Harris Texas Adoption of Incentive Stock Plan: Understanding the Benefits and Types What is Harris Texas Adoption of Incentive Stock Plan? The Harris Texas Adoption of Incentive Stock Plan is a program established by companies to incentivize their employees by granting them stock options or the ability to purchase company stocks at a predetermined price. It aims to motivate and reward employees for their long-term loyalty, dedication, and contributions to the company's success. This plan is specific to companies in Harris County, Texas. Benefits of Harris Texas Adoption of Incentive Stock Plan: 1. Employee Retention: By offering stock options, companies can encourage talented employees to stay with the organization in the long run. As employees become vested in the stock options, they develop a sense of ownership and have a financial interest in the company's performance. 2. Motivation and Performance: Incentive stock plans motivate employees to excel in their roles as they realize that their efforts directly impact the company's success. With the potential for financial rewards tied to the stock's value, employees are motivated to go above and beyond to contribute to the company's growth. 3. Tax Advantages: Incentive stock options may provide tax benefits for both the company and employees. If certain conditions are met, employees may benefit from favorable tax treatment when exercising the options. Types of Harris Texas Adoption of Incentive Stock Plan: 1. Non-Qualified Stock Options (SOS): SOS are the most common type of incentive stock options. They offer flexibility to the company in determining who is eligible to receive options and the terms and conditions associated with them. However, SOS are subject to regular income tax rates upon exercise. 2. Incentive Stock Options (SOS): SOS are more restrictive than SOS and have specific tax advantages. They must meet certain legal criteria, such as being granted at fair market value, having a ten-year exercise period, and imposing limitations on the total value of options exercisable in a calendar year. SOS offer potential tax benefits, including the ability to defer taxes until the stocks are sold. 3. Employee Stock Purchase Plans (ESPN): ESPN allow employees to purchase company stocks at a discounted price, often through payroll deductions. Employees contribute a portion of their salary towards the purchase of shares, providing an opportunity to acquire ownership in the company. 4. Restricted Stock Units (RSS): RSS grant employees the right to receive company shares at a future date, usually after a vesting period. Unlike stock options, RSS do not require employees to make a purchase or exercise the options but provide a direct grant of stock once vesting requirements are met. In conclusion, the Harris Texas Adoption of Incentive Stock Plan provides companies with a method to retain and motivate employees by offering stock-based incentives. Whether through non-qualified stock options, incentive stock options, employee stock purchase plans, or restricted stock units, these plans offer various benefits and potential tax advantages to both companies and employees.

