Palm Beach Florida Incentive Stock Option Plan of the Bankers Note, Inc.

Description

How to fill out Incentive Stock Option Plan Of The Bankers Note, Inc.?

Whether you plan to establish your business, enter into an agreement, submit your ID renewal application, or address legal matters related to family, it is essential to prepare specific documentation that complies with your local laws and regulations.

Locating the appropriate documents can be time-consuming and labor-intensive unless you utilize the US Legal Forms library.

The platform offers users over 85,000 professionally crafted and validated legal templates for any personal or corporate situation. All documents are categorized by state and area of application, making the selection of a template like Palm Beach Incentive Stock Option Plan of the Bankers Note, Inc. quick and easy.

Documents offered by our site can be reused. With an active subscription, you can access all your previously purchased documents at any time in the My documents section of your account. Stop wasting effort on an endless search for current official documents. Join the US Legal Forms platform and keep your paperwork organized with the largest online form library!

- Ensure the template meets your specific requirements and adheres to state legal regulations.

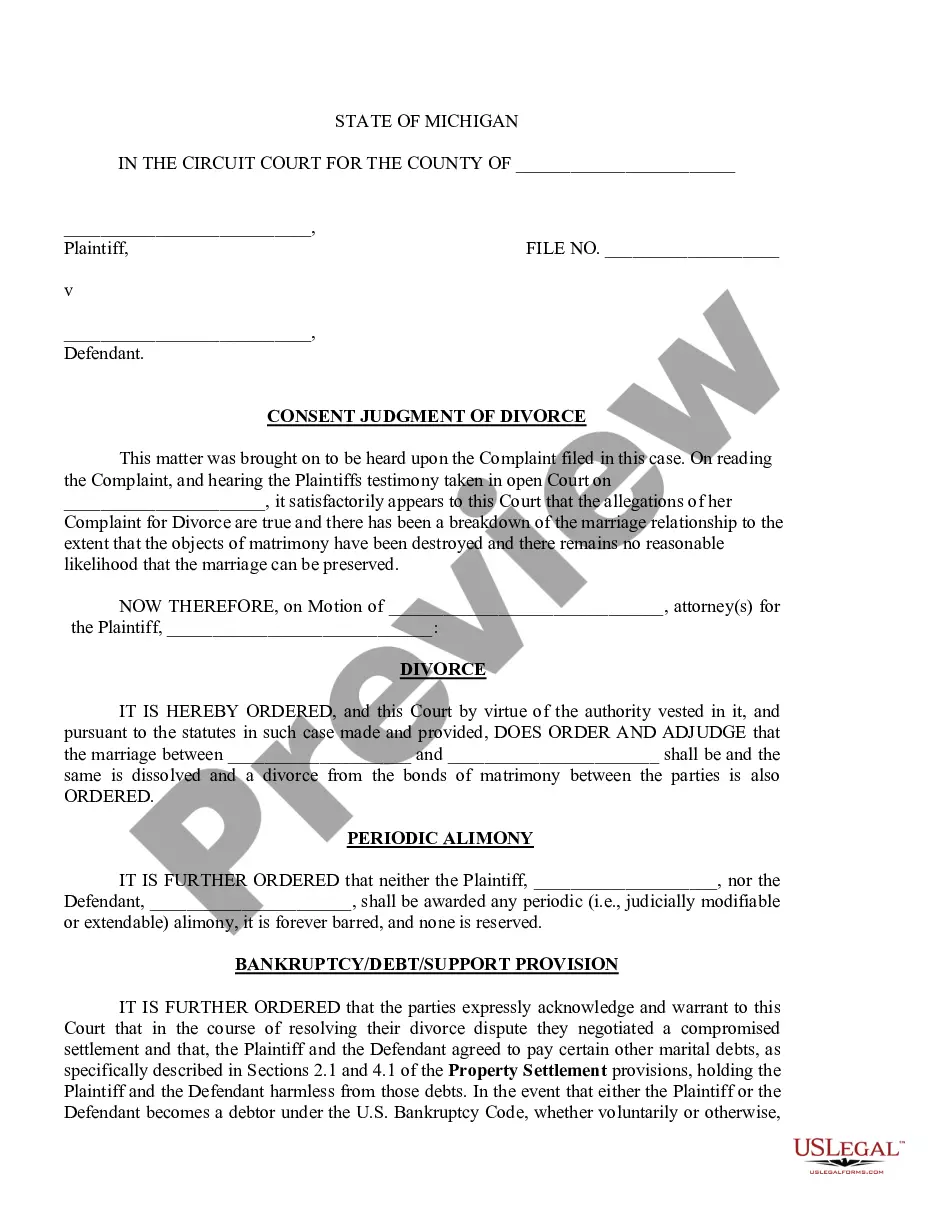

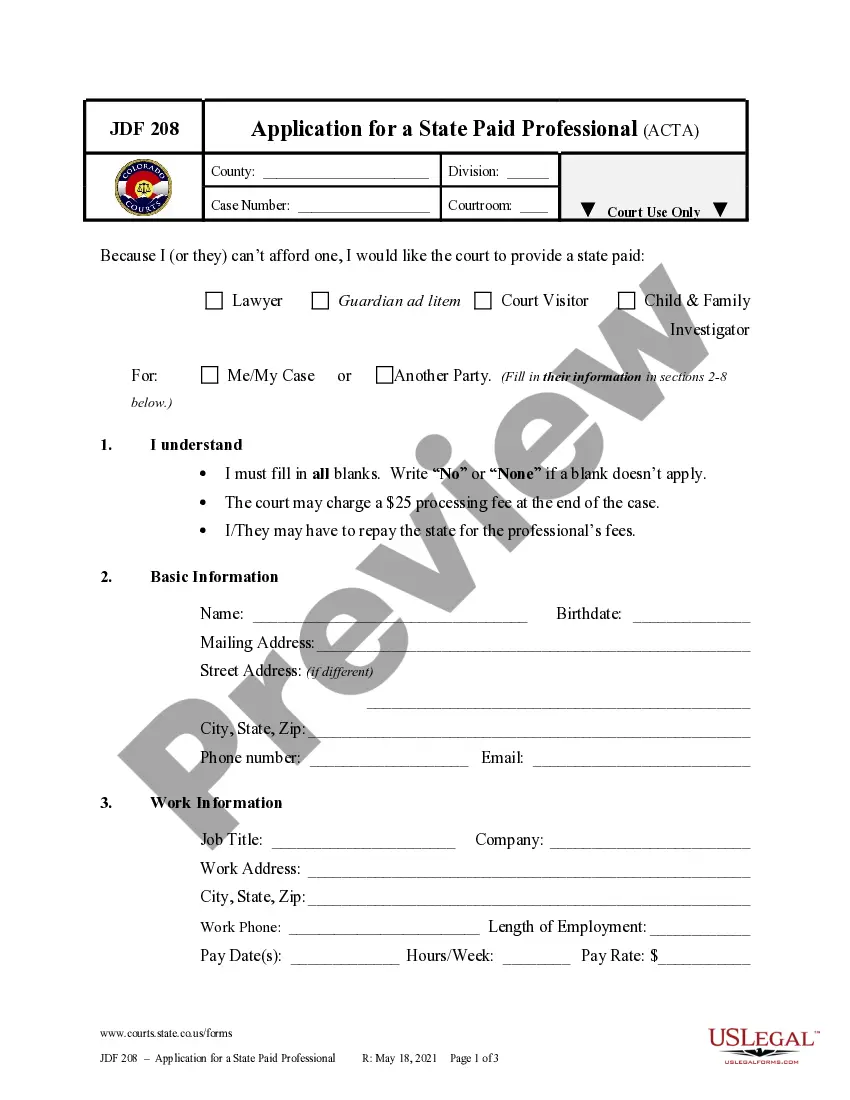

- Review the form description and examine the Preview if available on the site.

- Utilize the search box specifying your state above to locate another template.

- Click Buy Now to acquire the document when you identify the correct one.

- Choose the subscription plan that best fits your needs to proceed.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Palm Beach Incentive Stock Option Plan of the Bankers Note, Inc. in your preferred file format.

- Print the document or complete it and sign it electronically through an online editor to save time.

Form popularity

FAQ

The bargain element is calculated as the difference between the exercise price and the market price on the day you exercised the options and purchased the stock. $45 Market Price - $20 Exercise Price = $25. $25 x 100 shares = $2,500 Bargain Element.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

Many executive compensation consultants say stock options are still a valuable tool?as long as employers know how and when to use them. If anything, stock options may be undervalued as a performance incentive tool, particularly as part of a long-term package.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Employee Stock Options in Valuation A company's equity value is calculated by multiplying the diluted number of shares outstanding by the current share price.

The benefit is equal to the value of the shares, minus the amount paid.

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.

1: Setup Develop your philosophy. Your stock option plan is an expression of your company philosophy.Paper it. Adopt your stock plan and option agreements and get board and stockholder approval.Make it official. Work with your lawyers to obtain all relevant state permits for your option plan.

At present, ESOPs are taxable as perquisites (salary income) in the hands of employees. The value is the difference between the fair market price of the stock on the day the option is exercised and the price at which it is exercised.

The value of the options is typically determined using Black-Scholes or similar valuation formulas, which take into account such factors as the number of years until the option expires, prevailing interest rates, the volatility of the stock price, and the stock's dividend rate.