Nassau New York Indemnification Agreement is a legal contract designed to protect directors of a corporation from personal liability that may arise from their actions or decisions made in their capacity as board members. This agreement assures directors that they will be indemnified by the corporation, meaning that the company will cover any legal expenses, damages, or liabilities they may incur while carrying out their duties. This indemnification agreement is crucial for attracting and retaining qualified directors, as it provides a sense of security and peace of mind. Directors can perform their duties without fearing personal financial loss or facing unjustified legal battles. The Nassau New York Indemnification Agreement typically consists of several key provisions to safeguard directors' interests: 1. Indemnification Scope: This clause outlines the extent of indemnification available to directors. It covers legal fees, expenses, judgments, fines, and settlements arising from any claims, investigations, or proceedings, whether civil, criminal, administrative, or regulatory. 2. Advancement of Expenses: This provision enables directors to request the corporation to pay their legal fees and other expenses related to legal proceedings upfront, prior to the final outcome of the case. 3. Standard of Conduct: This section establishes the duties and responsibilities of directors, emphasizing their obligation to act in good faith, with loyalty, and in the best interests of the corporation. 4. Limitations and Exceptions: The agreement may include specific provisions that limit indemnification in certain circumstances, such as instances of intentional misconduct or violation of law. 5. Insurance: The corporation may agree to maintain insurance coverage to protect directors against certain risks and liabilities. Different types of Nassau New York Indemnification Agreements may vary in their level of coverage and specific terms. Some variations include: 1. Basic Indemnification Agreement: This is the most standard form of the agreement, providing broad indemnification to directors for their activities within the company. 2. Expanded Indemnification Agreement: In some cases, corporations may offer enhanced indemnification protection to directors, extending coverage to include claims related to mergers, acquisitions, and other significant corporate transactions. 3. Advance Payment Indemnification Agreement: This type of agreement allows directors to request the corporation to cover legal expenses before the conclusion of legal proceedings, facilitating their ability to defend against claims promptly. The Nassau New York Indemnification Agreement ensures that directors can perform their roles effectively without fear of personal financial repercussions. It serves as a formal commitment from the corporation to protect its directors in recognition of their essential contributions and potential exposure to legal risks.

Nassau New York Indemnification Agreement between corporation and its current and future directors

Description

How to fill out Nassau New York Indemnification Agreement Between Corporation And Its Current And Future Directors?

Preparing documents for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Nassau Indemnification Agreement between corporation and its current and future directors without professional assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Nassau Indemnification Agreement between corporation and its current and future directors by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Nassau Indemnification Agreement between corporation and its current and future directors:

