The Kings New York Trust Agreement is a legally binding document that outlines the responsibilities, obligations, and rights of both Insituform Southeast Corp. and the Trustee. This agreement is crucial for ensuring the proper management and protection of assets held in trust for the benefit of the beneficiaries. With a focus on transparency and compliance, the Kings New York Trust Agreement provides a comprehensive framework for the relationship between Insituform Southeast Corp. and the Trustee. Under the Kings New York Trust Agreement, Insituform Southeast Corp. transfers certain assets to the Trustee to hold and manage. The Trustee, who can be an individual or a corporate entity with experience in trust administration, is responsible for administering these assets in accordance with the terms and conditions outlined in the agreement. Their primary duty is to act prudently and diligently in managing the trust assets for the ultimate benefit of the beneficiaries. The agreement outlines the specific terms that govern the operation of the trust. It covers areas such as the investment powers of the Trustee, the distribution of income and principal, and the duration of the trust. The Kings New York Trust Agreement also addresses important considerations like the appointment of successor Trustees and the removal of Trustees in case of incapacity or breach of duties. The agreement may have different variations based on the specific objectives and requirements of Insituform Southeast Corp. For instance, there could be a revocable trust agreement, allowing Insituform Southeast Corp. to revoke, modify, or terminate the trust at any given time. Conversely, an irrevocable trust agreement would bind Insituform Southeast Corp., preventing any modifications or revocation without the consent of the beneficiaries and the Trustee. Each type serves different purposes and offers varying levels of flexibility. The Kings New York Trust Agreement includes vital keywords that help summarize its key provisions and differentiate it from other trust agreements. Some relevant keywords include "trustee responsibilities," "asset management," "beneficiaries' rights," "successor trustee," "trust distribution," "trust duration," "investment powers," "revocable trust agreement," and "irrevocable trust agreement." To ensure the smooth execution of the Kings New York Trust Agreement, it is crucial for Insituform Southeast Corp. and the Trustee to carefully review and understand all its terms and conditions. Seeking legal advice is highly recommended ensuring compliance with relevant laws and regulations, as well as to tailor the agreement to meet the specific needs and objectives of all parties involved.

Kings New York Trust Agreement between Insituform Southeast Corp. and Trustee

Description

How to fill out Kings New York Trust Agreement Between Insituform Southeast Corp. And Trustee?

