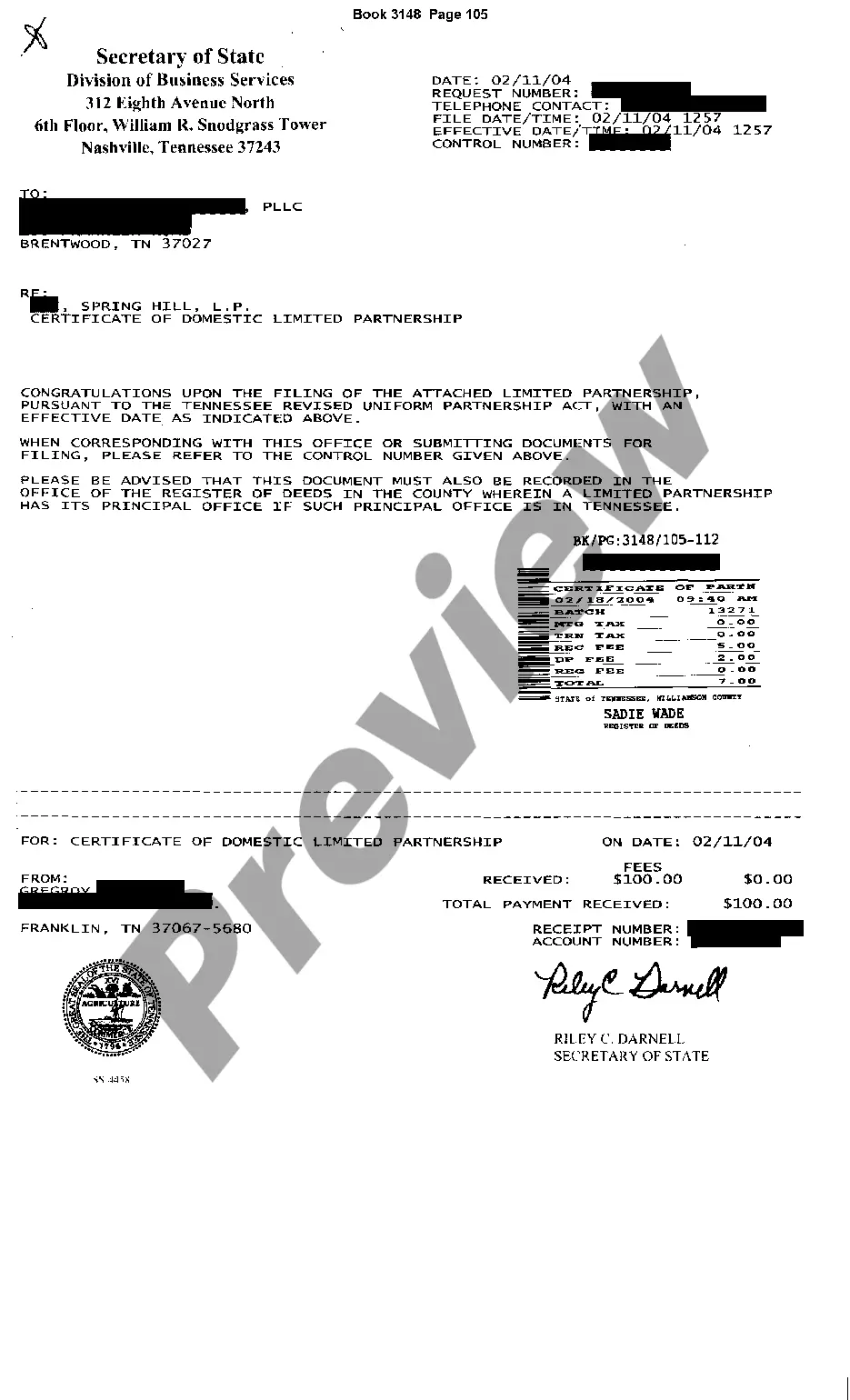

Dallas Texas Directors and Officers Indemnity Trust is a specialized form of insurance coverage designed to protect the personal assets of board directors and officers of organizations located in the Dallas, Texas area. This type of trust provides financial protection for directors and officers who are held personally liable for their actions or decisions while carrying out their duties. The Dallas Texas Directors and Officers Indemnity Trust primarily covers the costs associated with legal defense expenses, settlements, and judgments arising from claims made against directors and officers for alleged wrongful acts, negligence, errors, or omissions in their roles and responsibilities. There are several types of Dallas Texas Directors and Officers Indemnity Trust available to cater to the specific needs of different organizations: 1. Corporate Directors and Officers Indemnity Trust: This type of trust is designed for directors and officers of for-profit corporations based in Dallas, Texas. It protects them from potential lawsuits arising from actions taken or decisions made during their leadership roles. 2. Non-Profit Directors and Officers Indemnity Trust: Non-profit organizations in Dallas, Texas can benefit from this trust, which safeguards the personal assets of their directors and officers against claims of mismanagement, misuse of funds, or other allegations related to their governance responsibilities. 3. Executive Directors and Officers Indemnity Trust: Specifically tailored for executives who hold positions of leadership and authority within Dallas-based organizations, this trust provides coverage for both the organization and its individual directors and officers. 4. Limited Liability Company (LLC) Directors and Officers Indemnity Trust: This trust is designed to protect directors and officers of LCS in Dallas, Texas from personal liability for their decisions and actions made in the course of their official duties. 5. Municipal Directors and Officers Indemnity Trust: Aimed at safeguarding individuals serving as directors or officers of local government entities, such as cities and towns in the Dallas, Texas area, this trust provides financial protection against claims of wrongful acts or negligence. In conclusion, Dallas Texas Directors and Officers Indemnity Trust offers vital protection to directors and officers, regardless of the organization they serve. These trusts vary depending on the type of organization, such as corporations, non-profits, LCS, or government entities, ensuring each category's specific needs are met and their personal assets are safeguarded in the face of potential legal claims or liabilities.

