In Orange California, the ratification and approval of directors and officers insurance indemnity fund is a vital process that aims to protect the interests of individuals serving in key positions within an organization. This fund provides financial security, reimbursing directors and officers for any legal expenses incurred while fulfilling their duties and responsibilities. To ensure transparency and clarity, a copy of the agreement is available to stakeholders. The Orange California Ratification and Approval of Directors and Officers Insurance Indemnity Fund encompasses various types depending on the specific needs of the organization. Here are a few prominent ones: 1. Non-Profit Directors and Officers (D&O) Insurance Fund: Specifically designed for non-profit organizations, this fund safeguards the directors and officers from lawsuits or claims arising from their actions or decisions made on behalf of the organization. It covers legal costs, judgments, and settlements. 2. Corporate Directors and Officers (D&O) Insurance Fund: Tailored for corporations, this type of fund offers protection to directors and officers against claims alleging errors in judgment, breaches of duty, or wrongful acts while conducting business. It ensures their personal assets are safeguarded by covering legal defense costs and settlements. 3. Small Business Directors and Officers (D&O) Insurance Fund: Catering to the unique requirements of small businesses, this fund protects directors and officers from lawsuits related to mismanagement, negligence, or employment practices. It assists in covering legal expenses, compensatory damages, and settlements. 4. Employment Practices Liability Insurance (EPL): Often included within the directors and officers insurance indemnity fund, EPL protects directors and officers from claims related to wrongful termination, discrimination, or harassment in the workplace. It helps cover legal defense costs and settlement fees, reducing potential financial strain on the organization. Regardless of the specific type of Orange California Ratification and Approval of Directors and Officers Insurance Indemnity Fund, the underlying agreement outlines the rights, obligations, and responsibilities of all parties involved. It includes critical clauses such as policy limits, indemnification terms, coverage exclusions, and claims procedures. The agreement ensures that all stakeholders are aware of and have access to the terms governing the fund, promoting transparency and accountability. By ratifying and approving the directors and officers insurance indemnity fund, Orange California organizations can foster a secure environment for their directors and officers while protecting the interests of the organization as a whole.

