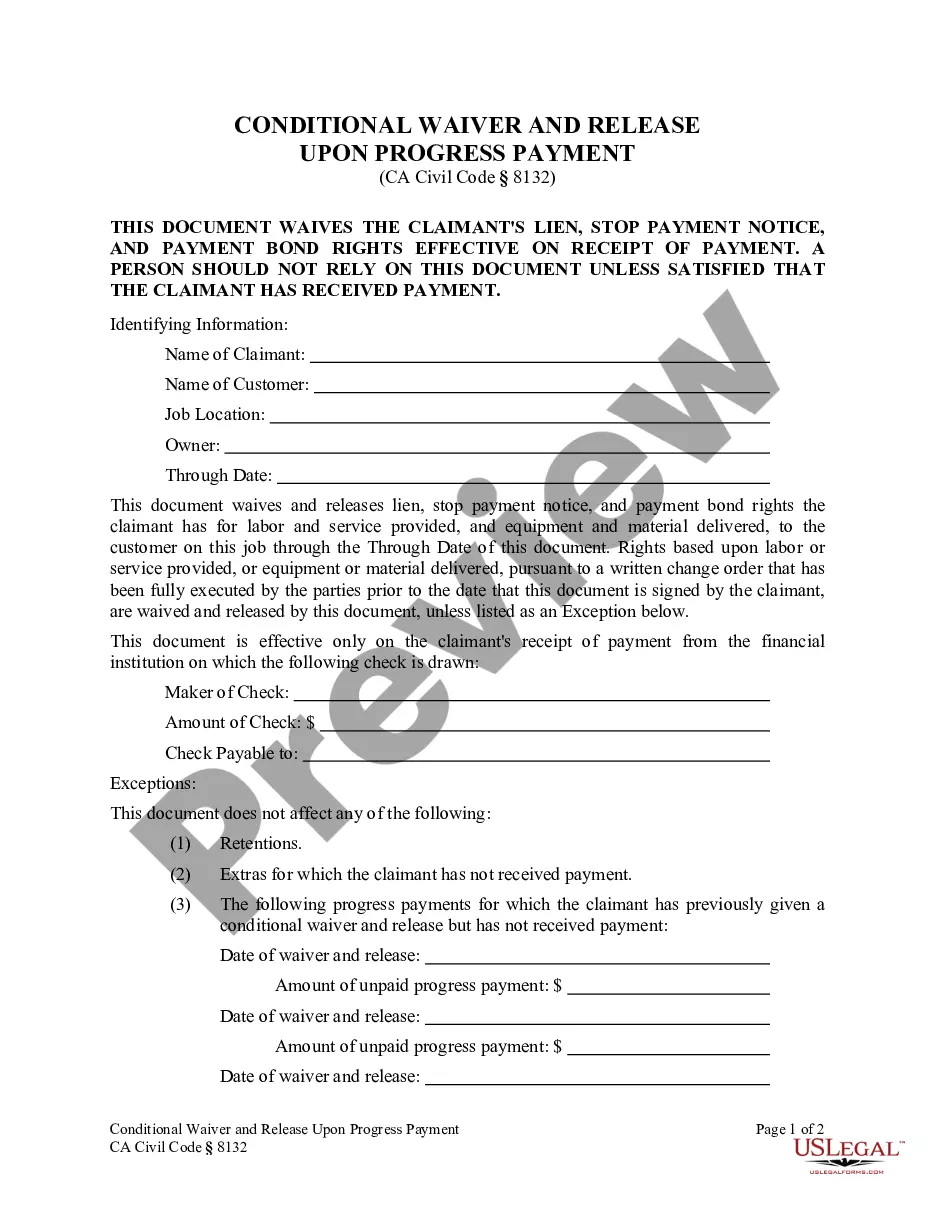

The Maricopa Arizona Incentive Stock Option Plan of the Bankers Note, Inc. is a program aimed at incentivizing employees of the company through stock options. The plan offers employees the opportunity to purchase a specified number of company stocks at a predetermined price during a defined period. This allows employees to benefit from the potential growth of the company's stock value. The Maricopa Arizona Incentive Stock Option Plan helps attract, retain, and motivate talented individuals by offering them a stake in the company's success. Eligible employees are granted a certain number of stock options, often based on their job position, performance, or length of service. These options can be exercised once they fully vest, usually after a certain period of time, allowing the employee to buy company shares at a predetermined price, known as the exercise price or strike price. One notable advantage of this Incentive Stock Option Plan is the potential for financial gain if the company's stock price rises above the exercise price. Employees can profit from the difference between the exercise price and the market price when they choose to sell their acquired shares. This aligns the employees' goals with the company's performance and encourages them to contribute to its growth and success. Different variations of the Maricopa Arizona Incentive Stock Option Plan may include the following: 1. Non-Qualified Stock Options (SOS): These are commonly offered to employees, directors, and consultants. SOS provide flexibility in terms of vesting schedules, exercise prices, and eligibility requirements. However, they do not receive the same tax advantages as qualified stock options. 2. Qualified Incentive Stock Options (SOS): SOS are governed by specific rules and regulations set by the Internal Revenue Service (IRS). They often come with tax advantages for employees, such as potential capital gains tax treatment upon the sale of acquired shares. To qualify as an ISO, certain conditions must be met, such as a maximum exercise price, limits on the number of shares granted, and a minimum holding period. 3. Performance-Based Stock Options: This type of stock option plan links the grant of options to specific performance criteria set by the company. It allows employees to earn additional stock options if predetermined performance targets are achieved. Performance-based stock options can be an effective way to align employee motivation with the company's strategic objectives. Overall, the Maricopa Arizona Incentive Stock Option Plan of the Bankers Note, Inc. provides a powerful tool for attracting and retaining talented employees, fostering a sense of ownership, and aligning their interests with the company's growth. This comprehensive plan offers various types of stock options that cater to different employee levels and objectives, ultimately promoting the overall success of Bankers Note, Inc.

Maricopa Arizona Incentive Stock Option Plan of the Bankers Note, Inc.

Description

How to fill out Maricopa Arizona Incentive Stock Option Plan Of The Bankers Note, Inc.?