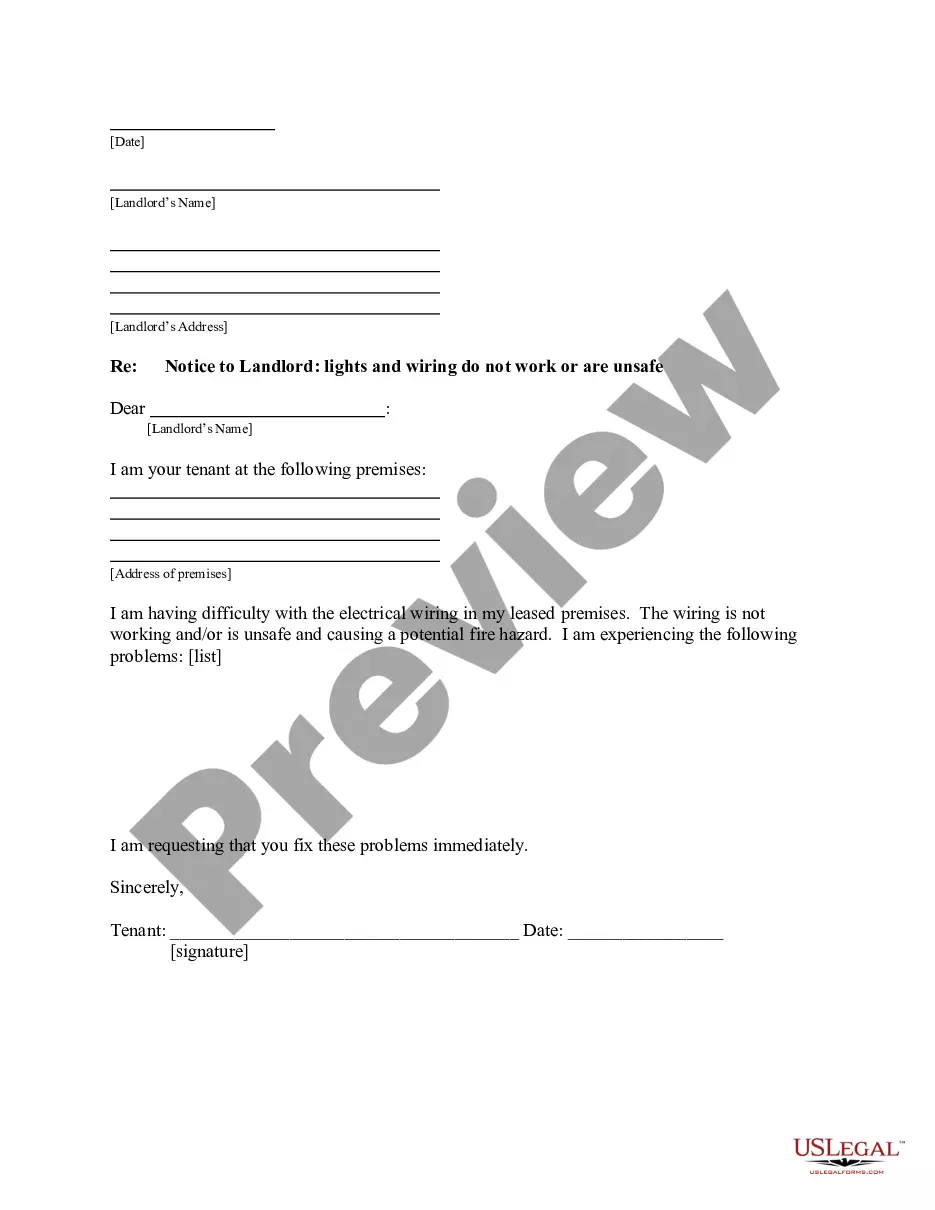

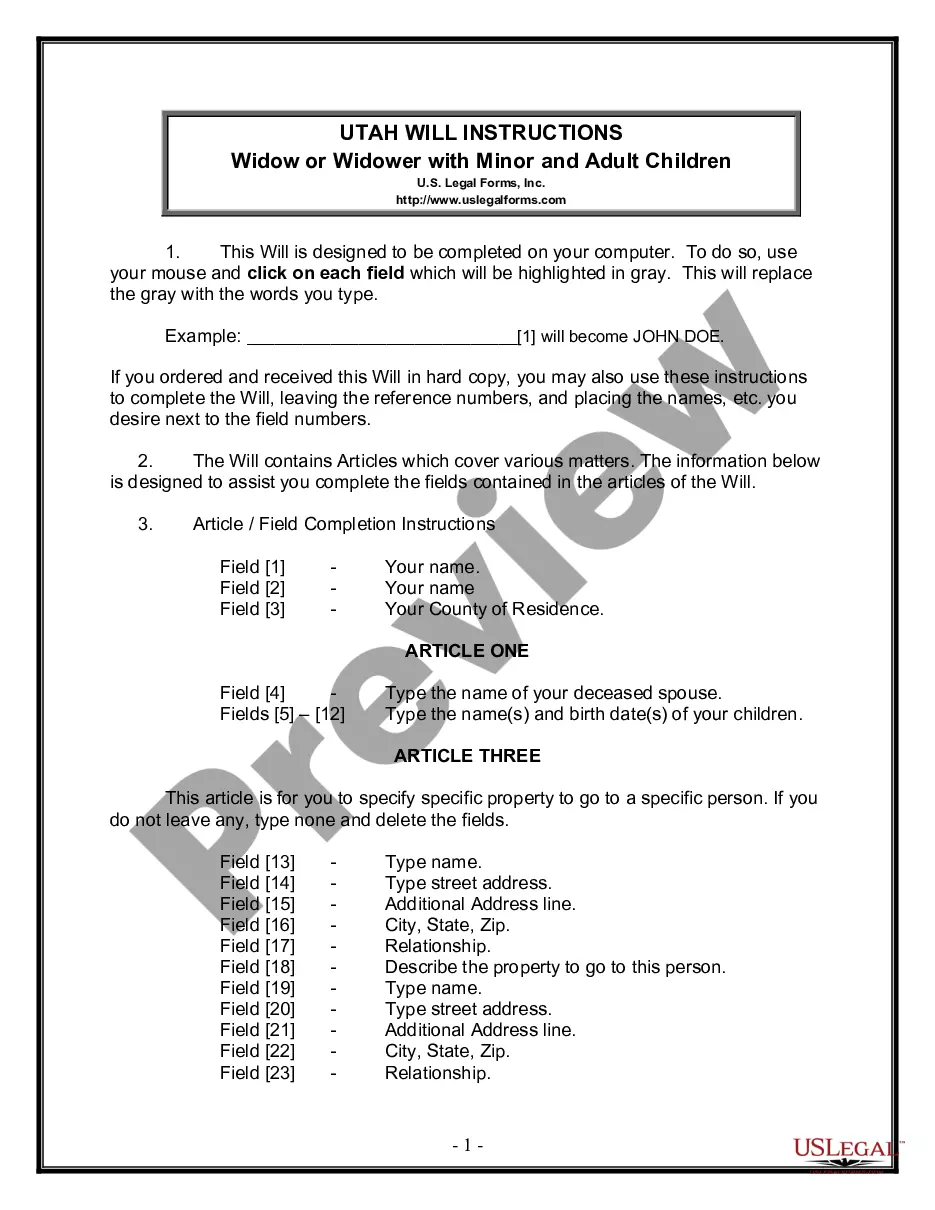

