Phoenix Arizona Ratification and Approval of Directors and Officers Insurance Indemnity Fund In Phoenix, Arizona, the ratification and approval of directors and officers insurance indemnity fund is a crucial aspect of corporate governance for organizations. This insurance indemnity fund provides protection and financial security to directors and officers serving in leadership roles within a company or organization. It safeguards their personal assets and offers coverage for legal defense expenses in case they face lawsuits or claims related to their professional duties. The directors and officers insurance indemnity fund offers a wide range of benefits, ensuring that directors and officers can confidently execute their responsibilities without the fear of personal liability. By subscribing to this fund, executives gain the reassurance of a robust financial safety net. The agreement associated with the Phoenix Arizona Ratification and Approval of Directors and Officers Insurance Indemnity Fund outlines the terms and conditions that govern the indemnification process. It specifies the rights and obligations of both the directors and officers and the organization providing the insurance coverage. There are different types of directors and officers insurance indemnity funds available in Phoenix, Arizona, catering to various industries and organizational structures. Some of these variations include: 1. Non-Profit Directors and Officers Insurance: This type of insurance indemnity fund is tailored specifically for directors and officers serving on boards of non-profit organizations. It offers protection against claims related to mismanagement, breach of duty, or failure to act in good faith. 2. Private Company Directors and Officers Insurance: Private companies face unique risks and challenges. This insurance indemnity fund caters to the needs of directors and officers in the private sector, safeguarding them from claims arising from operational decisions, employment practices, or breaches of fiduciary duty. 3. Public Company Directors and Officers Insurance: Publicly traded companies have their own set of exposures and legal responsibilities. This type of insurance indemnity fund offers comprehensive coverage to directors and officers, protecting them from claims related to securities fraud, insider trading allegations, or non-compliance with regulatory requirements. 4. Financial Institution Directors and Officers Insurance: Financial institutions, such as banks and credit unions, operate in a highly regulated environment. This specialized insurance indemnity fund provides coverage specific to the unique risks faced by directors and officers in the financial sector. It is important for organizations in Phoenix, Arizona, to ratify and approve directors and officers insurance indemnity funds to demonstrate their commitment to protecting their leadership team. By assuring directors and officers that their personal assets are shielded, these funds attract and retain top talent, enhance corporate governance, and promote effective decision-making. By complying with the legal requirements and securing a copy of the agreement associated with the directors and officers insurance indemnity fund, organizations can ensure that their leaders are confident and empowered to carry out their duties, knowing they have the necessary protection and support in place.

Phoenix Arizona Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

How to fill out Phoenix Arizona Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

Preparing papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Phoenix Ratification and approval of directors and officers insurance indemnity fund with copy of agreement without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Phoenix Ratification and approval of directors and officers insurance indemnity fund with copy of agreement on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step guide below to get the Phoenix Ratification and approval of directors and officers insurance indemnity fund with copy of agreement:

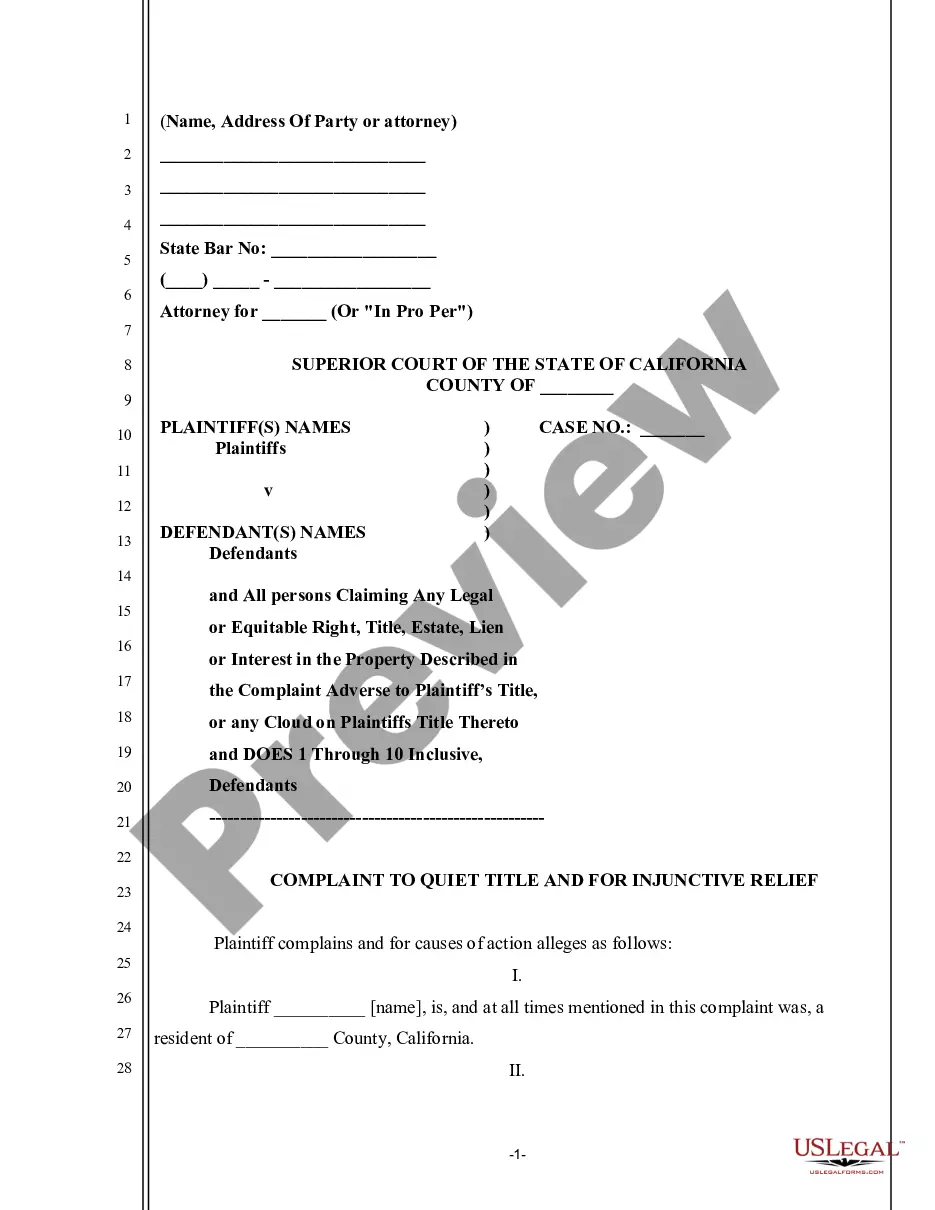

- Look through the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!