A Cook Illinois Indemnity Agreement is a legal contract that outlines the obligations and rights of a corporation towards its directors and officers, granting them protection and financial security in the event of any legal actions or liabilities arising from their roles within the organization. This agreement acts as a form of insurance for directors and officers, safeguarding their personal assets from potential lawsuits and litigation costs. The Cook Illinois Indemnity Agreement offers comprehensive coverage for directors and officers, shielding them from legal liability, expenses, and damages incurred while performing their duties. It covers a range of scenarios, including breaches of fiduciary duties, negligence claims, conflicts of interest, and other legal conflicts arising from their official roles. Different types of Cook Illinois Indemnity Agreements may exist, tailored to specific circumstances or industries. Some common variations include: 1. General Indemnification Agreement: This is a broad agreement that offers protection to directors and officers against a wide range of legal actions and liabilities related to their official roles within the corporation. 2. Limited Indemnification Agreement: In certain cases, corporations may choose to limit the extent of indemnification provided to directors and officers. This type of agreement specifies the scope and limitations of protections offered, narrowing the range of covered liabilities. 3. Corporate Expenses Indemnification Agreement: This agreement focuses specifically on reimbursing the directors and officers for expenses incurred during legal proceedings, such as attorney fees, court costs, and other related costs. 4. Advancement of Expenses Agreement: This agreement allows the corporation to provide immediate financial support to directors and officers to cover legal expenses while a legal action is pending. It ensures that individuals do not have to bear the financial burden of defending themselves during legal proceedings. Regardless of the specific type of Cook Illinois Indemnity Agreement, the primary goal is to provide directors and officers with peace of mind, enabling them to fulfill their duties without fear of personal financial repercussions. It encourages capable individuals to assume leadership positions within corporations, ensuring that competent and experienced professionals are willing to undertake the responsibilities associated with such roles. Overall, a Cook Illinois Indemnity Agreement reinforces the relationship between the corporation and its directors and officers, establishing a mutually beneficial arrangement where both parties are protected. By offering indemnification, the corporation demonstrates its commitment to supporting its leadership team and promoting a culture of trust and accountability.

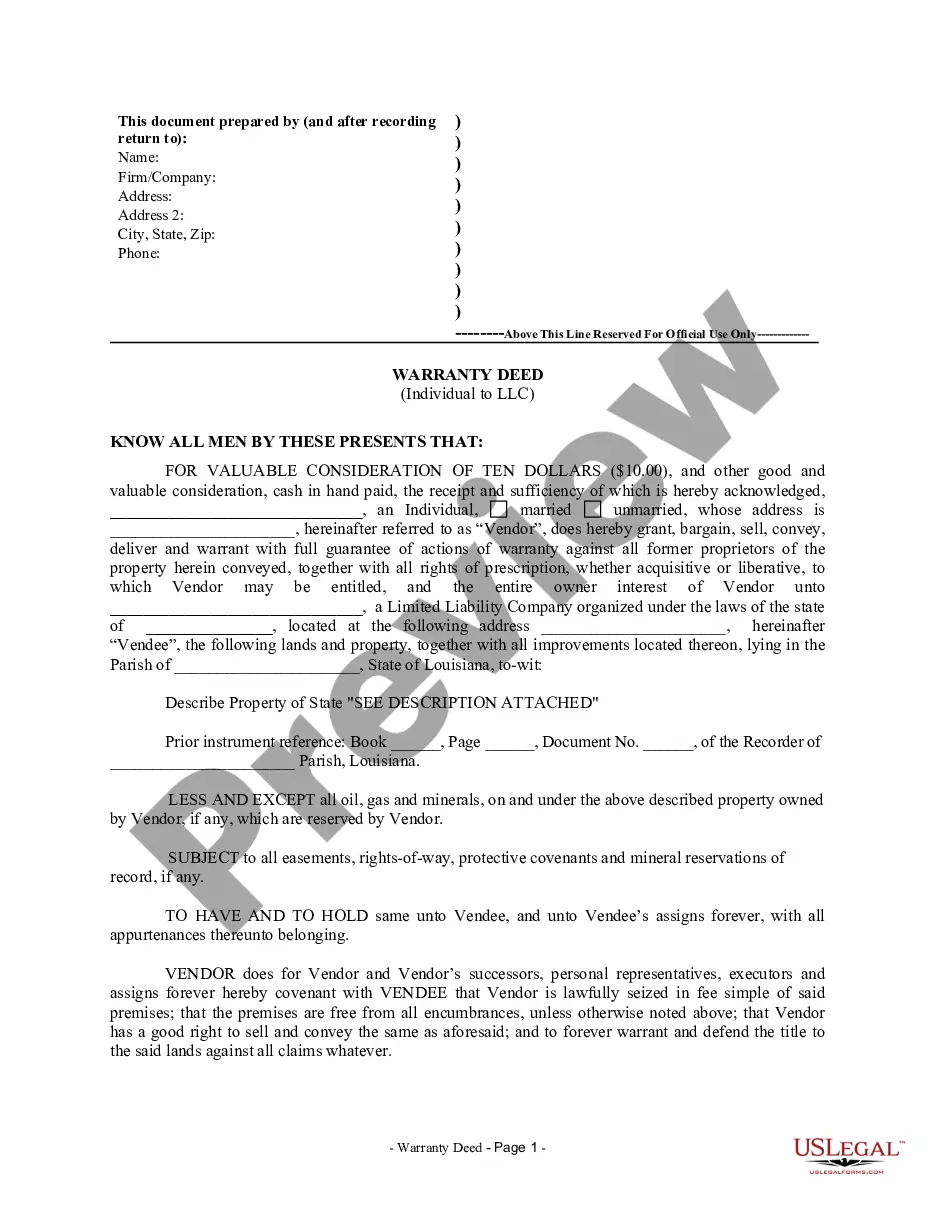

Cook Illinois Indemnity Agreement between corporation and directors and / or officers

Description

How to fill out Cook Illinois Indemnity Agreement Between Corporation And Directors And / Or Officers?

If you need to get a reliable legal form supplier to find the Cook Indemnity Agreement between corporation and directors and / or officers, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support make it simple to locate and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to search or browse Cook Indemnity Agreement between corporation and directors and / or officers, either by a keyword or by the state/county the form is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Cook Indemnity Agreement between corporation and directors and / or officers template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less costly and more affordable. Create your first business, arrange your advance care planning, draft a real estate agreement, or complete the Cook Indemnity Agreement between corporation and directors and / or officers - all from the comfort of your sofa.

Join US Legal Forms now!