In Chicago, Illinois, an indemnification agreement is a legally binding contract between a corporation and its directors that aims to provide protection and financial security to the directors in the event of any legal actions or claims against them arising from their duties and responsibilities. The Chicago Illinois Indemnification Agreement is designed to safeguard the interests of both the corporation and its directors. It serves as a means to attract and retain talented individuals for directorial roles, as it assures them protection and minimizes any personal financial risks associated with their service. These agreements typically outline various scenarios where the corporation will indemnify its directors. This may include instances such as legal proceedings, investigations, or claims arising from alleged breach of fiduciary duties, negligence, or other acts or omissions committed in their capacity as directors. There are different types of indemnification agreements that may be used in Chicago, Illinois, depending on the level of protection and specific terms agreed upon between the corporation and its directors. Some notable types include: 1. Standard Indemnification Agreement: This is the most common type and provides broad indemnification coverage for directors, subject to certain limitations and conditions specified in the agreement. 2. Enhanced Indemnification Agreement: This type of agreement offers expanded protections and coverage, often including additional provisions such as advancement of litigation expenses, coverage for settlement payments, or coverage for derivative actions. 3. Indemnification Agreement with Duty to Defend: This agreement places the responsibility on the corporation to not only indemnify but also actively defend the directors in legal actions or claims brought against them. This ensures that the corporation takes an active role in protecting their directors' interests. 4. Indemnification Agreement with Third-Party Insurance: In some cases, corporations may opt to procure specific insurance policies, known as Directors and Officers (D&O) insurance, to provide additional layers of protection for their directors. This agreement would outline the corporation's commitment to maintaining such insurance and ensuring its directors' coverage. It is crucial for both the corporation and its directors to thoroughly understand the specifics of the chosen indemnification agreement, including the extent of coverage, any limitations or exclusions, the process for making indemnification claims, and any disputes resolution mechanisms outlined in the agreement. In conclusion, the Chicago Illinois Indemnification Agreement between a corporation and its current and future directors is a vital legal instrument that offers protection, financial security, and peace of mind to directors while serving in their roles. These agreements vary in scope and provisions, aiming to strike a balance between the interests of the corporation and its directors.

Chicago Illinois Indemnification Agreement between corporation and its current and future directors

Description

How to fill out Chicago Illinois Indemnification Agreement Between Corporation And Its Current And Future Directors?

Preparing papers for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Chicago Indemnification Agreement between corporation and its current and future directors without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Chicago Indemnification Agreement between corporation and its current and future directors by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Chicago Indemnification Agreement between corporation and its current and future directors:

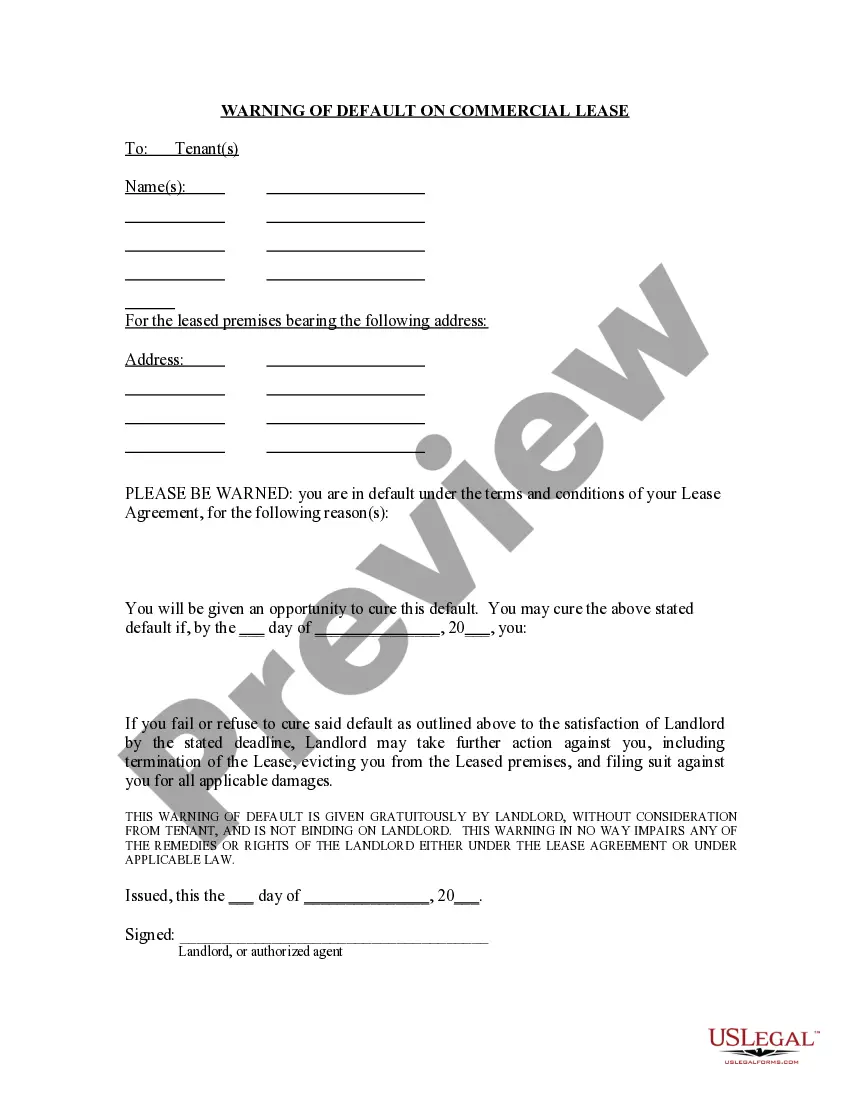

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

Companies can now indemnify directors against the costs of defending: criminal proceedings (subject to them not being convicted). If the director is convicted then any defence costs must be repaid to the company.

In a criminal matter, it is strictly personal liability of the director or officer. However, nothing prohibits the company from giving the director or officer any form of indemnification.

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

Put simply, indemnity is a contractual agreement between two parties, where one party agrees to pay for potential losses or damages claimed by a third party.

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.?

Any UK company can now indemnify any of its directors, and any director of a company in the same group, against damages, costs and interest awarded against him in civil proceedings brought by a third party, and against legal and other costs incurred in defending both civil and criminal proceedings if and when the

You should look to limit indemnification clauses by narrowing their scope, putting in caps on damages, and clearly defining the indemnifiable acts (i.e. the representations and warranties in the example above). Also consider purchasing insurance as a means to limit your financial risk.

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.?

An indemnification agreement obligates the corporation to indemnify the director or officer to the fullest extent permitted by the CBCA and the law, and to advance defence costs when they are required.