A Phoenix Arizona indemnification agreement establishing escrow reserve is a legally binding document designed to protect parties involved in a transaction by creating a financial reserve for potential future claims or liabilities. This agreement ensures that funds are set aside to cover any losses or damages that may arise during the term of the agreement. The indemnification agreement establishes an escrow reserve account, which acts as a secure holding for funds. This account is typically managed by a third-party escrow agent who ensures that the funds are safeguarded until they are required for indemnification purposes. The purpose of creating an escrow reserve is to provide peace of mind to the parties involved by reducing the risk of financial loss. Key elements of a Phoenix Arizona indemnification agreement establishing escrow reserve include: 1. Parties: The agreement outlines the parties involved in the transaction, such as the buyer, seller, and escrow agent. Each party's responsibilities and obligations are clearly defined. 2. Escrow Account: The agreement specifies the establishment of an escrow account and designates the escrow agent responsible for managing the account. 3. Funding the Escrow Reserve: The agreement outlines the initial funding requirements for the escrow reserve. This may include a specific amount or a percentage of the total transaction value. 4. Escrow Release Conditions: The conditions and triggers for releasing funds from the escrow reserve are detailed in the agreement. These conditions are typically based on certain events or milestones in the transaction. For example, the escrow funds may be released upon the completion of certain warranties or after a specific timeframe. 5. Indemnification Provisions: The agreement defines the scope and terms of indemnification, including the types of claims or liabilities covered, limitations, and exclusions. It clarifies the party responsible for indemnifying the other parties and the process for making claims. 6. Dispute Resolution: The agreement may include provisions for resolving any disputes that may arise regarding the release or use of the escrow funds. This may involve mediation, arbitration, or other alternative dispute resolution methods. Different types of Phoenix Arizona indemnification agreements establishing escrow reserves can include: 1. Real Estate Indemnification Agreement: This type of agreement is commonly used in real estate transactions to protect the buyer or seller from potential future claims, such as title defects, environmental issues, or undisclosed liabilities. 2. Mergers and Acquisitions Indemnification Agreement: When companies merge or one company acquires another, an indemnification agreement may be established to allocate the risk of potential future losses or liabilities between the parties involved. 3. Business Sale/Purchase Indemnification Agreement: This agreement is used when buying or selling a business, protecting the parties from any undisclosed liabilities or breaches of representations and warranties. 4. Construction Indemnification Agreement: This type of agreement is specific to construction projects and is commonly used to safeguard against defects, delays, or other potential risks associated with the project. In summary, a Phoenix Arizona indemnification agreement establishing escrow reserve is a crucial legal tool that provides financial protection to parties involved in a transaction by setting aside funds to cover potential future claims or liabilities. It ensures transparency, reduces risks, and allows parties to proceed with confidence in their business dealings.

Phoenix Arizona Indemnification Agreement establishing Escrow Reserve

Description

How to fill out Phoenix Arizona Indemnification Agreement Establishing Escrow Reserve?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

