Maricopa Arizona Directors and Officers Indemnity Trust is a specialized insurance policy designed to protect the directors and officers of companies or organizations in Maricopa, Arizona, against legal claims brought against them in their role as leaders. This coverage helps safeguard directors and officers from potential financial losses resulting from lawsuits alleging wrongful acts, negligence, or breaches of fiduciary duty in carrying out their corporate functions. Directors and officers play a critical role in an organization's decision-making process, and their actions can have significant implications for the company, its shareholders, and stakeholders. However, the complex and evolving legal landscape can expose directors and officers to personal liability risks. By obtaining Maricopa Arizona Directors and Officers Indemnity Trust coverage, companies can provide an additional layer of protection for their directors and officers. This policy covers legal defense costs, settlements, and judgments resulting from covered claims, helping to alleviate the financial burden on individuals who may otherwise face personal liability. The trust ensures that directors and officers have the necessary resources to defend themselves against claims, potentially saving their personal assets. In Maricopa, Arizona, there might be different types of Directors and Officers Indemnity Trust policies available, tailored to the specific needs of various organizations. Some key variations may include: 1. Non-profit Directors and Officers Indemnity Trust: This variation is specifically designed for directors and officers serving on the boards of non-profit organizations. It provides coverage for claims related to the unique risks and challenges faced by non-profit entities. 2. Public Company Directors and Officers Indemnity Trust: This type of policy caters to directors and officers serving in publicly traded companies. As these companies are subjected to more stringent regulations and scrutiny, this coverage addresses the specific exposures concerning these individuals. 3. Private Company Directors and Officers Indemnity Trust: Private companies have distinct insurance needs, and this policy offers protection to their directors and officers against claims related to their managerial actions within the private business sphere. It's crucial for companies in Maricopa, Arizona, to assess their risks adequately and select the appropriate Directors and Officers Indemnity Trust that aligns with their organizational structure, size, and industry. In summary, Maricopa Arizona Directors and Officers Indemnity Trust provides essential protection and peace of mind for directors and officers by offering financial defense in the face of legal claims related to their corporate roles. Whether for non-profit organizations, publicly traded companies, or private entities, this coverage is crucial in mitigating the potential financial consequences of lawsuits, allowing directors and officers to focus on their leadership responsibilities.