Dallas Texas Directors and Officers Indemnity Trust

Description

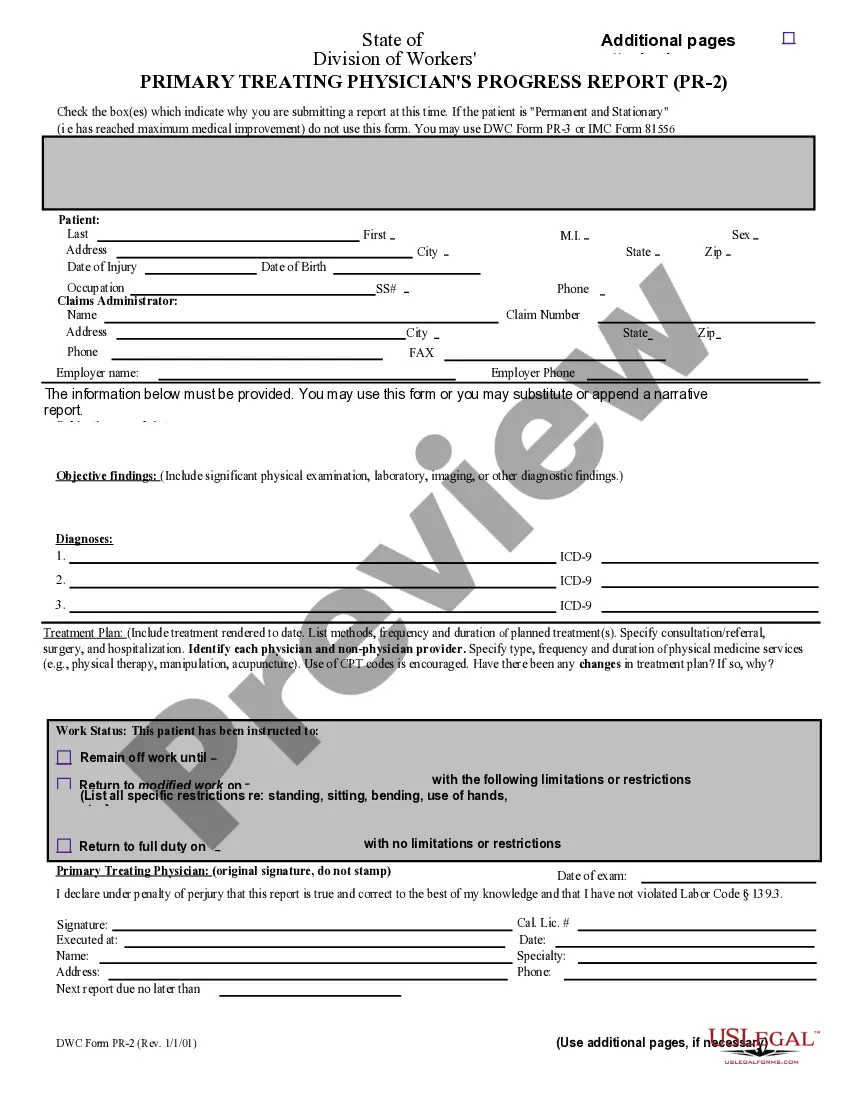

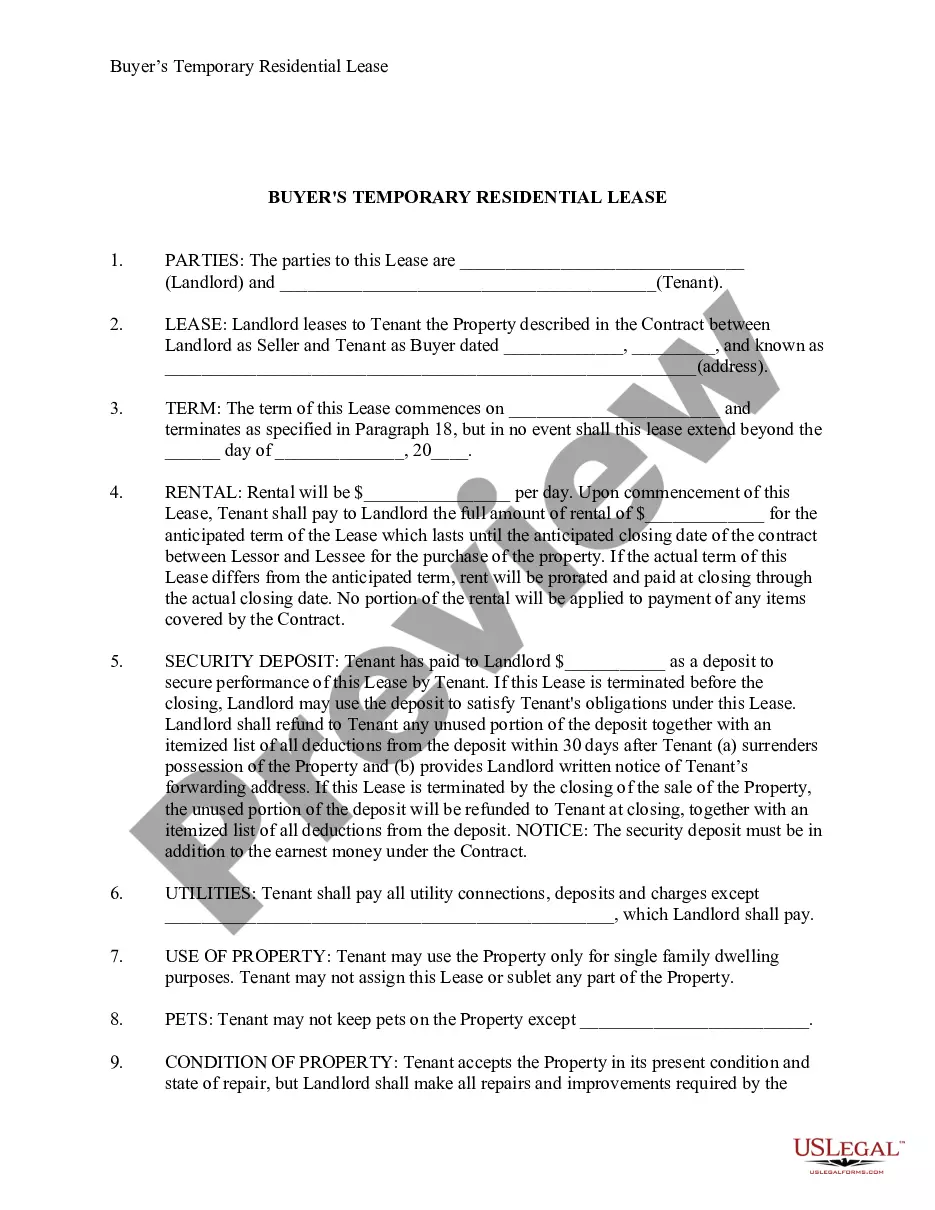

How to fill out Dallas Texas Directors And Officers Indemnity Trust?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Dallas Directors and Officers Indemnity Trust meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. In addition to the Dallas Directors and Officers Indemnity Trust, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Dallas Directors and Officers Indemnity Trust:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Dallas Directors and Officers Indemnity Trust.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Professional liability insurance (PLI), also called professional indemnity insurance (PII) but more commonly known as errors & omissions (E&O) in the US, is a form of liability insurance which helps protect professional advice- and service-providing individuals and companies from bearing the full cost of defending

In a nutshell, directors and officers insurance protects the directors and their personal assets from claims of business mismanagement, whilst professional indemnity protects a business and its assets from claims of negligent service provision.

In the context of D&O policy claims, a wrongful act may include violation of a statute, improper self-dealing, conflict of interest, fraudulent financial statements, a tort, violation of the articles of incorporation of by-laws or transactions with companies in which the officers or directors have a personal interest.