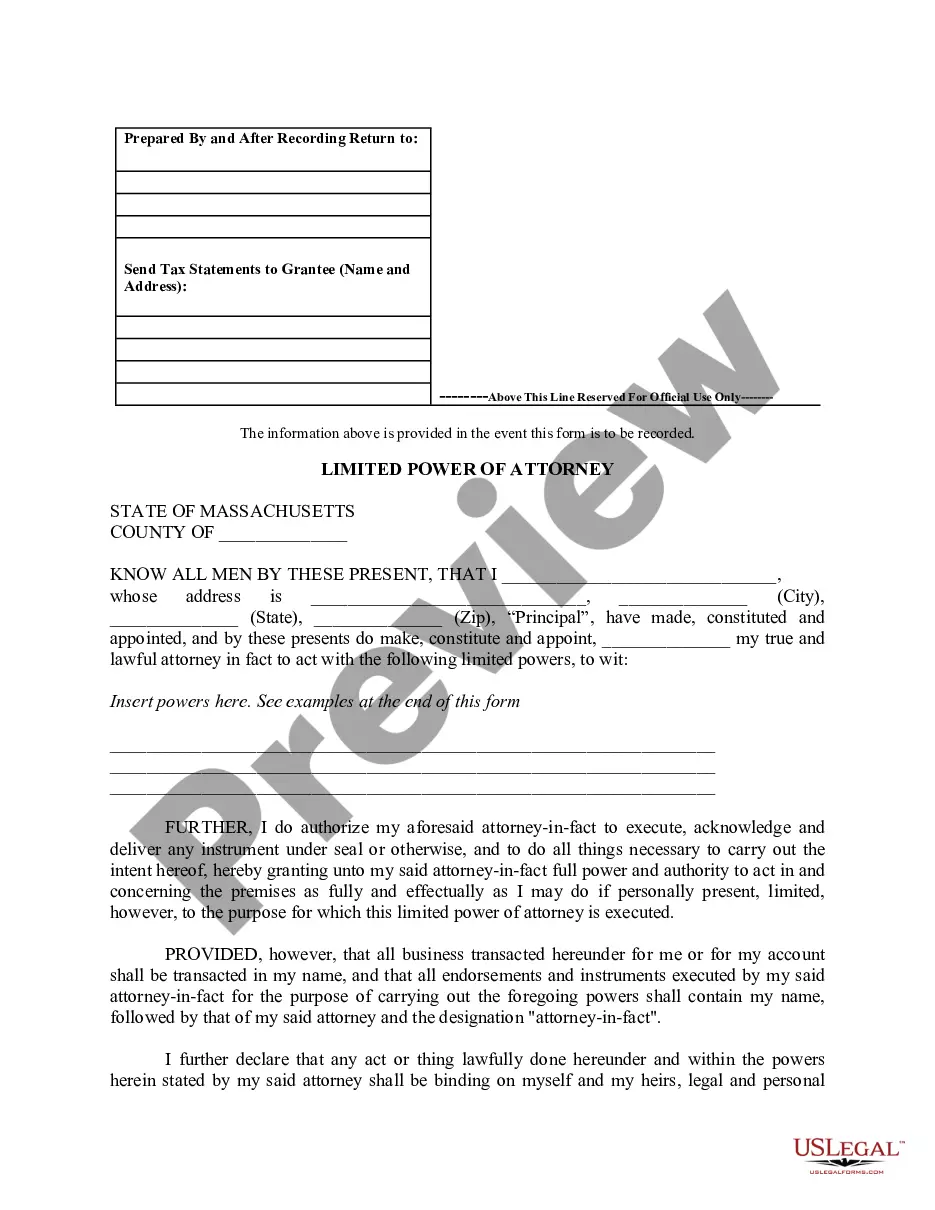

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Phoenix Indemnification Agreement establishing Escrow Reserve.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Phoenix Indemnification Agreement establishing Escrow Reserve will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Phoenix Indemnification Agreement establishing Escrow Reserve:

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Phoenix Indemnification Agreement establishing Escrow Reserve on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Escrow instructions normally identify the escrow holder's contact information and escrow number, license number, important dates including the date escrow opened, as well as the date it is scheduled to close, the names of the parties to the escrow, the property address and legal description, purchase price and terms,

Joint Escrow Account means the deposit account established and maintained at the Depository Bank into which payments of the Royalties and Milestones are to be remitted in accordance with Section 2.02(a) (and the terms of an escrow agreement to be agreed upon by the parties) and the account from which the Depository

An escrow agreement to be used in connection with an M&A transaction. This agreement sets out the terms and conditions by which an escrow agent will hold and distribute the portion of the purchase price placed in escrow to satisfy certain post-closing obligations of the seller.

Escrow is a legal arrangement in which a third party temporarily holds money or property until a particular condition has been met (such as the fulfillment of a purchase agreement).

At their core, indemnification provisions transfer liabilities related to a claim from one party to another party, generally in the event of a breach of contract or a party's negligence or misconduct in the performance of the agreement.

An escrow agreement refers to a contract that outlines the terms and conditions of a transaction for something of value ? such as a bond, deed, or asset ? which is held by a third party until all conditions have been met.

A common example of indemnification happens with reagrd to insurance transactions. This often happens when an insurance company, as part of an individual's insurance policy, agrees to indemnify the insured person for losses that the insured person incurred as the result of accident or property damage.

An indemnification escrow account is a separate fund that the parties can establish at the closing of a transaction for the payment of indemnification obligations. The indemnification escrow is funded from the buyer's purchase price.

In the simplest sense, indemnification obligations protect one party to a contract against claims that arise after a transaction that should be the other party's responsibility.

Put in the simplest terms, an escrow is basically an account held by a trusted, neutral third party. Within this account, documents or money are typically held until a set of predefined conditions are met.