The Dallas Texas Incentive Stock Option Plan offered by Bankers Note, Inc. is a comprehensive employee benefit program designed to attract and retain top talent within the organization. This plan provides employees with the opportunity to purchase company stock at a predetermined price, known as the exercise price, within a specific period of time. One of the key features of the Dallas Texas Incentive Stock Option Plan is the ability to purchase company stock at a discounted price, thereby allowing employees to potentially benefit from any future growth in the company's value. This serves as a powerful incentive to motivate employees and align their interests with the success of the organization. Participants of the Dallas Texas Incentive Stock Option Plan can exercise their stock options after a specified vesting period. This means that employees must work for the company for a certain period of time before they can exercise their options and purchase the underlying stock. Vesting schedules may vary depending on the terms of the plan and the position of the employee within the company. Bankers Note, Inc. may offer different types of incentive stock option plans tailored to specific employee groups. For instance, they could have plans targeted towards executives, management-level employees, or even a broad-based plan open to all eligible employees. These plans may have varying terms, such as different vesting schedules or exercise prices, depending on the specific objectives and requirements of each employee group. The Dallas Texas Incentive Stock Option Plan provides employees with a valuable opportunity to participate in the company's growth and success. It not only serves as an attractive employee benefit but also fosters a sense of ownership and loyalty among participants. By linking employee compensation to the company's performance, this plan encourages employees to work towards the long-term success of Bankers Note, Inc. while also rewarding their individual contributions. Overall, the Dallas Texas Incentive Stock Option Plan of Bankers Note, Inc. offers a powerful tool to attract, motivate, and retain talented employees, while aligning their interests with the organization's growth and success.

Dallas Texas Incentive Stock Option Plan of the Bankers Note, Inc.

Description

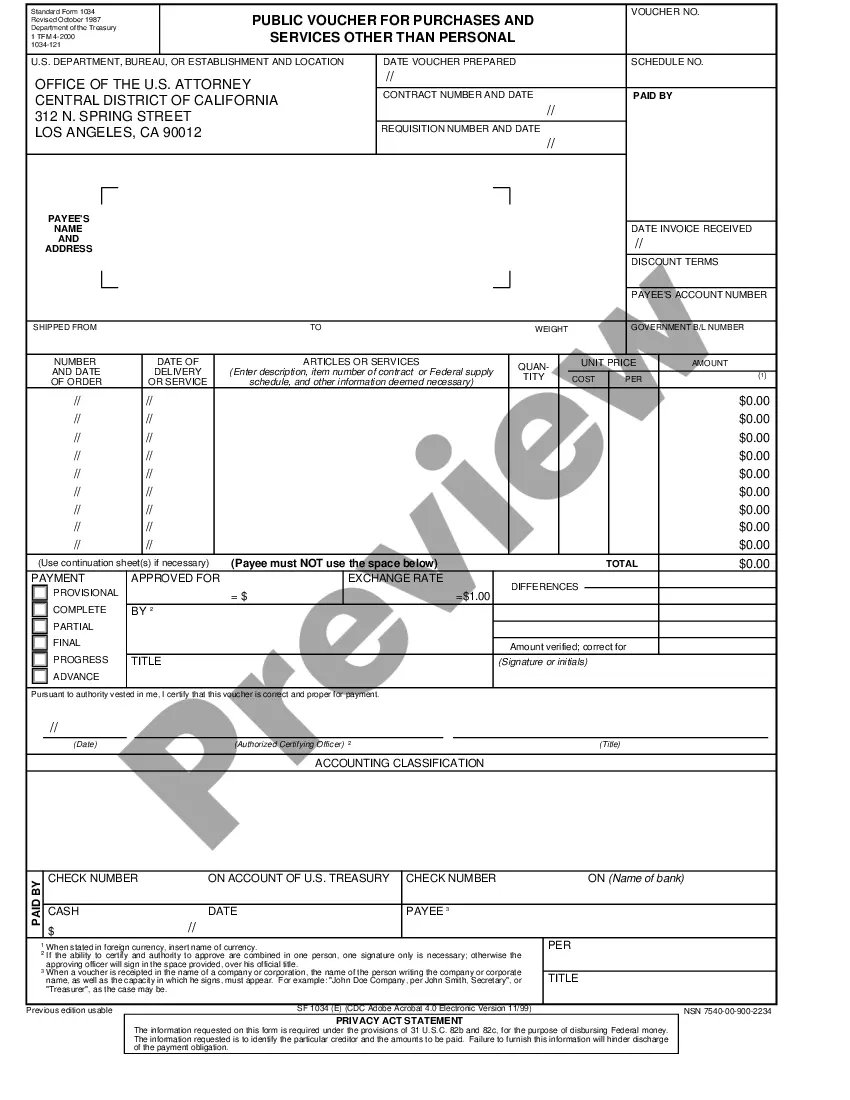

How to fill out Dallas Texas Incentive Stock Option Plan Of The Bankers Note, Inc.?

Preparing papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Dallas Incentive Stock Option Plan of the Bankers Note, Inc. without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Dallas Incentive Stock Option Plan of the Bankers Note, Inc. on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Dallas Incentive Stock Option Plan of the Bankers Note, Inc.:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

Stock options are also a way to encourage employees to stay and not be tempted to leave and work for a competitor. However, critics of stock options warn that they can encourage executives to follow strategies that might benefit the stock price in the short term but could be detrimental to the company in the long term.

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

ISOs only apply while you are still employed at the company that issued the grant and cannot be extended beyond 90 days after you leave. NSOs don't require employment and can be extended well beyond 90 days.

Call example The current price of the stock is $30. If the price of the stock shoots up to $55 on the day of expiration, Jon can exercise his option to buy 100 shares of CSX at $45 and then sell them at $55 on the day of expiration, making a profit of $10 per share.

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

How to ask for stock options in a job offer Evaluate what the discount is.Find out about the most recent appraisal.Determine the type of stock options offered.Negotiate salary.Learn the company's guidelines for stock options.Request your employer to write a contract.

Incentive stock options (ISOs) are popular measures of employee compensation received as rights to company stock. These are a particular type of employee stock purchase plan intended to retain key employees or managers. ISOs often have more favorable tax treatment than other types of employee stock purchase plan.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

A stock incentive plan, or employee stock purchase plan, is a form of compensation by a company for employees or contractors which can be used as an alternative to cash payment. It's designed to motivate employees by offering them the opportunity for future earnings through company stocks.