Harris Texas Adoption of Incentive Stock Plan

Description

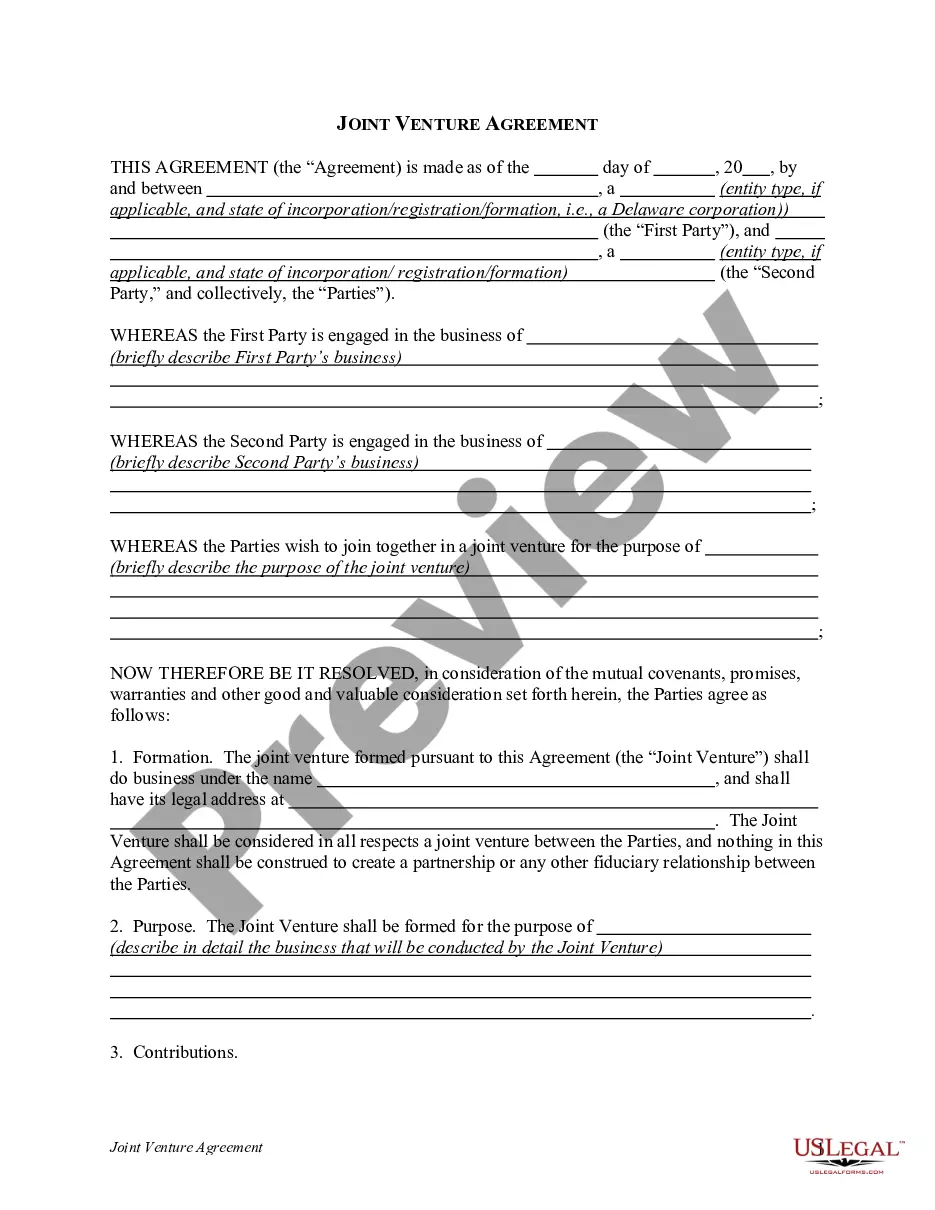

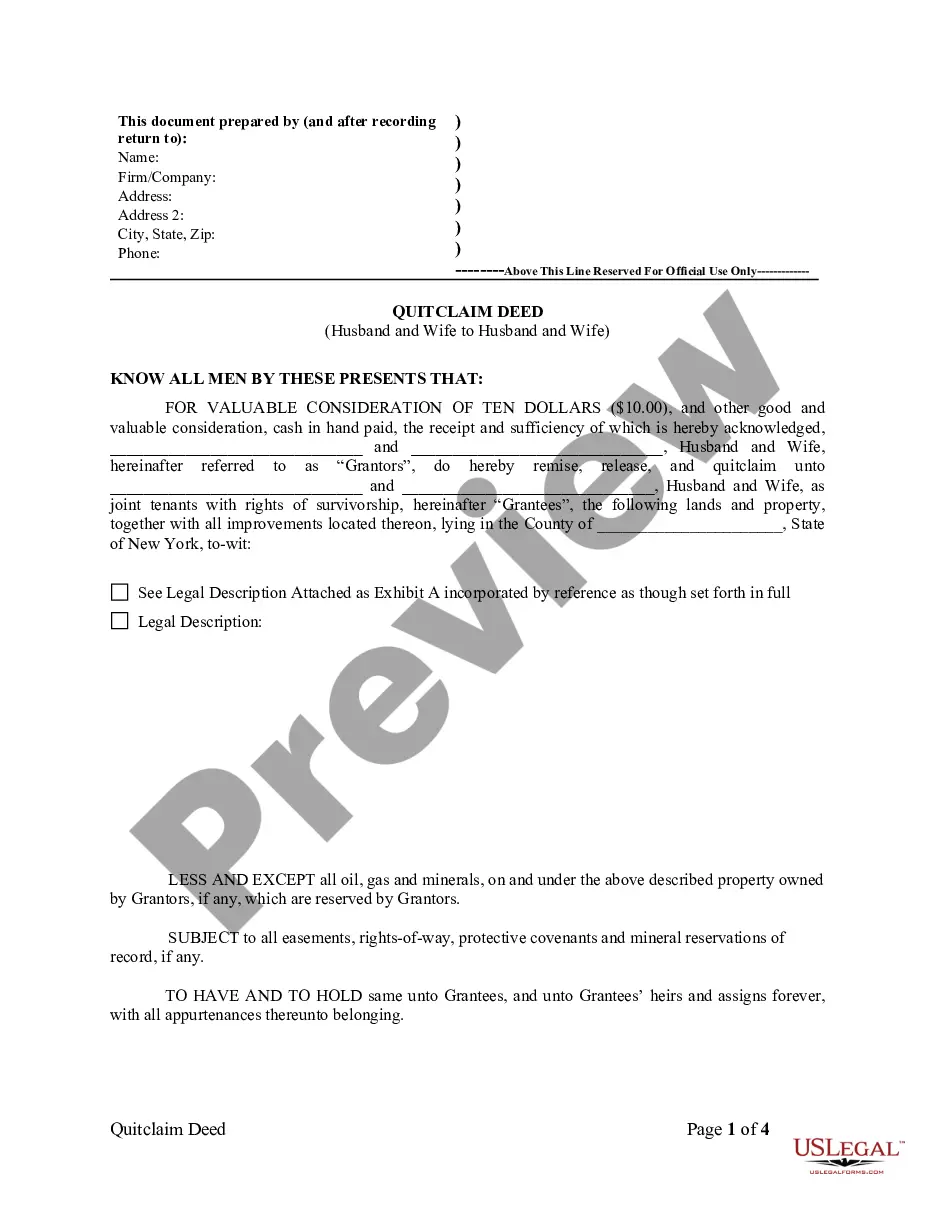

How to fill out Harris Texas Adoption Of Incentive Stock Plan?

If you need to get a trustworthy legal document supplier to obtain the Harris Adoption of Incentive Stock Plan, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it easy to find and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Harris Adoption of Incentive Stock Plan, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Harris Adoption of Incentive Stock Plan template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate agreement, or execute the Harris Adoption of Incentive Stock Plan - all from the comfort of your sofa.

Join US Legal Forms now!