Orange California Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

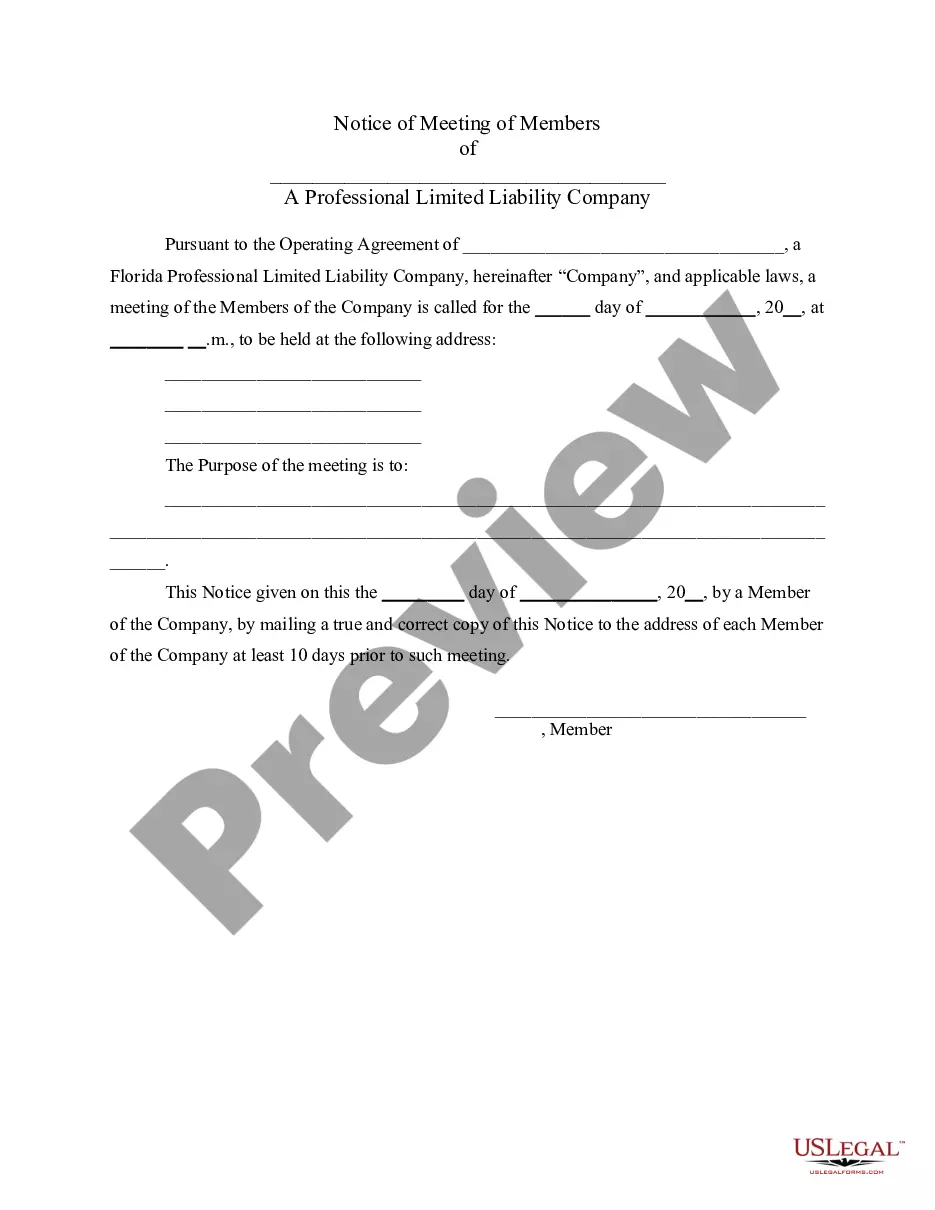

How to fill out Orange California Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

Whether you intend to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Orange Ratification and approval of directors and officers insurance indemnity fund with copy of agreement is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Orange Ratification and approval of directors and officers insurance indemnity fund with copy of agreement. Adhere to the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Orange Ratification and approval of directors and officers insurance indemnity fund with copy of agreement in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

1 : to secure against hurt, loss, or damage. 2 : to compensate or reimburse for incurred hurt, loss, or damage. Other Words from indemnify. indemnifier noun.

An officer's deed of indemnity is a deed signed by a company that is intended to protect you against claims made by third parties.

Definition of indemnity 1a : security against hurt, loss, or damage. b : exemption from incurred penalties or liabilities.

A deed of indemnity is a contractual agreement between a company and a company director. A deed of indemnity can help to indemnify a director against liabilities or legal costs incurred in his or her professional capacity as a director of the company.

An officer's deed of indemnity is a deed signed by a company that is intended to protect you against claims made by third parties.

Indemnity is a comprehensive form of insurance compensation for damages or loss. In this type of arrangement, one party agrees to pay for potential losses or damages caused by another party.

A Deed of Access and Indemnity is a contract between the director and the company, which in simple terms, aims to protect a director from being liable for legal costs or liabilities that may be incurred during their time as director.

Indemnity benefits are monetary payments you may be entitled to receive as compensation for lost wages or damages related to your workers' compensation claim.

Professional indemnity insurance protects you against claims for loss or damage made by clients or third parties as a result of the impact of negligent services you provided or negligent advice you offered. Compensation claims can be brought against you even if you provided a service or offered advice for free.

Side C Cover These securities claims often include allegations of breaches of continuous disclosure obligations, breaches of fiduciary obligations and/or misleading and deceptive conduct and usually are brought in the form of a class action. These claims are normally covered under the Side C Cover.