Nassau New York Ratification and Approval of Directors and Officers Insurance Indemnity Fund The Nassau New York Ratification and Approval of Directors and Officers Insurance Indemnity Fund is a comprehensive insurance program designed to protect directors and officers (D&O) of organizations from potential liabilities they may face while performing their duties. This insurance indemnity fund provides financial coverage for legal costs, settlements, and judgments that may arise when directors and officers are sued for alleged wrongful acts, such as breach of fiduciary duty, mismanagement, negligence, or errors in judgment. Here are the different types of Nassau New York Ratification and Approval of Directors and Officers Insurance Indemnity Fund with a copy of the agreement: 1. Basic Coverage: This is the standard insurance policy that offers protection to directors and officers against legal claims arising from their official duties. It covers defense costs, settlements, and damages awarded by a court. 2. Side A Coverage: Also known as "Personal Liability Coverage," this type of insurance protects individual directors and officers when the organization is unable or unwilling to provide indemnification. Side A coverage ensures that personal assets are safeguarded in case of a covered claim. 3. Side B Coverage: This coverage reimburses the organization for indemnifying directors and officers in situations where the organization provides indemnification. It helps the organization offset the costs it incurs when it indemnifies its directors and officers. 4. Side C Coverage: Also known as "Entity Coverage," this policy protects the organization itself from damages resulting from wrongful acts committed by its directors and officers. It covers legal costs and damages awarded against the organization. The Nassau New York Ratification and Approval of Directors and Officers Insurance Indemnity Fund agreement includes detailed provisions regarding the coverage, exclusions, limits, and terms of the insurance policy. It outlines the responsibilities and obligations of the insured individuals and the insurance provider. The purpose of this insurance indemnity fund is to ensure that directors and officers can carry out their duties effectively, without the fear of personal financial liability. It provides them with peace of mind and promotes responsible decision-making within organizations. Organizations in Nassau New York are encouraged to consider ratifying and approving these Directors and Officers Insurance Indemnity Fund to mitigate potential risks and protect their valuable assets, directors, and officers. In conclusion, the Nassau New York Ratification and Approval of Directors and Officers Insurance Indemnity Fund is a vital means of safeguarding organizations and their directors and officers from the legal and financial risks associated with their roles. By securing the appropriate types of coverage, organizations can ensure their leadership is well-protected and capable of making sound decisions in pursuit of their goals.

Nassau New York Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

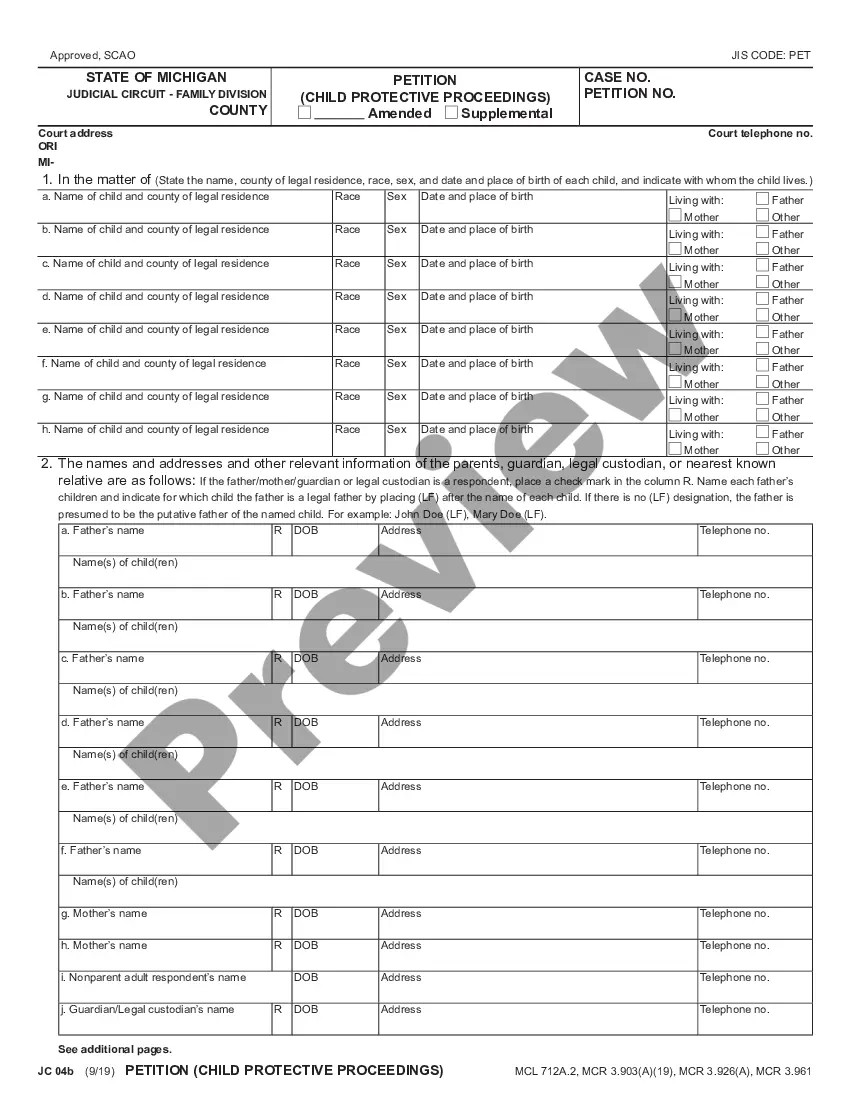

How to fill out Nassau New York Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Nassau Ratification and approval of directors and officers insurance indemnity fund with copy of agreement, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any tasks related to document execution straightforward.

Here's how to purchase and download Nassau Ratification and approval of directors and officers insurance indemnity fund with copy of agreement.

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the legality of some documents.

- Check the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and purchase Nassau Ratification and approval of directors and officers insurance indemnity fund with copy of agreement.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Nassau Ratification and approval of directors and officers insurance indemnity fund with copy of agreement, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you have to deal with an extremely complicated case, we advise getting a lawyer to examine your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!