San Jose California Articles of Incorporation with Indemnification: A Comprehensive Overview The San Jose California Articles of Incorporation with Indemnification serves as a vital legal document that sets out the foundational structure and operations of a corporation in the city of San Jose, California. This detailed description will provide an in-depth understanding of the purpose, contents, and significance of these articles, incorporating relevant keywords for search engine optimization. Keywords: San Jose California, Articles of Incorporation, Indemnification, Legal Document, Corporation, Structure, Operations 1. Introduction to San Jose California Articles of Incorporation: The Articles of Incorporation is a legal filing required by the California Secretary of State's office to officially establish a corporation within the city of San Jose, California. It outlines various essential details about the corporation, such as its purpose, structure, and governance. 2. Purpose and Importance of San Jose California Articles of Incorporation: The primary purpose of the Articles of Incorporation is to provide a formal legal framework for the corporation's creation, intent, and ongoing operations. By incorporating in San Jose, California, businesses can enjoy a range of advantages, such as limited liability protection and potential tax benefits. 3. Key Elements Covered in San Jose California Articles of Incorporation: a. Corporation Name: The chosen name of the corporation, which should comply with the requirements of the California Secretary of State and must be unique. b. Purpose: A clear and concise statement identifying the lawful activities the corporation intends to engage in within San Jose, California. c. Shareholders: Information about the individuals or entities holding shares of the corporation. d. Directors: Identification of the corporation's initial board of directors responsible for overseeing its activities. e. Registered Agent: Designation of an individual or corporation within San Jose, California, for receiving official legal and tax documents on behalf of the corporation. f. Principal Place of Business: The physical address of the corporation's main office or principal place of business within San Jose. g. Indemnification Clause: The provision addressing the corporation's indemnification obligations towards its officers, directors, employees, and agents to protect them from legal liabilities incurred while acting in their official capacities. 4. Types of San Jose California Articles of Incorporation with Indemnification: While there may not be distinct types of Articles of Incorporation specific to San Jose, California, the inclusion of the Indemnification clause can vary. Different options for indemnification include: a. Standard Indemnification Clause: A basic clause stating the corporation's commitment to indemnify its officers, directors, employees, or agents to the maximum extent permitted by California law for any actions taken in the scope of their duties. b. Expanded Indemnification Clause: A more comprehensive clause that provides broader protection, extending indemnification to cover expenses, legal fees, settlements, fines, and damages incurred during legal proceedings. c. Customized Indemnification Clause: Corporations may customize their indemnification clauses to suit their specific needs, subject to compliance with California state laws and regulations. In conclusion, the San Jose California Articles of Incorporation are essential legal documents that play a key role in establishing and governing corporations within the city. By including an indemnification clause, corporations can provide a layer of protection to their officers, directors, and employees. Understanding the purpose and contents of these articles is crucial for any business looking to incorporate in San Jose, California, ensuring their legal compliance and safeguarding their interests.

