Allegheny County, located in Pennsylvania, has implemented the Allegheny Pennsylvania Adoption of Incentive Stock Plan, a program designed to attract and retain businesses in the region by offering incentives in the form of stock options. This plan is aimed at stimulating economic growth, creating job opportunities, and promoting investment in Allegheny County. The Allegheny Pennsylvania Adoption of Incentive Stock Plan seeks to encourage businesses to establish or expand their operations in Allegheny County by providing them with stock options as a means of financial reward. By offering these incentives, the county's economic development agency aims to entice companies to invest in the local economy and contribute to its overall growth. One of the key benefits of the Allegheny Pennsylvania Adoption of Incentive Stock Plan is that it helps businesses attract and retain talent. Stock options provide employees with a financial stake in the success of the company, which can serve as a significant motivator and encourage them to stay with the organization for the long term. Moreover, the plan also enables businesses to raise capital without incurring immediate costs. By distributing stock options, companies can attract investors who believe in their potential and are willing to take a stake in their growth. This not only provides financial resources for expansion but also allows businesses to forge valuable partnerships with investors who have a vested interest in their success. Within the Allegheny Pennsylvania Adoption of Incentive Stock Plan, there are several types of stock options available. These may include incentive stock options (SOS), which are granted to employees and provide certain tax advantages, or non-qualified stock options (SOS), which typically offer greater flexibility but may be subject to different tax treatment. The Adoption of Incentive Stock Plan is governed by specific regulations and eligibility criteria, which businesses must meet in order to participate. This ensures that the program is targeting companies that align with the county's economic development goals and have the potential to make a significant impact on the local economy. In summary, the Allegheny Pennsylvania Adoption of Incentive Stock Plan is a strategic initiative aimed at attracting and retaining businesses in Allegheny County, Pennsylvania. By offering stock options as incentives, the plan encourages investments, creates job opportunities, and fosters economic growth in the region. The availability of different types of stock options allows businesses to tailor their compensation packages to better suit their needs and goals. Ultimately, this program serves as a powerful tool for promoting economic development and enhancing the overall prosperity of Allegheny County.