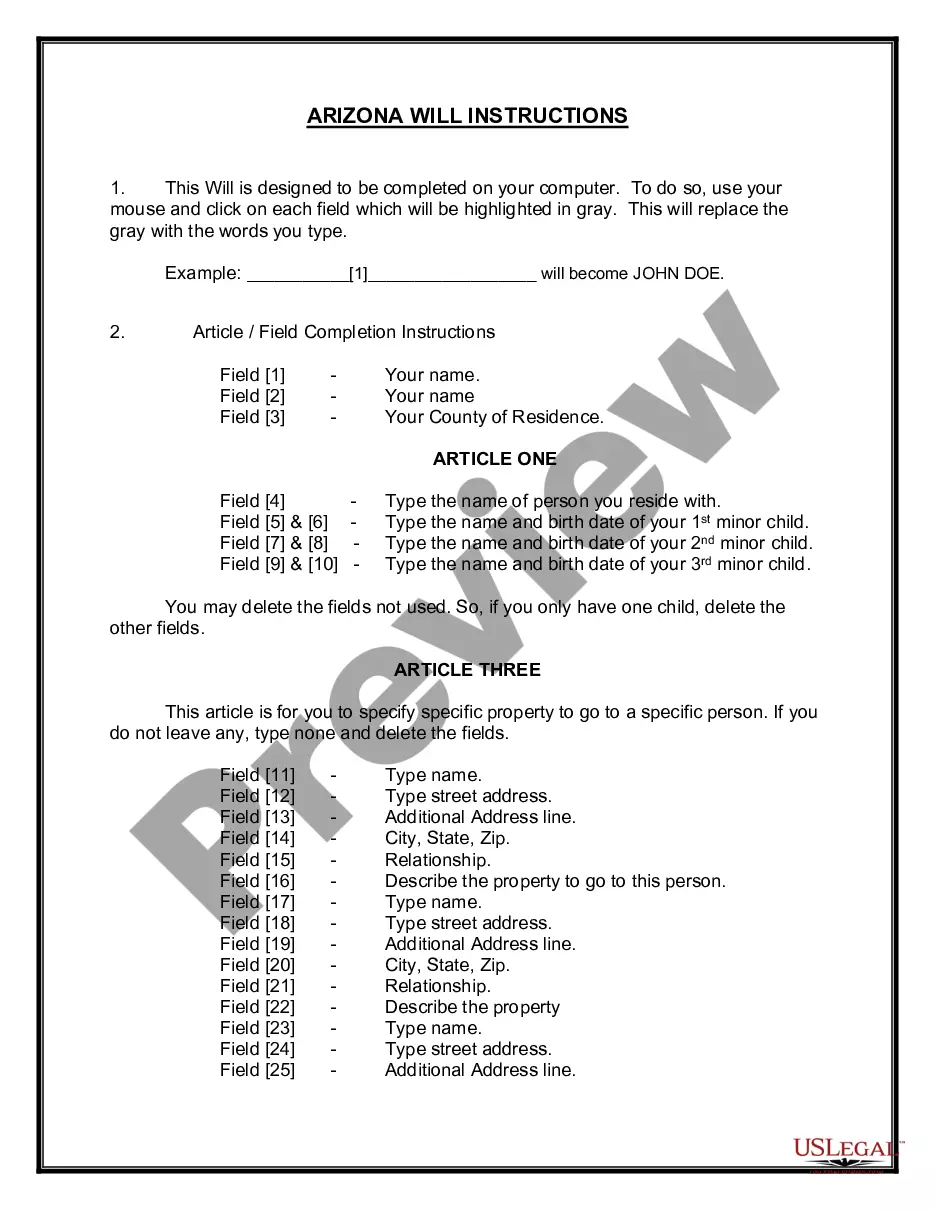

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!