San Jose California Articles of Incorporation with Indemnification

Description

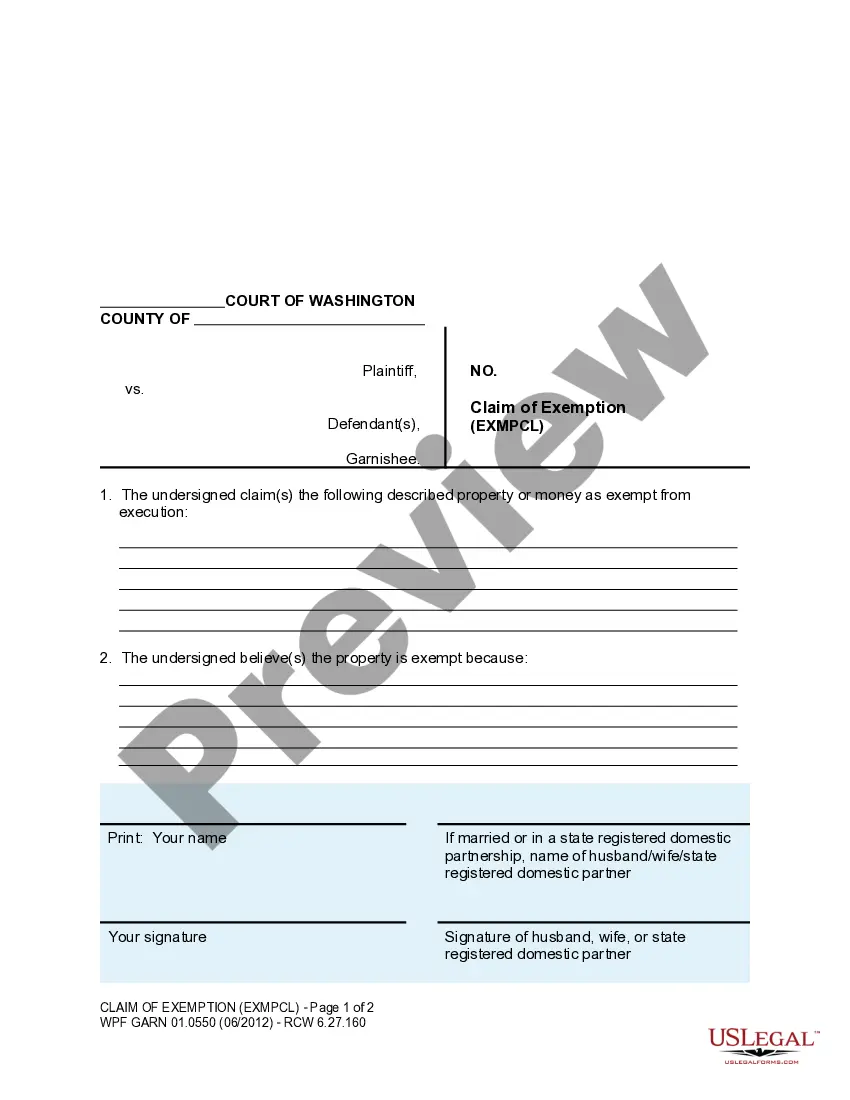

How to fill out San Jose California Articles Of Incorporation With Indemnification?

Draftwing paperwork, like San Jose Articles of Incorporation with Indemnification, to take care of your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for different cases and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the San Jose Articles of Incorporation with Indemnification form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading San Jose Articles of Incorporation with Indemnification:

- Make sure that your form is specific to your state/county since the rules for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the San Jose Articles of Incorporation with Indemnification isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our service and download the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Further, in light of the recent amendments to Section 145, only certain officers are entitled to mandatory indemnification of expenses as a matter of law when they are successful on the merits; an indemnification agreement allows a director or officer to secure such rights in the absence of express statutory coverage.

What does "Corporate Indemnification" mean? Generally, indemnification refers to a situation in which one party (the indemnifying party) agrees or is required to cover the costs, losses and/or expenses experienced by another party (the indemnified party).

A deed of indemnity is a contractual agreement between a company and a company director. A deed of indemnity can help to indemnify a director against liabilities or legal costs incurred in his or her professional capacity as a director of the company.

Therefore, directors can now be indemnified by companies against such liabilities. Thus, for the acts of director before 01.04. 2014, the Company cannot indemnify the director.

Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

Often a company will agree to indemnify its shareholders, members, officers, and directors for actions they take in such roles on behalf of the company. In order to attract new investors in a startup, a common agreement that investors will demand is an indemnification agreement.

Exculpation and indemnification are very similar. Both clauses in a contract seek to remove liability from one party. However, the main difference is that while an exculpatory clause seeks to deny a party the right to recover damages, an indemnification clause attempts to shift liability to another party.

Any UK company can now indemnify any of its directors, and any director of a company in the same group, against damages, costs and interest awarded against him in civil proceedings brought by a third party, and against legal and other costs incurred in defending both civil and criminal proceedings if and when the

Companies may indemnify directors against the legal and financial costs of proceedings brought by third parties. This does not extend to the legal costs of unsuccessful defence of criminal proceedings, fines imposed by criminal proceedings and fines imposed by regulatory bodies.

A director's or officer's right to indemnification and advancement of expenses is subject to the company's ability to pay, and several legal limitations. Bankruptcy Law Limits. Claims against directors and officers more frequently occur when the company is under financial distress that leads to bankruptcy.