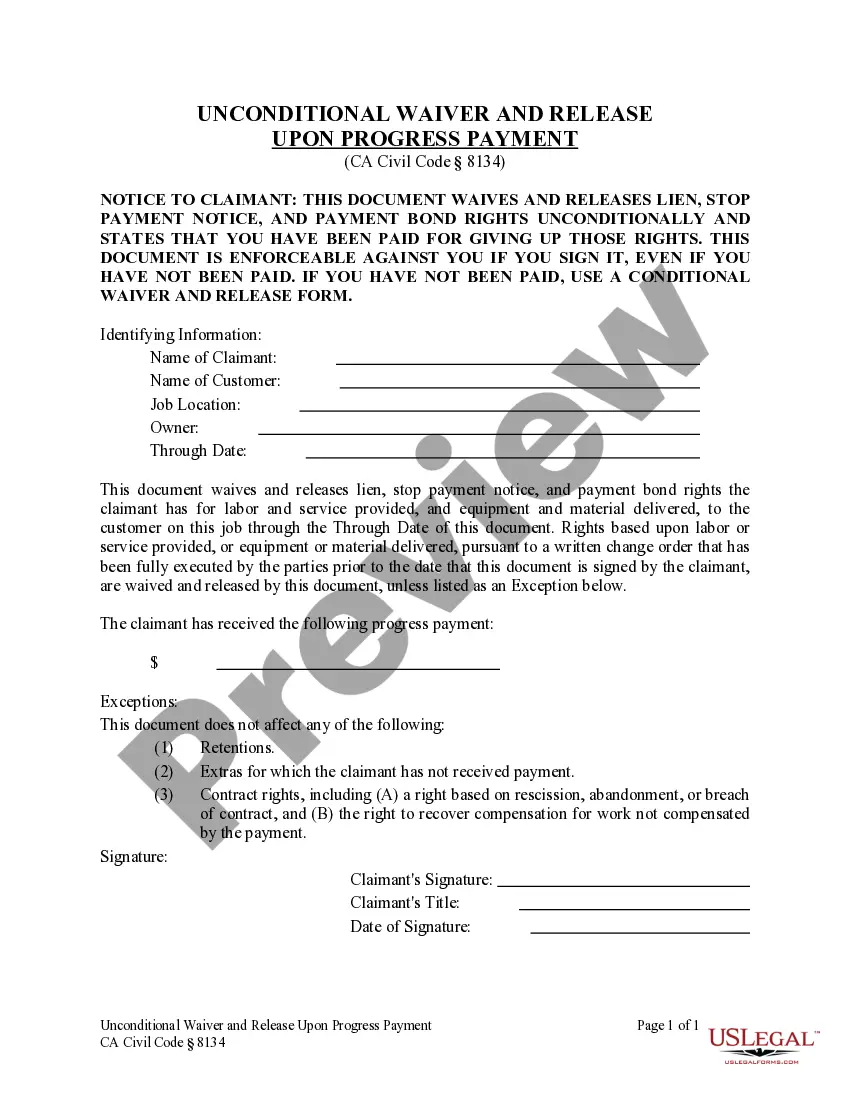

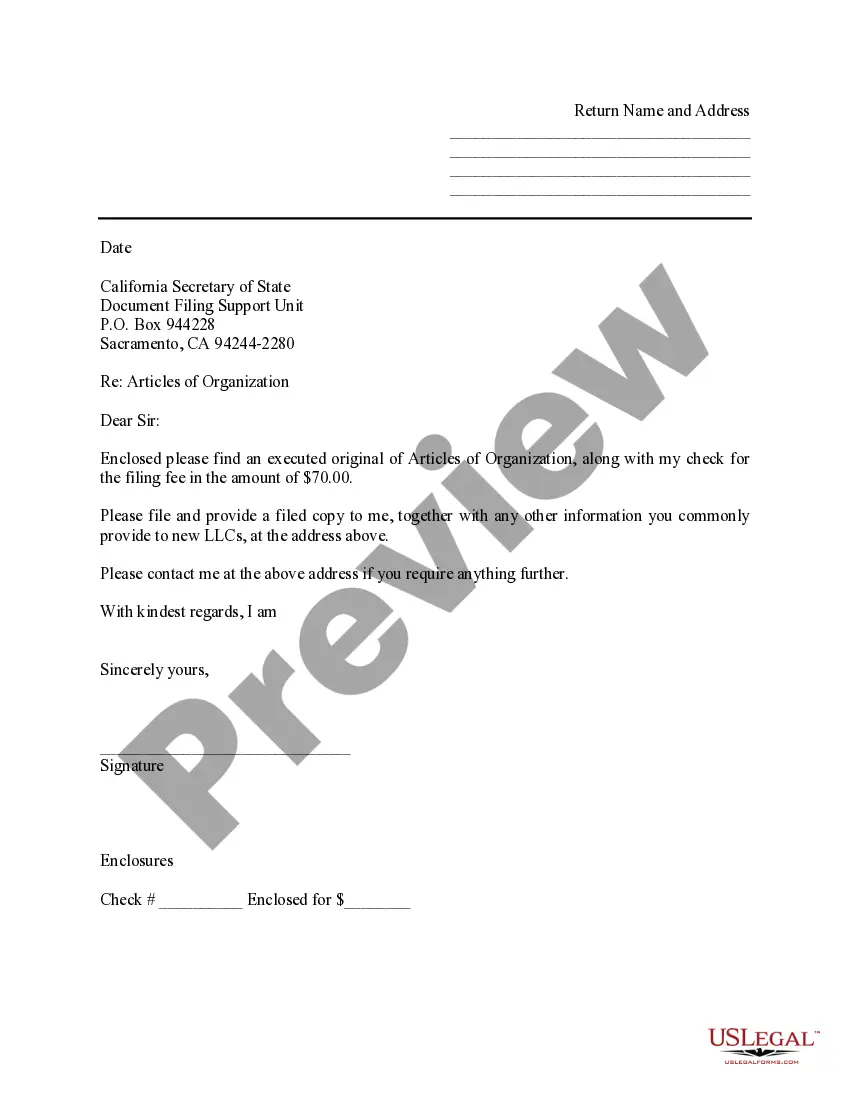

Draftwing forms, like Maricopa Incentive Stock Option Plan of the Bankers Note, Inc., to take care of your legal affairs is a challenging and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents crafted for various scenarios and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Maricopa Incentive Stock Option Plan of the Bankers Note, Inc. form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before downloading Maricopa Incentive Stock Option Plan of the Bankers Note, Inc.:

- Make sure that your document is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Maricopa Incentive Stock Option Plan of the Bankers Note, Inc. isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!