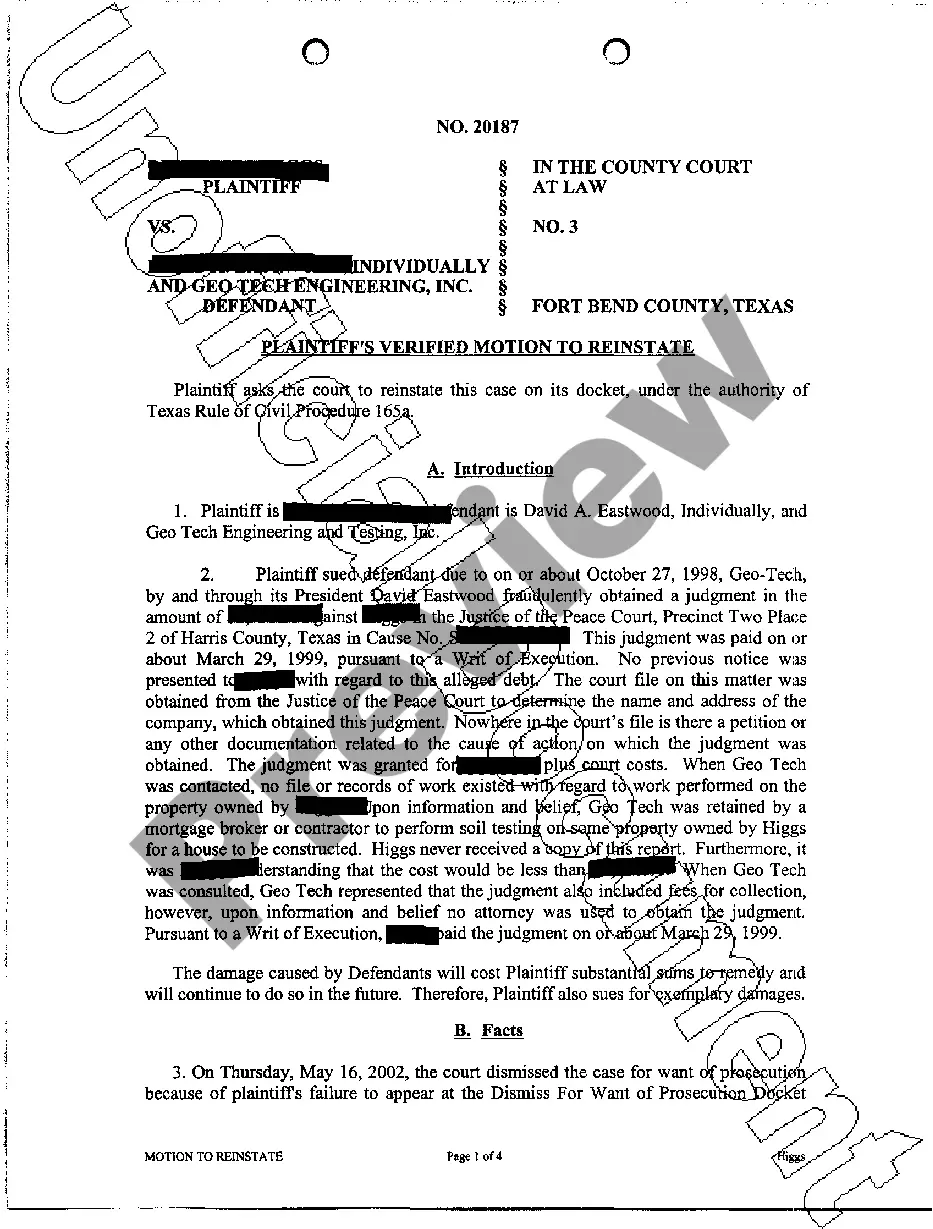

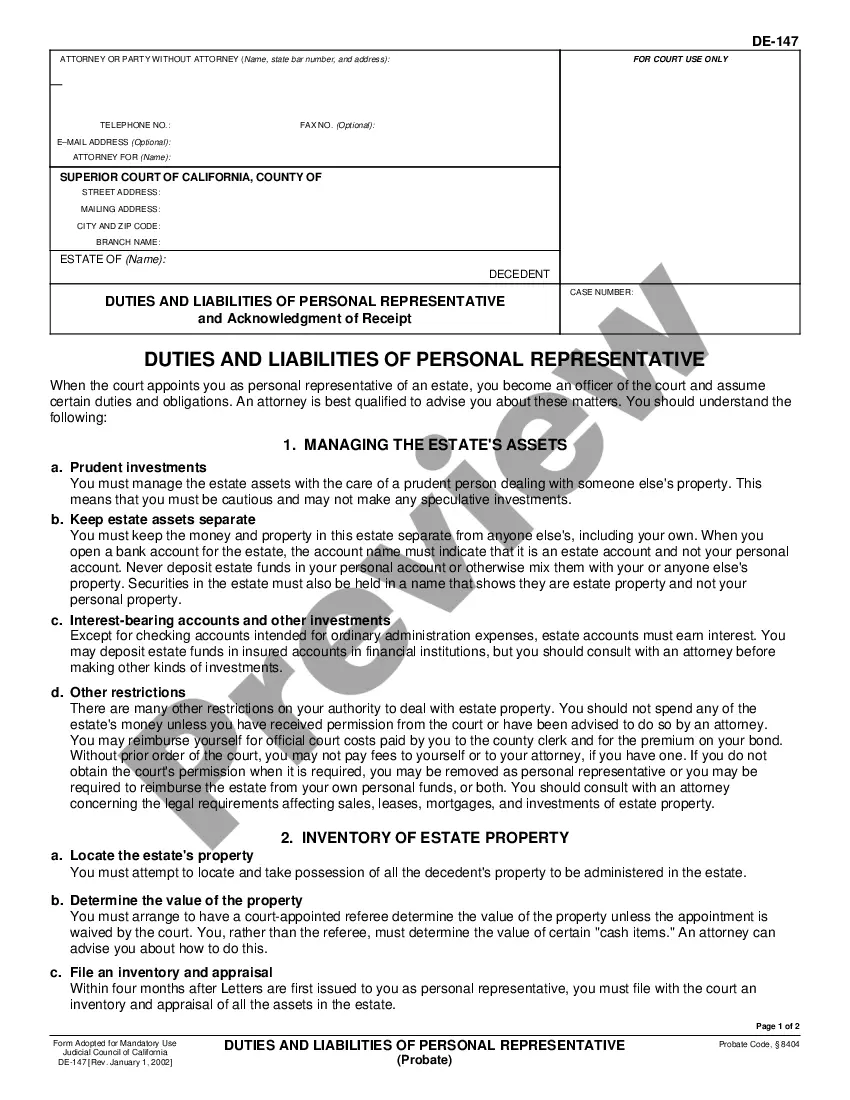

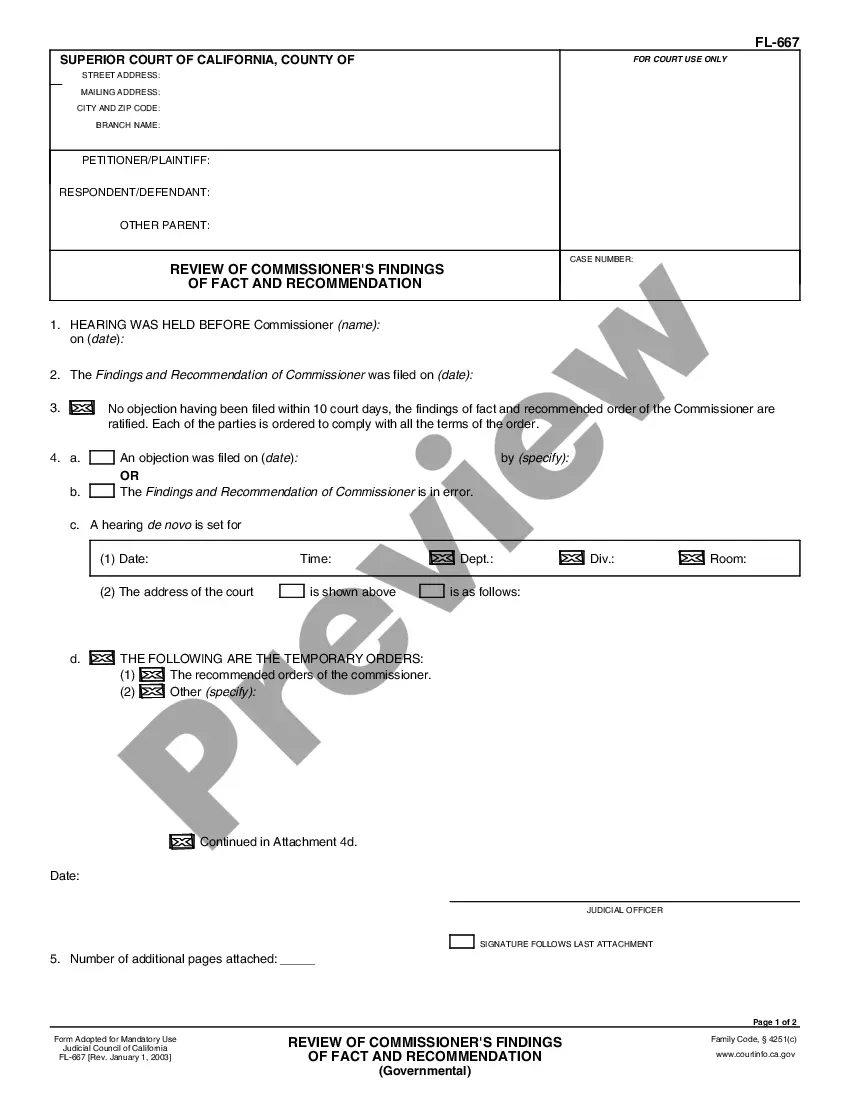

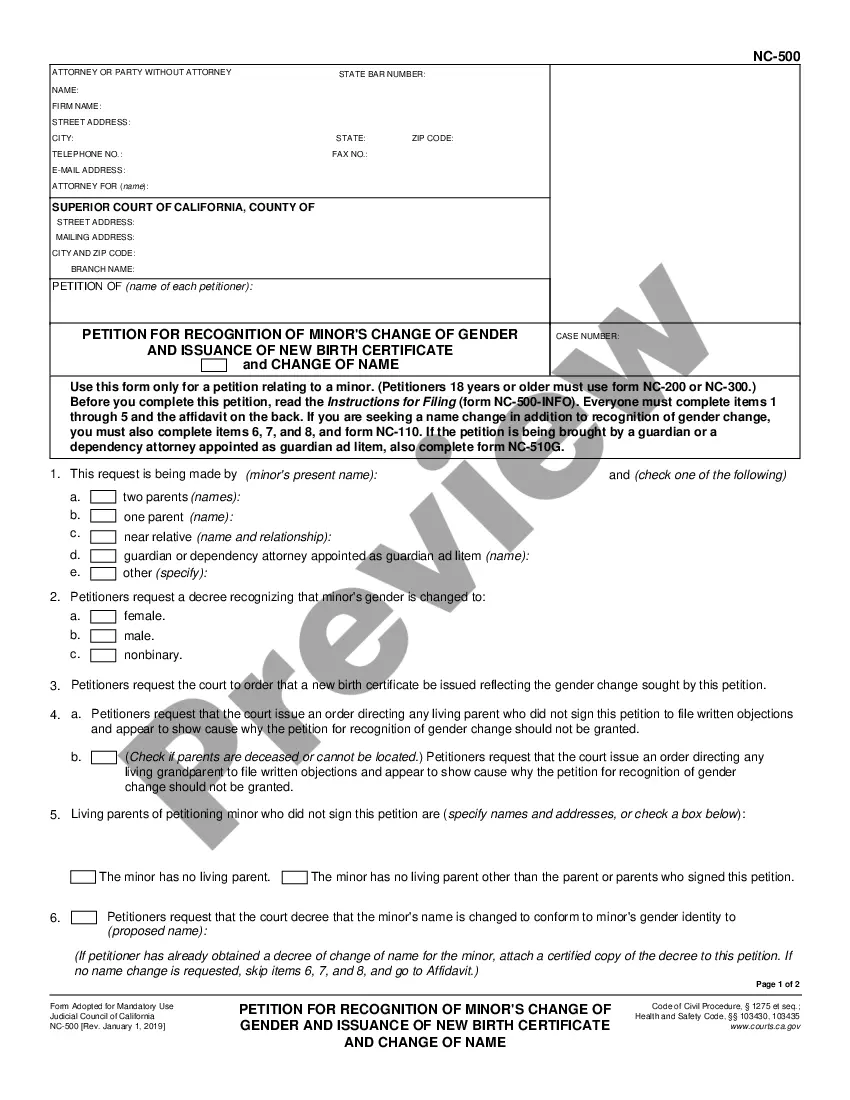

Riverside California Indemnification Agreement is a legally binding document that outlines the terms and conditions under which a corporation agrees to indemnify its current and future directors. This agreement aims to protect directors from any potential legal liabilities that may arise during the course of their service to the corporation. Keywords: Riverside California, indemnification agreement, corporation, directors, legal liabilities, terms and conditions. There are various types of Riverside California Indemnification Agreements that can be established between a corporation and its directors, depending on the specific needs and circumstances. Some of these types include: 1. Standard Indemnification Agreement: This is the most common type of agreement, which broadly covers all aspects of indemnification for directors. It typically includes provisions on indemnification for legal expenses, settlements, judgments, and any other costs incurred due to legal proceedings arising from actions taken in their official capacity. 2. Expanded Indemnification Agreement: This type of agreement goes beyond the standard terms and conditions and offers additional protections to directors. It may include provisions for indemnification in cases of derivative actions, claims made by the corporation itself, or claims arising from the performance of duties outside the official scope. 