Harris Texas Articles of Incorporation with Indemnification: The Harris Texas Articles of Incorporation with Indemnification is a legal document that outlines the establishment and structure of a corporation in the Harris County region of Texas, with a specific emphasis on indemnification protections. This document is of utmost importance for companies seeking to operate within the jurisdiction of Harris County, as it ensures that both the corporation and its directors, officers, and other stakeholders are shielded from certain legal liabilities. Indemnification is a critical aspect of this document, as it serves to protect those involved in the corporation from financial losses and legal expenses that may arise due to legal actions, litigation, or claims made against them during the course of their corporate duties. This provision grants indemnity to the corporation's directors, officers, employees, and agents, shielding them from monetary damages, settlements, and other costs associated with legal disputes. The Harris Texas Articles of Incorporation with Indemnification typically includes language that clearly defines the rights and responsibilities of the corporation, its shareholders, and its governing bodies. The document will outline the purpose of the corporation, the types of activities it will engage in, and the classes and rights of the shares it issues. Additionally, the document may specify the process for holding shareholder meetings, electing directors, and making important corporate decisions. It may also outline the procedures for amending the articles of incorporation, dissolving the corporation, or transferring ownership. There are different types of Harris Texas Articles of Incorporation with Indemnification, each tailored to the specific needs and objectives of different corporations. Some variations may include: 1. Nonprofit Articles of Incorporation with Indemnification: Specifically designed for nonprofit organizations seeking to establish themselves in Harris County, this type of document will incorporate provisions related to the corporation's mission, charitable activities, and compliance with state and federal nonprofit laws. 2. For-Profit Articles of Incorporation with Indemnification: This variant is suitable for profit-oriented corporations setting up operations in Harris County. It includes provisions related to the corporation's capital structure, shareholders' rights, and distribution of profits. 3. Professional Corporation Articles of Incorporation with Indemnification: Professionals like doctors, lawyers, and accountants looking to form a professional corporation in Harris County can utilize this type of document. It encompasses specific provisions that meet the legal requirements for professional corporations, while also providing indemnification safeguards. In conclusion, the Harris Texas Articles of Incorporation with Indemnification is a crucial legal document for corporations operating in Harris County. It outlines the corporation's structure, purpose, and rights, while prioritizing indemnification provisions that protect directors, officers, and other stakeholders from potential legal liabilities. There are various types of articles of incorporation, including nonprofit, for-profit, and professional corporation variants, each customized to suit different types of corporations operating in the region.

Harris Texas Articles of Incorporation with Indemnification

Description

How to fill out Harris Texas Articles Of Incorporation With Indemnification?

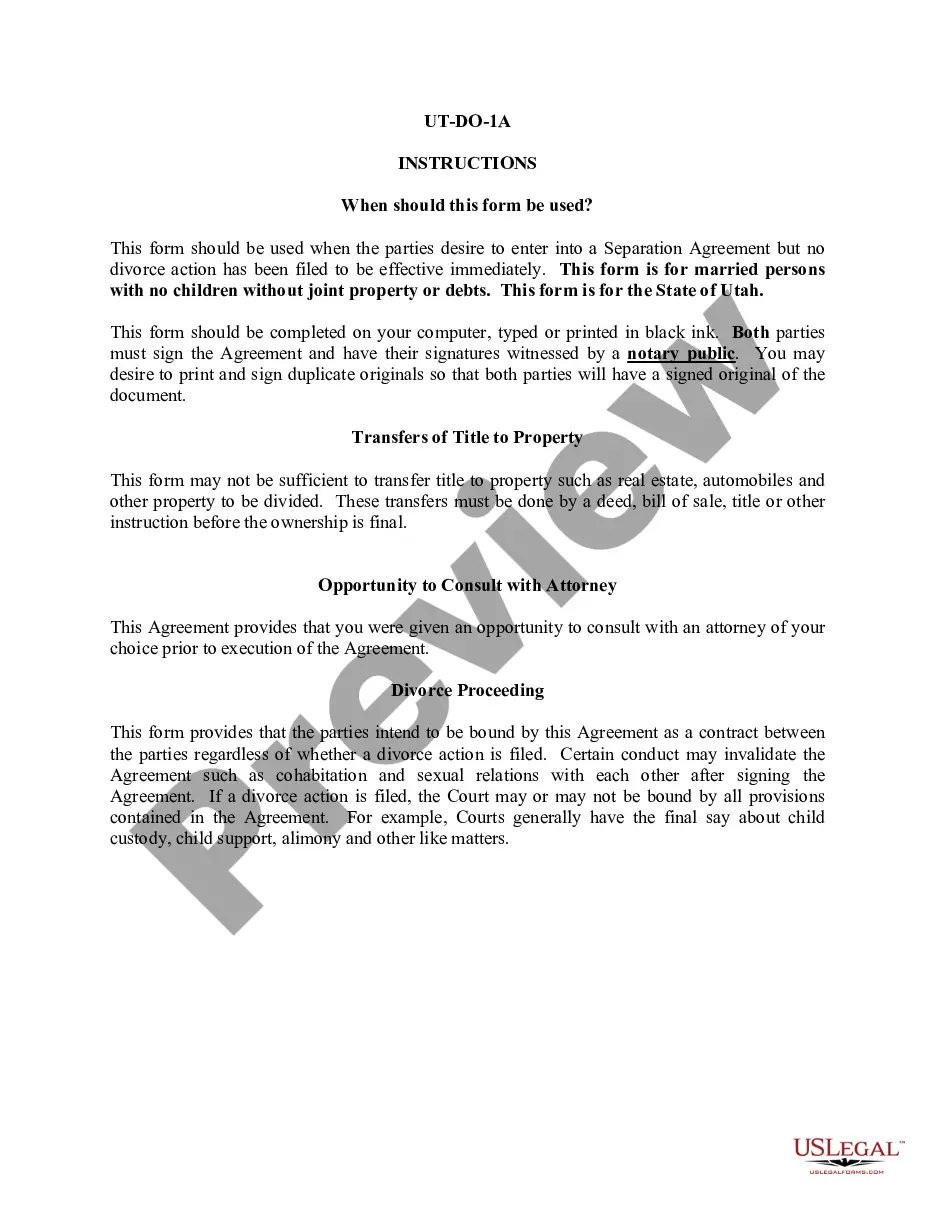

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Harris Articles of Incorporation with Indemnification, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any activities related to document completion straightforward.

Here's how you can locate and download Harris Articles of Incorporation with Indemnification.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the related forms or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and purchase Harris Articles of Incorporation with Indemnification.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Harris Articles of Incorporation with Indemnification, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to deal with an extremely difficult case, we recommend using the services of an attorney to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and get your state-compliant documents with ease!