Harris Texas Indemnity Agreement refers to a legally binding contract that establishes the terms and conditions under which a corporation indemnifies its directors and/or officers in the state of Texas. This agreement is designed to protect directors and officers from potential liabilities that may arise in the course of their duties while working for the corporation. The agreement outlines the corporation's commitment to cover legal costs, damages, and other expenses incurred as a result of lawsuits or claims filed against the directors and/or officers. There are various types of Harris Texas Indemnity Agreements, each catering to specific circumstances and needs. These types of agreements may include: 1. General Indemnity Agreement: This is the most common type of agreement that offers broad indemnification protection to directors and officers. It covers a wide range of liabilities, including legal fees, settlements, judgments, and other related expenses. 2. Advancement of Expenses Agreement: This type of agreement allows the corporation to provide immediate financial assistance to directors and officers for legal expenses and liabilities before the final resolution of a lawsuit or claim. It ensures that directors and officers do not face financial burdens during legal proceedings. 3. Indemnity Agreement with Limitations: Some agreements may include certain restrictions or limitations on the extent of indemnification. These limitations could be based on specific scenarios, such as cases where the director or officer acted in bad faith or engaged in intentional misconduct. 4. Indemnity Agreement for Specific Roles or Circumstances: These agreements may be tailored to cater to specific positions or circumstances within the corporation. For example, there might be separate agreements for executive officers, board members, or individuals serving in risky roles or industries. 5. Indemnity Agreement for Non-Profit Corporations: Non-profit organizations often have their own unique indemnity agreement types that align with their specific legal requirements and regulations. It is crucial for both the corporation and directors/officers to carefully review and negotiate the terms and conditions outlined in the Harris Texas Indemnity Agreement. Legal counsel is highly recommended ensuring that the agreement adequately addresses the potential risks and liabilities faced by the directors and officers while aligning with the corporation's best interests.

Harris Texas Indemnity Agreement between corporation and directors and / or officers

Description

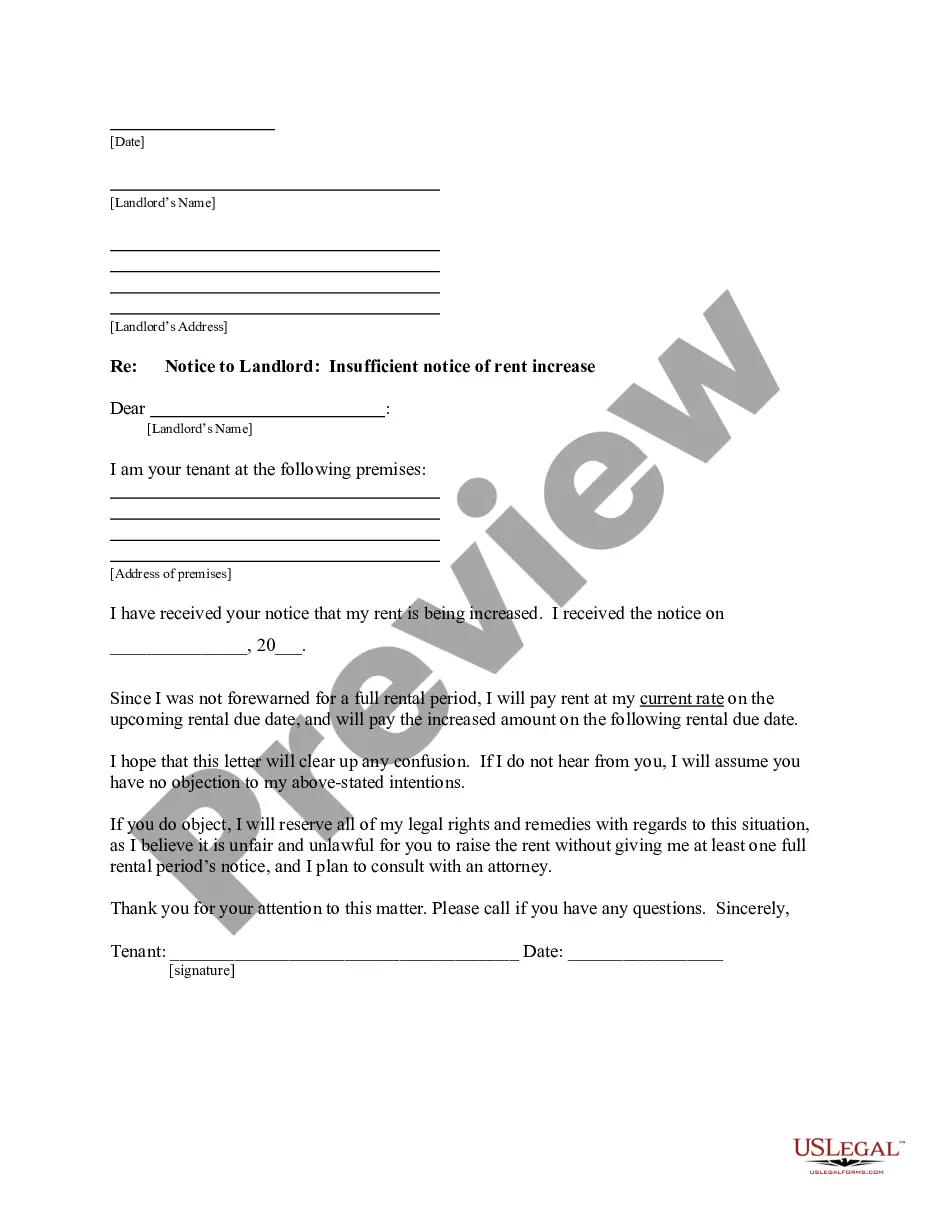

How to fill out Harris Texas Indemnity Agreement Between Corporation And Directors And / Or Officers?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Harris Indemnity Agreement between corporation and directors and / or officers, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the latest version of the Harris Indemnity Agreement between corporation and directors and / or officers, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Indemnity Agreement between corporation and directors and / or officers:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Harris Indemnity Agreement between corporation and directors and / or officers and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Key Takeaways. Indemnity is a comprehensive form of insurance compensation for damages or loss. In this type of arrangement, one party agrees to pay for potential losses or damages caused by another party.

Indemnity is a comprehensive form of insurance compensation for damages or loss. In this type of arrangement, one party agrees to pay for potential losses or damages caused by another party.

An indemnity agreement is a contract that 'holds a business or company harmless' for any burden, loss, or damage. An indemnity agreement also ensures proper compensation is available for such loss or damage.

By statute, Delaware has established a minimum standard of conduct that, if met by a director or officer, permits a corporation to indemnify such director or officer pursuant to a charter or bylaw provision, an indemnification agreement with such D&O, or a resolution of the board or stockholders.

To indemnify another party is to compensate that party for losses that that party has incurred or will incur as related to a specified incident.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Further, in light of the recent amendments to Section 145, only certain officers are entitled to mandatory indemnification of expenses as a matter of law when they are successful on the merits; an indemnification agreement allows a director or officer to secure such rights in the absence of express statutory coverage.

Indemnification. Indemnification is an undertaking by the company to defend the director and officer against the cost of certain claims, including legal fees, litigation awards and settlement costs.

There are three levels of indemnification broad, intermediate and limited form: Broad Form Indemnity.Intermediate Form Indemnity.Limited Form Indemnity.Validity of Indemnity Provisions.State-by-State Case.Operations in Multiple States.Insurance Considerations.

In a mutual indemnification, both parties agree to compensate the other party for losses arising out of the agreement to the extent those losses are caused by the indemnifying party's breach of the contract. In a one-way indemnification, only one party provides this indemnity in favor of the other party.