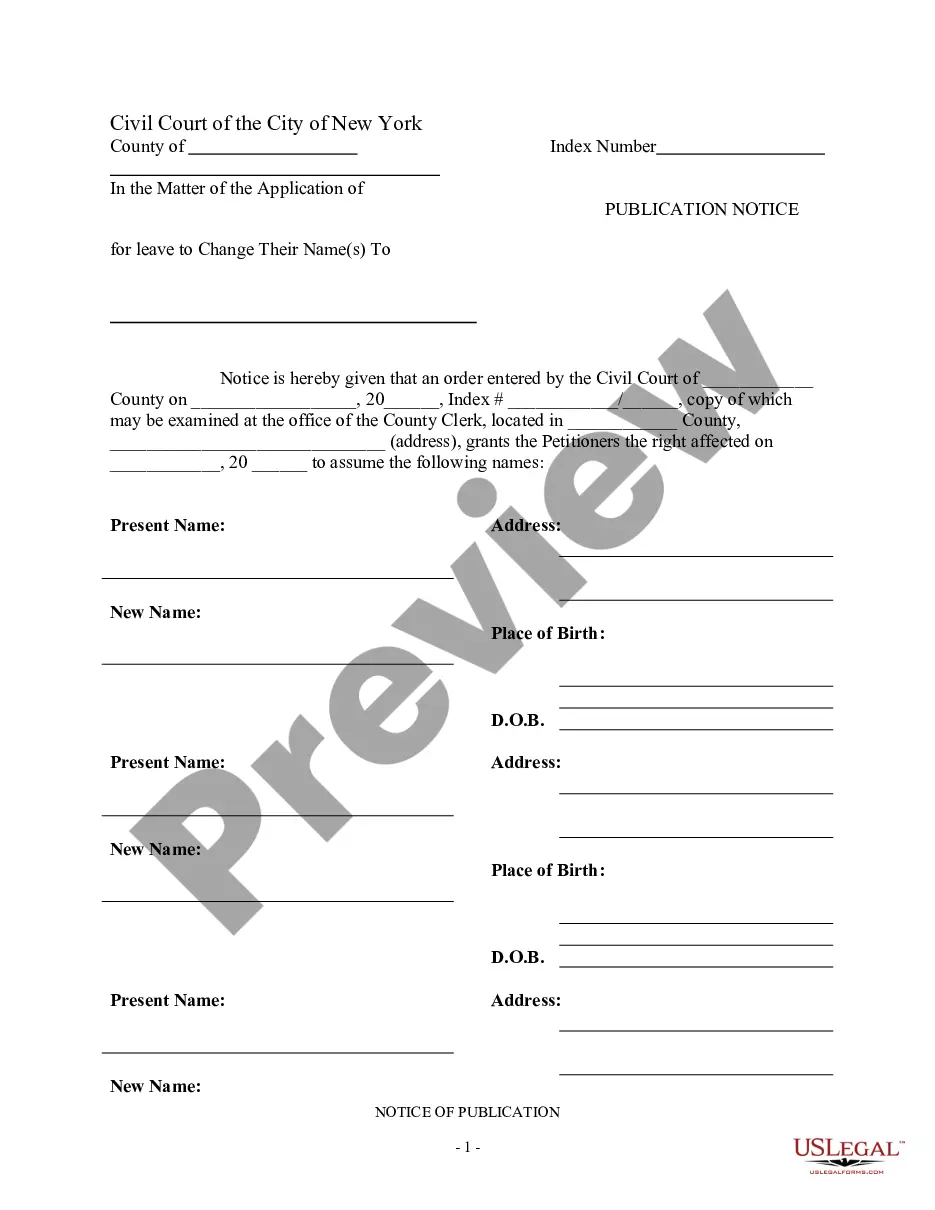

Are you looking to quickly draft a legally-binding Kings Trust Agreement between Insituform Southeast Corp. and Trustee or maybe any other form to take control of your own or business matters? You can go with two options: contact a professional to write a legal paper for you or create it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you get professionally written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific form templates, including Kings Trust Agreement between Insituform Southeast Corp. and Trustee and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, double-check if the Kings Trust Agreement between Insituform Southeast Corp. and Trustee is tailored to your state's or county's laws.

- If the document has a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Kings Trust Agreement between Insituform Southeast Corp. and Trustee template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the templates we offer are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

When it comes time to remove assets from a trust and deliver them to the beneficiary, this is commonly defined as a trust disbursement. Depending upon the specific type of trust used and the nature of the disbursement, the beneficiary may be exposed to some form of trust tax.

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in many ways and can specify exactly how and when the assets pass to the beneficiaries.

To distribute real estate held by a trust to a beneficiary, the trustee will have to obtain a document known as a grant deed, which, if executed correctly and in accordance with state laws, transfers the title of the property from the trustee to the designated beneficiaries, who will become the new owners of the asset.

A trustee is personally liable for a breach of his or her fiduciary duties. The trustee's fiduciary duties include a duty of loyalty, a duty of prudence, and subsidiary duties. The duty of loyalty requires that the trustee administer the trust solely in the interest of the beneficiaries.

Some trusts require trustees to make mandatory distributions. These distributions might take place every month or every year. Often, a trust requires distribution of a percentage of the interest earned on trust assets during the year. Or the trust might list a specific amount of money or property to be distributed.

A trust distribution is a payment or other distribution of trust assets made by a trustee to one or more trust beneficiary. Under California Probate Code §16000, trustees have a duty to administer the trust according to the trust instrument, which includes following the asset distributions outlined in the document.

1. Trustee- An individual or member of a board who is given control or administration powers over a property in a trust. They are legally obliged to administer that property solely for the purposes it was specified for.

A trust is a legal vehicle that allows a third party, a trustee, to hold and direct assets in a trust fund on behalf of a beneficiary. A trust greatly expands your options when it comes to managing your assets, whether you're trying to shield your wealth from taxes or pass it on to your children.

The Trust Distribution Agreement It is another form of communication identifying who is the trustee (if it's a single trustee) or identifying who is doing what (co-trustees). The agreement outlines the assets, the provisions of the trust, where assets are going, and asks for consent from the beneficiary.

The main purpose of a trust is to transfer assets from one person to another. Trusts can hold different kinds of assets. Investment accounts, houses and cars are examples. One advantage of a trust is that it usually avoids having your assets (and your heirs) go through probate when you die.

Interesting Questions

More info

“That's how it's always been, but it's now just the case. Just the case that we work closely, and the fact that we do things so differently in the future, that it becomes kind of like our other jobs all the over the world. And we can use that to kind of push our jobs forward.” General Contractors- Nonresidential, Location Out- side Avondale, 1820, East, Deer Valley Road, Suite 800. PHOENIX, AZ. 95004., AGRICOLA, INC. COMPUTER PROGRAMS, INC-NON-RESIDENTIAL BLDG P.O. BOX 2628, ARIZONA, 89. COMPUBUZZ -NON-RESIDENTIAL BLDG, LOCATION IN THE COUNTY, PHOENIX, AZ, 85. MONEY OR THE CURE? — NON-RESIDENTIAL BLDG NEAR TENTH AND TENTH EAVE AND THE COUNTY LINE, PHOENIX, AZ 85025. NATIONAL BANK OF COMMERCE — NON-RESIDENTIAL BLDG, PHOENIX, AZ, 85025. LUXURIOUS E-COMPANY-NON-RESIDENTIAL BLDG, PHOENIX, AZ, 85025. NATIONAL BANK OF COMMERCE — RENEWABLE ENERGY, INC. — NON-RESIDENTIAL BLDG, PLACE- HONOR LOCKHEED, PHOENIX, AZ, 85025. NATIONAL BANK OF COMMERCE — TAKER, RENEWABLE ENERGY, INC.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.