An Alberta corporation is not permitted to indemnify its directors for their actions if they have not acted honestly and in good faith with a view to the best interests of the corporation that is, if they have breached their fiduciary duty to the corporation.

Indemnification. Indemnification is an undertaking by the company to defend the director and officer against the cost of certain claims, including legal fees, litigation awards and settlement costs.

D&O Insurance. D&O insurance provides protection for company officials when corporate indemnification is not available, whether due to insolvency or legal prohibition. D&O insurance also provides a mechanism for corporations to be reimbursed when they do indemnify their executives.

There are two possible options: giving directors an exemption from any liability to the company and an indemnity against liability to third parties; taking out and paying for insurance against any liability incurred by the directors.

Companies may indemnify directors against the legal and financial costs of proceedings brought by third parties. This does not extend to the legal costs of unsuccessful defence of criminal proceedings, fines imposed by criminal proceedings and fines imposed by regulatory bodies.

D&O insurance specifically covers members on a board of directors and officers. Professional liability insurance, on the other hand, covers professionals (of nearly any position within a company) that offer specialized services.

Maric Law Office A company can usually indemnify a director for his/her defense costs and/or damages, judgments and settlements if he/she was the only one responsible for the procedure and was found guilty. In such case the usual conditions would apply as to proof of the amount of damage, defense costs etc.