3. Advancement Indemnification Agreement: This agreement provides directors with the ability to request advances for legal expenses before the resolution of any claims or legal proceedings. Directors can access these funds to cover their legal costs and resources required to respond to allegations, investigations, or lawsuits promptly. 4. Exculpation Indemnification Agreement: In some cases, corporations may choose to include clauses that limit or exempt directors from liability for certain actions or omissions. This type of agreement protects directors from personal liability for acts conducted in good faith and in the best interest of the corporation. 5. Tailored Indemnification Agreement: Corporations can also create customized indemnification agreements that address specific concerns or risks associated with their particular industry or business model. These agreements can include unique provisions that cater to the specific needs and circumstances of the corporation and its directors. In conclusion, a Riverside California Indemnification Agreement between a corporation and its current and future directors is a critical legal document that provides directors with protection against potential legal liabilities. It is crucial for both parties involved to carefully review and negotiate the terms and conditions of the agreement to ensure comprehensive coverage and alignment with their respective interests and obligations.

Riverside California Indemnification Agreement between corporation and its current and future directors

Description

How to fill out Riverside California Indemnification Agreement Between Corporation And Its Current And Future Directors?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Riverside Indemnification Agreement between corporation and its current and future directors meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Aside from the Riverside Indemnification Agreement between corporation and its current and future directors, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Riverside Indemnification Agreement between corporation and its current and future directors:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Riverside Indemnification Agreement between corporation and its current and future directors.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

What does "Corporate Indemnification" mean? Generally, indemnification refers to a situation in which one party (the indemnifying party) agrees or is required to cover the costs, losses and/or expenses experienced by another party (the indemnified party).

Further, in light of the recent amendments to Section 145, only certain officers are entitled to mandatory indemnification of expenses as a matter of law when they are successful on the merits; an indemnification agreement allows a director or officer to secure such rights in the absence of express statutory coverage.

Indemnification. Indemnification is an undertaking by the company to defend the director and officer against the cost of certain claims, including legal fees, litigation awards and settlement costs.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

An indemnity agreement is a contract that 'holds a business or company harmless' for any burden, loss, or damage. An indemnity agreement also ensures proper compensation is available for such loss or damage.

Why do I need an indemnity clause? Indemnity clauses are used to manage the risks associated with a contract, because they enable one party to be protected against the liability arising from the actions of another party.

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

Modification: As opposed to indemnification and advancement rights created by the company's organizational documents, which may be amended by the board or shareholders, indemnification agreements allow the director or officer to prevent the company from unilaterally terminating or reducing the indemnitee's rights.

Indemnification clauses are common in corporations and LLCs. Often a company will agree to indemnify its shareholders, members, officers, and directors for actions they take in such roles on behalf of the company.

Definition: Indemnity means making compensation payments to one party by the other for the loss occurred. Description: Indemnity is based on a mutual contract between two parties (one insured and the other insurer) where one promises the other to compensate for the loss against payment of premiums.