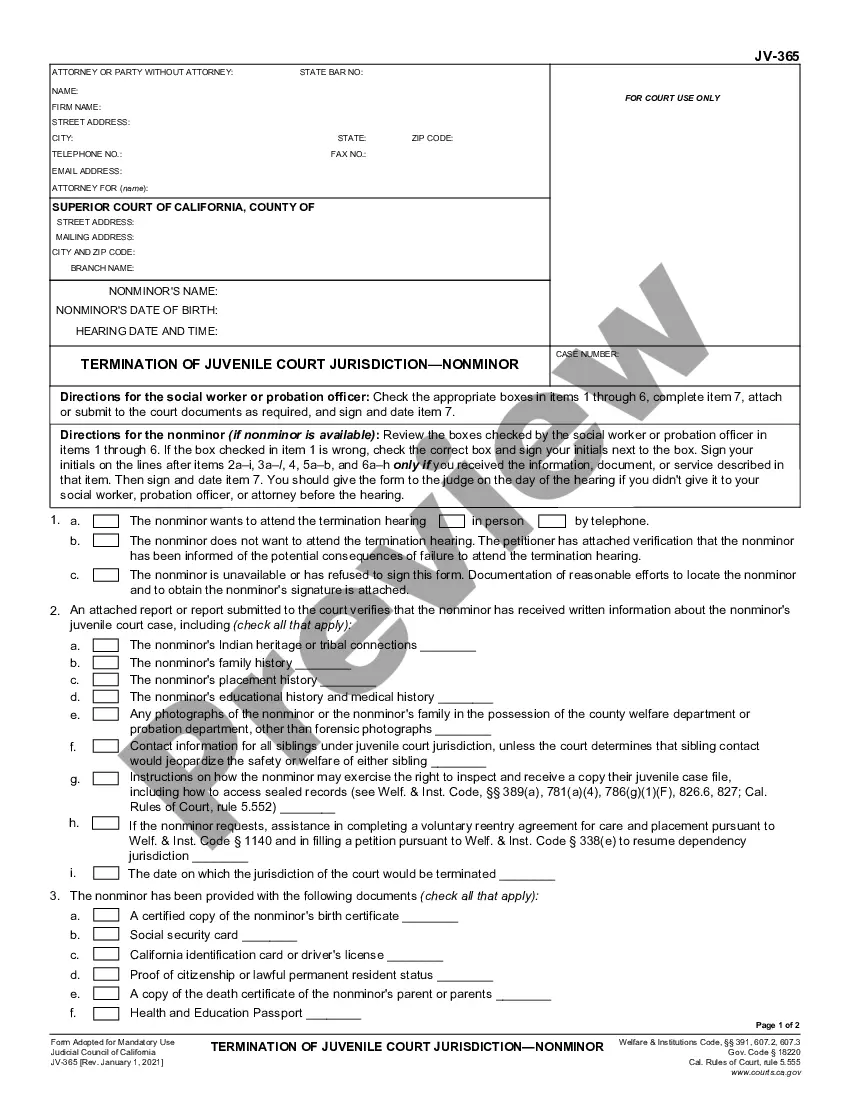

Maricopa Arizona Directors and Officers Indemnity Trust

Description

How to fill out Maricopa Arizona Directors And Officers Indemnity Trust?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life situation, finding a Maricopa Directors and Officers Indemnity Trust meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. In addition to the Maricopa Directors and Officers Indemnity Trust, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Maricopa Directors and Officers Indemnity Trust:

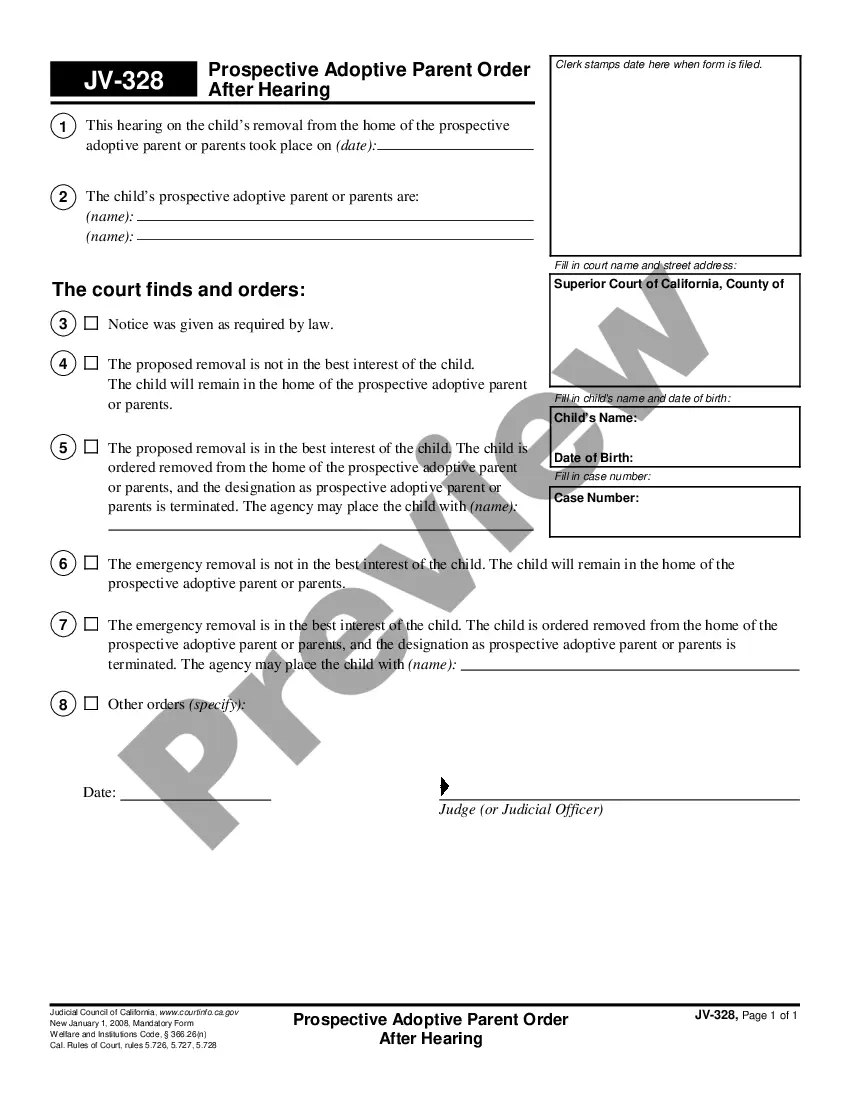

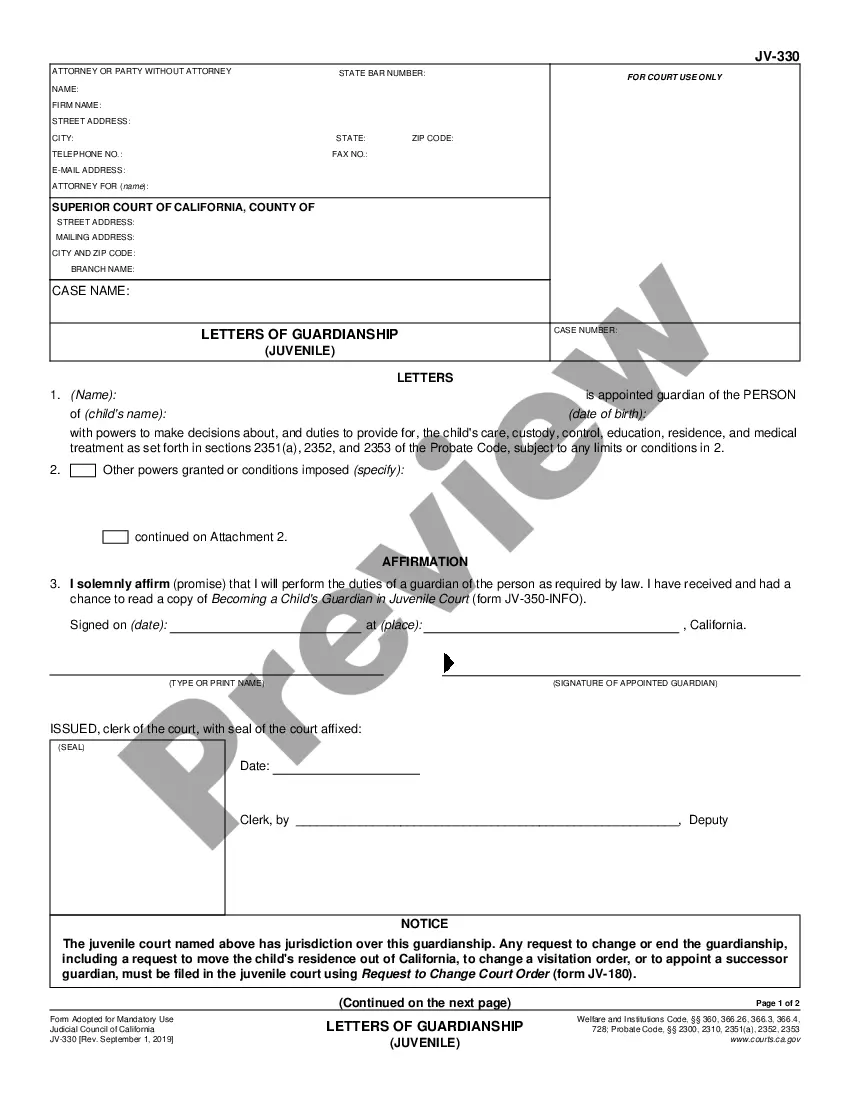

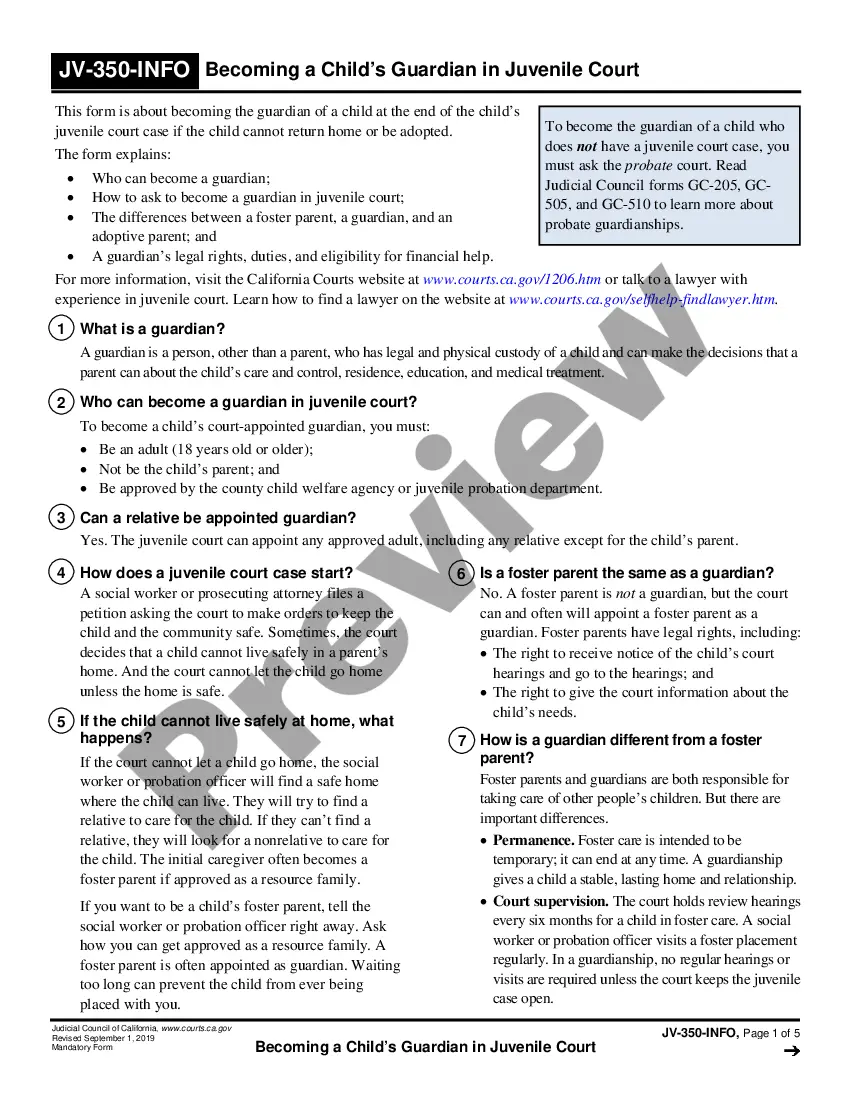

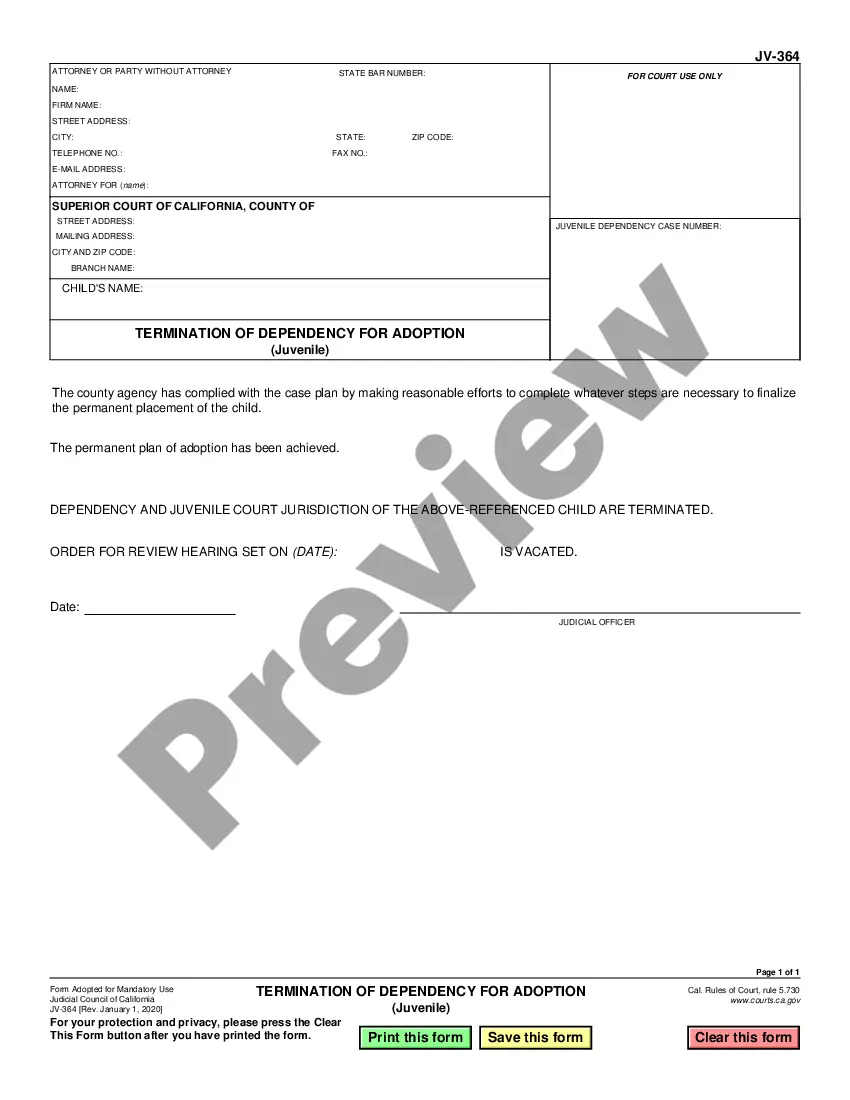

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Maricopa Directors and Officers Indemnity Trust.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!