Allegheny Pennsylvania Adoption of Incentive Stock Plan

Description

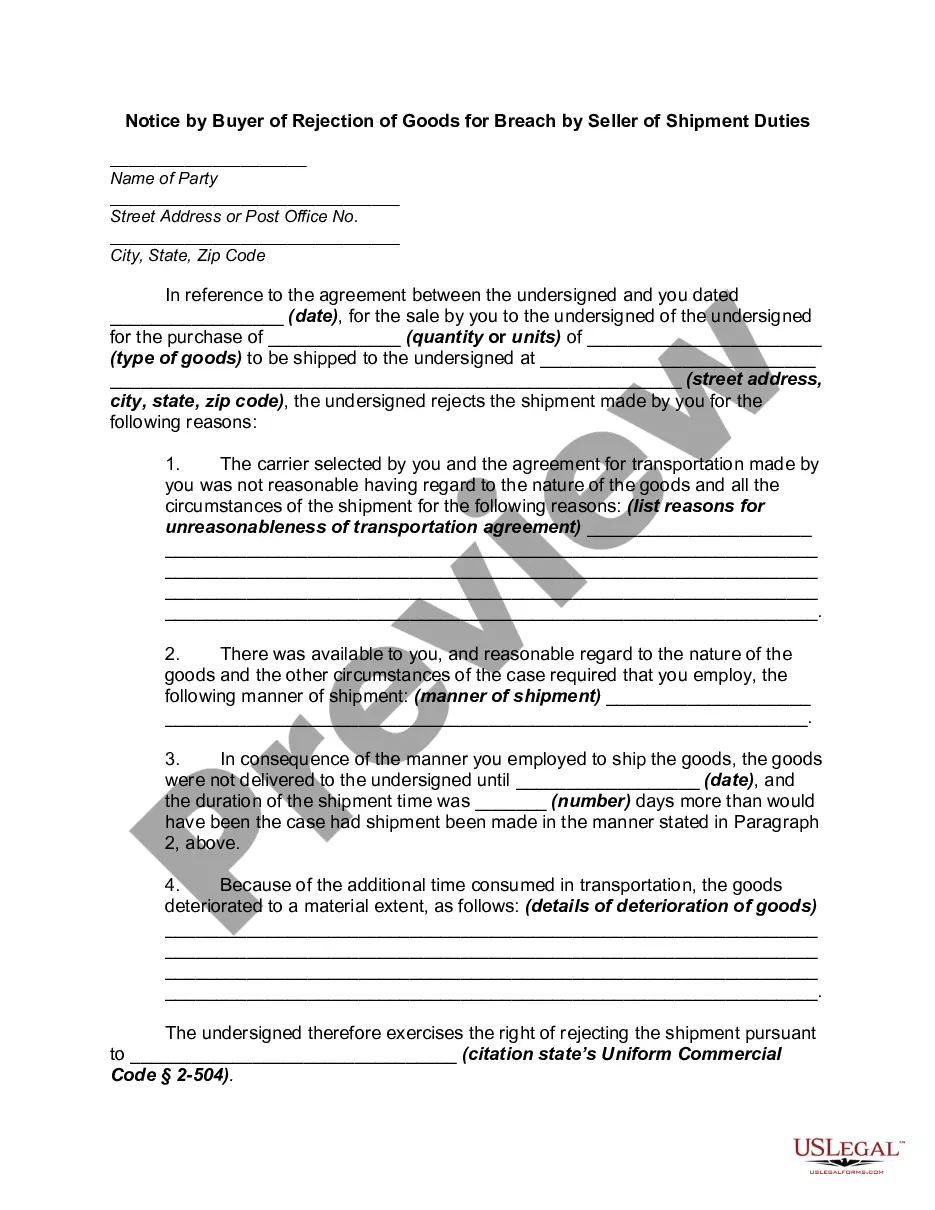

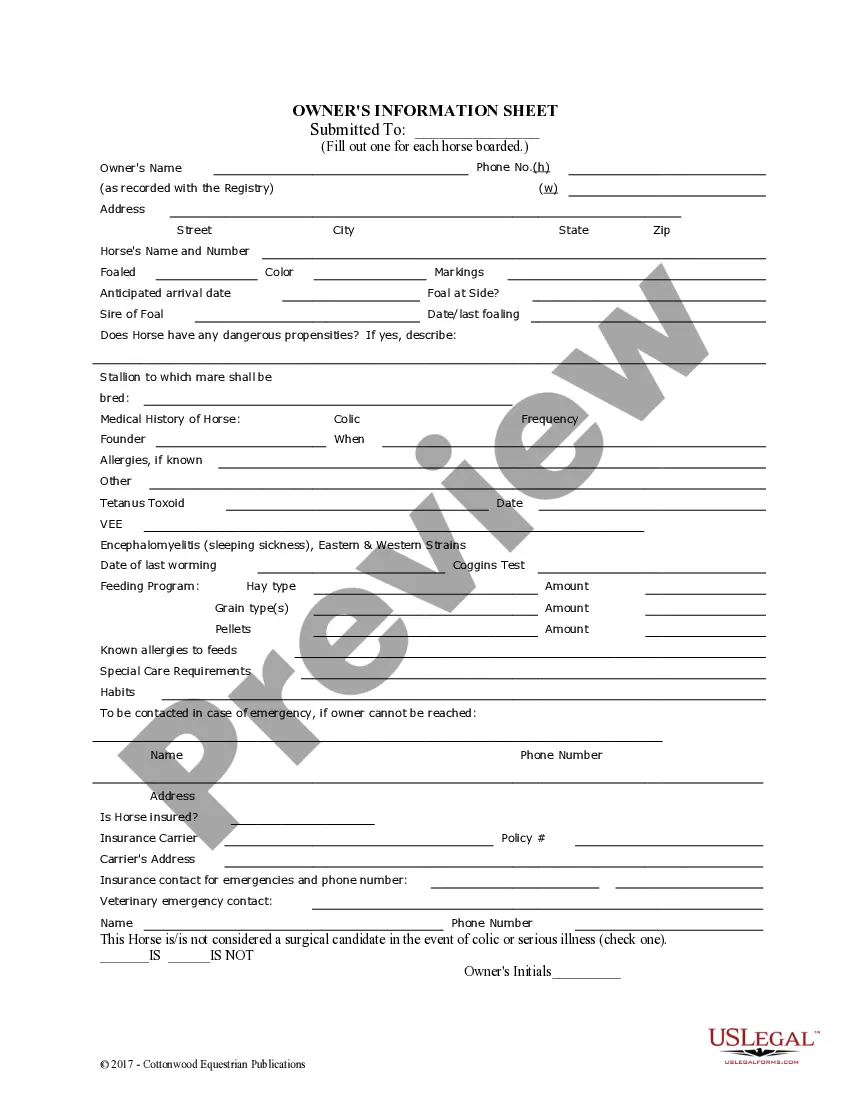

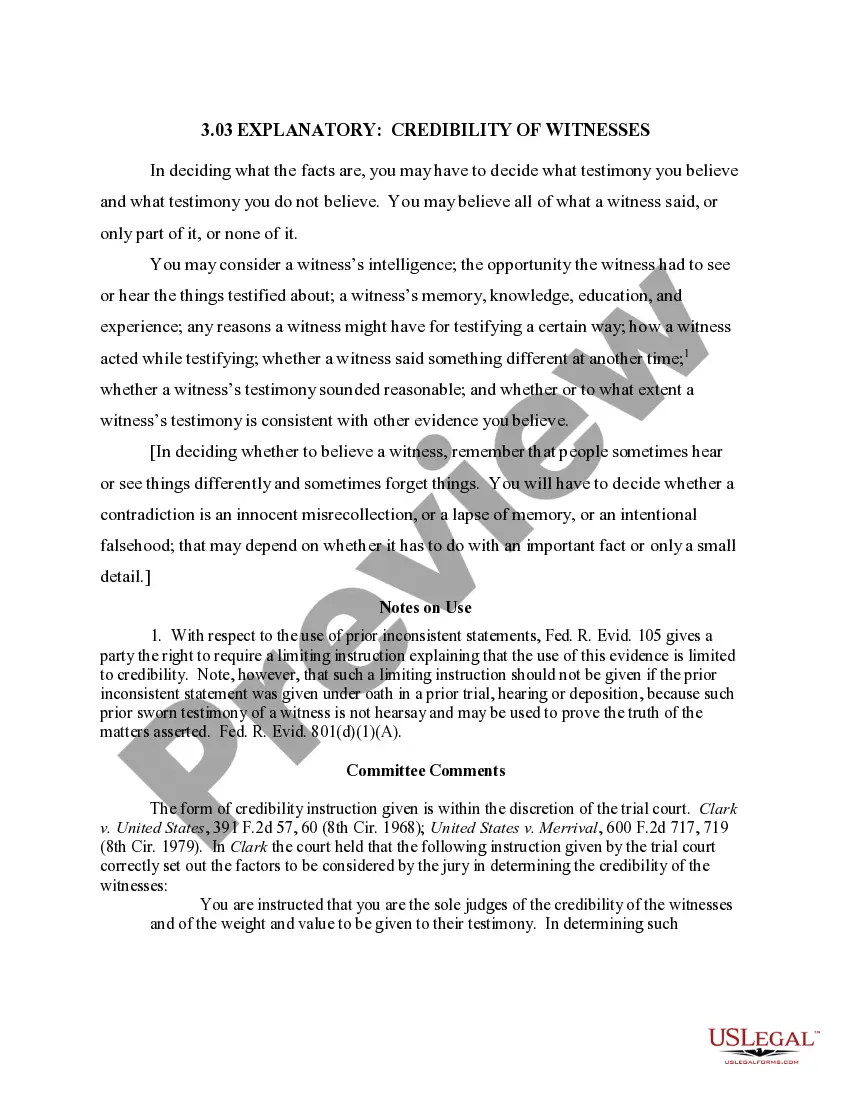

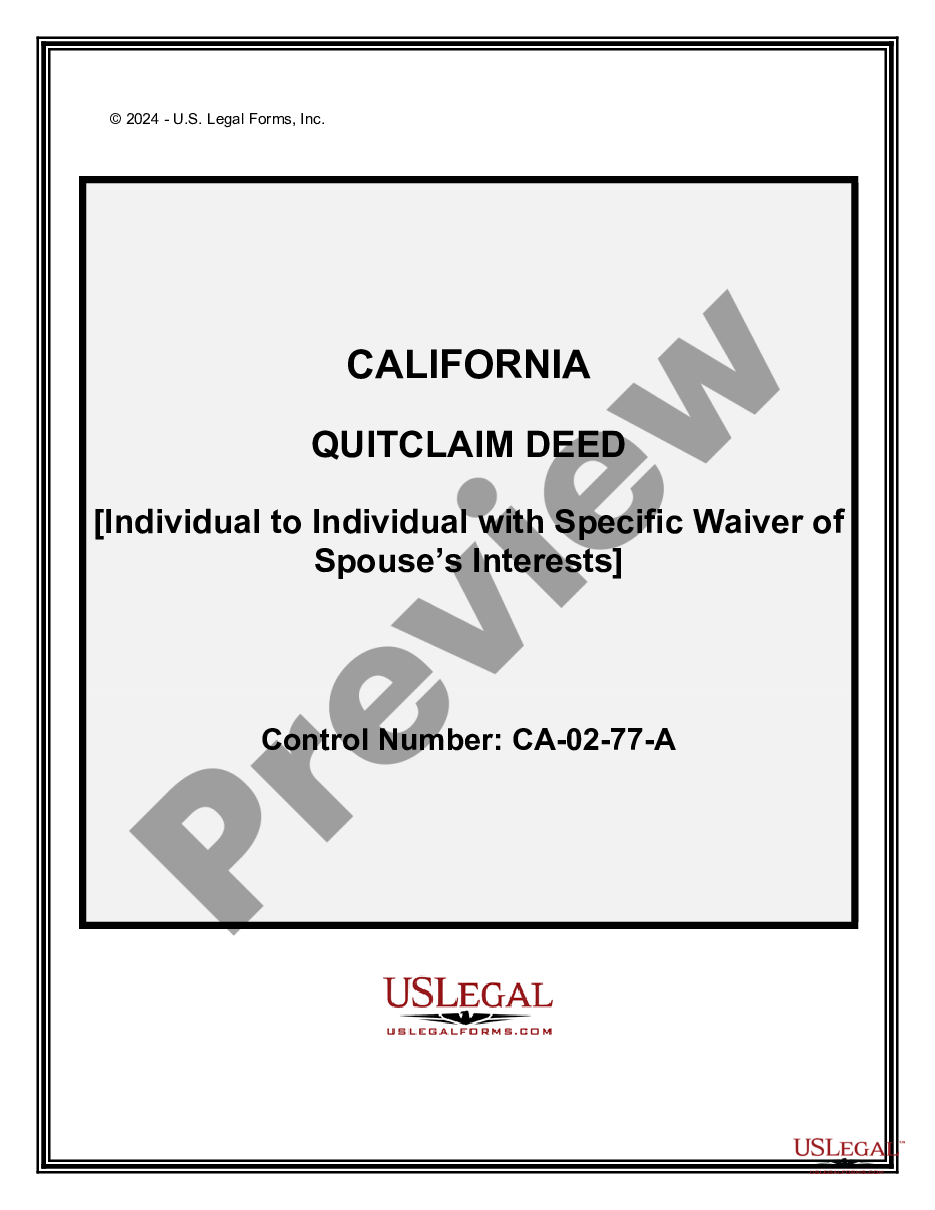

How to fill out Allegheny Pennsylvania Adoption Of Incentive Stock Plan?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Allegheny Adoption of Incentive Stock Plan is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Allegheny Adoption of Incentive Stock Plan. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Adoption of Incentive Stock Plan in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

ISOs require a vesting period of at least two years and a holding period of more than one year before they can be sold. ISOs often have more favorable tax treatment on profits than other types of employee stock purchase plans.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment.

Foreign stock or securities, if you hold them outside of a financial account, must be reported on Form 8938, provided the value of your specified foreign financial assets is greater than the reporting threshold that applies to you.

Can foreign employees receive incentive stock options? Yes, in some cases. However, depending on the tax laws of the country where the foreign employee is located, they may not receive any of the tax benefits of ISO.

An equity incentive plan must be approved by the stockholders.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.

Remember, while you can offer ISOs to domestic employees in the US, you cannot use any EOR service to offer ISOs to foreign employees. Instead, you must offer NSOs, RSUs, VSOs, or similar.

The ISO qualifications and limitations are: ISOs can only be granted to employees.Only the first $100,000 that becomes exercisable during any 12 month period can qualify for ISO treatment. ISOs to 10% or greater stockholders have to be priced at 110% of FMV and have no more than 5 year term.

C Corporations Why? C corporations can offer what are known as incentive stock options to employees, and incentive stock options allow employees to defer tax on the equity compensation that they receive until they ultimately sell the underlying stock that is subject to the stock options.