Harris Texas Trust Agreement between Insituform Southeast Corp. and Trustee is a legally binding contract that outlines the obligations and responsibilities of the parties involved in a trust arrangement. This agreement establishes a legal framework for the management, protection, and distribution of assets held in trust by Insituform Southeast Corp. as the granter and the appointed trustee. The primary purpose of the Harris Texas Trust Agreement is to ensure that the trust assets are held, maintained, and distributed in accordance with the intentions of the granter. This agreement typically contains various clauses and provisions, detailing the scope of the trustee's authority and limitations, the rights and responsibilities of the granter, and the conditions under which the trust assets may be accessed or transferred. One key aspect of the Harris Texas Trust Agreement is the identification and classification of trust assets. These assets can include real estate properties, financial investments, personal possessions, or any other form of valuable property. By clearly defining the assets held in trust, the agreement enables the trustee to effectively manage and substantiate the assets' existence and value. Furthermore, the agreement will outline the trustee's duties and obligations concerning the trust administration. This includes the trustee's responsibility to prudently invest and manage the trust assets, keep accurate records, provide regular accounting to the granter and beneficiaries, and act in the best interests of the trust and its beneficiaries. Under the Harris Texas Trust Agreement, specific terms and conditions for trust termination, modification, or amendment may also be established. These provisions allow for flexibility in adapting the trust to changing circumstances, ensuring the granter's intentions are upheld. Different types of Harris Texas Trust Agreement between Insituform Southeast Corp. and Trustee may include: 1. Revocable Living Trust Agreement: This type of trust agreement allows the granter to maintain control over the trust assets during their lifetime and modify or revoke the trust at will. 2. Irrevocable Trust Agreement: In contrast to the revocable trust, the irrevocable trust agreement cannot be modified or revoked without the consent of all parties involved. This type of trust may offer certain tax benefits or asset protection advantages. 3. Testamentary Trust Agreement: This type of trust agreement is established through a will and takes effect upon the granter's death. It enables the granter to designate how their assets will be managed and distributed after their passing. 4. Special Needs Trust Agreement: This agreement aims to provide financial support and asset management for individuals with special needs, ensuring that their eligibility for government benefits remains preserved. Overall, the Harris Texas Trust Agreement between Insituform Southeast Corp. and Trustee serves as a legally binding contract that safeguards and guides the administration of trust assets. It establishes clear guidelines for the trust's management, protection, and distribution, ensuring that the granter's intentions are respected and that the beneficiaries receive their designated benefits.

Harris Texas Trust Agreement between Insituform Southeast Corp. and Trustee

Description

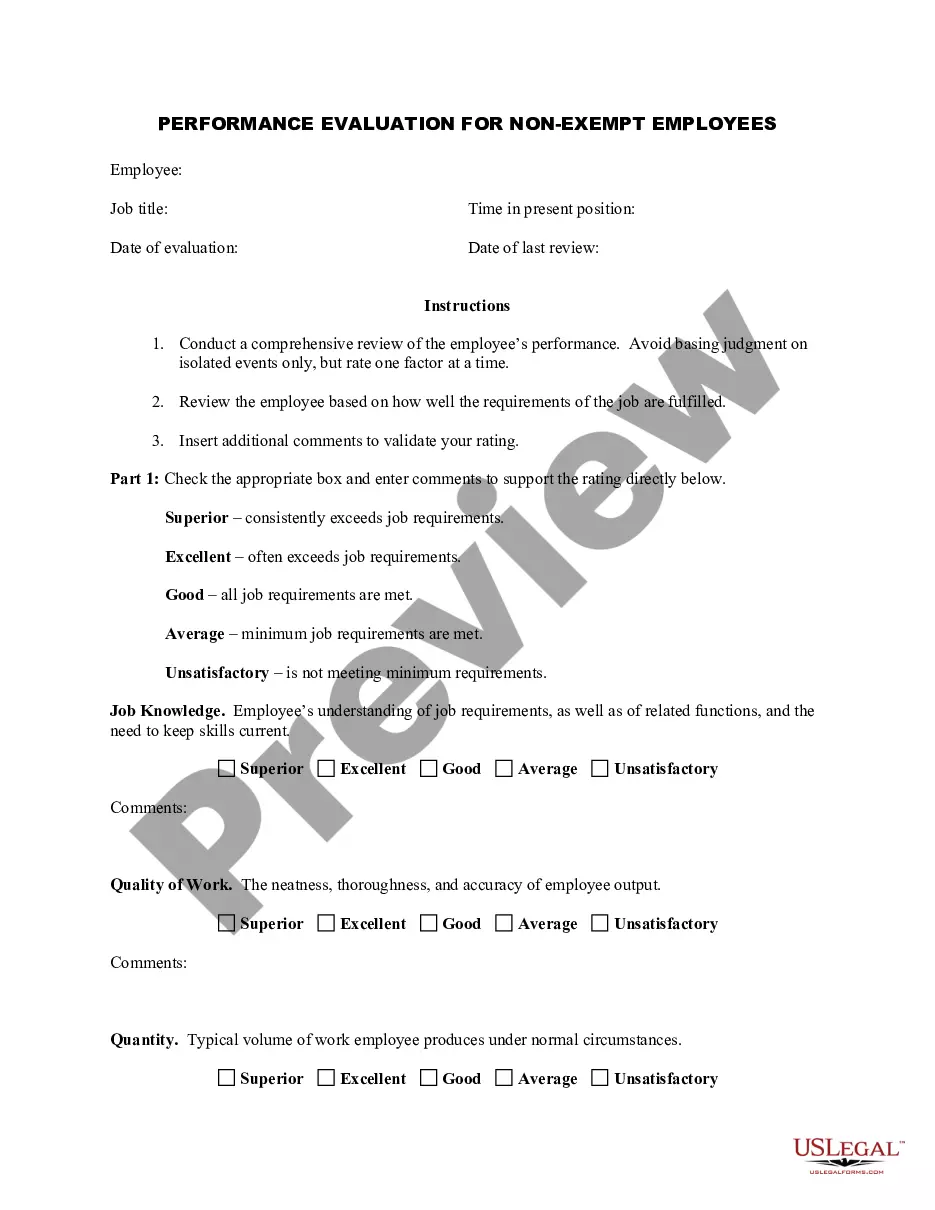

How to fill out Harris Texas Trust Agreement Between Insituform Southeast Corp. And Trustee?

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like Harris Trust Agreement between Insituform Southeast Corp. and Trustee is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Harris Trust Agreement between Insituform Southeast Corp. and Trustee. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Trust Agreement between Insituform Southeast Corp. and Trustee in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!