The Philadelphia Pennsylvania Incentive Stock Plan of Chaparral Resources, Inc. is a comprehensive employee compensation program designed to reward and retain talented individuals within the company. With a focus on performance-based incentives, this stock plan aims to align the interests of employees with the long-term success of Chaparral Resources, Inc. Keywords: Philadelphia Pennsylvania, Incentive Stock Plan, Chaparral Resources, employee compensation program, performance-based incentives, retain talented individuals, long-term success. This stock plan provides eligible employees with an opportunity to acquire stock options or stock grants as part of their compensation package. By offering a stake in the company's ownership, Chaparral Resources fosters a sense of partnership and motivates employees to contribute their best efforts towards the organization's growth. The Philadelphia Pennsylvania Incentive Stock Plan is based on a set of predetermined criteria, ensuring that rewards are granted to employees who meet or exceed the established performance expectations. This promotes a culture of meritocracy, encouraging employees to continuously enhance their skills and achieve outstanding results. The plan may include various types of awards depending on the employee's position, seniority, and performance. These awards can consist of both stock options and restricted stock units (RSS), each carrying its own unique characteristics and benefits. 1. Stock options: Stock options under the Philadelphia Pennsylvania Incentive Stock Plan offer employees the right to purchase a specific number of company shares at a predetermined price, known as the exercise price or strike price. Typically, there is a time frame during which employees can exercise their stock options, after which they may expire. If the company's stock price rises above the exercise price, employees can benefit from capital gains. 2. Restricted Stock Units (RSS): RSS are another component of the Philadelphia Pennsylvania Incentive Stock Plan. RSS represents a promise to deliver shares of company stock to employees at a future date, subject to certain vesting conditions. Once the RSS vest, employees receive the corresponding shares. RSS offers a direct ownership stake in the company and align the interests of employees with the overall success and value appreciation of Chaparral Resources. It is worth noting that while both stock options and RSS are common forms of incentives under the Philadelphia Pennsylvania Incentive Stock Plan, the specific terms, conditions, and details of the program may vary based on the employee's level, tenure, and contribution to the company. In conclusion, the Philadelphia Pennsylvania Incentive Stock Plan of Chaparral Resources, Inc. is an employee compensation program designed to provide incentives, such as stock options and RSS, to eligible employees. By offering ownership in the company and linking rewards to performance, this stock plan aims to attract, retain, and motivate talented individuals who contribute to the long-term success of Chaparral Resources, Inc.

Philadelphia Pennsylvania Incentive Stock Plan of Chaparral Resources, Inc.

Description

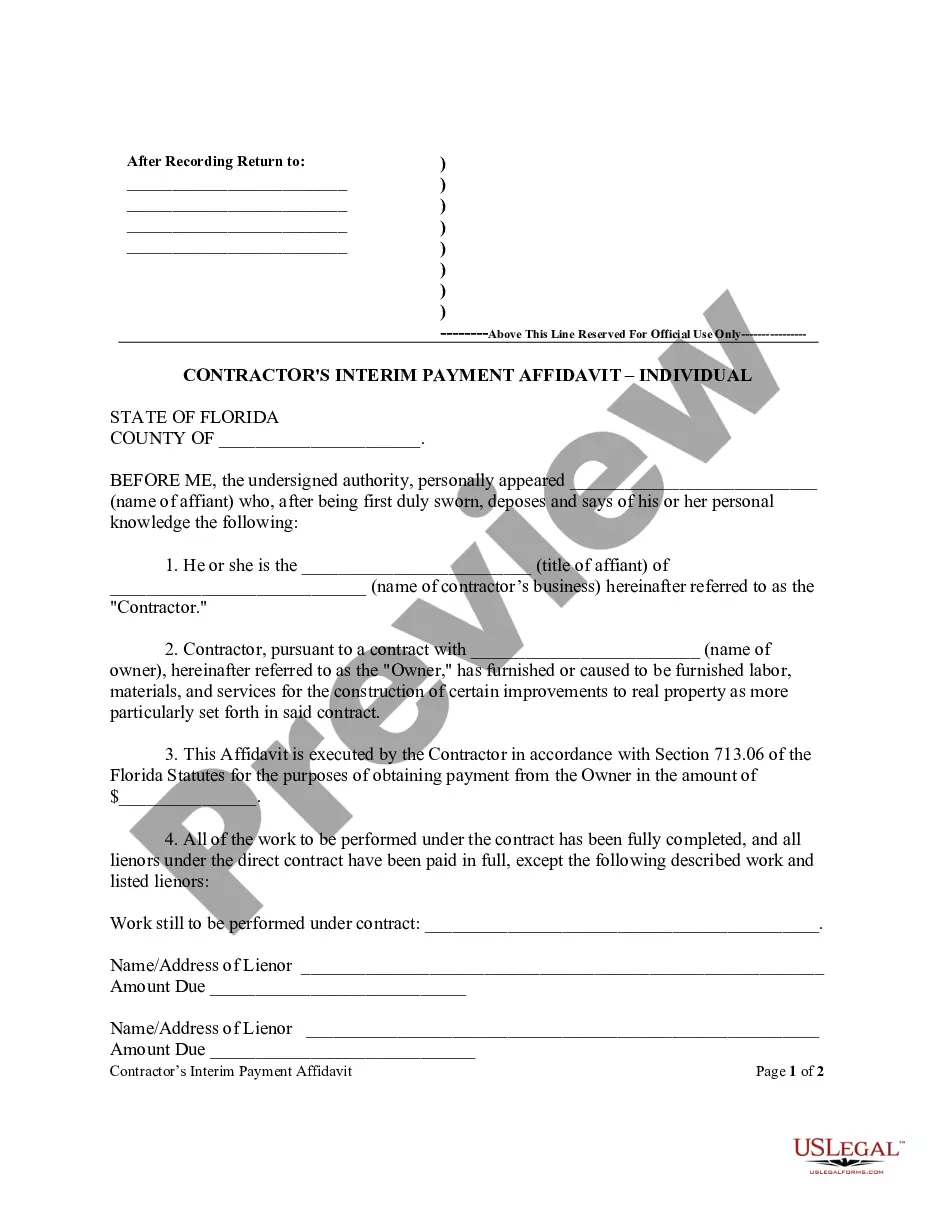

How to fill out Philadelphia Pennsylvania Incentive Stock Plan Of Chaparral Resources, Inc.?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the Philadelphia Incentive Stock Plan of Chaparral Resources, Inc..

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Philadelphia Incentive Stock Plan of Chaparral Resources, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Philadelphia Incentive Stock Plan of Chaparral Resources, Inc.:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Philadelphia Incentive Stock Plan of Chaparral Resources, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

The core elements of an Employee Stock Option Plan include: Definitions, Option Commitment Certificate, Grant of Options, Conditions of Options, Vesting, and Exercise of Option, Termination of Participation, Payment.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Your employer is not required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs. The acronym NSO is also used. These do not qualify for special tax treatment.

Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs. The acronym NSO is also used. These do not qualify for special tax treatment.

Your employer is not required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

If you follow IRS rules when you report the sale of stock bought through an ISO, you'll avoid being taxed twice on the same income. The broker your employer uses to handle the stocks will send you a Form 1099-B.

An incentive stock option must be granted within 10 years from the date that the plan under which it is granted is adopted or the date such plan is approved by the stockholders, whichever is earlier. To grant incentive stock options after the expiration of the 10-year period, a new plan must be adopted and approved.

S corporations can issue both incentive stock options and non-qualified stock options to employees, consultants, advisors and other service providers.